Biden's Nominee For Top Bank Regulator Earned "Lenin" Award, Praised USSR's "Equality", And Wants To "End Banking As We Know It"

President Biden's pick for Comptroller of the Currency is quite the anti-capitalist.

Cornell University law professor Saule Omarova, who proposed 'ending banking as we know it,' and that radical change to the system would make the institution 'more inclusive, efficient and stable,' has come under fire over her extreme views. Saule Omarova in 201

"Until I came to the US, I couldn’t imagine that things like gender pay gap still existed in today’s world. Say what you will about old USSR, there was no gender pay gap there. Market doesn’t always ‘know best,’" Omarova tweeted in 1999, adding (after receiving harsh criticism) "I never claimed women and men were treated absolutely equally in every facet of Soviet life. But people’s salaries were set (by the state) in a gender-blind manner. And all women got very generous maternity benefits. Both things are still a pipe dream in our society!"

What's more, Omarova supports several progressive proposals - including the Green New Deal, and the creation of a giant bureaucracy she dubbed the National Investment Authority, which would - among other things - coordinate the long term economic strategy for the United States with upcoming infrastructure developments, according to the Washington Free Beacon. It would also manage a "big and bold" climate agenda.

The authority would have a congressionally approved governing board and regional offices across the country. In addition to developing roads, bridges, and other traditional infrastructure projects, the authority would fund affordable housing, public transit, and clean energy projects, as well as "climate change mitigation solutions," Omarova told Congress this year. -Free Beacon

As the Wall Street Journal editorial board notes, "Ms. Omarova thinks asset prices, pay scales, capital and credit should be dictated by the federal government. In two papers, she has advocated expanding the Federal Reserve’s mandate to include the price levels of “systemically important financial assets” as well as worker wages. As they like to say at the modern university, from each according to her ability to each according to her needs."

In a recent paper “The People’s Ledger,” she proposed that the Federal Reserve take over consumer bank deposits, “effectively ‘end banking,’ as we know it,” and become “the ultimate public platform for generating, modulating, and allocating financial resources in a modern economy.” She’d also like the U.S. to create a central bank digital currency—as Venezuela and China are doing—to “redesign our financial system & turn Fed’s balance sheet into a true ‘People’s Ledger,’” she tweeted this summer. What could possibly go wrong? -WSJ

Omarova also wants to create a "Public Interest Council" of "highly paid" academics who would wield subpoena power over regulatory agencies, including the Fed.

In her earlier days, Omarova worked in the Bush administration Treasury Department.

As The Washington Free Beacon notes, Omarova's policies have won her accolades from prominent progressive lawmakers and special interest groups. Sen. Elizabeth Warren (D., Mass.) said Omarova's nomination was "tremendous news." The Sierra Club said Omarova would help the Office of the Comptroller of the Currency fight against "climate chaos" and set up "guardrails against Wall Street's risky fossil fuel investments."

Interestingly, The Wall Street Journal reports that Biden nominated Ms. Omarova over the objections of Treasury Secretary Janet Yellen, to whom the comptroller reports. One theory they suggest for this bizarre nomination is that Mr. Biden is trying to appease progressives because he plans to reappoint Jerome Powell as Fed chairman. Tyler Durden Thu, 09/30/2021 - 15:04

http://dlvr.it/S8glv6

Thursday, September 30, 2021

Stagflation Risk: Stephen Roach Latest Economist To Sound Alarm On '70s-Style Inflation

Stagflation Risk: Stephen Roach Latest Economist To Sound Alarm On '70s-Style Inflation

Authored by Tom Ozimek via The Epoch Times,

Stephen Roach is the latest high-profile economist to sound the alarm on the risk of a 1970s-style stagflation—where economic growth falls but inflation stays stubbornly high.

The former Morgan Stanley Asia chairman told CNBC in a Sept. 29 interview that the energy price spike is inflicting major damage to struggling supply chains and that he believes the United States is “one supply chain glitch” away from a 70s-era bout of stagflation.

His remarks came as gasoline stations were running dry in Britain, power costs were surging in the European Union ahead of winter, and amid rising prices for oil, natural gas, and coal.

In the interview, Roach spoke of supply chain bottlenecks shifting from one part of the supply chain to another rather than easing, a situation he called “strikingly reminiscent of what we saw in the early 1970s” and one that “suggests that inflation will stay at these elevated levels for longer than we thought.”

“We were sort of one supply chain glitch away from stagflation,” Roach said, adding, “That seems to be playing out, unfortunately.”

Roach took aim at the Fed’s easy money policies, arguing they were excessive, particularly in the face of persistent inflationary pressures.

While Fed officials have maintained that the current bout of inflation is temporary and will abate once supply chain dislocations abate, they have increasingly started to acknowledge that inflation has been stickier than previously thought.

“This is not the situation that we have faced for a very long time and it is one in which there is a tension between our two objectives. … Inflation is high and well above target and yet there appears to be slack in the labor market,” Federal Reserve Chair Jerome Powell said at a European Central Bank forum, with his remarks appearing to point to a stagflationary dynamic.

Surging prices have been a headline theme amid the economic recovery, rising faster than wages and eroding the purchasing power of Americans.

Core personal consumption expenditures (PCE) inflation, which excludes the volatile categories of food and fuel and is the Fed’s preferred gauge for price growth, has risen sharply in recent months, well above the central bank’s 2 percent target.

In April of this year, core PCE was 3.1 percent, rising to 3.5 percent by May and 3.6 percent in June and July, the latest months of available data from the Commerce Department.

While Fed officials have expressed concern about price pressures, they predict that the high rate of inflation is a transitory phenomenon. Still, they acknowledge there’s a risk that price pressures will be stickier than previously anticipated.

New York Federal Reserve Bank President John Williams said Monday that consumer expectations for what the rate of inflation will be several years down the road remain “well-anchored” around the Fed’s 2 percent objective, though he said there are upside risks and a “great deal of uncertainty” around the inflationary outlook.

Economist Nouriel Roubini, known for his gloomy-yet-accurate forecast of the 2008 financial crash—a prediction he made at a time of peak market exuberance—warned in a recent op-ed that the global supply chain crisis combined with high debt ratios and ultra-loose monetary and fiscal policies threaten to turn the “mild stagflation” of recent months into a full-blown stagflationary crisis. Tyler Durden Thu, 09/30/2021 - 14:00

http://dlvr.it/S8gXQx

http://dlvr.it/S8gXQx

“Transitory” is the New Spandex: Powell Admits it, Still Denies its Cause. Why this Inflation Won’t Go Away on its Own

by Wolf Richter, Wolf Street: Blames tangled-up supply chains but not what’s causing supply chains to get tangled up in the first place: The most grotesquely overstimulated economy ever. Fed Chair Jerome Powell, during a panel discussion hosted by the ECB today, admitted again that inflation pressures would run into 2022 and blamed “bottlenecks and […]

http://dlvr.it/S8gR73

http://dlvr.it/S8gR73

We Will Not Comply: Red States Should Offer Sanctuary To Businesses, Military And Medical Personnel

by Brandon Smith, Alt Market: All it takes is one free place to change the dynamic between the public and an authoritarian regime. Just one. This week has been an extremely busy news cycle and there is a lot to cover, so along with my normal weekly analysis on one major topic, I am going […]

http://dlvr.it/S8fh3q

http://dlvr.it/S8fh3q

Wednesday, September 29, 2021

Natgas Drops 7% On Warmer Forecasts, Largest One-Day Decline Since January

Natgas Drops 7% On Warmer Forecasts, Largest One-Day Decline Since January

U.S. natural gas futures plunged more than 7% Wednesday from a seven-year-high on warmer weather forecasts for the next few weeks, which indicates lower demand for powerplant and heating fuel, according to Bloomberg.

Above-normal temperatures for the East Coast while below-normal temperatures for the West Coast are expected to last through Oct. 13. Shown below is the U.S. Lower 48 mean temperature positively diverging from the 30-year norm.

"October is supposed to be warmer than normal. If that's the case, natgas is going to find some stability," said Phil Flynn, senior market analyst, Price Futures Group.

Heating degree days (HDD), the measure of demand for energy needed to heat a building when the average temperature is below 65F, began to slightly increase from 1 HDD to nearly 3 HDD from Sept. 15-30 but has since negatively diverged the 30-year trend and estimated to do so through Oct. 13.

Natgas futures have been on a tear, reaching seven-year highs above the $6 handle on shortage fears in Europe. Futures have plunged almost 12.5% in the last two trading sessions, with today's 7% drop the largest daily slump since Jan. 19.

The largest decline since Jan. 19.

BloombergNEF estimates that "even mild weather in coming months" will keep U.S. stockpiles below historical averages because of increasing demand and will put a bid under prices.

"There's a 64% chance that inventories will finish below the five-year average level at the end of winter 2021-22," BNEF noted in its latest U.S. Gas Monthly report.

The problem with soaring natgas prices, especially prices in Europe, is that it may threaten economic recoveries as consumers and businesses cannot afford gas to power homes and businesses. Tyler Durden Wed, 09/29/2021 - 14:52

http://dlvr.it/S8brKj

http://dlvr.it/S8brKj

UK hospital data shocks the world: 80% of COVID deaths are among the vaccinated… COVID deaths up 3,000% after vaccine wave

by Lance Johnson, DC Clothesline: (Natural News) A deadly combination of science fraud, institutional coercion, bribery, Big Tech censorship, government force and media propaganda are bringing the world to its knees. There is NO real-world data showing that covid-19 vaccines reduce the risk of hospitalization and death. Right now, hospital data from the United Kingdom is […]

http://dlvr.it/S8bpwz

http://dlvr.it/S8bpwz

"Declaration Of Media War": Russia Threatens Total Ban On YouTube After Major Channels Deleted

"Declaration Of Media War": Russia Threatens Total Ban On YouTube After Major Channels Deleted

The Kremlin on Wednesday slammed YouTube for unwarranted "censorship" and "media obstruction" after the day prior the Google-owned video hosting platform suddenly blocked two German RT channels, including RT Deutsch which was competing for traffic with major German news and politics channels. YouTube said the Russian state media channels had breached its Covid 'disinformation' policies.

At the time it was blocked RT Deutsch had over 600,000 subscribers and was approaching 600 million total views, according to Russian media reports. "Of course, there are signs that Russian laws have been violated, violated very rudely, as this, of course, is associated with censorship, and with obstruction of the media information dissemination," Kremlin spokesman Dmitry Peskov said. Image source: SNA/Der Spiegel

"If our supervisory authorities come to the conclusion that this is, indeed, a violation of our legislation, then, of course, we cannot, we should not exclude the possibility of taking measures to force this platform to comply with our laws," he added.

A separate Foreign Ministry statement called it "outright information aggression" - and RT's editor-in-chief Margarita Simonyan called the ban a "real media war declared by the state of Germany to the state of Russia" in a social media post.

However, the German government was quick to distance itself from Facebook's ban, saying it didn't have anything to do with the order. "They were not implemented by the German government," a German official said.

"This is a YouTube's decision against RT and, I believe, one more channel, which is based on YouTube rules. We are taking note of this. Obviously, the affected channels have opportunities to oppose this," cabinet spokesman Steffen Seibert told reporters at a briefing.

'A declaration of media war against Russia by Germany,' claims RT editor-in-chief after YouTube deletes popular RT DE channels — RT Russia & Former Soviet Union https://t.co/Tc273VbUft — George Galloway (@georgegalloway) September 28, 2021

Moscow was quick to hit back at parent company Google, according to Politico threatening to block the platform altogether from the Russian Federation:

Russian authorities threatened to block YouTube on Wednesday, a day after RT's German-language channels were deleted with Google's video platform saying the Russian state-backed broadcaster had breached its COVID-19 information policy.

This morning, Roskomnadzor, the Russian government’s media watchdog, threatened to block YouTube in Russia if it didn’t restore the banned channels, RBC news reported.

It's not the first time that such a threat has been made, which also recently included Twitter. The Kremlin has in the past charged US-based social media platforms with violating obscenity laws. More recently Russian officials have denounced 'political interference' based on the platforms advancing pro-Navalny groups and other opposition content.

On Wednesday, a Russian court moved to take concrete action against Google for the Germany ban, slapping it with a 6.5mn rouble fine for not deleting "prohibited content." Given the fine is not at all an immense one, it's being seen as largely a symbolic act portending more punitive action to come. Tyler Durden Wed, 09/29/2021 - 14:00

http://dlvr.it/S8bh1F

http://dlvr.it/S8bh1F

YouTube could face total BAN in Russia if tech giant doesn’t unblock RT’s German-language channels, Moscow’s media regulator warns

from RT: Officials in Moscow have issued a sternly-worded ultimatum to YouTube’s parent company, Google, saying the video streaming site could face restrictions after it took down two channels run by RT’s German-language service. In the statement, released on Wednesday morning, the country’s national media regulator, Roskomnadzor, said that it “demands all restrictions be lifted from […]

http://dlvr.it/S8bYw5

http://dlvr.it/S8bYw5

Florida Governor Ron DeSantis Announces Lawsuit Against Joe Biden’s Illegal Human Trafficking Operations

from The Conservative Treehouse: Florida Governor Ron DeSantis announced Tuesday that he is triggering a three point plan to confront Joe Biden’s human trafficking operation. One measure includes a lawsuit against the federal government for illegal human trafficking operations into the state of Florida. A second measure includes an executive order which -in part- allows […]

http://dlvr.it/S8ZsNs

http://dlvr.it/S8ZsNs

Tuesday, September 28, 2021

Get Out of the Cities – Part 1

by SaraSue, Survival Blog: If you’re on the fence, then please get off of it and make your move. I realize how scary that sounds because I’ve done it. I realize how insane it sounds to walk away from a job with really good benefits and a retirement account. Again, because I did it. I did […]

http://dlvr.it/S8X3wF

http://dlvr.it/S8X3wF

Pro Tennis Player Ends Season After Covid Vaccine Left Him With ‘Violent Pain’: ‘Suddenly I Cannot Train, I Cannot Play’

from Humans Are Free: Tennis pro Jeremy Chardy, 34, says he may never play the sport again after Pfizer’s Covid-19 vaccine reportedly left him suffering major bouts of pain. Speaking to Agence-France Presse, the French 2020 olympian explained he began experiencing violently painful, debilitating health effects immediately after taking the vaccine. TRUTH LIVES on at https://sgtreport.tv/ […]

http://dlvr.it/S8X1L2

http://dlvr.it/S8X1L2

Bezos' Blue Origin Prepares For Next Human Flight As UN Bashes "Billionaires Joyriding To Space"

Bezos' Blue Origin Prepares For Next Human Flight As UN Bashes "Billionaires Joyriding To Space"

It's only been a few months since billionaires Richard Branson, Jeff Bezos, and Elon Musk launched private space crews into low Earth orbit. The latest was Musk's SpaceX's Inspiration4 mission that catapulted the first-ever private crew of astronauts 150 miles higher than the International Space Station for three days.

Musk can't have all the limelight. Bezos' Blue Origin announced Monday that New Shepard's 18th mission, NS-18, will lift off on Oct. 12. The crew will include Dr. Chris Boshuizen, a former NASA engineer and co-founder of Planet Labs, Glen de Vries, Vice-Chair, Life Sciences & Healthcare, Dassault Systèmes and Medidata, according to a company press release. There are also going to be special announcements of two other astronauts in the coming days.

NS-18 follows Blue Origin's successful first human flight on July 20 when Bezos, his brother, and two others launched into space.

With billionaires focused on who can go the deepest into space, the Federal Aviation Administration recently grounded Branson's Virgin Galactic after its space mission on July 11.

Meanwhile, the secretary-general of the United Nations has bashed the billionaires for their "joyriding to space while millions go hungry on earth." Tyler Durden Tue, 09/28/2021 - 13:50

http://dlvr.it/S8WvYM

http://dlvr.it/S8WvYM

Tense Exchange As Tom Cotton Asks Gen. Milley: "Why Haven't You Resigned?"

Tense Exchange As Tom Cotton Asks Gen. Milley: "Why Haven't You Resigned?"

US CentCom Commander Gen. Mark Milley got into a testy exchange with Republican Sen. Tom Cotton over the botched Afghan withdrawal and evacuation in Congressional testimony on Tuesday. He appeared to undercut President Biden, who previously told ABC News' George Stephanopoulos that "no one" that he "can recall" advised in favor of keeping a few thousand-strong force inside Afghanistan to ensure there'd be no rapid collapse or attacks on Americans. "I can only conclude your advice about staying in Afghanistan was rejected," Cotton began in his questioning.

But things really got tense when Cotton questioned, "If all this is true General Milley then why haven't you resigned?"

Wow. Exchange between Gen. Milley & Sen Cotton on why he hasn’t resigned re #Afghanistan

“President doesn't have to agree w advice just because we're Generals..This country doesn't want Generals to figure out which orders we're going to follow or not..”

pic.twitter.com/cb3do7pmGh — Joyce Karam (@Joyce_Karam) September 28, 2021

"It's a political act if I'm resigning in protest," Milley began his response. "My job is to provide advice.. to provide the best military advice to the president, and that's my legal requirement - that's what the law is."

"This country doesn't want generals figuring out what orders we are going to accept and do or not," Milley emphasized. He added that "on a personal note"...

"My dad didn't get a choice to resign at Iwo Jima. Those kids at Abbey Gate didn't get a chance to resign."

"I'm not gonna turn my back on them. They can't resign so I'm not going to resign," he added. "If the orders are illegal, then we're in a different place."

Last month, Joe Biden claimed that no military leader advised him to leave a small troop presence in Afghanistan.

Today, General Milley and General McKenzie both confirmed their recommendation that 2,500 U.S. troops remain in Afghanistan.

Which is it? pic.twitter.com/3Tnw1a6V4q — Tom Cotton (@SenTomCotton) September 28, 2021

While the explanation of a top commander's duties and the Constitution's laying out elected civilian control of the armed forces are certainly accurate, the whole exchange does bring up the question of accountability.

It remains that now a month out, there's been no accountability whatsoever for the series of bungled actions which in the end resulted in the deaths of 13 American troops and over 60 Afghan civilians.

WOW!

Biden said no senior military leadership advised him to leave a troop presence in Afghanistan. (Cotton)

Milley & McKenzie confirm they wanted a troop presence.

Austin said their advice was “received & considered, for sure.”

Biden has some questions to answer! — Kayleigh McEnany (@kayleighmcenany) September 28, 2021

There's also been zero accountability for the drone strike targeting a misidentified "ISIS-K terrorist" - which ended up being a local humanitarian aid worker. In total the strike killed 10 civilians, including up to 7 children.

So far there's not been so much as a single formal reprimand or demotion over the Aug.29 drone strike within either the Biden administration or military ranks. This despite the Pentagon since openly admitting that the drone operation was a "mistake". Tyler Durden Tue, 09/28/2021 - 13:06

http://dlvr.it/S8WmdJ

http://dlvr.it/S8WmdJ

Medical experts warn: Coronavirus boosters kill more lives than they save

by Ramon Tomey, Natural News: Medical experts and other personalities have joined hands in opposing Wuhan coronavirus (COVID-19) vaccine booster shots during a Food and Drug Administration (FDA) hearing. They warn that COVID-19 vaccines “kill more people than they save” and give rise to new, vaccine-resistant SARS-CoV-2 strains. The experts’ opposition to booster shots comes as President Joe Biden […]

http://dlvr.it/S8W33d

http://dlvr.it/S8W33d

Monday, September 27, 2021

Sorry, Fed, Inflation is Already Embedded

by Charles Hugh Smith, Of Two Minds: The Fed and its minions are about to get what they so richly deserve: the full blame for the coming catastrophe. The key justification for the Federal Reserve’s zero-interest rate policy is that inflation is transitory. Sorry, Fed, inflation is already embedded, i.e. inflation is now a self-reinforcing feedback loop: price […]

http://dlvr.it/S8S8zX

http://dlvr.it/S8S8zX

Prepping 101: What are the best states to live in during a pandemic?

(Natural News) Medical science already has a good understanding regarding the spread of disease today. However, there are diseases that we are still hopeless against. Medicines are not a catch-all, either. Antibiotics, for instance, work well against bacterial infections, but can’t do anything against viruses. Hundreds of thousands become infected with influenza every year, and...

http://dlvr.it/S8S5ws

http://dlvr.it/S8S5ws

US Shale Is Finally Ready To Drill Again

US Shale Is Finally Ready To Drill Again

By Irina Slav of OilPrice.com

U.S. shale producers have behaved in an exemplary way in the past year. It wasn’t something the industry wanted to do. It was something it was forced to do by the pandemic and by its shareholders, who after years of waiting for windfalls put their foot down and demanded higher returns. But it just might be time for a change.

U.S. shale must by now be used to the price shocks. Even so, the pandemic-driven destruction of demand for crude must have hurt. On top of that pain, the large public shale producers had many unhappy shareholders to deal with. They dealt with them by cutting spending, slashing production, and focusing on cash flow generation.

They largely did it with some help from OPEC+, which cut an unprecedented 7.7 million bpd from its combined production, and some non-OPEC producers that stepped in to shoulder part of the burden. Since then, demand has recovered, and so have prices. All eyes have been on U.S. shale for months now, expecting drillers to start ramping up drilling in a major way. So far, the industry has defied expectations. But it seems this won’t continue for much longer.

U.S. crude oil production is set to rise by 800,000 bpd next year, the Financial Times reported this week. This is hardly surprising given that U.S. oil prices are around $70 per barrel now, making most shale wells profitable again, the report notes. But there is one interesting thing that is different this time. According to an IHS Markit analyst, it would be private independent drillers that will lead the charge this time.

As interesting as this forecast is, it is hardly surprising. Even before the pandemic struck, disgruntled shareholders were the talk of the town in shale oil. Years of burning cash to boost production just so the United States could become the largest oil producer in the world never made sense with shareholders who bought into Pioneer Natural Resources, Devon Energy, and Continental Resources. They bought into these companies and their public peers for the dividends.

So when these dividends did not come in the size shareholders expected, disgruntlement grew. It also coincided with the growing popularity of the energy transition narrative sparking worry that shale oil bets were becoming increasingly unsafe in a changing energy world. So the public shale drillers had one option left: begin to deliver.

They have been doing this for a while now. As Reuters recently reported, the large shale players have been boosting dividends and adding to them things like variable distributions and share buybacks to keep shareholders on board while also taking active steps to reduce their debt load - a major cause for worry among shale investors.

So, public shale drillers have been pampering shareholders after years of disappointments and even now continue to be at risk of a backlash if they start drilling more. This, however, they will need to do soon as the inventory of drilled but uncompleted wells shrinks amid the return of demand. Shale drillers, therefore, would need to raise spending to keep their output at current levels.

Meanwhile, small private drillers have hung on by the skin of their teeth until the worst of the pandemic crisis blew over. Now that this is behind them, their hands are untied to ramp up production as much as they like. Private drillers have no shareholders to report to. Their only concern is the market. If there is enough demand to push prices to a profitable level, then these companies will drill and pump more oil. And the outlook for demand is quite rosy.

No wonder then that, according to IHS Markit’s Raoul LeBlanc, those private shale oil independents are set to account for more than half of the expected increase in U.S. crude oil production next year. That’s up from 20 percent in any other year, the FT quoted LeBlanc as noting.

“The privates are not on board with this whole capital discipline thing. For them, this is their window,” the IHS Markit analyst told the FT.

“They’re thinking, ‘here’s my chance and I’m going to take advantage of it’ because they see it as maybe their last, best chance.”

In January, when prices were on the rebound and WTI was trading at around $50, one Wood Mac analyst called it a siren song - the price recovery that was expected to switch U.S. shale producers to a growth mode again and pressure prices. This did not happen because of the majors’ newfound capital discipline. Yet small producers are a lot more flexible since they don’t have shareholders to keep happy. And they could become a downside risk for prices before too long.

A lot of shale oil became profitable at prices around $50. At $20 over that, most shale oil is profitable. No one could possibly blame private independents for grabbing the chance to monetize their oil assets, not with the long-term forecasts - although these are rather wishes than forecasts - about the end of the oil era. Tyler Durden Mon, 09/27/2021 - 13:40

http://dlvr.it/S8RzcK

http://dlvr.it/S8RzcK

"A Crypto Bank Like No Other": Morgan Stanley Initiates Silvergate With "Overweight", Setting Stage For Big Squeeze

"A Crypto Bank Like No Other": Morgan Stanley Initiates Silvergate With "Overweight", Setting Stage For Big Squeeze

It is hardly a secret that in addition to energy and uranium equities, we have been favorably predisposed toward the small crypto-linked bank, Silvergate...

Silvergate announced that Fidelity Digital Assets will serve as a custody provider for its SEN Leverage product. — zerohedge (@zerohedge) March 29, 2021

... widely unknown until May, when the company attracted the attention of Wall Street when it announced a partnership with Facebook to roll out the social network's stablecoin, Diem (formerly known as Libra).

The bullish thesis is simple: as we explained previously, should regulators crackdown on Tether or any of the other popular stablecoins (which judging by Gary Gensler's latest comments is just a matter of time), the most likely winner will be an institutionalized alternative, and with Diem's Facebook backing - which will be issued by Silvergate - it doesn't get any more institutional...or more of a contingency plan to a tether crackdown.

But while SI stock had fluctuated in a tight range after breaking out early in the year then sliding to the ~$100 range, it had attracted little bank coverage. Until now.

This morning Morgan Stanley analyst Ken Zerbe published an initiating coverage with an overweight rating and $158 price target on Silvergate which "is one of the most distinctive banks we cover" adding that the company gives bank investors “a nearly pure-play way to participate in the rapid growth of the nascent cryptocurrency industry.”

Silvergate is one of the most distinctive banks we cover. We initiate coverage at OW with a $158 PT (52% upside). We see a 3:1 bull:bear skew, but recognize that SI has the widest risk-reward of any bank we cover as its growth is tied directly to the health and growth of the cryptocurrency industry.

Some more details from the note:

We recommend an Overweight position in Silvergate. Silvergate is unlike any other bank we cover,and that could be a very good thing. At the heart of its business model is a real-time payments platform — the Silvergate Exchange Network (SEN) — that facilitates the transfer of US dollars between its digital currency customers. Thus, Silvergate gives bank investors a nearly pure-play way to participate in the rapid growth of the nascent cryptocurrency industry. It is the fastest growing bank we cover, with earning asset balances expected to increase 48% over the next 12 months (and already up 434% LTM), with minimal credit risk as loans held for investment are just 6% of earning assets. It has the highest percentage of noninterest-bearing deposits at 99.3% (vs. the peer median of 35%) of any bank in our coverage, the lowest cost of funds at just 1 basis point (vs. peer median of 19 bps),and is the most asset-sensitive bank by far, with a 100-bp increase in rates driving a 52% increase in net interest income (vs.a 5.5% increase for the median midcap bank). We expect 37% annual EPS growth through 2025, and see the potential for further earnings growth (which is not included in our model) from new lending or fee-based products yet to be introduced.

The SEN is the core of its distinctive business model. The company does not charge to use the Silvergate Exchange Network, but it does benefit because customers hold their deposits with Silvergate in order to use the SEN to transfer money around the digital currency ecosystem. Growth in core deposits, which are up 581% Y/Y to $11.4 bil, is a key part of our investment thesis. We expect deposit growth will remain robust,albeit growing at a much slower pace than the over the last year, rising 47% over the next 12 months, driven by the growing number of participants in the cryptocurrency market using the SEN and increased acceptance of cryptocurrency as an asset class and a form of payment. Moreover, Silvergate pays no interest on its digital currency deposits,although its customers benefit from improved capital efficiency and positive network effects.

SEN Leverage and stablecoins could provide earnings upside. Silvergate makes bitcoin-backed loans to its digital currency customers through its SEN Leverage program. Since this program started in early 2020, ithas never incurred a loss or a forced liquidation given its constant monitoring and low LTV requirements. We expect SEN Leverage to drive most of the company's loan growth going forward, although even at $900 mil in loans expected by the end of 2022, SEN Leverage loans would still account for just 4.5% of earning assets. Unlike most other banks, loan growth is not a meaningful driver of earnings growth (but deposit growth is), implying far less credit risk at Silvergate than most other banks. Potential upside to our EPS estimates could come from the company switching to an originate and sell model for its SEN Leverage loans,as well as moving to a variable fee for the use of the SEN when stablecoins are minted or burned. As stablecoin adoption improves for merchant payments and cross-border transactions, including remittances,a variable fee structure could provide meaningful upside to our EPS estimates. Neither originate and sell nor a variable fee is included in our earnings model currently.

Sizable upside… We believe Silvergate should be valued based on its earnings growth (similar to other faster-growing financials), rather than being compared against more traditional and slower-growing banks, particularly given its minimal credit risk as its held for investment loan portfolio is just 6% of earning assets. Using a peer group of 34 faster-growing financials, Exhibit 11 and applying a 50% discount to account for the volatility and uncertainty around its earnings growth, its potential credit risk (however minimal), the volatility of the crypto markets, and other potential risk factors (including regulation of the cryptocurrency markets), we arrive at a price target of $158. And that includes our expectation that SI issues another 6.3 mil shares through 2025 to fund its rapid balance sheet growth (it has already issued 7.4 mil shares since the start of the year). However, given the wide range of outcomes, both in terms of its growth potential and meaningful risk factors, SI has the widest risk-reward skew of our coverage, with a $300 bull case (189% upside) and a $40 bear case (61% downside)

There is much more in the full Morgan Stanley report (available to pro subs in the usual place), but we would add another reason why we think this stock could grow substantially from here: with a very modest market cap (below $3 billion), the stock which is quite illiquid has seen its short interest surge to record highs.

This means that in keeping with other heavily shorted stocks, it wouldn't take much of a move to start a squeeze especially if it is compounded with Silvergate becoming a meme stock du jour (or longer) for the reddit daytrading crowd, an outcome we expect is inevitable as more big banks follow Morgan Stanley in initiating bullishly in the name. Tyler Durden Mon, 09/27/2021 - 12:59

http://dlvr.it/S8RsK7

http://dlvr.it/S8RsK7

Luxury EV Maker Polestar Eyeing $21 Billion SPAC Listing

Luxury EV Maker Polestar Eyeing $21 Billion SPAC Listing

If you're wondering whether or not the public company EV space or the SPAC boom are both saturated yet, the answer is apparently "no".

That's because Swedish EV maker Polestar is reportedly prepping to go public via a SPAC with Gores Guggenheim, Inc., according to the Wall Street Journal. Polestar will be the latest in a long line of public company EV names that includes Nio, Tesla, Lordstown, and Lucid.

Polestar falls under Volvo's EV brand, and both brands are owned by Zhejiang Geely Holding Group Co.

The company's existing investors, who include actor Leonardo DiCaprio, will receive an additional $250 million investment as part of the SPAC.

The company has touted its ambitions to create carbon neutral vehicles by creating a "life cycle assessment framework for the electric car manufacturing industry, one in which the entire manufacturing, sales and end-of-life process is transparent and traceable," TechCrunch reports.

Going public via SPAC gives the manufacturer an instant "in" in the U.S., where its main competition will be Tesla. The company's Polestar 2 sedan has been positioned as its main competition for Elon Musk's brand.

The company is targeting manufacturing its Polestar 3 SUV at a Volvo plant in South Carolina, the report says. Its past models have all been made in China.

The deal would mark one of the largest recent SPAC deals and is yet another name that Elon Musk is going to have to worry about - especially because Polestar seems to have a great relationship with China, and it hasn't even had to produce any propaganda-style conference speech videos praising the country yet.

Tyler Durden Mon, 09/27/2021 - 09:30

http://dlvr.it/S8R8vz

http://dlvr.it/S8R8vz

Sunday, September 26, 2021

Elizabeth Warren demands Amazon censor best-selling books

(Natural News) Senator Elizabeth Warren is demanding Amazon censor best-selling books because they contain information that challenges the official narrative on coronavirus. (Article by Paul Joseph Watson republished from Summit.news) Warren wrote a letter asserting that Amazon was complicit in spreading “COVID-19 misinformation” because it allows people to buy books authored by people like Dr. Joseph Mercola, who has...

http://dlvr.it/S8NSSf

http://dlvr.it/S8NSSf

“We’re Going to Take Back Our Country from These Lunatics” Massive Crowd in Georgia Greets President Trump

by Joe Hoft, The Gateway Pundit: “We’re going to take back our country from these lunatics.” President Trump shared in front of a massive crowd in Georgia. President Trump greeted Georgia and shared: Inflation is skyrocketing. TRUTH LIVES on at https://sgtreport.tv/ Corruption is rampant. Our leaders are issuing unconstitutional orders. “It’s really not even believable what’s […]

http://dlvr.it/S8NGf5

http://dlvr.it/S8NGf5

Saturday, September 25, 2021

Video: School Board Attempts To Silence Parent Reading Out Pedo Porn Books From Its Own Library

by Paul Joseph Watson, Summit News: Parents jeer at school officials who don’t want to hear disgusting gay pedo porn being given to children A school board in Virginia attempted to cut off a mother who read out loud from disgusting pedophilia porn books stocked in the school’s own library as part of a “diversity […]

http://dlvr.it/S8KfD6

http://dlvr.it/S8KfD6

Massive 'horse' lies about Nobel prize winning treatment

STORY AT-A-GLANCE KFOR news ran a fake story in which a doctor claimed emergency rooms in Oklahoma were inundated with people who used horse ivermectin paste as a treatment for COVID-19 and overdosed The story turned out to be pure fiction, as no such cases have occurred. Still, KFOR has not retracted the story or...

http://dlvr.it/S8KS9c

http://dlvr.it/S8KS9c

Buchanan: The Coming Climate Crisis Shakedown In Scotland

Buchanan: The Coming Climate Crisis Shakedown In Scotland

Authored by Pat Buchanan,

“Follow the money!”

The old maxim is always sound advice when assessing the motives of those advancing bold agendas for the benefit of mankind.

Invariably, the newest progressive idea entails a transfer of wealth from the taxpaying classes of Western nations to our transnational, global and Third World elites.

For the masters of the universe, establishing justice and equality for the world’s poor are rewarding exercises in every sense of the word.

Consider the 2015 Paris climate accords.

Its declared goal: Save the planet from the ravages of climate change, which is caused by carbon dioxide emissions, which are produced by industrial nations with too many of the world’s factories, farms, ships, planes and autos.

Under the Paris accords, wealthier nations of the West were to set and meet strict national targets for reducing their carbon emissions.

Together, these reductions were to prevent any rise in the planet’s temperature of more than 1.5 degrees Celsius above pre-industrial levels.

This was presented as the world’s last best hope of preventing a climate catastrophe in this century.

Among the warnings the climate has been sending us:

The melting of polar ice caps, killer hurricanes, droughts, wildfires such as we had this year in California, river floods in Europe, rising sea levels, and the swamping of coastal towns, cities and islands like the Maldives in the Indian Ocean.

With the apocalypse thus laid out if we failed to act, there arose the inevitable question: How much hard cash would the global elites and their Third World clients be needing from the West — to grant the West an absolution for its past sins of carbon emissions?

Answer: The rich nations would fork over $100 billion yearly to repair damage done by climate change to the poorer nations and to compensate them for reorienting their energy dependence away from coal, oil and gas, to greener forms like sun, wind and water.

But in 2016, an inconceivable event aborted the Paris climate scheme. The Americans elected Donald Trump. Calling the Paris deal a rip-off of his country, Trump swiftly pulled the U.S. out of the accords.

Upon what grounds?

Put simply, America First.

Under the Paris accords, the U.S. was to cut back carbon emissions annually and contribute the lion’s share of the $100 billion annual wealth transfer for the developing world.

Meanwhile, China, the world’s number one polluter, if carbon dioxide is a pollutant, was to be permitted to increase its carbon emissions until 2030. Thus, today, China is responsible for 28% of world carbon emissions, while the U.S. contribution is half of that, and falling.

Came then President Joe Biden, who immediately reentered the Paris deal.

In April, he pledged to pony up $5.7 billion as a payment on our share of the $100 billion. At the U.N. last week, he pledged to double that contribution to $11.4 billion. Congress has yet to appropriate either sum.

China’s game? Beijing is suggesting that it wants to stay cooperative. “China will not build new coal-fired power projects abroad,” pledged Chinese President Xi Jinping in prerecorded remarks to the U.N. General Assembly.

Yet, as the New York Times writes, in 2020, China “built more than three times more new coal power capacity than all other countries in the world combined, equal to ‘more than one large coal plant per week.'”

Yet there are trade-offs here.

Those Chinese coal-fired plants in poorer nations do contribute to global carbon emissions. But such coal plants also enable the peoples of Asia and Africa to enjoy the benefit such plants produce — electricity, heat, light. These can make life far better for 21st-century Asians and Africans, just as coal and oil made life better for 19th- and 20th-century Americans.

In Glasgow from Oct. 31 to Nov. 12, the U.K.’s Boris Johnson will host the 26th U.N. Climate Change Conference of the Parties, or COP26.

There, new demands will be made on the Americans, both for more money and new reductions in carbon emissions.

A paradigm, a pattern, has been long set.

Brand the U.S. as history’s great producer of carbon dioxide. Depict the Second and Third Worlds as victims of American self-indulgence. And get on with the shakedown. Demand more money. Castigate the Americans by calling Biden’s $11.4 billion a pittance, not enough.

One wonders: Among the climate elites, how many will be traveling to Glasgow on commercial and private jets, and how many will be battling climate change by arriving by boat, bus or bicycle?

If this New World Order crowd wanted both to set an example and cut the carbon footprint, why not do a virtual summit?

As for the Chinese, we should probably be prepared for one of those “offers they can’t refuse”:

“If you Americans want China’s cooperation on climate change, you might want to cut back your propaganda about the ‘Wuhan virus,’ Hong Kong, the South China Sea, Taiwan and those allegations of ‘genocide’ against the Uyghurs.” Tyler Durden Sat, 09/25/2021 - 09:20

http://dlvr.it/S8JxdJ

http://dlvr.it/S8JxdJ

Friday, September 24, 2021

$1 Trillion Coins Instead of More Federal Debt?!

by Stefan Gleason, Money Metals: Credit risk out of China and debt ceiling drama in Washington are driving precious metals markets this week. Gold and silver attracted some significant safe-haven buying as equity markets succumbed to selling. The storyline being trumpeted in the financial media is that a government shutdown and possible debt default loom […]

http://dlvr.it/S8G8KY

http://dlvr.it/S8G8KY

The Great Game moves on

by Alasdair Macleod, GoldMoney: Following America’s withdrawal from Afghanistan, her focus has switched to the Pacific with the establishment of a joint Australian and UK naval partnership. The founder of modern geopolitical theory, Halford Mackinder, had something to say about this in his last paper, written for the Council on Foreign Relations in 1943. Mackinder […]

http://dlvr.it/S8G00m

http://dlvr.it/S8G00m

Fed Changed Nothing but Gold Was Smashed Anyway — Any Questions?

by Chris Powell, Gold Seek: The U.S. dollar index, our friend Dave Kranzler of Investment Research Dynamics writes today, “is back to where it was right before Federal Reserve Chairman Jerome Powell’s press conference yesterday. When Powell said ‘maybe in November we’ll have a taper schedule,’ the dollar shot up and paper gold was slammed. […]

http://dlvr.it/S8Fw4L

http://dlvr.it/S8Fw4L

Too Late... House Passes Amendment To Defund Wuhan Lab Middleman Outfit EcoHealth Alliance

Too Late... House Passes Amendment To Defund Wuhan Lab Middleman Outfit EcoHealth Alliance

Authored by Steve Watson via Summit News,

The House passed an amendment to the National Defense Authorization Act Thursday that will seeing all funding blocked to EcoHealth Alliance, the outfit that fuelled US money to the Wuhan Institute of Virology for gain of function experiments that some scientists believe led to the COVID pandemic.

Republican Pennsylvania Rep. Guy Reschenthaler introduced the amendment, noting “It is deeply disturbing that EcoHealth Alliance funneled American taxpayer dollars to support dangerous and potentially deadly research at the WIV, a laboratory run by the Chinese Communist Party (CCP) and tied to military biological research and the probable origin of the COVID-19 pandemic.”

Reschenthaler added “I am proud to lead this effort to end the flow of defense funding to EcoHealth Alliance, and I thank my colleagues for including my amendment in the defense authorization bill and ensuring Americans’ hard-earned money never again funds risky experiments in labs operated by our adversaries.”

As was reported earlier this week, EcoHealth Alliance under head Peter Daszak attempted to secure millions more in funding from the Pentagon’s scientific arm DARPA to genetically alter viruses, including bat coronaviruses, to make them more infectious to humans, and then to spray nanoparticles containing skin penetrating SARSr CoV spike proteins into the air, just eighteen months prior to the subsequent COVID outbreak and pandemic.

DARPA rejected the plan as being too dangerous to the human population, but the work may have gone ahead anyway.

* The proposal calls for aerosol delivery of recombinant SARSr CoV spike proteins in nanoparticles or in orthopoxviral vectors. Not aerosol delivery of SARSr CoVs. — Richard H. Ebright (@R_H_Ebright) September 22, 2021

* * *

Brand new merch now available! Get it at https://www.pjwshop.com/

In the age of mass Silicon Valley censorship It is crucial that we stay in touch. We need you to sign up for our free newsletter here. Support our sponsor – Turbo Force – a supercharged boost of clean energy without the comedown. Also, we urgently need your financial support here. Tyler Durden Fri, 09/24/2021 - 12:30

http://dlvr.it/S8FjbB

http://dlvr.it/S8FjbB

Thursday, September 23, 2021

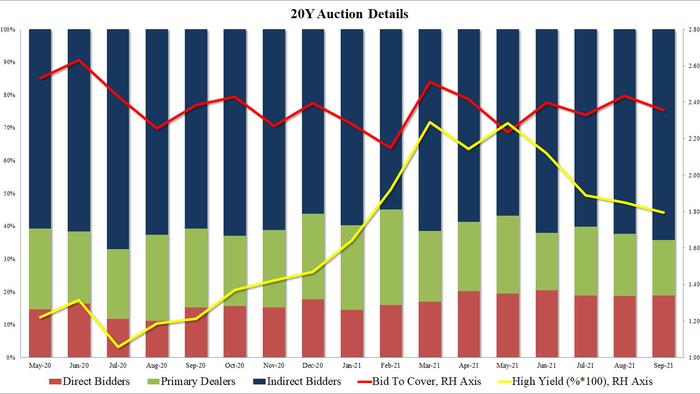

Fed Reverse Repo Soars To Record $1.35 Trillion After Fed Doubles Counteparty Limit

Fed Reverse Repo Soars To Record $1.35 Trillion After Fed Doubles Counteparty Limit

Early this morning, one day after the Fed doubled the counterparty limit for reverse repo usage from $80 billion to $160 billion, Wrightson ICAP predicted that usage on the Fed's overnight Reverse Repo facility would surge.

According to the interdealer broker, GSEs have been the only RRP countrparties constrained by the previous $80 billion limit, adding that the the low level of overnight GC repo rates which have frequently dipped below IOER in recent days (orange line below), reflects the fact that “some of the float associated with this month’s UMBS principal and interest payments had to be invested in the repo market

As ICAP economist Lou Crandall wrote, “much, perhaps, all of that cash is likely to be moved to the Fed today,” adding that he was looking for volume to rise to the $1.325 trillion to $1.35 trillion range.

In retrospect, he was on the low side, because at 1:15pm ET the Fed revealed that courtesy of the counterparty ceiling cap doubling, the total usage on the Fed facility soared by $69.2 billion to a new record high of $1.352 trillion, the highest on record.

However, while today's spike is unlikely to see a substantial decline especially since the Fed will continue injecting inert liquidity via QE until at least such time as the taper ends some time in 2022 (assuming it ends), Crandall also noted that today's surge will be short-lived as GSE cash will have to be moved to its non-interest-bearing deposits on Friday in order to be available to meet UMBS payment obligations Monday morning.

In terms of future fund flow dynamics, there are several cross-currents: the monthly influx of cash from GSEs adds to the glut related to the Fed’s ongoing asset purchases and Treasury’s drawdown of its cash balance. At the same time, the Treasury continues paying down its bill supply as it attempts to stay under the debt ceiling.

And with the TGA account nearly depleted as a result of the debt ceiling fiasco and likely to be replenished dramatically in Q4 once the debt ceiling drama is over, the reverse repo usage will drop sharply in Q4 as the Treasury floods the market with a record amount of bills as it seeks to replenish its cash supply, as counterparties convert reserves to Bills. Tyler Durden Thu, 09/23/2021 - 14:05

http://dlvr.it/S88HZ9

http://dlvr.it/S88HZ9

Twitter Says Users Can Now "Tip" Others With Bitcoin

Twitter Says Users Can Now "Tip" Others With Bitcoin

Bitcoin has climbed to its highest levels of the day...

...amid reports that Twitter - led by the outspoken crypto advocate Jack Dorsey - has enabled users around the world to "tip" their favorite accounts with bitcoin (though the functionality will only be available for iOS users at first).

BREAKING: Twitter is launching Bitcoin Lightning Network tipping functionality on iOS. — Pomp 🌪 (@APompliano) September 23, 2021

Twitter announced on Thursday that its "tips" feature will roll out globally to all Apple iOS users this week, and will become available for Android users in coming weeks.

According to CNBC, users previously could tip with fiat currency using traditional payment services like Square’s Cash app (Square is also led by Dorsey) and PayPal's Venmo. Twitter is integrating the Strike bitcoin lighting wallet service so creators can receive bitcoin tips, while users will be allowed to add their bitcoin address to their accounts in order to send and receive these cryptocurrency tips. Twitter says it won't take a cut of the "tips". Notably, Twitter's shares also climbed on the news, and were recently up 3% on the day.

Additionally, Twitter said Thursday that it is also experimenting with a feature that would allow users to "authenticate and showcase" their NFT collections on the social network, though it didn't provide much detail or any specifics about the project.

Dorsey is one of the Valley's biggest bitcoin boosters. He once said he felt bitcoin would help bring about "world peace". And while the tip feature probably won't achieve such lofty aims, it will help struggling "creators" to raise money while creating an actual payments use case for bitcoin.

News organizations will no doubt be keeping a close eye on Dorsey's experiment with tips, as micro payments have been bandied about as a potential savior for the collapsing digital media industry. Tyler Durden Thu, 09/23/2021 - 13:34

http://dlvr.it/S88CFr

http://dlvr.it/S88CFr

Hunter Biden Tried To Charge Libya $2 Million To Recover Billions Frozen By Obama Administration: New Emails

Hunter Biden Tried To Charge Libya $2 Million To Recover Billions Frozen By Obama Administration: New Emails

Four years after Hillary Clinton famously said of executed Libyan leader Mummar Qaddafi "We came, we saw, he died," Hunter Biden, son of then-Vice President Joe Biden, offered to recover roughly $15 billion in assets which had been frozen by the Obama administration - for the tidy sum of $2 million dollars per year. Two previously unpublished emails offer a window into Beltway influence peddling — and how a potential client viewed Hunter Biden as an "alcoholic" and "drug addict." Teresa Kroeger/Getty Images for World Food Program USA; Samantha Lee/Insider

In emails obtained by Business Insider that are not related to the laptop fiasco, the $2 million would have been for a "retainer" plus "success fees."

Via Business Insider:

The first email, dated January 28, 2015, was sent from Sam Jauhari, a Democratic donor with businesses in the Persian Gulf, who was helping spearhead the Libya project. It was addressed to Sheikh Mohammed al-Rahbani, another Obama campaign donor involved in the proposal. In the email, Jauhari is frank about what Biden would bring to the table, and what he says Biden wanted in return:

"Per phone conversation I met with #2 son. He wants $2 per year retainer +++ success fees. He wants to hire his own people - it can be close circle of people for confidentiality. His dad is deciding to run or not.

His positives are he is Chairman of UN World Food Program, son of #2 who has Libya file, access to State, Treasury, business partner SofS [Secretary of State] J. [John] Forbes K [Kerry] son and since he travels with dad he is connected everywhere in Europe and Asia where M. Q. [Muammar Qaddafi] and LIA [Libya Investment Authority] had money frozen. He said he has access to highest level in PRC [China], he can help there.

His negatives are that he is alcoholic, drug addict - kicked [out] of U.S. Army for cocaine, chasing low class hookers, constantly needs money-liquidity problems and many more headaches.

We should meet in Gstraad or London to decide next steps."

Jauhari was incorrect that Biden was discharged from the Army - it was the Navy, and it was technically never confirmed that his positive test for cocaine was what led to the discharge.

Unpacking the email, BI's Mattahias Schwartz notes: "the tally of his "positives" reflects a keen sense of what he could offer the project. Biden's position at the United Nations meant he enjoyed face-to-face access to heads of state. In his memoir, Biden recalls a sit-down with King Abdullah II of Jordan. "The only reason the king had agreed to meet," he wrote, "was out of respect for my dad. I guess you could chalk it up to nepotism, in the best possible way.""

What's more, Biden told Jauhari that he has "access to the highest level" in the Chinese government - which has been a headache to Libya's new government which was attempting to recover the $15 billion frozen by Obama during the Qaddafi regime.

Business Insider confirmed with two people close to the negotiations that the "$2 per year retainer" meant $2 million.

"My recollection was that anything that had to do with Hunter started at $2 million," said the source.

According to other documents obtained by BI, "Jauhari and his partners expected to pocket as much as 5% of the recovered assets" - meaning a potential payday of hundreds of millions.

Talks with Hunter continued into 2016 - with a Feb 26, 2016 email between Jauhari and al-Rahbani which confirms that they were working on the deal.

The second email, dated February 26, 2016, indicates that the talks with Biden continued into the following year. In it, Jauhari and al-Rahbani receive a report by John Sandweg, a Washington lawyer who had served as acting director of Immigration and Customs Enforcement under Obama. Sandweg had reached out to Biden's team about the Libya deal:

"I spoke with HB's team yesterday. They are interested in the project, but emphasized that for them to get involved, the team (lobbyists, lawyers and PR) would need to be a small group of folks they have a tight relationship with. They do not want a large group involved and they only want people with whom they have a close relationship with due to the sensitivities surrounding their involvement."

Sandweg, who at the time was working at a law firm called Frontier Solutions, confirmed that he was in touch with one of Biden's associates about the project. "They indicated they would consider it and I passed the message back," he told Insider. "Jauhari wound up hiring a different law firm instead."

Nothing to see here folks. Totally legit!!! https://t.co/GHMWO9BZMn — Donald Trump Jr. (@DonaldJTrumpJr) September 23, 2021

Schwartz offers a few caveats:

Caveats: Deal didn't wind up happening. Emails aren't from the famous laptop -- I obtained them through another source during the course of reporting on something else.

Also, here are some sirens 🚨🚨🚨 — Mattathias Schwartz (@Schwartzesque) September 23, 2021

In other Hunter news, Several emails from Hunter Biden's laptop have been confirmed as legitimate, according to Politico, citing claims in a new book, along with emails released by a Swedish government agency.

Ben Schreckinger’s “The Bidens: Inside the First Family’s Fifty-Year Rise to Power,” out today, finds evidence that some of the purported HUNTER BIDEN laptop material is genuine, including two emails at the center of last October’s controversy.

A person who had independent access to Hunter Biden’s emails confirmed he did receive a 2015 email from a Ukrainian businessman thanking him for the chance to meet Joe Biden. The same goes for a 2017 email in which a proposed equity breakdown of a venture with Chinese energy executives includes the line, “10 held by H for the big guy?” (This person recalled seeing both emails, but was not in a position to compare the leaked emails word-for-word to the originals.)

MORE: Emails released by a Swedish government agency also match emails in the leaked cache, and two people who corresponded with Hunter Biden confirmed emails from the cache were genuine. -Politico

Recall that news of Hunter Biden's laptop was broken by the New York Post shortly before the 2020 election - resulting in a multi-week Twitter ban on the outlet, and a baseless claim spread throughout the MSM and by notable Democrats including Rep. Adam Schiff (D-CA) and Sen. Chris Murphy (D-CT) that it was Russian disinformation.

Is it just us, or are the Bidens everything the left accused the Trumps of? Tyler Durden Thu, 09/23/2021 - 12:50

http://dlvr.it/S886sT

http://dlvr.it/S886sT

Michigan Gov. Whitmer Bans Masks/Vaxx Mandates As Polls Crash, Re-Election Fight Looks Grim

Michigan Gov. Whitmer Bans Masks/Vaxx Mandates As Polls Crash, Re-Election Fight Looks Grim

Authored by Thomas Lifson via AmericanThinker.com,

Gretchen Whitmer, the governor of Michigan, early on distinguished herself as a pandemic hypocrite, demanding severe lockdowns of her citizens subjects while exempting her family and herself. Her husband was caught boating when she had forbidden ordinary Michiganders to do the same, and she was caught traveling to Florida, violating her own proclamations.

Resentment has grown, and not even an FBI informant–led bogus kidnapping plot has been enough to keep her polls strong as she faces re-election in November 2022. Mary Chastain of Legal Insurrection spotted Whitmer signing legislation that specifically banned the state from enforcing mask mandates and vaccine passports:

Whitmer and the Michigan state legislature agreed on a budget. This is no ordinary budget because it bans mask mandates and vaccine passports:

Democratic Michigan Gov. Gretchen Whitmer and the state legislature have agreed on a budget proposal that includes language banning health officials from enforcing mask mandates in schools and preventing state public agencies from enforcing vaccines on employees or customers.

"The director or local health officer shall not issue or enforce any orders or other directives that require an individual in this state who is under the age of 18 to wear a face mask or face covering," the 1,000-page budget states in one section.

Chastain notes that school districts are still free to enforce mask mandates.

The reason for Whitmer's reversal is not hard to figure out. Her polls stink. The Hill reports on a Trafalgar Group poll that shows her six points behind former Detroit police chief James Craig (who notably kept the peace there as Minneapolis and other cities were burning): Top ArticlesREAD MORERepeal the 17th Amendment

Michigan Gov. Gretchen Whitmer (D) trails former Detroit Police Chief James Craig by 6 points in a hypothetical general election match-up, according to a poll released this week.

The survey from the GOP-leaning Trafalgar Group shows Craig, a Republican, leading Whitmer 50.4 percent to 44.4 percent among likely general election voters. Another 5.2 percent of respondents remain undecided.

Craig, who retired as Detroit police chief in June after nearly eight years on the job, announced his campaign for governor earlier this month at the urging of top Michigan Republicans.

Trafalgar may be right-leaning, but other polls also indicate trouble. The Detroit News:

Gov. Gretchen Whitmer's job approval has fallen to a point where Michigan voters are nearly split about how she is doing, according to a new poll released Monday, marking a large decline from prior surveys.

The decrease has occurred as the Aug. 31-Sept. 3 survey by the Glengariff Group found that a majority of 600 registered voters said the state is on the wrong track and that they disapprove by a wide margin of the job that President Joe Biden is doing.

About 48% of voters approve of the Democratic governor's performance and 46% disapprove, according to the poll commissioned by the Detroit Regional Chamber, whose political action committee in 2018 endorsed Whitmer over Republican Bill Schuette for governor.

The latest numbers are a marked shift from September 2020, when 59% of voters approved of Whitmer's performance and 38% disapproved (snip)

Much of Whitmer's approval decline has occurred among independent voters, 39% of whom approved of her performance and 51% of whom disapproved, according to the poll, which has a margin of error of plus or minus four percentage points.

"Michigan elections are decided by independent voters and how she does with these independent voters moving forward will really dictate" her performance in the 2022 election, said Richard Czuba, a pollster with the Lansing-based Glengariff Group.

It looks as though, worldwide, resentment and rebellion against lockdowns and other severe restrictions are on the rise. The fact that so many politicians exempt themselves and their families from the masking and other restrictions they place on those they regard as inferiors isn't helping. Tyler Durden Thu, 09/23/2021 - 12:30

http://dlvr.it/S881mg

http://dlvr.it/S881mg

Peter Schiff Slams "The Fed That Cried Taper"

Peter Schiff Slams "The Fed That Cried Taper"

Via SchiffGold.com,

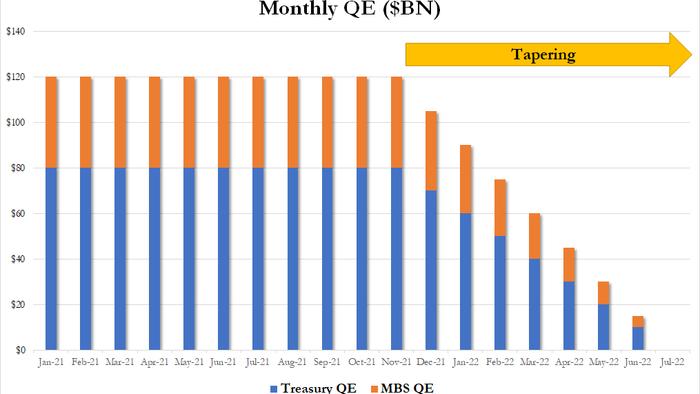

The Federal Reserve wrapped up its September FOMC meeting Wednesday and once again left its extraordinary loose “emergency” monetary policy in place. Quantitative easing continues unabated. Interest rates remain at zero. But the Fed did signal it may begin to taper quantitative easing “soon.” In his podcast, Peter Schiff broke down the FOMC statement and Fed Chair Jerome Powell’s post-meeting press conference. He said he thinks when it comes to tightening monetary policy, the Fed is bluffing.

This was a highly-anticipated Fed meeting. Peter wondered why, because after all of the speculation leading up to these FOMC meetings, the Fed always says pretty much the same thing.

The economy is great. Everything is going great. The labor market is strong. Inflation is contained. Yet, we’re not raising rates. We’re not tapering our asset purchase program. Everything is great, but we’re not going to remove any of the emergency monetary policy supports that we implemented when everything was terrible. Even though everything is now great, we’re still going to continue with these policies, because even though it’s not great, it’s not perfect.”

But the Fed did indicate it may begin to taper asset purchases “soon.”

If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted.”

As far as raising interest rates — now referred to as liftoff — more members of the FOMC now think that might happen as early as next year. But Fed Chairman Jerome Powell repeatedly goes out of his way to assure everybody that liftoff is still a long way off and that the central bankers aren’t yet considering a timeline for rate hikes. Powell has repeatedly said the Fed won’t begin raising rates until the taper is complete. That means nobody can put a timeline on liftoff until we have a timeline on tapering.

The FOMC downgraded its economic growth forecast to a 5.9% GDP increase this year compared with its 7% forecast in June.

On the inflation front, the Fed now acknowledges that prices are rising faster than they projected. The new forecast is for core inflation to increase 3.7% this year. That compares with a 3% projection in June.

Even while acknowledging surging prices, Powell continues to blame it completely on supply chain problems.

These bottleneck effects have been larger and longer-lasting than anticipated. While these supply effects are prominent for now, they will abate. And as they do, inflation is expected to drop back toward our longer-run goal.”

As Peter points out, the Fed never once takes any responsibility for surging inflation. In the Fed’s world, none of it is a function of monetary policy. It’s got nothing to do with too much money. It’s just not enough stuff.

Of course, Powell continues to promise that if inflation does become a bigger problem, the Fed has the tools to fight it. Peter said that is a bluff.

If the Fed was actually willing to use the tools, it would have already used them. The fact those tools are still buried in the shed someplace proves that they have no intention of using those tools, even if they can find them.”

Once again, everybody was looking for the Fed to lay out a plan for tapering QE. And once again, the Fed just talked vaguely about slowing the pace of asset purchases. All Powell and Company said was that they may begin a gradual tapering process soon- maybe.

Note all of the conditional words in the Fed statement. Tapering “may soon be warranted.” Of course, that means it may not soon be warranted. And what exactly does “soon” mean? What does “a moderation” in the pace of asset purchases mean?

During the Q&A session, Powell said he thought the taper would be finished by the end of next year. But we’re almost through September and there is no taper. Powell reiterated that they haven’t made the decision to taper and there is no tapering timetable other than it will be “gradual.” Peter said if they were really close to tapering, there would have at least decided on a timetable.

They would say, ‘Hey, this is how we’re going to do it, and we’re just going to implement it at some time, but they would already have decided on some type of framework.’ But according to Powell, they haven’t even had those discussions yet. They’re holding off on those discussions until they’ve already decided to taper. And they’re not even going to make that decision until sometime in the future.”

The earliest projection for the taper to begin is maybe in December.

If the earliest they can actually start the taper is in December – and Powell repeatedly said that the taper is going to be a very gradual process. It’s going to happen very slowly. Well, if it’s going to be finished by the middle of 2022, then you’re going to have to wrap the whole thing up in six months. Well, how is that slow? You’re going from $120 billion a month and you’re going to taper that to zero — in six months? That would not be slow. That would be pretty rapid, especially considering the pace of the last taper. So, to me, this just proves that the whole thing is a show. They’re not thinking about tapering.”

Peter said the reality is that the Fed is continuing to bluff that it has everything under control. It doesn’t.

In this podcast, Peter also talks about how Fed policies disproportionately hurt African Americans, Republicans and the debt ceiling, Evergrande and what gold will do when the markets realize the Fed is crying wolf. Tyler Durden Thu, 09/23/2021 - 08:53

http://dlvr.it/S87JQK

http://dlvr.it/S87JQK

Wednesday, September 22, 2021

TREASURY DEPARTMENT SEEKS TO TRACK FINANCIAL TRANSACTIONS OF PERSONAL BANK ACCOUNTS OVER $600

from The Waking Times: In May, the Treasury Department released the Biden administration’s revenue proposals for fiscal year 2022. One aspect of this document that has gone under-reported is the administration’s new plan for reporting requirements for financial institutions. The document is unequivocal about the administration’s goal for financial reporting, stating, “this proposal would create a comprehensive […]

http://dlvr.it/S84V9P

http://dlvr.it/S84V9P

1 Teen Killed, 2 Wounded In Kentucky Bus Stop Shooting; Suspect Still At Large

1 Teen Killed, 2 Wounded In Kentucky Bus Stop Shooting; Suspect Still At Large

Three teens were shot and one was killed while waiting for the school bus in Louisville, Kentucky early Wednesday, according to police.

The students were waiting on a corner in the Russell neighborhood situated immediately west of downtown around 0630ET when an unidentified assailant in a vehicle drove by and opened fire, according to the Louisville Metro Police Department.

An aunt of the student who died - whose name hasn't been released because he is a minor - spoke to a local TV station.

"I mean, you all probably interview a lot of families who are like, 'I can't believe this happened.' You know, he didn't hurt nobody, he didn't do anything. They can be out in God knows what, but I'm telling you, my nephew wasn't. He didn't have that time on his hands," she said.

A second student, a 14-year-old boy, was taken to a hospital with non-life-threatening injuries, while the third, a 14-year-old girl, was grazed, police said, but was treated at the scene. All three students were all enrolled at Eastern High School in the Jefferson County public school district.

The two other students have sustained serious injuries.

Alert: Confirmed that 3 juveniles were shot this morning at a bus stop at W J Hodge and Chestnut Sts. #LMPD on scene and will update shortly. #LMPD — LMPD (@LMPD) September 22, 2021

Police say they're gathering leads and launching what will be a well-funded investigation into finding the culprit, but right now, whoever did it remains at large.

The shooting comes after a bomb threat incident required the evacuation of several schools in nearby Lexington. The threat came with a demand for a $500,000 payment in bitcoin. Tyler Durden Wed, 09/22/2021 - 13:03

http://dlvr.it/S84RWD

http://dlvr.it/S84RWD

Top Border Official Blasts Psaki - Says Admin Approved 'Twirling' Reins To Keep Migrants Away From Horses

Top Border Official Blasts Psaki - Says Admin Approved 'Twirling' Reins To Keep Migrants Away From Horses

A top Border Patrol official slammed the Biden administration over their kneejerk reaction to reports that border patrol agents in Del Rio, Texas have been "whipping" Haitian migrants who materialized roughly 1,800 miles from home across the Gulf of Mexico, where they've gathered in large numbers at the southern US border in recent days.

In two separate interviews, Border Patrol agent and head of the National Border Patrol Council, Brandon Judd singled out White House Press Secretary Jen Psaki for condemning the agents' conduct as "horrible to watch," and something "they should never be able to do again," accusing Psaki of "perpetuating the narrative that police are bad."

"There are very few things that will boil my blood as bad as the White House directly coming out and condemning an action before they know what happened," Judd told Just the News. "Jen Psaki came out yesterday, and she condemned these actions, when in reality, it is a legitimate law enforcement action. This was meant to protect the illegal aliens."

Judd explained agents are trained for crowd control by the Homeland Security Department to "twirl the reins" if humans start approaching their horses to keep them away from getting injured, and the reins are never used to strike or harm people.

"We have to keep those individuals away from the horses," he explained. "If they get too close to the horses, the horses could step on them and they could break bones. They could kick them. They can get kicked in the head. It could cause death. -JTN

"Nobody was hit by those reins; they are not whips. The reins are used to control the horses. And so the reins will be twirled to keep people away from the horses for their protection," Judd added, comparing Psaki's comments and corresponding coverage by the MSM to deceptive tactics used by liberal activists who want to defund the police.

"Of course, this is exactly how the defund police movement works," said Judd. "You take photos, you take a 15-second video of something that happened over a period of 10 minutes. And you take those very small clips, and you blow them up and say, 'Well, look what's happening.' When in reality it was a law enforcement movement that agents are trained to use the reins to keep people away, not hit people with those reins."

According to Judd, twirling of the reigns is standard practice.

"This is a training module that they set up, that they go through and they approve, and even this administration, every single administration, when they come in, they will look at all training that is being given, and they will decide whether the way they want to continue on with training," he said, adding "And this administration even decided that they would continue on with the training of using the reins, to keep people away from the horses for their own protection."

Judd told the Epoch Times that the White House is perpetuating a false narrative.

Misinformation

Judd said agents on horseback in the area have not been rounding up Haitian refugees with whips after they were accused of doing so by multiple media outlets and officials.

On Monday, Sawyer Hackett, executive director of People First Future, a political action committee set up by Democrat Julián Castro, went viral on Twitter when he shared photos of border patrol agents on horseback as they held their “whips” while Haitian refugees stood near them on foot.

Hackett wrote on Twitter, “This is unfathomable cruelty towards people fleeing disaster and political ruin. The administration must stop this.”

He also shared video footage showing border agents on horseback attempting to prevent migrants from wading back and forth across a river.

The post was quickly shared over 27,000 times, including by members of Congress Rep. Alexandria Ocasio-Cortez (D-N.Y.) and Senator Jeff Merkley.

A report from the El Paso Times regarding the situation in Del Rio also went viral. An exert from it claims a border agent “swung his whip menacingly” at Haitian men who were trying to cross the river again after buying food and water in Ciudad Acuña, Mexico.

"That’s your ‘defund the police’ movement right there," Judd said of the video. "They only show a short segment of a video. The horse patrol agents under the administration are trained to ensure the safety of the migrants, to keep them away from the horses, because the horses can harm people—they can inadvertently step on them, they can rear up, they can kick them.

And so agents have to keep the migrants away from the horses for their own protection. And so they will use the reins, to twirl the reins, so that they will stay away from the horses. But they do not use those reins to lash out, to try to strike people. Those agents did not use those reins in any way, shape, or form to try to strike anybody."

More via The Epoch Times:

Judd added that the horses are also used as a “deterrent technique” to prevent illegal immigrants from coming into the United States.

The claims of whipping soon reached the White House, with press secretary Jen Psaki telling reporters during a briefing Monday, that she had seen some of the footage but didn’t yet have all the context.

“I can’t imagine what context would make that appropriate,” Psaki said. “But I don’t have additional details.”