Who’s Really Being Hospitalized?

Authored by Jennifer Margulis via The Epoch Times (emphasis ours), Mainstream media is reporting that severe COVID cases are mainly among unvaccinated people, but who is counted as having COVID, and who is counted as being unvaccinated muddy the waters. (wavebreakmedia/Shutterstock)

“I’m not going to arm wrestle with the administration about where to put you,” Dr. C., a highly skilled gastroenterologist, said gently to my friend who was in bed in a triage room in the ER. “We just want to get you into a bed so we can figure out what’s wrong and get you treated.”

We were at our small town’s hospital. No one was sure why, but my friend had not been able to keep anything more than a handful of raspberries down since a complicated surgery for a chronic health condition three weeks before. Dehydrated and unable to eat, my friend had been violently vomiting after taking just a sip of water or sucking on an ice chip, and had lost nearly twenty-five pounds.

I was by my husband’s side when he had a gallbladder attack so severe that it left his hands shaking. I’ve had three unmedicated childbirths and attended many more, both as a journalist and a patient advocate. Still, I’ve never seen a human in so much pain.

Diagnosed with a Pancreas Disorder, Admitted as a COVID Patient

After a battery of testing, my friend was diagnosed with pancreatitis. But it was easier for the hospital bureaucracy to register the admission as a COVID case.

Let me explain. This patient had none of the classic symptoms of COVID: No shortness of breath, no fever, no chills, no congestion, no loss of sense of smell or taste, no neurological issues. The only COVID symptoms my friend had were nausea and fatigue, which could also be explained by the surgery. However, nearly three weeks earlier, a COVID test had come back positive.

The mainstream media is reporting that severe COVID cases are mainly among unvaccinated people. An Associated Press headline from June 29 reads: “Nearly all COVID deaths in US are now among unvaccinated.” Another, from the same date: “Vast majority of ICU patients with COVID-19 are unvaccinated, ABC News survey finds.”

Is that what’s really going on? It’s certainly not the case in Israel, the first country to fully vaccinate a majority of its citizens against the virus. Now it has one of the highest daily infection rates and the majority of people catching the virus (77 percent to 83 percent, depending on age) are already vaccinated, according to data collected by the Israeli government.

After carefully reviewing the available data, including the safety and efficacy profiles of the mRNA vaccines, my friend had taken a cautious approach. Though a medical doctor who gives vaccines in the office every day, my friend opted to wait and see. According to WebMD, a “huge number” of frontline hospital workers have also chosen not to get the vaccine. Indeed, various news reports, from California to New York, confirm that up to 40 percent of health care workers have decided the risks of the vaccines do not outweigh the benefits.

After admission, I spoke to the nurse on the COVID ward. She was suited up in a plastic yellow disposable gown, teal gloves, and two masks underneath a recirculating personal respiratory system that buzzed so loudly she could barely hear. The nurse told me that she had gotten both vaccines but she was feeling worried: “Two thirds of my patients are fully vaccinated,” she said.

Data Limitations

How can there be such a disconnect between what the COVID ward nurse told me and the mainstream media reports? For one thing, it is very hard to get any kind of accuracy when it comes to actual numbers. In fact, the Centers for Disease Control and Prevention (CDC) have publicly acknowledged that they do not have accurate data.

As reported by the Associated Press, “The CDC itself has not estimated what percentage of hospitalizations and deaths are in fully vaccinated people, citing limitations in the data.”

At the same time, data collection is done on a state by state basis. In most states, a person is only considered fully vaccinated fourteen days after they have had the full series of the vaccine.

This means that anyone coming into an American hospital who has only had one dose, or who has had both vaccines but had the second one less than two weeks prior, will likely be counted as “unvaccinated.”

So when the South Carolina’s Department of Health and Environmental Control released a report about COVID severity on July 23, 2021, they reported higher morbidity and mortality rates in the “not fully vaccinated.” Are these people who have had one vaccine and gotten sick, two vaccines and gotten sick, or no vaccines at all? Without more details, it is impossible to know what is really going on.

“We don’t have accurate numbers,” insists Dr. James Neuenschwander, an expert on vaccine safety based in Ann Arbor, Michigan.

But what we do know, Neuenschwander says, is that the vaccines are not as effective as public health officials told us they would be. “This is a product that’s not doing what it’s supposed to do. It’s supposed to stop transmission of this virus and it’s not doing that.”

Overcounting COVID

Then there is the problem of attributing severe illness and deaths from other causes to COVID, like in my friend’s case. Health authorities around the world have been doing this since the beginning of the COVID crisis. For example, a young man in Orange County, Florida who died in a motorcycle crash last summer was originally considered a COVID death by state health officials (after Fox News investigation the classification was changed.) And a middle-aged construction worker fell off a ladder in Croatia and was also counted as a death from COVID (whether having COVID played a role in his death is still unclear.)

To muddy the waters further, even people who test negative for COVID are sometimes counted as COVID deaths.

Consider the case of 26-year-old Matthew Irvin, a father of three from Yamhill County, Oregon. As reported by KGW8 News, Irvin went to the ER with stomach pain, nausea, and diarrhea on July 5, 2020. But instead of admitting him to the hospital, the doctors sent him home.

Five days later, on July 10, 2020, Irvin died. Though his COVID test came back negative two days after his death and his family told reporters and public health officials that no one Irvin had been around had any COVID symptoms, the medical examiner allegedly told the family that an autopsy was not necessary, listing his death as a coronavirus case. It took the Oregon Health Authority two and a half months to correct the mistake.

In an even more striking example of overcounting COVID deaths, a nursing home in New Jersey that only has 90 beds was wrongly reported as having 753 deaths from COVID. According to a spokesman, they had fewer than twenty deaths. In other words, the number of deaths was over-reported by 3,700 percent.

Who’s Suffering from Severe COVID, Vaccinated or Unvaccinated?

In countries with the highest numbers of vaccinated individuals, we are also seeing high numbers of infections. Iceland has one of the most vaccinated populations in the world (over 82 percent) and is reporting that 77 percent of new COVID cases are in fully vaccinated Icelanders, according to Ásthildur Knútsdóttir, Director General of the Ministry of Health.

According to news reports, over 85 percent of the Israeli adult population has been vaccinated. But a July report from Israel’s Ministry of Health found that Pfizer’s vaccine is only 39 percent effective. Though Israeli health officials are telling the public that the cases are more mild in vaccinated individuals, this upsurge in COVID cases and deaths is leading Israel’s prime minister to issue new restrictions.

Dr. Peter McCullough, an academic internist and cardiologist in practice in Dallas, Texas, says that a large number of people in the hospitals right now have, indeed, been fully vaccinated. “Fully vaccinated people are being hospitalized, and … 19 percent of them have died,” McCullough says. “This is not a crisis of the unvaccinated. That’s just a talking point. The vaccinated are participating in this.”

Other physicians are seeing the same thing. “In my practice multiple patients who are fully vaccinated have been admitted to local hospitals,” says Dr. Jeffrey I. Barke, a board-certified primary care physician based in Newport Beach, California. Barke believes part of the problem is exaggeration of the efficacy: “If the vaccine works so well, why are we now pushing a booster?” Jennifer Margulis, Ph.D., is an award-winning journalist and author of Your Baby, Your Way: Taking Charge of Your Pregnancy, Childbirth, and Parenting Decisions for a Happier, Healthier Family. A Fulbright awardee and mother of four, she has worked on a child survival campaign in West Africa, advocated for an end to child slavery in Pakistan on prime-time TV in France, and taught post-colonial literature to non-traditional students in inner-city Atlanta. Learn more about her at JenniferMargulis.net Tyler Durden Tue, 08/31/2021 - 11:10

http://dlvr.it/S6gYH4

Tuesday, August 31, 2021

The Complete and Unthinkable Treason of a “Selected” President- Steve Quayle and Dave Hodges

by Dave Hodges, The Common Sense Show: I recently interviewed Steve Quayle about several critical issues that now burden the United States including the following: 1. The sending of terrorists to the United States with the full participation of Biden’s handlers. 2.The deliberate weakening of the American military. 3. The Biden administration’s handing off of […]

http://dlvr.it/S6gS77

http://dlvr.it/S6gS77

The American Descent Into Fascism

by Paul Craig Roberts, Paul Craig Roberts: This morning I posted “The Aggressive Stupidity of America’s business, educational, government, and military leaders is astounding.” https://www.paulcraigroberts.org/2021/08/30/the-aggressive-stupidity-of-americas-business-educational-government-and-military-leaders-is-astounding/ As it was astounding this morning, what do I call it this mid-afternoon when the stupidity of American leadership is already 10 times worse than it was this morning? You are […]

http://dlvr.it/S6gG82

http://dlvr.it/S6gG82

Jim Quinn: "A Critically-Thinking Person Might Look At The Delta Data & Conclude..."

Jim Quinn: "A Critically-Thinking Person Might Look At The Delta Data & Conclude..."

Authored by Jim Quinn via The Burning Platform blog,

“This work was strictly voluntary, but any animal who absented himself from it would have his rations reduced by half.”

- George Orwell, Animal Farm

“There are three types of lies — lies, damn lies, and statistics.”

- Benjamin Disraeli

It’s amazing how you can lie with statistics when you don’t provide context and/or leave key information out of your false narrative. As of July 4, the entire covid fear narrative was dying out, with cases crashing to new lows and the Big Pharma vaccine profit machine sputtering. That is when those controlling the media narrative began running the stories about the Indian variant and the imminent tragedy. As cases soared over 350,000 per day, the MSM was predicting bodies piling up in the streets.

They failed to give context that India has 1.4 billion people, four times the population of the U.S. On a cases per million basis, India’s surge was still 70% lower than the U.S. peak in January. And then the cases collapsed by 75% in a matter of weeks, with no mass rollout of vaccines. But they did distribute copious amounts of ivermectin. Must just be a coincidence. Everyone knows ivermectin is only for cows and horses, per the “experts” at the FDA.

With the Indian case collapse, the purveyors of fear needed to give the Indian variant a new scary name – Delta Variant. So India, with a 10% vaccination rate has seen a complete collapse in cases. Meanwhile, the UK and Israel, with some of the highest vaccination rates in the world, 64% and 60% respectively, have seen huge surges in Delta cases. It’s almost as if the vaccines have created the Delta surge. You might even conclude the vaccines are a complete and utter failure, with significant numbers of adverse reactions, 5 months of limited efficacy, and unknown long-term health effects.

The U.S. “surge” began shortly after July 4th, with the MSM building the Delta fear narrative day after day. Biden, Fauci, Walensky and the rest of the Big Pharma whores did their daily duty of feeding bullshit to the sheep. They bribed corporations, universities and left wing governors to mandate the jab, since they couldn’t mandate it Federally.

The mask theater opened again. To hell with the fact that masks have done absolutely nothing to slow or stop the spread of this virus. As they began reporting the case totals again, despite the fact the PCR test was already completely discredited, with the FDA pulling its EUA and taking it off the market as of 12/31, I noticed what they were not reporting – number of tests.

The number of reported cases in the U.S. went up by 750% since July 4. Coincidentally, the number of tests grew by over 500% since July 4.

Why the tremendous increase in testing?

If you want more cases, just do more mass testing of people showing no signs of illness. This is why the death rate is 65% lower than when cases were at the same level in February.

A critically thinking individual might look at the data and conclude these vaccines are enhancing the virus and creating the variants.

They might also conclude the Delta variant is far less lethal than the original virus.

They might also conclude the unholy alliance between the government, mass media, social media, and Big Pharma have ramped up the fear in order to force vaccinations into the veins of vaxx resisters, instilling vaccine passports, and attempting to install a digital surveillance system to track those who resist and destroy their lives.

A critically thinking person might wonder why such coercive measures are being used to inject an experimental gene therapy into our bodies for a relatively non-lethal virus with a 99.7% survival rate. Especially, when it is now beyond a doubt the jab doesn’t keep you from contracting the virus, spreading the virus, or dying from the virus.

*

At best, it is a therapy that may reduce the symptoms for some people.

*

At worst, ADE (antibody-dependent enhancement) will begin to rear its ugly head in the Fall.

The current all hands on deck campaign to discredit ivermectin is a sign of desperation, as they have only been able to coerce and scare just over 50% of the population to have this Big Pharma concoction injected into their bodies. With cases peaking at 155,000 per day, the desperation of Fauci and his acolytes is visible for all to see.

I submitted my strongly worded religious exemption to my employer this morning. I should know within a week whether they will buy it. If they deny it, the ball will be in their court, because I will never have that shit injected into my body. They can terminate me and I will be unbowed. They cannot force me to contaminate my body. I’m a free man and will not take the knee. I will not comply. Resistance is not futile. I hope enough of my countrymen will join me in choosing freedom over servitude.

“If ye love wealth better than liberty, the tranquility of servitude better than the animating contest of freedom, go home from us in peace. We ask not your counsels or arms. Crouch down and lick the hands which feed you. May your chains set lightly upon you, and may posterity forget that ye were our countrymen.”

- Samuel Adams Tyler Durden Tue, 08/31/2021 - 09:30

http://dlvr.it/S6gDXy

http://dlvr.it/S6gDXy

Monday, August 30, 2021

"Unprecedented" Power Outage Crippled Half Of NYC Subway Sunday Night

"Unprecedented" Power Outage Crippled Half Of NYC Subway Sunday Night

Late Sunday into the early hours of Monday morning, half the New York City subway system went dark and stranded hundreds, if not thousands of passengers.

New York Governor Kathy Hochul told reporters outside the Metropolitan Transportation Authority Headquarters in Lower Manhattan about the incident. She called it an "unprecedented system breakdown" that led to half of the nation's largest subway system losing power around 2100 ET Sunday and restored around 0130 ET Monday.

Governor Hochul said Con Edison reported power issues around 2030 ET Sunday "that resulted in a voltage dip across New York City." She said the outage was "momentary," and backup power generation systems kicked in. "But when they tried to go back to normal, there was a surge — an unprecedented surge — that resulted in the subway losing signalization and communication ability," she said. "The confluence of events that led to this has never happened before to our knowledge."

Hochul said more than 500 people exited crippled subway cars and walked the tracks to the nearest terminal. That in itself led to further delays.

"We never, ever want riders to do that," she said. "It is dangerous and causes a delay in the restoration of power."

Around the time of the outage, social media reports show a utility hole fire in Long Island City, Queens. Though Hochul said, the subway breakdown appears unrelated.

A manhole in LIC was undergoing maintenance and exploded. All the lights dimmed throughout NYC around 8:20pm and the explosion even set a car on fire. I saw the fireball from my window and caught the seconds after: https://t.co/TVNEXdEXwW pic.twitter.com/92xtltBGXN — Morgan (@Haazaa_Moto) August 30, 2021

Video shows FDNY firefighters lifting people off the tracks into safety.

A momentary power surge disrupted half of the New York City subway system for several hours and stranded hundreds of passengers, Gov. Kathy Hochul said Monday.

The unprecedented breakdown affected more than 80 trains @MTA @NYCSubwayLine @GovKathyHochul #NYC pic.twitter.com/SrU0baJBW5 — The Jewish Voice (@JewishVoice) August 30, 2021

One subway rider told ABC7 New York:

"They kept saying they don't know what's going on. But an hour and 36 minutes we were trapped on the train. A long time. Kids, children, no water, nothing," one woman said.

There's still no word on what sparked the outage. Tyler Durden Mon, 08/30/2021 - 10:55

http://dlvr.it/S6bz2p

http://dlvr.it/S6bz2p

America's Energy Strategy Is Bonkers

America's Energy Strategy Is Bonkers

Via Doomberg Substack,

“Higher gasoline costs, if left unchecked, risk harming the ongoing global recovery. The price of crude oil has been higher than it was at the end of 2019, before the onset of the pandemic. While OPEC+ recently agreed to production increases, these increases will not fully offset previous production cuts that OPEC+ imposed during the pandemic until well into 2022. At a critical moment in the global recovery, this is simply not enough. President Biden has made clear that he wants Americans to have access to affordable and reliable energy, including at the pump.”

– Jake Sullivan, National Security Advisor (emphasis added)

Almost a decade ago, the official mascots of the London 2012 Summer Olympics were revealed. It didn’t go very well. Meet Wenlock and Mandeville:

At the time, I was perusing a magazine article collecting various reactions to the mascots – I think it was in Time but I can’t be sure – and one commentator delivered a line that will stick with me forever.

“This can only be the work of a committee. It has cc written all over it.”

I am reminded of Wenlock and Mandeville as I observe America’s rambling approach to energy policy over the past several years. When you ponder the logical consequences of where we are headed, it is hard not to conclude that this too must be the work of a committee, and a disjointed one at that. More on the members of that committee a little later.

Let’s start with the opening quote for this piece, which I took from an official White House statement, because it is quite the stunner. The President and his allies are limiting domestically produced oil and gas at every opportunity, which should come as no surprise – they ran for office on exactly this policy, after all. The controversial Keystone Pipeline project was permanently cancelled shortly after Biden took office, signaling a major policy shift from the Trump administration. In late January, Biden issued a broad moratorium on oil and gas leases on federal lands and waters (subsequently partially reversed). Just last week, an Obama-appointed federal judge in Alaska reversed a previously approved $6B development project in her state, much to the chagrin of ConocoPhillips, the project’s owner.

If you think the burning of fossil fuels is bad for the planet and should be slowed and eventually stopped altogether, these actions are perfectly fine – even laudable. What is not fine is to expect that the price of oil (and by extension, gasoline) wouldn’t go up as a result of these policies. It takes a special kind of stupid to think that crimping supply for a highly inelastic commodity wouldn’t spike prices higher, especially as the economy continues to experience an accelerated recovery from the impact of Covid-19. Further, this is the exact result you should want if your intent is to reduce demand for fossil fuels. You don’t have to have a PhD in economics to understand that destroying demand with price is particularly effective. Higher prices for fossil fuels also make the development of alternatives more economically feasible, thereby accelerating our environmental transformation. There’s simply no path to substantially reduced carbon intensity without substantially higher prices for fossil fuels.

Crazy, I know.

And that is what makes Sullivan’s statement so confounding. By begging OPEC+ to produce more, thereby keeping US gasoline prices under control, the President is effectively stoking demand for fossil fuels while ceding market share – and power over our economic future – to countries that generally don’t like us very much, have minimal to no environmental or labor safeguards, and operate in volatile parts of the globe (necessitating massive US military expenditures to safeguard critical shipping lanes). It is truly a worst-of-all-worlds situation.

The President also is making a major push toward electrifying the US passenger vehicle market. He recently held a summit at the White House with key executives from the automotive industry (with one notable exception – Elon Musk was strangely absent from the invitation list). I happen to think full battery electric vehicles (BEVs) are a suboptimal environmental solution given the current state of battery technology, especially when compared to plug-in hybrid options (PHEVs), but I’m generally pro-electrification (with the notable exception of fences around chicken coops).

My beef with the President’s agenda is simpler. Where will the industrial metals and electricity needed for this conversion to electric come from? While the President proclaims that he will prioritize the domestic production of strategic minerals, the reality is his administration is making it even harder to get new mines operational. A recent analysis by Thompson Reuters had this to say:

“…the overwhelming effect of many changes proposed by the new administration will be to discourage, through extensive regulation, all forms of domestic mineral development and extraction. The new and revised regulatory framework will have the effect of:

· Prohibiting new mines outright in many places.

· Increasing the costs of development or operation of existing mines.

· Lengthening the time needed to bring a mine into production.”

Our nation’s electricity grid is woefully unprepared to even support normal economic growth going forward. It simply can’t support the revolution in transportation that the President proposes. Because of lack of investment, poor maintenance, and political opposition to the development of new power plants using traditional fuels, we are near a critical breaking point. Look no further than the rolling blackouts in California and the struggle Texas is having keeping its lights on. A thoughtful essay by Marsh McLennan opened as follows:

“To say that the United States has an aging electric transmission infrastructure is a sizable understatement. The average age of the installed base is forty years old, with more than a quarter of the grid fifty years old or older. While the system’s sheer longevity is a testament to the engineering expertise of our forebears, that aging infrastructure is long overdue for a major overhaul.”

The end result of these policies will be similar to what we will see with oil. As BEVs and (hopefully) PHEVs gain market share, the US will become increasingly reliant on dirty metals derived from international mines with minimal environmental and labor standards. Prices for these metals will soar, impacting all supply chains that rely on them today. We will enrich our international geopolitical opponents at the expense of the average US consumer. Our electric grid will become more unreliable. Rolling blackouts will become more common, and spread beyond California and Texas. It isn’t a pretty picture.

What would President Doomberg do differently? In the unlikely event that the 47th President of the United States is a paranoid chicken, the energy policy motto would be simple: Better is Better.

Under President Doomberg, the US would pass an infrastructure bill that actually invests in infrastructure. The bill would only fund a revitalization of our nation’s electric grid. There would be a zero-pork policy. Imagine that? I would sell the bill as a real investment in our children’s future. That’s money worth printing. Better is better.

Under President Doomberg, the US would replaceme coal-fired power plants with plants that burn natural gas. Electricity derived from natural gas is 60% less carbon intense than electricity derived from coal. Additionally, the burning of coal emits all manner of other toxins into the environment, while natural gas burns so cleanly we allow it to be piped into our homes for cooking and heating. These new natural gas plants would form the base load for future electricity generation. Better is better.

Under President Doomberg, the US would advance its development of renewable electricity, especially wind and solar, but would supplement these investments with a national initiative – something on the scale of the Manhattan Project – to create affordable, grid-scale batteries from readily available materials. Current lithium ion battery technology isn’t ideal for grid storage for a variety of reasons, and we’ll need those batteries elsewhere (see below). The development of such batteries is critical for the integration of renewables, would help with grid balancing, and would reduce the need for peaking power plants. Better is better.

Under President Doomberg, the US would prioritize the development of PHEVs to replace traditional internal combustion engine vehicles. On a gallon-of-gasoline-abated-per-pound-of-battery basis, PHEVs are far superior to full BEVs. I would institute a $10,000 federal tax credit for any vehicle that has at least 50 miles of electric range before the backup internal combustion engine kicks in. The technology for these vehicles exists today – no new inventions are needed. This would cut demand for fossil fuels significantly, while minimizing the need to source dirty metals from our geopolitical foes. While I would work to fast-track the approval of new mines for strategic minerals, this approach would lessen the need to do so. It would also eliminate the need for a national electric vehicle charging network, as consumers could rely on traditional gasoline for long trips. Better is better.

Under President Doomberg, the US would revitalize its nuclear power industry. If you claim to be serious about reducing our carbon intensity but you are opposed to nuclear power, you aren’t actually serious about reducing our carbon intensity – you are a scientifically ignorant poseur. That might sound a little harsh, and might even cost me a few subscribers, but it must be said. I’d be intellectually dishonest if I softened the message. Nuclear power is safe, affordable, and must be a critical part of our energy future. In the past 25 years, the US has commissioned precisely one new nuclear power facility, a true failure of political leadership. Opposition to nuclear power is destroying the planet. Get over it. It’s time. Better is better.

Unfortunately, there will never be a President Doomberg, nor do I expect any of these proposed policies to be implemented. President Biden’s de facto committee on energy is fatally conflicted, damning the US to the provably insane policies that are being imposed upon us today. On one end of that committee’s table sits progressive politicians – most of whom have never worked in heavy industry – who are demanding an all-or-nothing approach to energy policy that is completely at odds with sound scientific and economic theory. These politicians are underwritten and enabled by rent-seeking financiers on Wall Street, most notably Larry Fink, chair and CEO of Blackrock – and other similar cocktail-party dwellers – who don’t have to suffer the consequences of the policy recommendations they support. On the other end of the committee’s table sits the President’s base: blue-collar union members who drive pickup trucks for a living, middle-class families struggling to make ends meet, and all manner of economically-disadvantaged citizens. The President knows intuitively that placating the former will harm the latter, which is how we ended up with the policies we have.

If you insist on all or nothing, it will be all for nothing. The planet will be no better off, and we’ll all be poorer.

* * *

If you enjoy Doomberg, subscribe and share a link with your most paranoid friend! Tyler Durden Mon, 08/30/2021 - 10:35

http://dlvr.it/S6bwnX

http://dlvr.it/S6bwnX

Chase Bank Cancels General Mike Flynn's Credit Cards

Chase Bank Cancels General Mike Flynn's Credit Cards

Chase Bank has canceled General Mike Flynn's personal credit card, citing "possible reputational risk to our company."

🚨🚨BREAKING: Chase Bank cancels its credit card accounts with General Flynn citing possible “reputational risk” to their company. In case there was any doubt what is happening in this country. @TracyBeanzOfficial pic.twitter.com/GIyQHXgW9l — Regina Hicks (@reginahicksreal) August 29, 2021

Chase Bank cancelled General Flynn’s personal credit card over “reputation risk”… #BoycottChase JPMorgan Chase & Co. Agrees To Pay $920 Million in Connection with Schemes to Defraud Precious Metals and U.S. Treasuries Markets | OPA | Department of Justice https://t.co/LfRlE3ltTV — Joseph J Flynn (@JosephJFlynn1) August 29, 2021

Lt. Gen Michael Flynn, former President Trujmp's first National Security Adviser, was notably set up by the FBI in an unauthorized 'perjury trap' over his conversations with the former Russian ambassador over sanctions related to alleged interference in the 2016 US election.

Flynn pleaded in December 2017 to lying to the FBI about contacts with the former Russian ambassador during the 2016 presidential transition - only to have the Justice Department drop the case after Flynn's attorney, Sidney Powell, fought for the release of information suggesting that the FBI laid the 'perjury trap' to try and get him to lie. In January 2020, however, Flynn withdrew his guilty plea in the U.S. District Court in Washington, D.C. - stating that he was “innocent of this crime” and was coerced by the FBI and prosecutors under threats that would charge his son with a crime.

According to documents uncovered by Flynn attorney Sidney Powell, the FBI had already come to the conclusion that Flynn was guilty prior to their unauthorized interview with him in January, 2017 - and that agents were working together to see how best to corner the 33-year military veteran and former head of the Defense Intelligence Agency. The bureau deliberately chose not to show him the evidence of his phone conversation to help him in his recollection of events, which is standard procedure. Even stranger, the agents that interviewed Flynn later admitted that they didn’t believe he lied during the interview with them.

What's more, the entire FBI investigation of Flynn appeared to have been instigated by Russiagate operative Stephan Halper, who lied about Flynn's relationship with a Russian academic.

After the FBI's malfeasance was uncovered, the Trump Justice Department dropped all charges against Flynn - conceding that the FBI had no basis to interview him on January 24, 2017.

The judge in the case, Emmet Sullivan, refused to drop the case, and has instead asked a federal appeals court - twice - whether he can ignore the DOJ, after asking a government-paid private lawyer to argue against Flynn - only to eventually relent after Trump pardoned his former NatSec adviser. Tyler Durden Mon, 08/30/2021 - 09:35

http://dlvr.it/S6bkj0

http://dlvr.it/S6bkj0

The Approved Pfizer Vaccine Is Not Yet Available

by Paul Craig Roberts, Paul Craig Roberts: The Covid Vaccine profiteers are claiming that now the vaccine is officially approved, it can be mandated. This is false for two reasons. One reason is that all medical procedures, which includes inoculation, require under law ‘“informed consent.” Therefore, vaccination cannot be legally mandated. US corporations are trying to get around […]

http://dlvr.it/S6bhWq

http://dlvr.it/S6bhWq

Donnie Darko Film Analysis Pt 2: Aleister Crowley, 9/11, NWO & Halloween Sacrifice!

[Right Wing Daily] On today’s episode of the Conspiracy Theories and Unpopular Culture podcast we conclude with part 2 of our analysis of Donnie Darko from 2001! This film has been controversial to say the least and there is no shortage of conspiracies about what this movie is truly about! Part 2 will cover the second half of the film […]

The post Donnie Darko Film Analysis Pt 2: Aleister Crowley, 9/11, NWO & Halloween Sacrifice! appeared first on IlluminatiWatcher.

http://dlvr.it/S6bCHq

http://dlvr.it/S6bCHq

Sunday, August 29, 2021

US Air Strike Reportedly Takes Out Suicide Bomber Near Airport, Explosion Heard Across Kabul

from ZeroHedge: Just days after an ISIS-K suicide bomber killed at least 169 people at Kabul airport, TOLO News, Afghanistan’s largest TV news network, is reporting that “a powerful explosion was heard moments ago in Kabul.” The explosion was caused by a rocket striking a house near the airport, BBC journalist Secunder Kermani reported, citing a source in the […]

http://dlvr.it/S6Xxfk

http://dlvr.it/S6Xxfk

Fed Prints Money or the Whole Thing Blows Up-Craig Hemke

by Greg Hunter, USA Watchdog: Financial writer, market analyst and precious metals expert Craig Hemke says the Fed has all but said it was going to delay the so-called “taper” of easy money policies–forever. This is why gold and silver spiked as the dollar tanked on Friday. Hemke contends, “The Chinese, four months in a […]

http://dlvr.it/S6Xw18

http://dlvr.it/S6Xw18

COVID Bailouts Have Nothing To Do With COVID

COVID Bailouts Have Nothing To Do With COVID

Authored by Matthew Piepenberg via GoldSwitzerland.com,

Below, we ask a simple question: Is the 'war on COVID' the needed pretext for even more centralized market “performance?”

After all, who needs free markets when central bank liquidity determines price forces via endless COVID bailouts?

The trend toward centralized controls and centralized markets was in play long before COVID, but has the pandemic given the powers-that-be even more power?

As we discuss below, COVID may just be the final nail in the coffin of free market capitalism.

In this murky light, do traditional market indicators and forces even matter anymore?

Consumer Sentiment: Who Cares?

As stocks reached all-time highs in U.S. markets, consumer confidence recently saw its 7th greatest collapse in history.

Needless to say, cadres of Wall Street spin-sellers (propaganda specialists?) are already hard at work explaining why such a disconnect between sentiment and equity valuations (i.e., price bubbles) doesn’t matter.

After all, when buckets of QE liquidity pour daily into the financial system in a COVID-induced era of unlimited-QE, today’s central-bank driven markets don’t need consumer confidence or even healthy balance sheets (from free-cash-flows to profits & earnings) to make their zombie-like climb toward 34.6 PE levels on the S&P.

In short, who needs consumer confidence (or even consumers at all), when a central bank airbag sits permanently beneath the S&P, NASDAQ and DOW?

Words Replacing Math & Facts

Over a decade ago, when the first controversial bucket of QE1 began, Bernanke promised it would be a “temporary” measure.

But bear or bull, we are fairly clear by now that words like “temporary” and “transitory” coming out of D.C. are as empty as Nixon’s promise in 1971 that decoupling from the gold standard would be equally short-lived:

And when it comes to words vs. reality, it doesn’t take a Sherlock Holmes or even an Inspector Clouseau to see the lighthouse of true motives amidst a fog of false narratives.

Enter COVID—The Ultimate Bailout

Whatever one’s view of the COVID pandemic or its toll on human health and global GDP, one can no longer deny that a virus whose survivability percentage is greater than 99% has been the perfect setting (ruse?) to justify, inter alia, yet another tsunami of Wall-Street bailouts under the guise of a global health crisis.

In short, if Bear Sterns, Lehman Brothers, Morgan Stanley and other TBTF banks playing with MBS fire justified the 2008 bailout, certainly the optics of a “global health crisis” made trillions worth of more market “accommodation” easier to swallow (or sneak in).

Toward this end, as the needed and all-too important debates continue to rage (despite open censorship) about health passports, nation-wide shutdowns, case fatality rates, vaccine safety/efficiency facts and health ministry fictions in a backdrop of dying civil liberties, free-market forces and governmental trust, one thing is becoming clear…

COVID (and more specifically COVID bailouts) saved the global financial markets.

That is, despite the competing fear-porn vs. “we care for you” narratives from NYC to Sydney, COVID has been Wall Street’s greatest ally since the Geithner-Bernanke-Paulson era of 2008.

Stated even more simply, while millions wonder when they can travel, work or save money again, the markets got another bail-out at the expense of the real economy.

And COVID, whether man-made or bat-made, came just in time to bailout a credit market that was near death’s door by late 2019.

Coincidence? Deliberate? We’ll never find those answers in a carefully/privately censored Google search or YouTube video.

Meanwhile, policy makers (like bees buzzing galvanically around a pot of honey) continue exploiting the COVID narrative to justify an unprecedented era of centralized control over public free markets and individual free choice with a sanctimonious carte blanche the likes (and dishonesty?) of which history has never seen before.

Playing along or following along, companies like Amazon, the NY Times, BlackRock and Wells Fargo continue to push back their return-to-office dates as individual states debate whether mask mandates make sense, despite censored science which suggest that masks stop the spread of viral microbes about as well as chain-link fences stop mosquitos…

Has the world gone mad as a gullible herd following fork-tongued shepherds, or does Big Brother just care a lot about your health?

That’s for each of us to decide, but when it comes to what we can expect from central bankers, my view is clear: COVID will continue to be exploited to justify more liquidity and hence more market “support.”

The Taper or No-Taper Debate

This means investors can expect more market bubbles, volatility, and distortion alongside more inflationary tailwinds, currency debasements and policy double-speak as the taper vs no-taper debate takes on a prominence in the public discourse similar to the mask or no-mask comedy de jour.

That is, as Wall Street continues to debate whether the Fed will begin tapering its magical money printing, the growing volume of Delta variant headlines pouring from the global Ministries of Truth leads me to believe that a narrative is already being telegraphed to justify more rather than less monetary expansion in the near-term.

This may explain why BTC and gold, despite bumpy rides of late, have been recovering rather than hiding in a corner, as more and more investors see the currency debasement writing on the wall, despite such realities never making the headlines or FOMC meeting notes.

We’ve also written elsewhere that the “taper debate” is ultimately (and realistically) a non-debate, as any significant form of tapering means less sovereign bond support, and less sovereign bond support means bond-decay followed by immediate yield (and hence interest rate) climbs.

If interest rates climb in a $280T backdrop of global debt, the market party (i.e., artificial “recovery”) enjoyed since 2009 comes to an immediate end. Period, full stop.

Central bankers and politicos, of course, know this, which explains why more rather than less QE is all that keeps the current risk asset bubble (from stocks to real estate) alive.

In this sad yet seductive light, policy makers—and investors—have two choices: 1) keep the QE going and send inflation to the moon, or 2) taper and send the global markets to the basement of time.

At some point, of course, even unlimited QE becomes unsustainable and the entire house of cards collapses under its own grotesque weight.

When that moment (planned or natural) occurs, the very policy makers who caused this inevitable catastrophe will have the convenient excuse to blame the financial rubble on COVID rather than their bathroom mirrors.

Again, COVID is a very convenient narrative, no?

Near term, the cynical yet realist take on the taper ahead is that it will be postponed rather than embraced. That’s our view.

The Case for Tapering—Michael Burry’s Next Big Short

In fairness to open debate, however, it’s worth noting that far smarter folks have taken other views.

For example, Michael Burry of Scion Capital, the misunderstood genius behind the “Big Short” during the Great Financial Crisis of 2008, has been shorting US Treasuries to the tune of $280 million in put options against the iShares 20+ Year Treasury Bond ETF (ticker TLT), which makes him money if bond prices fall rather than rise.

Michael Burry, it seems, is expecting less rather than more FED bond support, and hence rising rather than “repressed” yields on long-term Treasuries.

And Burry, I’ll confess, may be right.

Even the Fed can’t print forever to keep yields and rates artificially suppressed. Hence, they may actually signal actual rather than semantic tapering, which is why all eyes will be on Jackson Hole to look for further signs of Fed tightening by year end.

This brings us back to COVID and the deliberate fear campaign from on high, as Powell has confidence that stoking the COVID narrative will force more investors into buying “safe” bonds, thus taking some of the onus off the Fed to buy the bulk of Uncle Sam’s debt via extreme QE.

If the Fed taper becomes a reality rather than debate, bond prices will fall, which means bond yields could easily and rapidly rise from the current 1.2% range to 1.8% or higher mark.

Rising bond yields, of course, mean rising interest rates, and rising interest rates means a rising cost of debt, which ultimately means that the debt-driven “party” which markets have been enjoying for years will see a genuine “hangover” moment worse in scope to what the rising rate window of late 2018 witnessed.

In short, should the Fed indeed turn naively hawkish and “taper,” this would be a disaster for just about every asset class but the dollar, and would likely be a short-lived and immediately reversed policy, akin to the 2019 reversal after the 2018 Q4 rate hike. We may even get a new variant and COVID bailout to mark the occasion!

Tapering & Gold

As for gold investing, rising rates would send gold lower and the dollar higher if inflation doesn’t rise measurably faster or higher than potentially rising bond yields.

Given the Fed’s primal fear of that anti-dollar known as gold, we can expect more fictionally downplayed bad CPI inflation reporting from DC in the near-term, especially if a dollar-surging taper were to occur.

Longer term, however, the damage created by years of expansionary monetary and fiscal policy will continue to be an inflationary tailwind for precious metals whose patience in the face of drunken fiscal policy is historically confirmed crisis after crisis after crisis…

Real Rates: Deeper Down Seems Inevitable

As all precious metal investors know, gold price moves inversely to real (i.e., inflation-adjusted) rates. That is, as real rates plunge, gold prices rise.

This would explain why gold bought from Switzerland is moving to patient gold investors in zip codes like China and India.

Despite genuine arguments in favor of tapering and the genuine intelligence of traders like Michael Burry, the realists play the long-game. They know, in short, that tapering is a self-inflicted bullet wound to risk assets.

Furthermore, they understand that the massive mountains of debt upon which countries in the West now sit would make rising rates impossible for countries like the U.S. to re-pay.

For this reason alone, I see more rather than less QE ahead, as the only real buyers of government debt needed to keep rates repressed come from central banks, not natural market demand.

As U.S. debt to GDP skyrockets past 100% and now 130% for the twin-deficit USA, the only solution/option available to such a debt-soaked nation is lower rather than higher real rates.

In such a light, tapering, again, is a dangerous option.

Since 2014, when the U.S. lost its external finance base (i.e., when global central banks stopped buying Uncle Sam’s debt on net), the Fed has had no choice but to be the buyer of last resort for its own IOUs.

This means Uncle Sam has a vested interest in keeping rates low while inflating away its debt with higher (albeit mis-reported) inflation rates—the perfect backdrop for falling rather than rising real rates—and hence a clear tailwind for gold.

Despite such realism, many are arguing that the negative 1.1 real rate figure seen last August represents a floor.

Hmmm?

A New War, a New Excuse to Print Money

Returning to that all-too-convenient COVID narrative (scapegoat?), I am of the strong opinion that the “war on COVID” will be the dominant and continued narrative moving forward, as wars are historically confirmed (as well as historically convenient) justifications for further rate repression and even lower real rates.

That’s good for gold.

Be reminded, for example, that the U.S. is no stranger to seeing real rates fall as low as -14%, as was seen in the Civil War, as well as World Wars I and II. In the post-Vietnam 70’s, real rates sank to -7%.

My cynical realism suggests therefore that the -1.1% real rates observed last August were anything but a “floor” and that the War on COVID will be deliberately exaggerated, promulgated, extended and alas conveniently exploited to justify even greater negative real rates ahead—all very good conditions for gold and silver.

As hard as it may be for modern investors lulled into thinking the Fed has actual intelligence and choices when it comes to tapering or managing inflation like a home thermostat, the only means they have for keeping the tragi-comical levels of U.S. debt sustainable is to see real rates closer to -15% not -1.1%.

To achieve this, they will need more COVID bailouts and QE, and hence more liquidity, and hence more dollar-debasing policies to pay their debts cheaply. Again, a very nice setting for precious metals.

But -15% real rates? No way? Crazy, right?

Growing Rather Printing Our Way Out of Debt?

Optimists, of course, will call me crazy, and pundits will say we can “grow our way out of debt.”

Fair enough.

But to “grow” our way out of debt in a normal rather than increasingly more negative real-rate environment would require GDP growth rates of 20% or higher for the next 5 years.

Does anyone actually believe that will happen?

We don’t either.

Taper or no taper, real war or a politically-contrived “COVID war,” pandemic altruism or pandemic scapegoat, the debt reality facing the world in general or the U.S. in particular suggests that COVID will be the politically-correct pretext for more rather than less “accommodation” from the Eccles Building.

Longer term, this means an already grossly debased dollar will become even more so, and that negative real rates can go far lower than expected, thereby ushering in a new yet all-too familiar era for gold.

Let’s wait and see. Tyler Durden Sun, 08/29/2021 - 09:20

http://dlvr.it/S6Xml3

http://dlvr.it/S6Xml3

Alberta government refuses to take part in digital vaccine passports

by Christina Maas, Reclaim The Net: It doesn’t want to hand over citizens’ vaccination status to the federal government. The government of the Canadian Province of Alberta has refused to share its residents’ vaccination status data with the federal government. Other provinces are cooperating with the government and have even launched vaccine passport plans. TRUTH […]

http://dlvr.it/S6XSsz

http://dlvr.it/S6XSsz

Saturday, August 28, 2021

Japan Plans To Build Undersea Tunnel To Help Dump Radioactive Water From Fukushima Into The Pacific

from ZeroHedge: In a world where the UN is pressuring the west (but oddly not China) to drastically lower emissions to save the world from global warming, where ESG investing is the hottest new trend in the investment universe, it’s remarkable that the government of Japan would do something so retrograde as to dump treated […]

http://dlvr.it/S6VVmq

http://dlvr.it/S6VVmq

ESG Is A Superfluous Virtue Signal

ESG Is A Superfluous Virtue Signal

Authored by Seth Levine via RIealInvestmentAdvice.com,

Environmental, social, and governance (ESG) investing is all the rage these days. Naturally, funds are launching to meet the growing investor demand. However, new company formation cannot keep pace with inflows. Yet, the investible universe is expanding nonetheless. Something funny‘s happening. Nearly every type of company is becoming ESG-compliant without transforming a single operation. While there are certainly some questionable practices at play, this phenomenon is merely exposing a hard truth: a good business is a good business. Christ driving the money-changers from the Temple, by Theodoor Rombouts, Public Domain

History Isn’t Kind

Few people aspire to evil—financiers included. However, history has not been kind to us. We’ve been repeatedly vilified throughout the ages. Jesus expelled merchants and moneychangers from the holy temple in moral disgust. The moneylender Shylock is the principal antagonist in William Shakespeare’s The Merchant of Venice. Greedy bankers are commonly blamed for the Great Financial Crisis in 2008. There are countless other examples of abuse.

This treatment of moneylenders is unjust but not new. For millennia they have been the primary scapegoats for practically every economic problem. They have been derided by philosophers and condemned to hell by religious authorities; their property has been confiscated to compensate their “victims”; they have been humiliated, framed, jailed, and butchered. From Jewish pogroms where the main purpose was to destroy the records of debt, to the vilification of the House of Rothschild, to the jailing of American financiers—moneylenders have been targets of philosophers, theologians, journalists, economists, playwrights, legislators, and the masses. Yaron Brook, The Morality of Moneylending: A Short History

While sympathy is hard to come to by, we’re not bad people. Quite the contrary, finance is vital for our modern economies. However, this virtue is unrecognized by most. ESG investing has become, in part, penance for this unearned shame. The ironic truth, though, is that ESG is an unnecessary and circular path. If only we had the courage to see. Social or moral considerations are the main drivers of ESG investing. Source

Sizing up the ESG landscape

ESG investing has become more popular, especially over the last three quarters. It’s a morally motivated framework focused on the three pillars of environmental, social, and governance issues. The criteria dominate investment decisions more than traditional, financial factors (like valuation and cash flow). “Doing good” is the primary objective. There are different frameworks, each with its own take on these matters. However, they all seem to prioritize emissions and climate change (for E), gender and race diversity (for S), and an assortment of governance issues (for G). While ESG frameworks differ, there are similar themes. Source

Investment dollars are flooding into ESG-related funds at record levels. By one account, they have attracted $39 billion of inflows in the first half of 2021 putting the category on track for a record year. Some estimate that ESG funds could account for one-third of all assets under management by 2025!

Investment dollars are flooding into ESG-related funds. Source

All that capital needs to find a home. Not surprisingly, new homes are forming. In the last quarter alone, over 25 funds launched in the US with an ESG focus. However, money flows faster than public companies can be created. Without new options to invest in, these funds joined the herds to buy tech stocks; what else?! Investment dollars are flooding into ESG-related funds. Source

All that capital needs to find a home. Not surprisingly, new homes are forming. In the last quarter alone, over 25 funds launched in the US with an ESG focus. However, money flows faster than public companies can be created. Without new options to invest in, these funds joined the herds to buy tech stocks; what else?! ESG-related funds are mostly investing in tech stocks. Source

ESG trophies for all

To be sure, some industries can satisfy the popular ESG guidelines more easily than others. Oil and gas producers, for example, have a particularly “tough row to hoe” given ESG’s explicit goal to reduce fossil fuel usage. Technology companies have an easier time. However, many companies suddenly became ESG-compliant without changing business practices, as if by magic. This is no surprise, though.

At first, I cynically saw these companies as gaming the system. They were torturing their existing policies to fit the ESG frameworks rather than complying with its spirit. However, I see things differently now. To me, the growth in existing company compliance simply highlights a fact of reality. Most companies are good companies! Almost all large companies satisfy sustainability reporting requirements now. Source

I’m sure there are companies gaming the ESG system. There’s simply too much to gain for some. However, the essence of ESG—improving the world—is something that every business does. Of course, every company is ESG-compliant. Given the intense market competition, every entity must lower its cost of capital if it can. ESG trophies for all!

Profits are good for humanity

If one’s objective is to better the world through investing, then (nearly) every viable company is worthy. This is because profits are good—not just for lining shareholders’ pockets—but for humanity as a whole. There is no conflict between ethically good companies and financially good companies. They are the same.

There’s a common belief that ethical companies produce poor financial results while offensive ones are among the most profitable. Thus, morally good companies make traditionally poor investments and vice versa. To me, this is backward and unsupported by reality.

Profits are simply what remains from revenues after all costs of production are paid. In other words, they are the value created by a company (or individual). Remember, other people voluntarily purchased the goods and services at prices in excess of what they took to create. Customers accepted those prices as good deals. If they were too high, no transactions would occur; too low and no items would exist to purchase. For buyers to buy and sellers to sell, the price must be attractive to both. (Free) trade is always win-win. Thus, profits represent millions of people improving their lives. Is this not good?

Unfortunately, our economies are not completely free. Distortions exist. Not all trade is voluntary. Hence, not all profits reflect pure value creation. For example, electric energy production is tightly regulated. Consumers have few (if any) choices. Trade is not free making an evaluation of value difficult to assess. The same goes for healthcare, finance, and many other industries that are controlled, to various extents. Nonetheless, these cases do not invalidate their productiveness for customers. Freedom exists on a spectrum and so too does the good that profits represent.

The goal of investing

The goal of investing is to make money from money. Investors seek assets that cash flow (i.e. have yields), have the potential to yield, or will appreciate due to greater demand. In all cases, assets must produce value (and thus cash). This manifests as profits, current or potential. Thus, profitable companies do good for portfolios and humanity alike.

ESG compliance is counter productive

In my view, a good company produces things that enhance human life. More than basic necessities, they provide health, joy, comfort, and enrich our time on this planet. Furthermore, they do it on the cheap. As a result, they are profitable.

Profits reflect billions’ views of good (if not more). Thus, ESG certifications are superfluous. In fact, they often represent a limited set of values rather than a broad evaluation. For example, the fossil fuel industry is particularly vilified by most ESG frameworks. Yet, a different perspective finds it vital for human life (and hence good). Context matters, and it’s mostly dropped by narrow-minded ESG policies. (Free) markets reflect all opinions and represent every context.

In many ways I find popular ESG guidelines to be unjust and even offensive. In such circumstances—and without getting into specifics since ethical standards are beyond this article’s scope—ESG investing is actually counterproductive. It rewards bad practices! Investors expect ethically good companies to be good financial investments. Source

ESG is coming full circle

Contrary to popular belief, financiers produce an immense amount of value. We enable modern wonders from abundant and diverse food supplies to personal space travel. However, investors are not given a fair evaluation. We are unjustly vilified throughout history. Thus, I see the rise in ESG’s popularity as (partially) motivated by changing this reputation.

However, ESG frameworks are entirely superfluous. Simply follow the profits to find those companies enhancing humanity the most. Profits reflect the moral evaluations of billions of customers around the world voting with their hard-earned money. The good financial performance sought by investors can only result from strong value creation.

The pool of ESG-compliant companies is growing to meet investor demand. While new companies are forming, this mostly reflects existing ones meeting the various guidelines without changing their operations. It’s an implicit recognition of the above more than scamming the system as I previously thought.

ESG designations can even be counterproductive. The freer the market the more purely profits indicate ethically good companies. Deferring to a handful of groups, committees, and organizations is not only inefficient but narrow-minded and potentially morally corrupt. It creates a system ripe for gaming by the biggest, the most connected, and those with the most resources to spare.

Investing is a powerful tool to enact positive change. To truly utilize its potential, fight for economic liberty, champion free trade, and follow the profits. For those are the purest virtue signals of all. Tyler Durden Sat, 08/28/2021 - 10:30

http://dlvr.it/S6VVLn

http://dlvr.it/S6VVLn

US Says It Killed "Planner" Behind Kabul Airport Attack In Targeted Drone Strike

US Says It Killed "Planner" Behind Kabul Airport Attack In Targeted Drone Strike

In a purposefully "remarkable" turnaround for Biden's catastrophic evacuation of Afghanistan, where the intelligence never even considered the option of a Taliban surge thus handing over the country to the militant Islamists on a silver platter, late on Friday the US said its intelligence had finally redeemed itself when it carried out a drone strike in eastern Afghanistan against an Isis-K “planner” behind the deadly attack on Kabul airport on Thursday, even as countries wrap up desperate efforts to evacuate thousands of Afghans trying to flee, potentially sparking an even more aggressive retaliation from the organization.

“U.S. military forces conducted an over-the-horizon counterterrorism operation today against an ISIS-K planner,” said Captain Bill Urban, a spokesman for U.S. Central Command. He added that the unmanned assault took place in Afghanistan’s Nangahar Province, east of Kabul. The target was killed by a Reaper drone while traveling in a vehicle.

“Initial indications are that we killed the target,” Urban said in a statement. “We know of no civilian casualties.”

It wasn't clear what said "indications" were or what evidence the Biden admin planned to show to the public that any of this had ever happened. It also wasn't clear just how the US intelligence apparatus which failed so miserably with the evacuation of Afghanistan managed to track down and successfully eliminate the one person who was supposedly behind it all. Indeed, coming at the lowest point for the careening Biden admin, it wouldn't be a huge surprise for the president to fabricate an entire drone attack just to appease his neo-con media warlords and in hopes of boosting his cratering approval rating.

Contradicting somewhat the official narrative, a U.S. official quoted by Bloomberg said that the unnamed person was suspected of being involved in plotting future attacks, but had no direct link to Thursday’s assault in Kabul.

In other words, the Biden admin claims it carried out what is effectively a carbon copy of the operation that Trump used to take out Iran's top general, Qasem Soleimani, back in January 2020. The only difference is back then there was not only evidence of the strike, but also confirmation on the ground. This time around, however, people are understandably skeptical that any of this even happened.

Then again it wouldn't be the first time a local warlord was quietly and secretly disposed of: after all none other than Osama bin Laden got a quick and traceless burial at sea under Barack Obama. Hardly surprising that Joe Biden took a similar route.

The alleged drone attack came in the wake of new warnings from top American security officials that another terror attack in Kabul is likely, just days ahead of Tuesday’s deadline for withdrawing US forces from Afghanistan. Isis-K, an Afghan affiliate of terrorist group Isis, claimed responsibility for the attack that this week killed more than 100 Afghan civilians and at least 13 US military personnel.

Joe Biden vowed to complete the U.S. evacuation mission in Afghanistan and pledged to pursue the attackers, saying Thursday evening that “we will not forgive, we will not forget, we will hunt you down and make you pay.”

Asked by reporters on Friday whether the president would order a mission to kill those responsible for the bombing, White House Press Secretary Jen Psakitold reporters: “He does not want them to live on the Earth any more.”

Meanwhile, thousands of people remain on the airport’s grounds awaiting evacuation, though their hopes of getting out are fading as countries conduct their final evacuation flights and Taliban fighters turn away eligible evacuees.

The latest strike marks at least the third time the General Atomics-built Reaper, has been used in a high-profile attack. A Reaper firing laser-guided Hellfire missiles was used in a nighttime November 2015 attack in Syria that killed Islamic State terrorist Mohammed Emwazi, known as Jihadi John.

More recently, a Reaper fired two Hellfires during a night attack outside Baghdad International Airport in January 2020 that killed Iranian general Qassem Soleimani just after he arrived in Iraq. The Reaper, a $64 million long-endurance aircraft with a 20-meter (66-foot) wingspan, had Soleimani in its sights for about 10 minutes before firing on two cars carrying the Iranian commander and other senior leaders and aides, including the head of an Iraqi-based militia group that had been.

Those skeptical that any of the above actually even happened, there will be a simple test: if the suicide attacks in and around the Kabul airport end in the coming days, Biden may have pulled it off. If not...well, we are about to see - metaphorically speaking of course - a whole lot more non-existent drone strikes. Tyler Durden Sat, 08/28/2021 - 09:03

http://dlvr.it/S6VK2y

http://dlvr.it/S6VK2y

248 Chinese Companies with Off-Limit Audits and a Market Cap of Over $2.1 Trillion Are Listed on U.S. Exchanges – Now Congress Demands Action from the SEC

by Pam Martens and Russ Martens, Wall St On Parade: For the past 19 years, China has been stonewalling U.S. regulators over access to the work papers of auditors of publicly traded companies that are based in China but listed on U.S. stock exchanges. China takes the position that these audit work papers hold state secrets and […]

http://dlvr.it/S6VJts

http://dlvr.it/S6VJts

Friday, August 27, 2021

Bad Breadth & Big Divergences

Bad Breadth & Big Divergences

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

BIg Divergences

While the market continues its bullish advance (why not with $120b in QE), the divergences between price and other internal indicators continue to widen. Another trip to the 50-dma would be a near 3% crash, and a decline in the 200-dma (which hasn’t happened for one of the longest spans in 40-years) would be a 10% disaster. (While I am sarcastic, the low volatility market experienced this year makes even normal annual corrections seem much worse than they really are.)

For now, the “stair-step” process continues with bounces off the 50-dma to slightly new highs before the next decline. At some point, investors will slip and fall down the stairs.

Price Targets Exceed Analysts Grasp

Analysts are rushing to peg a 5000 price tag on the S&P 500 by the end of 2022.

Even if it’s a HUGE if because analysts’ estimates are always too optimistic, earnings meet expectations valuations will remain extremely rich.

How Much Confidence Should We Have In Confidence Readings?

The graph below, courtesy of Renaissance Macro Research, presents quite the quandary.

As we discussed last week, the widely followed UMich Consumer Confidence fell sharply to levels below any seen in 2020. On the other hand, the lesser followed Langer confidence index continues upward. It isn’t easy to fully understand why they are diverging. However, Langer rose steadily in 2019 and 2020 while the UofM indicator was flat. Other than that period preceding the pandemic, the two indicators correlate well, including periods before the financial crisis and the tech crash.

Jackson Hole Appetizer

The host of the Jackson Hole symposium, Esther George of the Kansas City Fed, wants to start tapering soon. Per her interview on CNBC:

*

“The U.S. economy has hit the necessary benchmark of “substantial” progress needed to start to slow down its $120 billion per month of asset purchases”

*

“My own view on that is that we have made substantial further progress and we can begin to talk to talk about backing off some of that accommodation”

*

“I would be ready to talk about tapering sooner rather than later”

She alludes that the timetable and amount of tapering will be on the agenda at the upcoming September 21-22 FOMC meeting.

Rinse Wash Repeat

The graph below from Northman Trader shows the predictable pattern the S&P 500 has fallen into over the last several months.

The market grinds higher and hits an air pocket around the 15th of each month. It then quickly recovers and grinds higher again. The dips and surges all occur between the 14th and 19th of each month, corresponding with options expiration dates. Liquidity is poor, as witnessed by light trading volumes, so heavier than usual options-related trade activity is driving price action on those days.

Bad Market Breadth

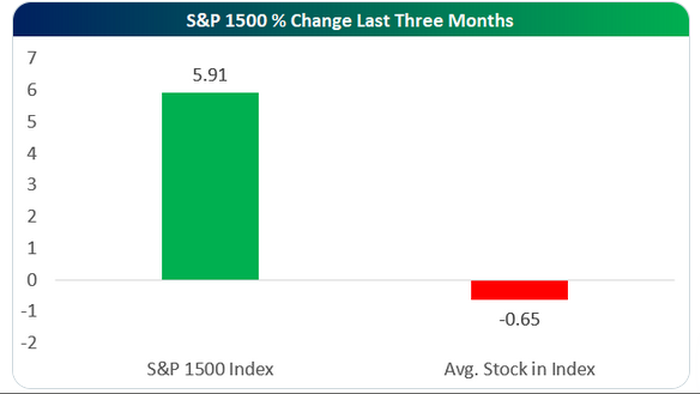

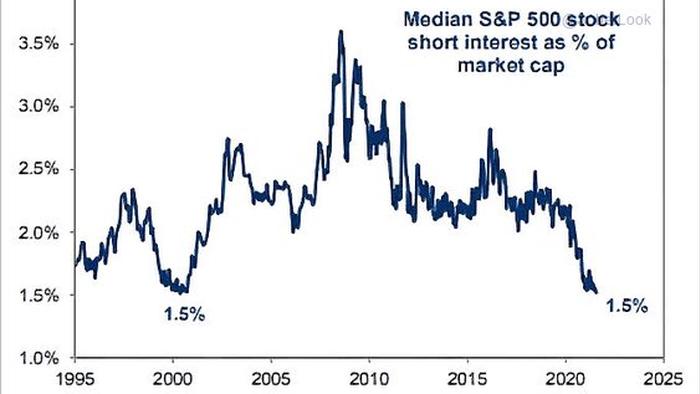

The Tweet below from Bespoke Investment provides more evidence the market is increasingly being driven higher by fewer stocks.

Bad breadth is often an indicator of a coming market retracement. Tyler Durden Fri, 08/27/2021 - 09:59

http://dlvr.it/S6RV41

http://dlvr.it/S6RV41

Somethin’s Gotta Give!

by Hugo Salinas Price, Plata: Rounded figures, based on Google.com: World population: In 1971: 3,761,000,000 human beings. In 2020: 7,900,000,000 human beings. In forty-nine years, the population of our World more than DOUBLED – the Earth’s population in 2020 was 2.1 times the population of the Earth in 1971. TRUTH LIVES on at https://sgtreport.tv/ When President […]

http://dlvr.it/S6RF8F

http://dlvr.it/S6RF8F

Biden's Bad Week Just Got Worse: Supreme Court Blocks CDC's Eviction Ban

Biden's Bad Week Just Got Worse: Supreme Court Blocks CDC's Eviction Ban

Saying that it has not been a good week for President Biden may be the understatement of the year as along with the Supreme Court's decision to force the administration to reinstate Trump's 'Remain in Mexico' immigration policy, and the terrible situation still unfurling in Afghanistan, The US Supreme Court on Thursday lifted the temporary eviction ban, originally imposed by the Centers for Disease Control and Prevention (CDC) for 120 days starting in March 2020, but repeatedly extended first by the Trump administration, then by the Biden administration (which was finally-finally-maybe set to expire on October 3, 2021).

“The Biden Administration is disappointed that the Supreme Court has blocked the most recent CDC eviction moratorium while confirmed cases of the Delta variant are significant across the country,” White House Press Secretary Jen Psaki said in a statement.

“As a result of this ruling, families will face the painful impact of evictions, and communities across the country will face greater risk of exposure to COVID-19.”

As WolfStreet's Wolf Richter writes below, the Court said in the unsigned opinion that the ban exceeded the CDC’s authority to combat communicable diseases, and that it forced landlords to bear the costs of the pandemic.

The decision was expected (and went 6-3, along ideological lines).

Even President Biden had acknowledged that the CDC’s latest extension of the eviction ban was legally iffy but the litigation would give the government time to distribute $47 billion to make landlords whole and get tenants off the hook.

“The CDC has imposed a nationwide moratorium on evictions in reliance on a decades-old statute that authorizes it to implement measures like fumigation and pest extermination,” the Court wrote.

“It strains credulity to believe that this statute grants the CDC the sweeping authority that it asserts.”

The most important aspect of the national eviction moratorium is that it came of top of the extra $600 a week in federal unemployment benefits last year and an extra $300 a week this year, on top of the regular unemployment benefits. These extra unemployment benefits, on top of the regular state unemployment benefits, were specifically designed to give people enough money – in many cases more money than they had before – to pay rent and health insurance and other stuff.

The federal unemployment benefits also covered gig workers and workers that didn’t qualify for any other programs. Plus, there were the stimulus payments. There was money everywhere and anywhere. The whole thing was designed to allow people to spend money even if they lost their jobs.

Many people made more money under these programs than before, and it triggered a historic spike in retail sales. But with the eviction moratorium in place, people didn’t have to pay rent anymore, and could just spend on other stuff all this money they got to pay for rent.

And they did.

But wait… There’s another layer of money now.

The federal government has provided $47 billion in taxpayer money to states and local governments to make landlords whole and get tenants off the hook, now that they spent on cars, electronics, furniture, and other things all the money they got from the extra unemployment benefits designed precisely to allow them to pay their rent.

Governments have been slow to dole out this federal taxpayer money, $47 billion being quite a pile to give away willy-nilly. Rules have been eased to speed up the process. Landlords can now apply for a whole bunch of tenants at once. Etc.

The Court said in the case, brought by the Alabama Association of Realtors, that the CDC exceeded its authority with the eviction ban, but that Congress might have the power to impose it.

“The moratorium has put the applicants [the Alabama Association of Realtors], along with millions of landlords across the country, at risk of irreparable harm by depriving them of rent payments with no guarantee of eventual recovery,” the court said.

It pointed out that “many landlords have modest means. And preventing them from evicting tenants who breach their leases intrudes on one of the most fundamental elements of property ownership – the right to exclude.”

“This decision is the correct one, from both a legal standpoint and a matter of fairness,” NAR spokesperson Patrick Newton told the Daily Caller News Foundation on Thursday.

“It brings to an end an unlawful policy that places financial hardship solely on the shoulders of mom-and-pop housing providers, who provide nearly half of all rental housing in America, and it restores property rights in America.”

However, the mainstream narrative makes it easier to feel sorry for the plight of the tenants.

But those tenants already got paid the extra unemployment benefits from the federal government, on top of the state unemployment benefits, on top of the stimmies, so that they could pay their rents.

But the eviction bans allowed those tenants to buy other stuff with this money instead of paying their rents. And now the taxpayer is paying $47 billion to landlords to make them whole and to get the tenants off the hook, in an economy where no one has to pay for anything anymore.

But this is not the end of the eviction bans. They live on in several states, including New York and California, and in many municipalities.

The whole idea of the eviction bans was that consumers don’t have to pay their debts and other obligations, such as rents, with the money that they received from the government precisely to pay those debts and other obligations, and that they could use that money to buy other stuff. And now the government is paying a second time for the same thing, this time to make landlords whole, in an economy that has gone nuts.

* * *

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Tyler Durden Fri, 08/27/2021 - 05:00

http://dlvr.it/S6Qbww

http://dlvr.it/S6Qbww

Thursday, August 26, 2021

US Beef Packers Margins Approach Record High As Demand Soars Ahead Of Labor Day

US Beef Packers Margins Approach Record High As Demand Soars Ahead Of Labor Day

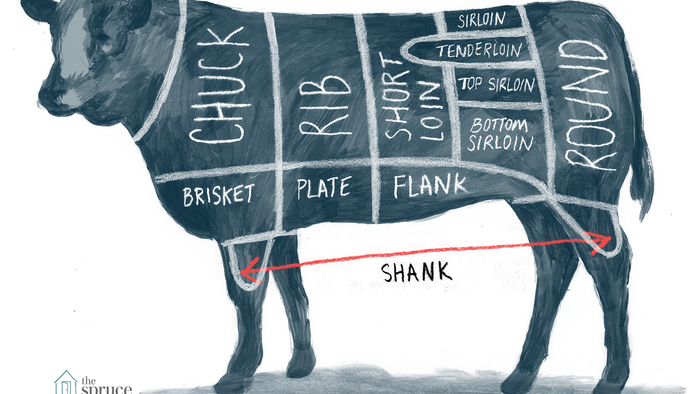

US live cattle prices in all regions are $128 per head Tuesday, but meat packer margins are somewhere out in orbit and continue to climb in the greatest squeeze since the beginning of the COVID-19 pandemic.

Demand for beef is skyrocketing ahead of labor day. Bloomberg compiled ag data via HedgersEdge that showed increasing beef demand is pushing meat-packer margins to near the $1,000 per head mark last seen in May 2020 when the virus pandemic squeezed food supply chains.

Bloomberg said, "restaurant reopenings, Labor Day grilling and more tourism around the world are boosting prices for the red meat. But with cattle prices lagging the eye-popping gains in meat, the profits that packers like Tyson Foods Inc. are making could bring more scrutiny in Washington for an industry that critics say is too concentrated."

With meatpackers, such as Tyson Foods raising its fiscal 2021 revenue forecast on strong beef demand, these companies are making hand over fist while raising retail prices.

Tyson's CEO Donnie King recently told investors that cost pressures would force the company to raise meat prices in the next two weeks.

The notable trend within the food supply chain is that COVID disruptions continue to linger. Food prices have gone through the roof, and megacorporations like Tyson are handsomely profiting from market imbalances.

No consumer is looking forward to this fall when supermarket prices are expected to spike even further. Perhaps, Labor Day cookouts will be the most expensive ever. Tyler Durden Thu, 08/26/2021 - 09:53

http://dlvr.it/S6Mrfm

http://dlvr.it/S6Mrfm

Nitric Oxide Nasal Spray Reduces Covid-19 Viral Load By 95% Within 24 Hours: Study