Negative COVID Tests For Sale Are Flooding The Dark Web

With Covid test results now becoming the key to people doing the once basic things they used to be able to do without turning over personal health records (i.e. go to the store and buy a sandwich, or do their laundry) it should come as no surprise that dark web searches for Covid test results are skyrocketing.

In fact, Uswitch recently analyzed Google searches and found that the number of people who were searching for "buy covid test results" in January 2021 had doubled since August 2020.

Other media outlets are also starting to pick up on the trend. "At the moment we are scanning more than 200 million dark web pages per week. We do see an increase in Covid-19 vaccine proof or Covid-19 test result but also there were some tests results on offer in certain marketplaces," a cybersecurity expert in New Zealand told NZHerald this week.

"Fake vaccination certificates are also being sold, as well as fake negative tests, aimed at those traveling abroad," HealthCareITNews reported on Monday.

Additionally, Google searches for "dark web covid" peaked on May 17, 2020, Uswitch says, "shortly after it was reported that more than 600 Covid-19 related medical products, supplies and fake vaccines had been found for sale on the dark web."

Uswitch found that people in the U.S. are the most curious about the dark web, and that most access it using the Tor browser:

The flooding of the dark web with fake test results, of course, highlights one of the largest fallacies of the idea of vaccine passports or needing to prove vaccinations: ensuring the integrity of tests and test results. It could also indicate the large number of people who aren't interested in getting the vaccine, but obviously are interested in getting back to reality.

Tyler Durden Wed, 03/31/2021 - 23:20

http://dlvr.it/Rwn0Ys

Wednesday, March 31, 2021

Rep. Matt Gaetz Says He Is Subject Of Sex Investigation, But Claims He’s The Target Of An ‘Extortion’ Plot

by Chuck Ross, The Daily Caller: Florida Rep. Matt Gaetz said Tuesday he is a subject in a federal sex trafficking investigation, though he denies any wrongdoing and says he is the victim of a $25 million extortion plot. On Tuesday, The New York Times reported that the Justice Department is investigating whether Gaetz, a […]

http://dlvr.it/RwlYj4

http://dlvr.it/RwlYj4

Bottom Line: Democrats are Afraid of You

by Christopher Chantrill, American Thinker: I’m having a problem deciding whether the Biden administration is stupid or evil or just flat-out afraid of us Commoners. And then I realized that it’s all three. Here’s why. Our liberal friends never imagined that a Trump could happen. Nothing in their world prepared them for him. So what […]

http://dlvr.it/RwlM5r

http://dlvr.it/RwlM5r

White House Unveils Details Of Biden's $2 Trillion Infrastructure Plan, Massive Tax Hikes

White House Unveils Details Of Biden's $2 Trillion Infrastructure Plan, Massive Tax Hikes

After weeks of waiting with investors hanging on every new detail, President Joe Biden is expected to unveil the first part of his sweeping economic reform/redistribution plan on Wednesday afternoon.

As Biden's press secretary Jen Psaki revealed over the weekend that Biden and his team are planning to unveil his sprawling "Build Back Better" plan in two parts: The first part of the "Build Back Better" plan, which will be officially unveiled later today, is expected to focus on rebuilding "roads and railways" while the second part, which will be released "in just a couple of weeks", will focus on "social infrastructure" funding, including childcare and healthcare initiatives.

Details of the plan have been leaking out at a steady pace for weeks, although some of the details reported earlier have been changed. According to the leaked 25-page document obtained by the NYT, Biden's "American Jobs Plan" will "invest in America in a way we have not invested since we built the inter-state highways and won the Space Race." The plan, which will carry a $2 trillion price tag (2/3rds of the $3 trillion marked for "BBB"), will finance the rebuilding of 20K miles of road, repairs to the 10 most economically important bridges in the country, and the elimination of lead pipes and service lines from the country's water supplies. In total, the plan features $50 billion "in dedicated investments to improve infrastructure resilience".

The plan also includes a long list of other projects intended to create millions of jobs, with the goal of strengthening America's long-term competitiveness. The plan will also address Biden's climate change priorities, by hastening the shift to new, cleaner energy sources, and would help promote racial equity in the economy. The plan includes $16 billion to fund a program to retain fossil fuel workers to transition to new work (we imagine they'll take to learning to code like a fish to water).

Fortunately for Tesla, its shareholders and - most importantly - its CEO, Elon Musk, the plan proposes an additional $46 billion in federal procurement programs for government agencies to buy fleets of electric vehicles, and $35 billion in research and development programs for cutting-edge, new technologies. While more competitors are making their own EV vehicles, Tesla remains the market leader.

Here's a breakdown of the innards of the $2 trillion proposal reported in the NYT (courtesy of Newsquawk):

*

USD 180bln for research and development

*

USD 115bln for roads and bridges

*

USD 85bln for public transit

*

USD 80bln for Amtrak and freight rail

*

USD 174bln to encourage EVs via tax credits and other incentives to companies that make EV batteries in the US instead of China

*

USD 42bln for ports and airports

*

USD 100bln for broadband

*

USD 111bln for water infrastructure

*

USD 300bln to promote advanced manufacturing

*

USD 400bln spending on in-home care

*

USD 100bln in programs to update and modernize the electric grid

*

USD 46bln in fed procurement programs for government agencies to buy fleets of EVs

*

USD 35bln in R&D programs for cutting-edge, new technologies

*

USD 50bln in dedicated investments to improve infrastructure resilience

*

USD 16bln program intended to help fossil fuel workers transition to new work

*

USD 10bln for a new "Civilian Climate Corps."

In theory, at least, a sweeping infrastructure plan should have strong bipartisan support. But as we learned during the Trump Administration, political priorities can easily scuttle even the most popular package, and while Democratic opposition helped transform Trump's "infrastructure week" into a punchline, the GOP - and a handful of East Coast Democrats - are already digging in their heels over taxes.

Here's a quick rundown of how Biden plans to pay for it all via massive tax hikes, some of which (like the corporate tax hike) have already been reported:

*

Eliminate tax preferences for fossil fuel companies

*

Raise the corporate tax rate to 28% from 21%

*

Overall taxation of profits earned oversees by US megacorps (including raising minimum tax on global profits and eliminating several provisions that allow companies to reduce US tax liability)

*

Ramp up enforcement of large companies avoiding taxes

*

Prevent American companies from "inversions" to tax havens

*

Eliminate loopholes that encourage offshoring

*

Deny expense deductions for companies that are offshoring jobs

Readers can learn more from a White House "fact sheet" released Wednesday morning that includes detailed breakdowns of the Biden infrastructure plan, and the associated tax plan.

Republicans and business groups have already attacked Mr. Biden’s plans to fund the spending with corporate tax increases, which they say will hurt the competitiveness of American companies. In addition, several Democrats including NY Rep. Tom Suozzi and New Jersey's Josh Gottheimer, have insisted that they will oppose the infrastructure package unless Biden repeals a Trump-era limit on state and local tax deductions known as the SALT deduction.

These Dems actually have a lot of pull, and could end up getting their way. Because, as a team of analysts at Deutsche Bank pointed out in a note to clients this morning, Biden can only afford to lose 3 Democrats in the House, and zero Dems in the Senate, if Republicans oppose the plan on a party-line vote.

"Policymakers should avoid creating new barriers to job creation and economic growth," said Joshua Bolton, the president and CEO of the Business Roundtable, a top business lobbying group.

Biden will unveil the plan during a Wednesday press conference in Pittsburgh. He's expected to start speaking at 1630ET, after the market day has come to an end. And with markets mostly closed on Friday, Thursday's session will be critical for parsing the market's reaction to the Biden plan.

“The plans as announced have a long and tortuous journey to make it through Congress and thus the end result is likely to be nine months or more away and may well look very different indeed once it has been through that political wranglings on the Hill,” said James Athey, investment director at Aberdeen Standard Investments. “If investors are weighing the risks appropriately, there shouldn’t be much impact on markets in the short term.”

Tyler Durden Wed, 03/31/2021 - 09:30

http://dlvr.it/Rwkv74

http://dlvr.it/Rwkv74

Volkswagen Says "Bogus" Name Change That Popped Stock 5% Was "April Fool's Joke"

Volkswagen Says "Bogus" Name Change That Popped Stock 5% Was "April Fool's Joke"

Either VW has gotten one over on some analysts, or the company's PR department made a last minute clawback of a proposed name change for the company. Either way, the company appears to be doing its best Elon Musk impression not only with EVs, but also with making false announcements to the market.

We're talking, of course, about the recent news that Volkswagen would be changing its name in the U.S. to "Voltswagen", a nod to the company's focus on EVs going forward and an idea that may or may not have originated from our Twitter feed to begin with.

You're welcome VW https://t.co/6Njx10ke46 — zerohedge (@zerohedge) March 30, 2021

The company came out yesterday and admitted to the press - who have mostly been unamused by the antic, judging by the tone of a recent AP piece - that the idea for the name change was just an "April's Fool's Joke".

"Mark Gillies, a company spokesman, confirmed Tuesday that the statement had been a pre-April Fool’s Day joke after having insisted Monday that the release was legitimate and the name change accurate. The company’s false statement was distributed again Tuesday, saying the brand-name change reflected a shift to more battery-electric vehicles."

AP referred to the company's stunt as "false statements", "bogus" and said that "Volkswagen’s intentionally fake news release, highly unusual for a major public company, coincides with its efforts to repair its image..."

The news organization also pointed out that Volkswagen could find itself in hot water with securities regulators, due to the fact that its stock rose 5% on the initial headlines of the name change. Using Elon Musk as a case study over the last 36 months, we're not sure if we agree.

But, we digress. The fake name change also helped put on display the continued uselessness of sell-side research, as Wedbush hurried out a note on March 30, called "Disruptive Technology", that spent several paragraphs explaining why Volkswagen's name change spoke to their "EV vision" and praising the company, even going so far as to suggest they could wind up as partners with Apple.

"We believe the name change underscores VW's clear commitment to its EV brand and massive EV endeavors over the coming years..." the note says.

We think Erik Gordon, a business and law professor at the University of Michigan, said it best when he told AP: “I don’t think the SEC is going to see this as stock price manipulation any more than when General Motors or Ford or Toyota or anybody talks about their (electric vehicle) future. It is incredibly stupid, but if being stupid were illegal, a third of the CEOs in the U.S. would be in jail.” Tyler Durden Wed, 03/31/2021 - 08:15

http://dlvr.it/Rwkdfl

http://dlvr.it/Rwkdfl

Tuesday, March 30, 2021

Iran Touts Russia-Iran-India 'North-South Trade Corridor' As "Alternative" & Challenge To Suez Canal

Iran Touts Russia-Iran-India 'North-South Trade Corridor' As "Alternative" & Challenge To Suez Canal

Coming after a 'successful' weekend in which sanctions-beleaguered Iran hailed its signing a major 25-year infrastructure and investment agreement with China, Iran's ambassador to Russia is also touting that a new north-south trade corridor across the region could become a prime 'alternative' to the strategic Suez Canal waterway that's been featured in global headlines due to the 'Ever Given' stuck tanker disaster that just played out.

Called the "International North-South Transport Corridor (INSTC)" — a two decades in the making ambitious project — the new trade corridor, currently partially in operation, is 7,200km long, linking up Russia, Iran, and India and ultimately accelerating trade with Europe as well.

Commenting on the stuck tanker fiasco in the Suez, Iranian Ambassador Kazem Jalali explained of a potentially less expensive and disaster-prone waterway transport route across Egypt:

"The North-South corridor is a great option to replace the Suez Canal with a reduction in travel times to 20 days and savings of up to 30 percent."

He further described that the mounting huge costs and fallout from the Ever Given jam disaster (commonly ballparked in the many multiple billions) demonstrates "the need to speed up the completion of infrastructure and the North-South corridor as an alternative to the route through the Suez Canal has become clear and more important than ever." Getty Images

A regional analysis site, Silk Road Briefing, reviews the recent history of the project as follows:

The INSTC project came into being in 2002, when the transport ministers of Russia, Iran, and India signed an agreement to create a multimodal ship, rail and road-based transport network stretching 7,200 km, from Mumbai, western India to Moscow via Iran and the Caspian Sea. Since then, Azerbaijan, Armenia, Belarus, Kazakhstan, Tajikistan, Kyrgyzstan, Ukraine, Oman, and Syria have all joined the project, and new routes via Azerbaijan and Central Asian countries have been examined to eliminate the need to transfer cargoes from overland-based transport to cargo ships and back...

The claims of reduced transport travel time and cost are often advanced according to these estimates:

The INSTC corridor has been tested, and cuts current transport costs by between 30-60 percent, in addition to reducing the transit time from west India to western Russia from 40 to 20 days. Dry runs of the route carried out in 2014 and 2017 identified potential bottlenecks and confirmed cost and shipping time estimates.

Will Iranian sea corridor compete with Suez Canal? https://t.co/gMSuAUW61r — Al-Monitor (@AlMonitor) July 17, 2020

It's been dubbed in Russian media, even long before the latest Suez crisis, a challenge to the Suez canal.

Also sometimes compared to the ancient 'Silk Road' (the most famous East-West trade route across Asia from antiquity through the Middle Ages) - and somewhat akin to China's expanding Belt & Road initiative under President Xi, it primarily by rail links two major bodies of water - the Indian Ocean and Persian Gulf - by way of Iran to Russia and northern Europe. Tyler Durden Tue, 03/30/2021 - 23:05

http://dlvr.it/RwjBTz

http://dlvr.it/RwjBTz

A "Very Surprised" JPMorgan Calculates The Damage From The Archegos Collapse

A "Very Surprised" JPMorgan Calculates The Damage From The Archegos Collapse

Unlike the devastating London Whale debacle in 2012, which was all JPMorgan eventually drawn and quartered quite theatrically before Congress (and was a clear explanation of how banks used Fed reserves to manipulate markets, something most market participants had no idea was possible), this time JPMorgan was nowhere to be found in the aftermath of the historic margin call that destroyed hedge fund Archegos. Which is may explain why JPMorgan bank analyst Kian Abouhossein admits he is quite "puzzled" by the recent fallout from the Archegos implosion (or maybe JPM simply was not a Prime Broker of the notorious Tiger cub), which however does not prevent him from trying to calculate the capital at risk from the Archegos collapse.

In a note published this morning, Kian writes after Nomura yesterday confirmed (at least) a $2Nn potential claim and fellow Japanese bank Mitsubishi UFJ Securities Holdings announcing today of another potential $300MM loss - which as the JPM strategist admits "for a likely non-material PB player is surprising to us" – JPMorgan now expects losses well beyond normal unwinding scenario for the industry: and explains that it now sees "the losses as very material in relation to lending exposure for a business that is mark-to-market and holds liquid collateral" and makes Nomura's indication of potentially losing $2bn and press speculation of CSG $3-4bn losses "as not an unlikely outcome" according to the JPM strategist.

So why is JPM surprised?

Because as Abouhossein writes, "in normal circumstances... we would have suspected industry losses of $2.5-5bn. We now suspect losses in the range of $5-10bn."To get there, JPM estimates that Archegos was highly leveraged at 5-8x (i.e. $50-80bn of exposure for $10bn of equity) - using Total Return Swaps and Certificates for Difference to lever up so massively as we discussed yesterday - and it was this use of equity-swaps tha "tincreased the inability of PBs to see the concentration risk in holdings within the hedge fund in question."

Even so, Kian admits that he remains "puzzled why Credit Suisse (CSG) and Nomura have been unable to unwind all their positions at this point – as we would expect to get an announcement as soon as this is the case, on the scale of potential losses (especially in the case of CSG which hasn’t provided numerical impact)" although we have gotten some headlines suggesting the total loss could be as big as $7 billion.

That said the JPM analyst expects full disclosure by the end of the week at the latest from CSG and would keep an eye on credit agencies statements as well. And in the harshest slam of JPM's competitors, Kian says he suspects "potentially poor risk mgmt being an issue here considering i) late unwinding, and ii) possibly significant more leverage than for GS/MS similar exposures."

Alternatively, one could argue that it was Goldman and Morgan Stanley who rushed to break ranks with the syndicate of Prime Brokers and started dumping blocks of Archegos shares for one reason or another on Friday morning as we detailed yesterday, which meant that while they suffered the least losses, those banks - like CS, Nomura and Wells - which were slow to start selling, would end up with the largest losses (for more see "How Goldman And Morgan Stanley Broke Ranks And Triggered The Biggest Margin Call Since Lehman"). Source: @KennethDredd

In terms of actual loss estimates with an empahsis on Credit Suisse which so far appears to be the hardest hit, here is a breakdown from JPMorgan of what is known:

In terms of capital at risk, based on press articles, Credit Suisse seems to have bigger issues than Nomura assuming press speculation of $3-4bn are correct and Grensill could potentially lead to additional litigation cost of $1-3bn. In the case of Nomura, JPM has reduced the share buyback for FY2020 from ¥75 billion to ¥10 billion; if the press speculation losses are correct, it would expect CS at a minimum will have to cancel its share buyback for 2021, preserving the dividend and we assume no buyback for the next 2 years assuming Basel 4 implementation as of Jan 2023.

Assuming no RWA growth vs. YE2020 levels, JPM calculates that CS can absorb a max. one-time pre-tax hit of c$4.5bn (CHF 4.2bn) for Archegos which post-tax is 116bps of CET1 capital offset by 32bps of Retained earnings (1Q Net Income less 1Q dividend accrual of CHF 0.2bn and share buyback of CHF 0.3bn completed YTD) and still reach 12% by end of 1Q 21 which is seen as an acceptable level for S/Hs under Basel 3 – with further hits to come (see below). The minimum CET1 requirement is 10% and every additional $1bn pre-tax hit is 26bps of CET1 capital based on YE2020 RWAs and hence "any hits beyond $5bn pre-tax from Archegos will call into question the capital position in our view", JPM warns.

Finally, JPM tries to answer a key question for many investors, namely what has happened with holdings (as speculated in the press ) of Archegos Capital?

As Kian writes, the share price of Arhcegos Capital linked stocks fell by -39% on avg. since the beginning of last week. According to press reports (Bloomberg), Archegos Capital was forced to sell large shareholdings in eight online and entertainment companies (GSX Techedu, ViacomCBS, Discovery, iQIYI, Tencent Music, Vipshop, Baidu, Farfetch) to cover potential losses after some positions moved against the fund. Once Archegos Captial failed to meet its margin commitments, the sell-off intensified further as banks started offloading via sizeable block trades the holdings posted by the fund as collateral, prompting more declines.

Based on the latest publicly available disclosure the banks with the largest exposure to the mentioned companies were Morgan Stanley, Credit Suisse, Goldman Sachs, Nomura and to a lesser extent UBS and DB (more details below). On Friday alone, both ViacomCBS and Discovery saw their largest ever daily decline, with each falling by more than -27%. Traded volumes for the eight companies peaked on Friday with daily volumes being on avg. more than 13x the 90 days moving average. The sell-off continued on Monday 29th with the aforementioned stocks falling further -6% on average.

Based on latest available public filings, JPM calculates that the banks which had the largest holdings in the eight Archegos Capital-linked stocks mentioned by the press were Morgan Stanley, Credit Suisse, Goldman Sachs and Nomura. Morgan Stanley exposure was relatively broad based with 5%+ holdings in all but one companies and with 10%+ stake in both GSX Techedu and iQIYI. Credit Suisse exposure was also broad based with holdings in all but one companies and with the largest exposure being its 9% stake in Discovery. Goldman Sachs exposure was mainly concentrated in GSX Techedu (22% stake), while Nomura had exposure in all but one companies and a relatively large holding of 7% in GSX Techedu. Other banks such as Bank of America, Citi, UBS, Deutsche and Barclays also had holdings above 2% in some the mentioned companies (mainly GSX Techedu and Discovery).

Finally, courtesy of JPM, here is a summary of all the latest publicly available information disclosing what exposure each bank may have had - and still has - to Archegos:

Tyler Durden Tue, 03/30/2021 - 12:37

http://dlvr.it/RwgpxV

http://dlvr.it/RwgpxV

Some NFT Sales Could Be Illegal: SEC Commissioner Hester Peirce

Some NFT Sales Could Be Illegal: SEC Commissioner Hester Peirce

Authored by Will Gottsegen via Decrypt.co,

In brief

*

SEC commissioner Hester Peirce - sometimes known as “Crypto Mom” - said investors should be wary of creating unregistered investment products with NFTs.

*

Fractionalized NFTs could potentially be securities, she said.

The hype around NFTs, or non-fungible tokens, refuses to die down, and regulators are taking notice.

SEC commissioner Hester Peirce, affectionately known as "Crypto Mom" within the cryptocurrency industry, warned investors yesterday that some NFTs could be considered unregistered securities under certain circumstances.

“The whole concept of an NFT is [it’s] supposed to be non-fungible, so it’s supposed to be unlike anything else,” Peirce said during a Security Token Summit webinar on Thursday.

“Which means that it’s, I think, in general, less likely to be a security, but people are being very creative in the types of NFTs they’re putting out there. It’s a wonder what some people will pay for. And so I think, given that creativity, as with anything else, you should be asking questions.”

NFTs are cryptographically secured digital assets—essentially just a token attached to an image or video file. They’ve been selling for ridiculous amounts of money (the digital artist Beeple sold a single NFT for $69 million at Christie’s), and have been used to promote music, digital art, tweets, and journalism.

They’ve also posed problems for investors. There are potential copyright issues, as well as ethical concerns around the Ethereum network’s energy consumption; some have suggested that crypto art might make a good vehicle for money laundering (sort of like physical art).

Peirce explained that certain kinds of fundraising efforts tied to NFTs might “raise the same kinds of questions that ICOs have raised.”

“If you’re doing something where you are saying, ‘I’m going to sell you this thing and I’m going to put a lot of effort into building something so that this thing that you’re buying has a lot of value," those kinds of sales will attract more regulatory scrutiny.

ICOs, or “initial coin offerings,” have been a thorn in the SEC's side for years; they give early investors in crypto startups the chance to buy into a company’s cryptocurrency, with the promise of return down the line. The issue is that the SEC has taken the position that just about every token ever sold through an ICO is unregistered security, and the Commission has come down hard against these token issuers in lawsuit after lawsuit.

Peirce also suggested fractionalized NFTs (i.e. selling partial interest in a single, expensive NFT) could run the risk of being unregistered securities.

Peirce’s comments add yet another new wrinkle to the NFT gold rush. “You’ve always got to ask those questions,” she said. “As we’ve seen, the definition of a security can be pretty broad.” Tyler Durden Tue, 03/30/2021 - 11:35

http://dlvr.it/RwgcXJ

http://dlvr.it/RwgcXJ

SpaceX Launches Starship SN11, But "Fails" During Flight Descent

SpaceX Launches Starship SN11, But "Fails" During Flight Descent

Elon Musk's SpaceX launched Starship prototype rocket Serial Number 11, or SN11, on Tuesday morning as high as 10 kilometers, or about 32,800 feet in altitude. Preliminary reports state the rocket may have experienced trouble during a landing maneuver.

*SPACEX STARSHIP FAILS IN TEST FLIGHT DURING DESCENT — *Walter Bloomberg (@DeItaone) March 30, 2021

Senior Transportation Correspondent for ABC News, David Kerley, tweeted an image of the SN11 debris raining down on the launch pad, suggesting the spaceship experienced some disaster.

That's debris falling to the left and slightly above palm tree caught by @NASASpaceflight @SpaceX #Starshipsn11 trouble after the re-light for landing. pic.twitter.com/XV83h260P0 — David Kerley (@David_Kerley) March 30, 2021

Here's the video of pieces of SN11 falling from the sky.

Final view of SN11 in the air:

➡️https://t.co/Q2p3q1HS0i pic.twitter.com/PNJta9svkA — Chris B - NSF (@NASASpaceflight) March 30, 2021

SpaceX is developing Starship to launch cargo to the moon and Mars.

The SN11 flight is similar to prior ones (SN8, SN9, and SN10) in the past four months - all have launched successfully and completed multiple development objectives but usually end in disaster. Tyler Durden Tue, 03/30/2021 - 09:31

http://dlvr.it/Rwg8hP

http://dlvr.it/Rwg8hP

Russian National Wealth Fund Turning To Gold, Dumping Dollars

Russian National Wealth Fund Turning To Gold, Dumping Dollars

Via SchiffGold.com,

The Russian Finance Ministry has given the green light for the Russian National Wealth fund to diversify and invest in gold and other precious metals. According to a report by RT, this is part of a broader move to de-dollarize the wealth fund.

The National Wealth Fund falls under the direction of the Russian Finance Ministry. One of the fund’s primary purposes is to support the nation’s pension system. According to the fund’s website, “Fund’s primer assignments are to co-finance voluntary pension savings of Russian citizens and to balance the budget of Pension Fund of the Russian Federation.” The fund can also be tapped to cover government budget deficits in times of a crisis. According to RT, as of November, the fund held more than $167 billion in assets, totaling about 12% of Russia’s GDP.

According to RT, the fund’s move into gold and other precious metals is aimed at diversifying assets to ensure the “safety” of the fund “as well as for increasing the yields.”

The Russian central bank has added significant amounts of gold to its reserves in recent years, although halted its buying spree last spring as the coronavirus pandemic gripped the world. Prior to the pause, the central bank added an average of 205 tons of gold to its reserves every year since 2014. In February 2018, Russia passed China to become the world’s fifth-largest gold-holding country.

Meanwhile, the Russian central bank was aggressively divesting itself of US Treasuries. Russia sold off nearly half of its US debt in April 2018 alone, dumping $47.4 billion of its $96.1 billion in US Treasuries. In January, the value of Russia’s gold holdings eclipsed its dollar holdings for the first time ever.

Russia’s shrinking dollar reserves is no accident. It was an intentional “de-dollarization” policy outlined by President Putin to lower the country’s exposure to the United States and shield it from the threat of US sanctions.

Gold now ranks as the second-largest component of Russia’s central bank reserves only behind euros. The Central Bank of Russia has also increased its holdings of yuan. The Chinese currency now makes up about 12% of Russian reserves.

It appears the Russian National Wealth Fund is following this same strategy. According to RT, the Ministry of Finance reduced the portion of US dollars and euros in the currency structure of its National Wealth Fund from 45% to 35% last month. It has increased holdings of Japanese yen and Chinese yuan. Now it plans to add gold to that mix.

Finance Minister Anton Siluanov previously said he supported the idea of allocating the NWF assets “more efficiently.”

He called precious metals a much more sustainable investment than financial market assets in the long-term. Tyler Durden Tue, 03/30/2021 - 08:14

http://dlvr.it/RwftsR

http://dlvr.it/RwftsR

Monday, March 29, 2021

Matt Taibbi Challenges Joe Scarborough: "Invite Me To Debate Your Network's Putrid Russiagate Coverage"

Matt Taibbi Challenges Joe Scarborough: "Invite Me To Debate Your Network's Putrid Russiagate Coverage"

Authored by Matt Taibbi via TK News

Joe Scarborough just had this to say on Morning Joe:

@mtaibbi you may like this one https://t.co/YWfUYPEdep — The Elegant Diplomat (@ElegantDiplomat) March 29, 2021

Joe begins his rant by insinuating that those who’ve spent time documenting errors on the Russiagate story are maybe on “Russia’s payroll,” which is nothing new for this network, of course, or frankly for the press in general during this time.

Implying that anyone who didn’t buy into the moral panic on Russia was a traitor was a fairly constant theme in media and politics in the last four years, with NBC’s smear of Tulsi Gabbard as a “favorite” of “Russia’s propaganda machine” being one of the ethical low points of the era. Why should Joe Scarborough be above the same tactics?

The exact quote:

I’m amused by so-called reporters who — I don’t know if they’re useful idiots for Russia, or if they’re on Russia’s payroll … but there are some gifted writers who spend all night and day, trying to dig through, looking for instances where the press screwed up on Russia stories.

He went on to say that yes, there were instances of mistakes, and some bad mistakes, but “more often than not,” the press got it right. Perhaps this could be a new slogan for the network:

MSNBC. We get it right. More often than not.

The full quote:

If you look at the totality of it, the totality of everything — I mean, yeah, the media screwed up at some points, and sometimes they screwed up badly… But more often than not, they got it right.

Obviously, I won’t presume that he’s talking about me when he mentions “some gifted writers” who may or may not be foreign spies, criticizing networks like his. He could be referring to Aaron Mate, or Glenn Greenwald, perhaps even Erik Wemple of the Washington Post, whose critique of Scarborough’s colleague Rachel Maddow’s Russia coverage was scathing enough.

It doesn’t matter, as the universe of people actually doing such work isn’t large. I do have a recent piece out, “Master List Of Official Russia Claims That Proved To Be Bogus,” that sounds like the kind of thing annoying him, so I’m happy to respond on behalf of the group.

The humorous thing about this is that the group of writers who have spoken out on this topic is small enough that we all communicate with each other. We’ve been able to calculate that I was actually the last of the Russiagate skeptics invited on MSNBC, on January 13, 2017 — before Trump’s inauguration — when I joined Chris Hayes and Malcolm Nance to discuss what at the time was a red-hot story.

The irony is that one of the major criticisms of the media’s performance on this issue is that it has not allowed any critics of the story to appear really anywhere in the mainstream press, and particularly not on television, for nearly four years. I doubt they will break that on-air pattern even now. Still, it’s worth asking Scarborough: if you’re so certain this issue is a “joke,” surely you won’t mind discussing it?

If you’d rather not have me on, I’m sure someone on the more critical side would be happy to walk you through exactly how far short of “right, more often than not” your network has been in the last five years or so. Most of the major outlets were terrible on this story, but MSNBC’s particular brand of suckage was visible from space during the key years of Russiagate. Which I’m happy to lay out for you. Come on — no matter how it turns out, it’ll be great TV! Tyler Durden Mon, 03/29/2021 - 23:00

http://dlvr.it/RwdST1

http://dlvr.it/RwdST1

Major World Banks Warn of Billions in Losses Today After They Exit Positions with Large US Hedge Fund

by Joe Hoft, The Gateway Pundit: News over the weekend indicates the markets may be in for a wild ride today. We reported over the weekend that two large US financial institutions reported sales of nearly $20 billion in Chinese Tech and US media companies on Friday: Now this morning, two massive overseas banks announced their pending […]

http://dlvr.it/Rwc4r2

http://dlvr.it/Rwc4r2

"Right Now I'm Scared" - CDC Director Chokes Back Tears As She Fearmongers "Impending Doom"

"Right Now I'm Scared" - CDC Director Chokes Back Tears As She Fearmongers "Impending Doom"

In a stunningly emotional outburst during this morning's COVID-19 Response press conference, new CDC Director Rochelle Walensky went "off-script" (though if one watches here eyes it appears she is very much reading a script) to warn the public about her "impending doom" following a rise in COVID cases.

CDC Director Dr. Rochelle Walensky goes off script with an emotional plea to the public about an “impending doom” following rise in COVID cases:

“Right now, I’m scared.” pic.twitter.com/UKjrRhr7He — The Recount (@therecount) March 29, 2021

"Right now, I'm scared," she exclaimed.

Here is what Walensky is freaking out about...

Source: Bloomberg

“I’m speaking today not necessarily as your CDC director, but as a wife, as a mother, as a daughter to ask you to just please hold on a little while longer," she implored, urging Americans to mask up, socially distance, etc., etc. and she is worried about a new wave "if rules are lifted" too soon.

Dr. Rochelle Walensky: “I’m speaking today not necessarily as your CDC director, but as a wife, as a mother, as a daughter to ask you to just please hold on a little while longer.”pic.twitter.com/fgFC4Yrl6z — The Recount (@therecount) March 29, 2021

Finally, just in case you were wondering, here's what is happening in Texas since all those federally-mandated restrictions were lifted...

Source: Bloomberg

This level of fearmongering is disgusting and disingenuous and the American people are growing more and more insensitive to such evocations. Tyler Durden Mon, 03/29/2021 - 11:38

http://dlvr.it/RwbwBm

http://dlvr.it/RwbwBm

Biden's Stimulus Will Cut Poverty By 40%... For One Year

Biden's Stimulus Will Cut Poverty By 40%... For One Year

Authored by Lance Roberts via RealInvestmentAdvice.com,

President Biden’s stimulus bill “will cut the number of children in poverty by 40%,” according to the Center on Budget and Policy Priorities.

“The current Child Tax Credit and EITC together lift more children above the poverty line, 5.5 million, than any other economic support program. This level of poverty reduction was achieved through multiple expansions of the EITC and Child Tax Credit since their respective enactments in 1975 and 1997. The House’s proposal — with one significant change to the Child Tax Credit — would lift another 4.1 million children above the poverty line, cutting the remaining number of children in poverty by more than 40 percent.” – CBPP

The NY Times also jumped on Biden’s stimulus package to tout how “transformative” Biden will be to the U.S. economy. To wit:

“The list of new policies goes on. There is money in the American Rescue Plan to expand food stamps, bolster state welfare programs, and increase federal support for child and dependent care. Put all this together and the bill is expected to reduce overall poverty by more than a third and child poverty by more than half. It is, with no exaggeration, the single most important piece of anti-poverty legislation since Lyndon B. Johnson’s Great Society, itself the signature program of a man who sought to emulate F.D.R.”

Here’s the problem. Unlike the New Deal, which benefitted the economy for decades, the American Rescue Plan will only help the poor for one year. As is always the case with such socialistic policies, they sound great in theory, but they rarely work as expected in reality.

The Poor Do Need Help

“More money in people’s pockets will lead to stronger economic growth.” – J.M. Keynes

I certainly agree with trying to help those in need. Such is why we have charitable organizations that do everything from providing housing, meals, and even job placement. These charities do formidable, challenging, and meaningful work and should have access to funding to do what they do best.

However, the Federal Government is not one of these charities, and throwing money at the problem does more harm than good in the long-term.

Let me explain.

Using data from the Census Bureau, we can look at the bottom 20% of the population’s historical incomes since 1967. As shown, there has virtually been no substantive increase in median incomes for that income group since 1980.

The problem is more apparent when viewed against the other income quintiles.

The problem of “government handouts” should be readily apparent. Since the 1960’s the U.S. has expanded access to social security, welfare, food stamps, tax credits, and a litany of other programs directly targeted to help the most deficient 20% of Americans.

Nothing has changed. Even if the current one-year subsidies are made permanent, they will fail to change the economics of poverty after one-year.

A Temporary Solution

Given the massive support given to the poor over the last 60-years, it should be readily apparent that something is flawed in the thinking. To explain the issue, let’s use another “socialistic policy” being floated by more liberal thinkers – a “universal basic income” or “UBI.”

The idea is that if the Government supplies a basic “living income” to the poor, they will be better off as they won’t have to worry about meeting their “basic needs.” While noble in its intent, economically, it doesn’t change outcomes over the longer term.

Let’s run a hypothetical example using GDP from 2007 to the present. In 2008, in response to the “Financial Crisis,” Congress passes a bill, in theory, that provides $1000/month ($12,000 annually) to 190 million families in the U.S.

The chart below shows the economy’s annual GDP growth trend assuming the entire UBI program shows up in economic growth. For those supporting programs like UBI, it certainly appears as if GDP elevates permanently to a higher level.

When you look at the annual rate of change in economic growth, which is how we measure GDP for economic purposes, a different picture emerges. In 2008, when the $12,000 arrives at households, GDP spikes, printing a 17% growth rate versus the actual 1.81% rate.

However, beginning in 2009, the benefit disappears. The reason is that after UBI enters the system, the economy normalizes to a “new level” after the first year. Also, notice that GDP grows at a slightly slower rate as dollar changes to GDP at higher levels print a lower growth rate.

UBI’s Dark Side

Of course, the money to provide the $12,000 UBI benefit had to come from somewhere.

According to the Center On Budget & Policy Priorities, in 2020, roughly 75% of every tax dollar went to non-productive spending.

“In the fiscal year 2019, the Federal Government spent $4.4 trillion, amounting to 21 percent of the nation’s gross domestic product (GDP). Of that $4.4 trillion, federal revenues financed only $3.5 trillion. The remaining $984 billion came from debt issuance. As the chart below shows, three major areas of spending make up most of the budget.”

Think about that for a minute. In 2019, 75% of all expenditures went to social welfare and interest on the debt. Those payments required $3.3 Trillion of the $3.5 Trillion (or 95%) of the total revenue collected.

Given the decline in economic activity during 2020, those numbers become markedly worse. For the first time in U.S. history, the Federal Government will have to issue debt to cover the mandatory spending. If we add a UBI payment, the deficit spending becomes markedly worse.

The chart below shows the impact of the additional debt on the Federal deficit.

While the “theoretical models” assume that UBI will create enough economic growth and prosperity to “offset” the increase in debt, 40-years of history suggest otherwise.

The Poor Will Remain Poor

Social programs don’t increase prosperity over time. Yes, sending checks to households will increase economic prosperity and cut poverty for 12-months. However, next year, when the checks end, the poverty levels will return to normal, and worse, due to increased inflation.

In a rush to help those in need, economic basics are nearly always forgotten. If I increase incomes by $1000/month, prices of goods and services will adjust to the increased demand. As noted above, the economy will quickly absorb the increased incomes returning the poor to the previous position.

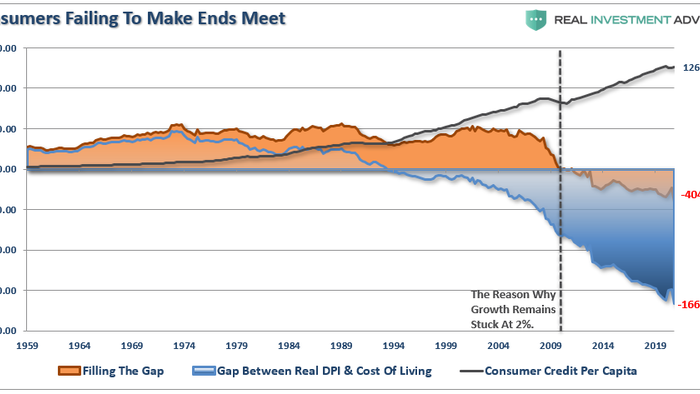

The annual increases in the cost of living impact those in the bottom 20% and those in the bottom 60% of income earners. As I discussed in “The Feedback Loop:”

“‘The ability to ‘maintain a certain standard of living’ remains problematic for many forcing them further into debt.’ – WSJ”

I often show the “gap” between the “standard of living” and real disposable incomes. In 1990, incomes alone were no longer able to meet the standard of living. Therefore, consumers turned to debt to fill the “gap.”

However, following the “financial crisis,” even the combined income and debt levels no longer filled the gap. Currently, there is almost a $4050 annual deficit facing the average American.

The problem with an economy built on “debt” is exceptionally problematic for the poor as they generally can’t obtain credit. Such cuts off a much-needed source of spending power in the economy.

“‘Consumers increasingly need it [debt].Companies increasingly can’t sell their goods without it. And the economy, which counts on consumer spending for more than two-thirds of GDP, would struggle without a plentiful supply of credit.’ – WSJ”

In the end, once the stimulus fades and the economy adjusts for inflation, Biden’s small moment of reduced poverty rates will revert with a vengeance.

Not A “New New Deal”

While the media is quick to fawn on Biden’s stimulus plan, claiming it to be the 2nd coming of FDR, it isn’t.

FDR’s “New Deal” did have many “social programs” embedded in it, including the beginning of the social welfare safety net. However, FDR backed those social programs with massive works projects from the Hoover Dam’s building to the Tennesse River Valley Authority. Not only did the spending on these projects create jobs, but they were also productive investments repaying the debt used to fund them.

More importantly, the focus of many of the programs was the creation of “jobs.” From the Works Progress Administration to the National Labor Relations Act, Roosevelt believed the best solution to help those in need was to get them back to work.

Furthermore, FDR focused on cleaning up the predatory nature of the financial system on Americans. The 1933 Banking Act, which reformed the banking system by separating banking and brokerage activities. He also established regulatory oversight on the banking system with the Securities Act of 1933.

While providing short-term relief, Biden’s plan does nothing to solve the long-term problems of those living at poverty levels. They need both incentives to “go to work” and access to training and education to obtain gainful employment.

Such is what FDR understood. As with all Government programs, some programs worked while others didn’t. Today, there is still debate about whether FDR’s programs cured or exacerbated the “Great Depression.”

However, what history does define well is that debt-funded programs to provide social assistance to the poor have failed.

Next year, when the money is all spent, we will find poverty levels surged, economic growth weakened, and deficits exploded.

Such is the outcome of all socialistic programs in history. Tyler Durden Mon, 03/29/2021 - 09:30

http://dlvr.it/RwbTLB

http://dlvr.it/RwbTLB

ARGENTINA’S ECONOMY IS CRASHING! – IMF DESTROYS MILLIONS OF LIVES! – CRYPTO SAVES THE DAY?

from World Alternative Media: TRUTH LIVES on at https://sgtreport.tv/

http://dlvr.it/Rwb9Hd

http://dlvr.it/Rwb9Hd

Sunday, March 28, 2021

Congress, In Five-Hour Hearing, Demands Tech CEOs Censor The Internet Even More Aggressively: Greenwald

Congress, In Five-Hour Hearing, Demands Tech CEOs Censor The Internet Even More Aggressively: Greenwald

Authored by Glenn Greenwald via greenwald.substack.com,

Over the course of five-plus hours on Thursday, a House Committee along with two subcommittees badgered three tech CEOs, repeatedly demanding that they censor more political content from their platforms and vowing legislative retaliation if they fail to comply. The hearing — convened by the House Energy and Commerce Committee’s Chair Rep. Frank Pallone, Jr. (D-NJ), and the two Chairs of its Subcommittees, Mike Doyle (D-PA) and Jan Schakowsky (D-IL) — was one of the most stunning displays of the growing authoritarian effort in Congress to commandeer the control which these companies wield over political discourse for their own political interests and purposes. Facebook CEO Mark Zuckerberg, Twitter CEO Jack Dorsey, and Google/Alphabet CEO Sundar Pichai testify before the House Energy and Commerce Committee, Mar. 25, 2021

As I noted when I reported last month on the scheduling of this hearing, this was “the third time in less than five months that the U.S. Congress has summoned the CEOs of social media companies to appear before them with the explicit intent to pressure and coerce them to censor more content from their platforms.” The bulk of Thursday’s lengthy hearing consisted of one Democratic member after the next complaining that Facebook CEO Mark Zuckerberg, Google/Alphabet CEO Sundar Pichai and Twitter CEO Jack Dorsey have failed in their duties to censor political voices and ideological content that these elected officials regard as adversarial or harmful, accompanied by threats that legislative punishment (including possible revocation of Section 230 immunity) is imminent in order to force compliance (Section 230 is the provision of the 1996 Communications Decency Act that shields internet companies from liability for content posted by their users).

Republican members largely confined their grievances to the opposite concern: that these social media giants were excessively silencing conservative voices in order to promote a liberal political agenda (that complaint is only partially true: a good amount of online censorship, like growing law enforcement domestic monitoring generally, focuses on all anti-establishment ideologies, not just the right-wing variant). This editorial censoring, many Republicans insisted, rendered the tech companies’ Section 230 immunity obsolete, since they are now acting as publishers rather than mere neutral transmitters of information. Some Republicans did join with Democrats in demanding greater censorship, though typically in the name of protecting children from mental health disorders and predators rather than ideological conformity.

As they have done in prior hearings, both Zuckerberg and Pichai spoke like the super-scripted, programmed automatons that they are, eager to please their Congressional overseers (though they did periodically issue what should have been unnecessary warnings that excessive “content moderation” can cripple free political discourse). Dorsey, by contrast, seemed at the end of his line of patience and tolerance for vapid, moronic censorship demands, and — sitting in a kitchen in front of a pile of plates and glasses — he, refreshingly, barely bothered to hide that indifference. At one point, he flatly stated in response to demands that Twitter do more to remove “disinformation”: “I don't think we should be the arbiters of truth and I don't think the government should be either.”

Zuckerberg in particular has minimal capacity to communicate the way human beings naturally do. The Facebook CEO was obviously instructed by a team of public speaking consultants that it is customary to address members of the Committee as “Congressman” or “Congresswoman.” He thus began literally every answer he gave — even in rapid back and forth questions — with that word. He just refused to move his mouth without doing that — for five hours (though, in fairness, the questioning of Zuckerberg was often absurd and unreasonable). His brain permits no discretion to deviate from his script no matter how appropriate. For every question directed to him, he paused for several seconds, had his internal algorithms search for the relevant place in the metaphorical cassette inserted in a hidden box in his back, uttered the word “Congressman” or “Congresswoman,” stopped for several more seconds to search for the next applicable spot in the spine-cassette, and then proceeded unblinkingly to recite the words slowly transmitted into his neurons. One could practically see the gears in his head painfully churning as the cassette rewound or fast-forwarded. This tortuous ritual likely consumed roughly thirty percent of the hearing time. I’ve never seen members of Congress from across the ideological spectrum so united as they were by visceral contempt for Zuckerberg’s non-human comportment:

But it is vital not to lose sight of how truly despotic hearings like this are. It is easy to overlook because we have become so accustomed to political leaders successfully demanding that social media companies censor the internet in accordance with their whims. Recall that Parler, at the time it was the most-downloaded app in the country, was removed in January from the Apple and Google Play Stores and then denied internet service by Amazon, only after two very prominent Democratic House members publicly demanded this. At the last pro-censorship hearing convened by Congress, Sen. Ed Markey (D-MA) explicitly declared that the Democrats’ grievance is not that these companies are censoring too much but rather not enough. One Democrat after the next at Thursday’s hearing described all the content on the internet they want gone: or else. Many of them said this explicitly.

At one point toward the end of the hearing, Rep. Lizzie Fletcher (D-TX), in the context of the January 6 riot, actually suggested that the government should create a list of groups they unilaterally deem to be “domestic terror organizations” and then provide it to tech companies as guidance for what discussions they should “track and remove”: in other words, treat these groups the same was as ISIS and Al Qaeda.

Words cannot convey how chilling and authoritarian this all is: watching government officials, hour after hour, demand censorship of political speech and threaten punishment for failures to obey. As I detailed last month, the U.S. Supreme Court has repeatedly ruled that the state violates the First Amendment’s free speech guarantee when they coerce private actors to censor for them — exactly the tyrannical goal to which these hearings are singularly devoted.

There are genuine problems posed by Silicon Valley monopoly power. Monopolies are a threat to both political freedom and competition, which is why economists of most ideological persuasions have long urged the need to prevent them. There is some encouraging legislation pending in Congress with bipartisan support (including in the House Antitrust Subcommittee before which I testified several weeks ago) that would make meaningful and productive strides toward diluting the unaccountable and undemocratic power these monopolies wield over our political and cultural lives. If these hearings were about substantively considering those antitrust measures, they would be meritorious.

But that is hard and difficult work and that is not what these hearings are about. They want the worst of all worlds: to maintain Silicon Valley monopoly power but transfer the immense, menacing power to police our discourse from those companies into the hands of the Democratic-controlled Congress and Executive Branch.

And as I have repeatedly documented, it is not just Democratic politicians agitating for greater political censorship but also their liberal journalistic allies, who cannot tolerate that there may be any places on the internet that they cannot control. That is the petty wannabe-despot mentality that has driven them to police the “unfettered” discussions on the relatively new conversation app Clubhouse, and escalate their attempts to have writers they dislike removed from Substack. Just today, The New York Times warns, on its front page, that there are “unfiltered” discussions taking place on Google-enabled podcasts: New York Times front page, Mar. 26, 2021

We are taught from childhood that a defining hallmark of repressive regimes is that political officials wield power to silence ideas and people they dislike, and that, conversely, what makes the U.S. a “free” society is the guarantee that American leaders are barred from doing so. It is impossible to reconcile that claim with what happened in that House hearing room over the course of five hours on Thursday. Tyler Durden Sun, 03/28/2021 - 23:00

http://dlvr.it/RwYsDS

http://dlvr.it/RwYsDS

Media Starting To Admit Federal Prosecutors Have Scant Evidence Against January 6th DC Protestors As Judges Start Asking Questions

from The Conservative Treehouse: Apparently the creation of the DOJ’s politically convenient “domestic extremist” narrative is starting to come under scrutiny. After several federal judges initially granted the DOJ the benefit of doubt for their outlandish conspiratorial claims, now with judges ordering the targets to be released the media are catching on. The 2021 political […]

http://dlvr.it/RwXnPJ

http://dlvr.it/RwXnPJ

Biden’s First Press Conference – Oh Boy!

by Martin Armstrong, Armstrong Economics: Biden is not competent to be President — plain and simple. During his first press conference, he had cheatsheets and only took questions from journalists who already agreed to never expose the truth. He had photos of all those in the room and the ones who were marked (see New York […]

http://dlvr.it/RwXfkh

http://dlvr.it/RwXfkh

Oil Tanker Rates Surge As Suez Canal Blockage Continues

Oil Tanker Rates Surge As Suez Canal Blockage Continues

Submitted by OilPrice.com,

Oil product tanker rates have surged almost double since a giant container ship ran aground the Suez Canal on Tuesday, blocking traffic on the vital shipping lane.

The rates for shipping oil products in the Mediterranean region have almost doubled, while shipping companies have started to divert tankers bound for Asia away from the Suez Canal to the longer route around the Cape of Good Hope in Africa.

While efforts continue to dislodge the huge ship the length of the Empire State Building from the Suez Canal, it could be weeks until traffic returns to normal, while nearly three dozen tankers are waiting on either side of the canal to pass through.

The lower availability of tankers has sent rates surging.

The rates for smaller tankers for shipping in the Mediterranean region jumped first, Braemar ACM Shipbroking told Reuters.

“Lower availability of tankers would lead to a short-term spike in freight rates for European and Mediterranean loadings if tankers unable to transit the canal fail to meet already agreed laycans and charterers have to opt for a flurry of prompt replacements,” oil analytics firm Vortexa said on Thursday.

“Though unlikely congestion lasts this long, if it does persists long enough to lead to diversions, longer voyage lengths and an overall increase in tonne-miles would provide further support for freight rates to rise in the short-term,” Vortexa analysts said.

Since the Suez Canal was blocked, the rate for renting some tankers for shipping oil from the Middle East to Asia has surged by 47 percent to US$2.2 million, Anoop Singh, a Singapore-based tanker analyst at Braemar ACM, told The Wall Street Journal.

Meanwhile, signs have started to emerge that some tanker operators are already diverting Asia-bound Suezmax tankers – the largest tanker that can pass through the Suez Canal and capable of carrying up to 1 million barrels of oil – away from the blocked shipping lane.

The Suezmax tanker Marlin Santorini, traveling from Houston to Asia, abruptly change its course on Thursday, and instead of to the Suez Canal, it headed to the Cape of Good Hope, according to Bloomberg data. Tyler Durden Sun, 03/28/2021 - 09:20

http://dlvr.it/RwXNT1

http://dlvr.it/RwXNT1

Things That Make Me Go Hmmm: Inflation, Crypto, Command Economies and Gold.

by Matthew Piepenburg, Gold Switzerland: Over the years I’ve written almost ad nauseum about the crazy I see (and saw) around me as a fund manager, family office principal and individual investor. The list includes: 1) an entire book on the grotesque central bank distortions of free market price discovery, 2) the open (and now accepted) dishonesty […]

http://dlvr.it/RwXCG0

http://dlvr.it/RwXCG0

Saturday, March 27, 2021

Your Tax Dollars at Work: Biden’s Illegal Migrants and Fake Refugees Are Being Flown Out Across America – 40% of McAllen, TX Air Traffic Now Migrants

by Jim Hoft, The Gateway Pundit: The Biden administration is now flying the thousands of migrants out of McAllen, Texas. According to Jenn Pellegrino from OAN — 40% of the traffic is illegal aliens, paid for by your tax dollars. And, of course, no one knows about their COVID status! We were sent this yesterday […]

http://dlvr.it/RwWHjp

http://dlvr.it/RwWHjp

Transportation Secretary Mayor Pete Is Pushing For A "Vehicle Mileage Tax"

Transportation Secretary Mayor Pete Is Pushing For A "Vehicle Mileage Tax"

At what point to Democrats start to realize that they're running out of things to tax?

Could today be a wake up call? Perhaps the fact that Mayor Pete, now Transportation Secretary, is honestly pitching the idea of a vehicle mileage tax that would increase the further one travels, might wake some people up to the idea that we've gone too far?

Buttigieg told CNBC Friday that the idea was on the table to help pay for President Biden's upcoming infrastructure plans. "He spoke fondly of a mileage levy," CNBC wrote.

Buttigieg said: “When you think about infrastructure, it’s a classic example of the kind of investment that has a return on that investment. That’s one of many reasons why we think this is so important. This is a jobs vision as much as it is an infrastructure vision, a climate vision and more.”

He continued: “A so-called vehicle-miles-traveled tax or mileage tax, whatever you want to call it, could be a way to do it.”

“I’m hearing a lot of appetite to make sure that there are sustainable funding streams. A mileage tax shows a lot of promise if we believe in that so-called user-pays principle: The idea that part of how we pay for roads is you pay based on how much you drive,” Buttigieg said. “You’re hearing a lot of ‘maybe’ here because all of these things need to be balanced and could be part of the mix.”

He's also considering issuing "Build America Bonds" and says there's “a lot of promise in terms of the way that we leverage that kind of financing. There have been ideas around things like a national infrastructure bank, too.”

He concluded: “There is near-universal recognition that a broader recovery will require a national commitment to fix and transform America’s infrastructure.”

Biden's infrastructure proposals are expected to total $3 trillion to $4 trillion. Biden said last week that rebuilding the nation's infrastructure was was critical to restore the economy and continue to compete with China. Tyler Durden Sat, 03/27/2021 - 12:15

http://dlvr.it/RwVBJt

http://dlvr.it/RwVBJt

2 Dead, 10 Shot In Virginia Beach During "Chaotic Night Of Violence"

2 Dead, 10 Shot In Virginia Beach During "Chaotic Night Of Violence"

In what appears to be the third mass shooting in the US in under three weeks, 10 people have been shot, 2 fatally, after what the NYT described as "a chaotic night of violence" in Virginia Beach.

It's the first shooting incident to grab national headlines in the city since an engineer slaughtered a dozen of his colleagues back in 2019 (an investigation into that incident had only just wrapped a few days ago). Police Chief Paul Neudigate told reporters Saturday morning that 8 people appeared to have been shot during a single incident, while 2 more were shot during other incidents.

In total, 2 of the victims succumbed to their wounds.

Details so far are sparse, but the chief confirmed that officers responded to the first seen around 2300ET Friday night. While officers were responding to the first shooting, they heard shots fired about a block away. As the rushed to confront the shooter, a uniformed police officer engaged one of the suspects in a firefight, killing them.

The department's twitter account shared a warning about the shootings around 0100ET.

VBPD is investigating a shooting involving several victims with possibly life-threatening injuries. Large police presence at the oceanfront between 17th and 22nd St. Please avoid the area at this time. More to follow as it becomes available. @CityofVaBeach — Virginia Beach PD (@VBPD) March 27, 2021

VBPD actively investigating oceanfront shooting with multiple gunshot wound victims and 1 deceased. Officer involved shooting with 1 deceased. @CityofVaBeach https://t.co/09uGbn9rOT — Virginia Beach PD (@VBPD) March 27, 2021

Although the timeline was left unclear, police also said a second victim was shot and killed in a third shooting incident that appeared to be unrelated to the others Neudigate said. A police officer was struck by a car while responding to the incident, though the officer's wounds were non-life-threatening.

"What you can see is that we have a very chaotic incident, a very chaotic night in the beach," Chief Neudigate said. "Many different crime scenes."

Several people were in custody, the chief told reporters. But their exact connection to the violence was unclear.

In a Twitter post just after 1 a.m. on Saturday, the department said that it was investigating a shooting in which several victims had “possibly life-threatening injuries,” and that there was a large police presence along a section of the city’s oceanfront.

"Please avoid the area at this time," it said.

A person who answered the phone at the department said that no one was available to comment. Virginia Beach was the site of a mass shooting in May 2019, which we mentioned above. In that incident, 12 people were killed and several others injured before the shooter was killed during a gun-battle with police.

On social media, some disputed whether any of the incidents qualified as an "active shooter" situation, saying that the shooters were simply two people with a personal beef, and terrible aim.

People the Virginia Beach shooting WAS NOT A ACTIVE SHOOTER it was two idiots fighting that wanted to shoot each other but unfortunately have horrible aim and shot innocent people. NOT A ACTIVE SHOOTER. Just groups fighting turned shooting — 🏳️🌈🏴🏳️=🇺🇸 (@tony3879) March 27, 2021

Whether that is an accurate characterization, or not, will need to wait for more information from the department.

Of course, while two dead from gun violence in a single evening is extremely unusual in Virginia Beach, if the same incident unfolded on the South Side of Chicago, it would barely make the news. Tyler Durden Sat, 03/27/2021 - 11:25

http://dlvr.it/RwV3Yw

http://dlvr.it/RwV3Yw

UK Supreme Court Judge Expects People Will Be Forced To Wear Masks, Stay Home For Ten Years

UK Supreme Court Judge Expects People Will Be Forced To Wear Masks, Stay Home For Ten Years

Authored by Steve Watson via Summit News,

British former Supreme Court judge Lord Sumption has warned that “social controls” brought about by the coronavirus pandemic may be kept in place by governments for up to a decade.

“It’s politically unrealistic to expect the Government to backtrack now,” commented Sumption, who has been highly critical of the government’s ‘totalitarian’ lockdown policies.

The judge compared the reaction to rationing after the Second World War, which went on for nine years, adding that this time “I think it may be even longer.”

“An interesting parallel is the continuation of wartime food rationing after the last war. People were in favour of that because they were in favour of social control,” he said during a ‘Sketch notes on’ podcast.

“In the 1951 general election, the Labour party lost its majority entirely because people with five years more experience of social control got fed up with it. Sooner or later that will happen in this country,” he added.

Sumption’s warning comes in the wake of Public Health England officials stating that restrictions will remain in place for as long as other countries have not vaccinated everyone, a process likely to take years.

England’s chief medical officer also recently asserted that the pandemic restrictions, which have been in place on and off for a year, have “improved life” for some people.

Despite promising an end to restrictions in June, the UK government yesterday extended emergency COVID laws until October, with Health minister Matt Hancock refusing to say how long they will remain in place after that.

Lord Sumption also noted during the podcast that scientists skeptical of lockdown policies have been “subjected to an extraordinarily unpleasant campaign of personal abuse”.

“I know a lot of people that would prefer not to put their head above the parapet,” He continued, adding:

“From the very moment I started to make these points I began to get emails from politicians who agreed with what I had to say but that they themselves didn’t dare to speak out. That I think is a very serious state of affairs.”

The judge also argued that governments are using the virus politically, noting “They have consistently tried to maintain that the virus is indiscriminate when it is perfectly well-established that it primarily affects people with identifiable vulnerabilities, particularly in the elderly.”

Speaking about the draconian crack down on anti-lockdown protesters, Sumption said “People ought to be entitled to voice their differences (of opinion),” adding “If the only way you can enforce distancing is by beating people over the head with truncheons then it’s not worth it.”

Now that Brits have allowed society to be permanently deformed, with polls routinely showing vehement support for lockdown and other pandemic rules, things are never going to be the same again.

Having allowed the precedent that the government can put the entire population under de facto house arrest on a whim, look for the policy to be repeated over and over again with different justifications that have nothing to do with COVID-19.

As we previously highlighted, one of those justifications will be man-made global warming, with climate lockdowns set to become a regular reality. Tyler Durden Sat, 03/27/2021 - 09:20

http://dlvr.it/RwTltJ

http://dlvr.it/RwTltJ

Third of Danes Don’t Want to Get Vaccinated Against COVID-19 Amid AstraZeneca’s Blood Clot Drama

from Sputnik News: According to a new poll, AstraZeneca concerns have raised considerable scepticism in the country previously topping Europe in vaccine acceptance. A third of Danes will reject the chance to get vaccinated against the coronavirus, according to a new Megafon poll for TV2. The slumping confidence in the vaccines against coronavirus has been linked to […]

http://dlvr.it/RwTZ5y

http://dlvr.it/RwTZ5y

Friday, March 26, 2021

Philippines Alarmed By More 200 Chinese Ships Massing In Disputed Waters

Philippines Alarmed By More 200 Chinese Ships Massing In Disputed Waters

If nothing else, the blockage of the Suez Canal by a massive container ship has served as an unwelcome reminder that chokepoints to global trade like the Straits of Hormuz, the Straits of Malacca and the Straits of Gibralter represent geopolitical risks that have perhaps haven't been fully appreciated by investors.

Source: Chatham House

Of course, vulnerabilities to global trade extend beyond these narrow chokepoints.

Take, for example, the South China Sea. The United Nations Conference on Trade and Development estimates that roughly 80% of global trade by volume and 70% by value is transported by sea. Of that volume, 60% of maritime trade passes through Asia, with the South China Sea carrying an estimated one-third of global shipping. Under President Trump, the US Navy intensified to check growing Chinese naval power in the area. And just the other day, a US spy plane flew closer to China's coast than ever before.

Well, in a concerning sign that tensions might be about to come to a head in the region, Reuters reports that Philippines leader Rodrigo Duterte has complained to Chinese ambassador about Chinese naval forces that have been massing in the area. In recent days, international concern has grown over what the Philippines has described as a "swarming and threatening presence" of more than 200 Chinese vessels that it believes were manned by China's maritime militia. The boats were moored at the Whitsun Reef within Manila’s 200-mile exclusive economic zone.

EXCLUSIVE: We have footage showing nearly 200 Chinese vessels in Philippine waters. The government has demanded China to withdraw these vessels, but more than that, a maritime expert suggests taking the matter to an international court.

Our @davidyusantos has more. pic.twitter.com/kZ5NB7t8fS — CNN Philippines (@cnnphilippines) March 26, 2021

Brunei, Malaysia, the Philippines, Taiwan, China and Vietnam have competing territorial claims in the South China Sea. But China has pointedly ignored all these claims, instead viewing the South China Sea as something that belongs exclusively to Beijing. China shocked the world in 2016 when it ignored an international court ruling validating the Philippines' claims to the sea. Since then, tensions over the conflicting claims have complicated relations between the two Pacific powers.

China's claims have put pro-Beijing leader Duterte in "an awkward spot," according to Reuters. China's embassy in Manila has reportedly said the ships were fishing ships taking shelter in rough seas. But visuals like the video clip above appear to contradict this.

China’s maritime assertiveness has put Duterte in an awkward spot throughout his presidency due to his controversial embrace of Beijing and reluctance to speak out against it.

He has instead accused close ally the United States of creating conflict in the South China Sea.

China’s embassy in Manila did not respond to a request for comment on Duterte’s meeting.

On Wednesday it said the vessels at Whitsun Reef were fishing boats taking refuge from rough seas. A Philippine military spokesman said China’s defence attache had denied there were militia aboard.

Vietnam, which is also a party to the overlapping territorial claims, has also complained about China's presence. Foreign Ministry spokeswoman Le Thi Thu Hang on Thursday said the Chinese vessels at the reef had infringed on its sovereignty.

"Vietnam requests that China stop this violation and respect Vietnam’s sovereignty," Hang told a regular briefing.

A Vietnamese coastguard vessel had been moored near the area on Thursday, according to ship tracking data.

The story hasn't made much of a mark in the American press. But if Chinese ships keep massing in the area, investors might start asking themselves whether cementing Beijing's control of the disputed waters could be a preamble to something much more concerning - like a move against Taiwan, perhaps? Tyler Durden Fri, 03/26/2021 - 22:40

http://dlvr.it/RwSYtk

http://dlvr.it/RwSYtk

Cable Rallies As EU, UK Near Landmark Deal On Financial Regulation

Cable Rallies As EU, UK Near Landmark Deal On Financial Regulation

Cable rallied Friday afternoon on the news that, days after striking a reciprocity deal to ensure adequate supplies of COVID jabs for EU member states, London and Brussels are on the cusp of a high-level agreement on a new regulatory framework for financial regulation that could revive London-based firms' access to European markets.

Investors have been closely watching for news about the deal on financial regulation, which was left out of the original Brexit trade deal, and has been seen as a major risk for the British financial services industry, which has already suffered a wave of defections as foreign firms have moved more of their European workforce to within the EU (Dublin and Warsaw have been two popular locations).

According to Bloomberg, which broke the news, the two sides are proposing "a joint forum for discussing regulations and sharing information." In its current form,the forum would lead to "informal consultations concerning decisions to adopt, suspend or withdraw equivalence,” according to the draft. "Equivalence" is a hot-button issue and anathema to Brexiteers, who are averse to ceding any regulatory control to Brussels.

The pound rallied against the euro on the news, and against the dollar as well.

Since the start of the year, London-based firms have been blocked from operating in the block as Brexit officially took effect following the end of the transition period. The European Commission told EU ministers at a meeting earlier this week that the proposal is based on the framework the EU currently has with the U.S., according to a diplomatic note seen by Bloomberg. A spokesman for 10 Downing Street said "talks are taking place between officials and we won’t be giving a running commentary whist they are ongoing."

However, whether the deal will lead to more cooperation remains unclear. The two sides could still reject that approach in favor of increased independence.

In other news, during a video summit on Thursday, EU leaders gave lukewarm support to a plan to better control the exports of shots to the rest of the world, as European Commission head tweeted that Brussels was acting to ensure Europeans receive their "fair share" of new jabs.

The EU has exported 77 million doses of vaccines to 33 countries since 1 December 2020.

In addition, as a lead donor to COVAX, it has contributed to exports to low & middle income countries.

While remaining open, the EU needs to ensure Europeans get a fair share of vaccines. pic.twitter.com/9TbTxAuFxk — Ursula von der Leyen (@vonderleyen) March 25, 2021

In keeping with this decision, a vaccine factory in the Netherlands at the center of the spat over AstraZeneca jabs between London and Brussels has been given the go ahead by the European Medicines Agency to begin supplying Astra jabs to the EU, after European leaders asked the company to fulfill the rest of the EU's order of jabs, which have been plagued by production delays. The EMA said on Friday that the Leiden factory, run by subcontractor called Halix, had finally been approved for production and export of AstraZeneca's vaccine, bringing the total number of factories making the vaccine in Europe to four, per the FT.

At the same time, Norway has joined nearby Denmark in extending its halt on AstraZeneca jabs, the latest sign that a paucity of vaccine supplies isn't the only obstacle to boosting the vaccination rate. Tyler Durden Fri, 03/26/2021 - 12:00

http://dlvr.it/RwR71x

http://dlvr.it/RwR71x

Gas Prices Are Soaring, I Pay $3.28, How Much Do You Pay?