Stellar 20Y Auction Thanks To Second Highest Indirects On Record

With Treasury yields resuming their slide this week on the back of Monday's sharp risk-off sentiment, and today's surprise reversal which sent yields back to unchanged even as stocks rebounded, there were some concerns today's 20Y auction (technically a 19-year-11-month reopening) would face some demand challenges. It did not, and in fact demand for today's $24 billion offering was one of the strongest since this auction was introduced last May.

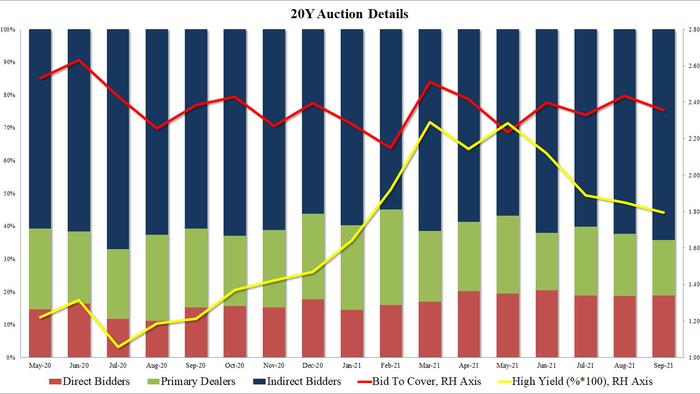

Starting at the top, the high yield of 1.795% stopped through the When Issued 1.797% by 0.2bps. It was the lowest yield for the tenor since January's 1.643%, and well below last month's 1.850%.

The bid to cover of 2.36 was slightly below last month's 2.44, and just below the recent, six-auction average of 2.39.

The internals were more solid, with Indirects at 64.2% taking down the most since July 2020 and the second highest on record. Directs took down 18.9%, or in line with the recent average of 19.1% leaving Dealers holding 16.9%.

Overall, a remarkably solid 20Y auction made possible by near-record foreign demand, and indicates that nobody is worried about any hawkish surprises out of the Fed tomorrow.

Tyler Durden Tue, 09/21/2021 - 13:18

http://dlvr.it/S80mc4

No comments:

Post a Comment