Goldman: "This Needs To Change Before A Larger Correction Can Occur"

Last week, we published one Goldman trader's top ten reasons why investors are especially bearish for the last two weeks of September, which he then countered with a list of his own reasons why there is little to be worried about. Judging by last week's market moves which saw the S&P swoon lower and slide sharply on Friday's opex, it appears that once again Goldman was wrong. So, one week later, Goldman flow trader Scott Rubner has doubled down with a thread focusing on market technicals, in which he lays out what in his view - "given new market structure dynamics" - needs to change "before a larger correction can occur."

So without further ado, here is Rubner's latest Tactical Flow of Funds market summary, which he summarizes as "Consensus is Bearish! But the market is currently positioned for it", which however is news to Wall Street because as the latest Fund Manager Survey found, equity protection is at the lowest level since Jan’18, a far cry from the financial media - and Goldman's - repeated erronous claims that everyone is hedged for a crash.

With that in mind, here is Goldman's Scott Rubner on why one should buy this dip:

I did a number of back-to-back zoom calls this week and sentiment was more bearish than I have seen in a very long time. The 10 biggest reasons for the bear case are highlighted below. This was my pushback on the calls this week, who have been calling for a 2H September correction.

Given new market structure dynamics, this needs to change before a larger correction can occur. September already logged a massive +$32B inflows M-T-D (basically a few trading days). Money continues to flow into the market if the dips are small, there is a competition for dip alpha.

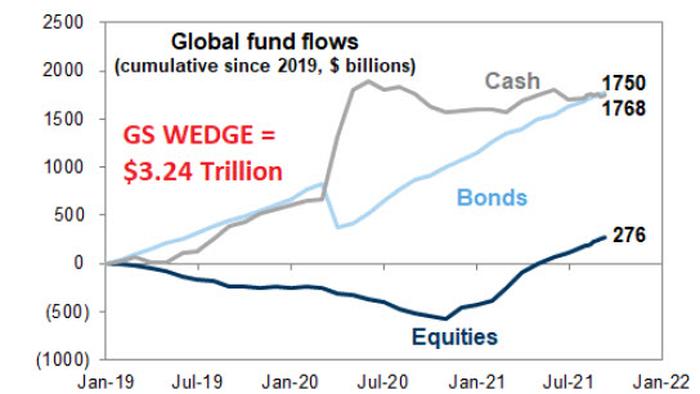

1. Global Equities logged +$12.7B worth of weekly inflows during week 36. The magic money tree keeps flowing as retail bought the dip again this week. Week 36 saw inflows into all asset classes, yet again, stocks, bonds, and cash. Issuance paper was absorbed during this week. Source: Goldman Sachs Investment Research Division, Cormac Conners, as of 9/10/21. Past performance is not indicative of future returns

2. Global Equities have logged a massive +$725B worth of inflows YTD or $1.1 Trillion worth of annualized inflows.

** These next two bullets are the most important lines of this whole email.

3. Passive inflows have logged +$606B (~84%) of inflows, while active funds +$120B (~16%) of inflows.

4. For the first time in history, US passive fund AUM has now fully exceeded active fund AUM.

5. USA Passive AUM = $4.636 Trillion (52% of assets) vs. $4.287 Trillion (48% of assets).

6. Global Passive AUM = $7.565 Trillion. This is the first time above > $7 Trillion.

7. Geographically, USA has seen (+$452B worth of inflows) or 63% of flows vs. ROW at 37%.

8. Tech stocks saw 11 straight weeks of inflows. Let's simply call this 2021 dynamic = USA, Passive, large cap, tech. This is new. I haven't seen anything like this in the past. It's made it hard to tactically short the market, and broad indices grind bps higher.

9. Passively Allocated? Passive Inflows = "you give me money, I buy" vs. "you ask me money, I sell". For the past 45 weeks you have not asked for any money and given me a massive +$921 Billion worth of dollars.

10. To summarize, the 10 points above:

* If you allocate $1 into SPY, that means 6 cents into AAPL, 6 cents in MSFT, 4 cents into GOOG/L, 4 cents in AMZN, 2 cents into FB. That is 22 cents of every $1 into 5 stocks.

* If you allocate $1 into QQQ, that means 11 cents into AAPL, 10 cents in MSFT, 8 cents into GOOG/L, 8 cents in AMZN, 4 cents into FB. That is 41 cents of every $1 into 5 stocks.

Tyler Durden Sat, 09/18/2021 - 13:00

http://dlvr.it/S7qLTK

No comments:

Post a Comment