The Largest Experiment On Humans Ever Seen

Authored by Rob Slane via TheBlogMiore.com,

Which is the more reasonable approach a society might take in the outbreak of epidemic:

*

To quarantine the sick, and take reasonable precautions to stop those who are identified as vulnerable from contracting the illness.

*

To attempt to “control the virus” by preventing millions of healthy people from having contact with other healthy people.

To any society prior to 2020, it would have been obvious that the first approach is not only logical and proportionate, but the one least likely to have other unintended and highly destructive consequences. However, to my continued astonishment, many in our society not only believe that the answer is the second, but they somehow believe it to be based on established science.

Now I understand that many who support Lockdown will object to my characterisation of their position. They will say that it is deliberately misleading, since it talks about healthy people, and does not mention the sick. Such objections founder, however, on this undeniable fact: Lockdowns are, by their nature, an entirely untargeted and indiscriminate approach to a health issue, and the prohibiting by law of millions of healthy people from having contact with other healthy people is a feature, not a bug of a policy that was untried and untested before it was first implemented by the Chinese Communist Party in January last year, then copied by many Governments around the world thereafter.

For some reason, many Lockdownists seem to think that the onus is on Lockdown opponents to disprove their position. But as Dr Malcolm Kendrick points out in his excellent piece – Does Lockdown Work or Not, this is the opposite of how things are supposed to work:

“The starting point, for any scientific hypothesis, is for the proponents to disprove the null hypothesis. Demanding that those who believe something may not work, to prove that it doesn’t, is to turn the scientific method upside down. You can never prove a negative.”

Even so, he goes on to point out that most of the countries with the highest deaths per million are those which had fairly stringent Lockdowns, and therefore the data so far most certainly does not show that Lockdowns are effective, even on their own terms. Of course, Covidian Logic always has an answer to this, which is that these Lockdowns weren’t real Lockdowns. They were too little, too late, too soft, too lenient, too short, too small, too purple or something like that! But they can never be wrong. Low death rates show they work. High death rates show they would have worked if only people hadn’t been bad.

But the main point I wish to make about them is that they are not something that has been proposed, studied or trialled before, but are an entirely new practice, foisted upon the world for the first time in 2020. Which means what? It means that they are an experiment in real time. It means that our society (along with many others) has for the last year, and continues to be for the foreseeable future, subject to an experiment. In fact, the largest psychological, social and experiment ever conducted.

When I use this sort of language, it tends to meet the following mocking response: “So are you saying it’s all a mass conspiracy? Who’s the puppet-master then?” But this just misses the point. It does not need some Dark Lord sitting over all of it in order to be an experiment, although it has to be said that the likes of Professor Schwab do seem keen on putting themselves forward as pretty good candidates. No, it simply is by definition a psychological, social and economic experiment by the very nature of the fact that the mass quarantining and mass masking of millions of people, which cannot fail to change the psychology, society and economy, are untried, untested methods, based merely on hypothesis, and not on hard data. In fact, the data is still coming in from this enormous experiment, but as Dr Kendrick says, it doesn’t actually look good for the hypothesis:

“…I would conclude that the observational studies had – thus far – failed to disprove the null hypothesis. In fact, the evidence up to this point could suggest that lockdowns may actually increase the death rate. In short, I would look for another idea.”

But the psychological, social and economic experimentation are by no means the end of it. We have now moved on to the medical experimentation, by which I mean the giving of so-called “vaccines” to millions of people (so-called because they don’t actually stop people getting the virus, and it is not yet known whether they prevent transmission).

Incredibly, if you look at the Pfizer BioNTech SE Clinical Study Trial on the US National Library of Medicine Clinical Trials database, you will notice something very odd, which is that the Estimated Study Completion Date is on January 31st 2023. This is:

“the date on which the last participant in a clinical study was examined or received an intervention/treatment to collect final data for the primary outcome measures, secondary outcome measures, and adverse events.”

In other words, the medium to long-term side effects of this product cannot possibly be known, because the study is still ongoing. The long and short of it, as Professor Sucharit Bhakdi points out in this excellent interview (watch it soon before the YouTube Gatekeepers scrub it) is this: every single person now getting these jabs is effectively an unwitting test subject in the largest medical experiment ever carried out, having been asked to give their consent to receive a product injected into their bodies without being properly informed as to the status of the product.

Simply put, neither those administering these jabs nor those receiving them can have any idea of the potential medium to long-term consequences of these things, because the companies producing them have not completed the studies on them. And no, it is not the mark of an anti-vaxxer to be deeply concerned about this (I am not); it is just the mark of having one’s critical faculties in working order and of caring about what is being done to people – it’s called Loving Your Neighbour as Yourself.

In summary, both Lockdowns and the “vaccines” are essentially a mass experiment on humanity. The mid to long-term consequences of both are entirely unknown. Future generations will marvel at how the authorities were able to do this, but they will marvel even more at how millions of people acquiesced without much thought. None of this can possibly bode well. We need to humble ourselves and take a long hard look at what we are doing, or allowing to be done to us, as a matter of the utmost urgency. Tyler Durden Mon, 02/01/2021 - 02:00

http://dlvr.it/Rrlpvv

Sunday, January 31, 2021

Medical Tyranny: CDC Announces All Travelers Must Wear Two Masks, Threatens Arrest

Medical Tyranny: CDC Announces All Travelers Must Wear Two Masks, Threatens Arrest

Authored by Joseph Jankowski via PlanetFreeWill.news,

The Center for Disease Control has issued a new coronavirus order requiring DOUBLE masks to be worn for all forms of public transportation in the United States.

From CNN:

The CDC announced an order late Friday that will require people to wear a face mask while using any form of public transportation, including buses, trains, taxis, airplanes, boats, subways or ride-share vehicles while traveling into, within and out of the US.

The order goes into effect at 11:59 p.m. Monday.

Masks must be worn while waiting, boarding, traveling and disembarking, it said. The coverings need to be at least two or more layers of breathable fabric secured to the head with ties, ear loops or elastic bands — and scarves and bandanas do not count, the order says.

The CDC said it reserves the right to enforce the order through criminal penalties, but it “strongly encourages and anticipates widespread voluntary compliance” and expects support from other federal agencies to implement the order.

The tyrannical order comes after Joe Biden signed an executive order last week requiring all travelers to wear mask on federal property.

The establishment has been recently pushing double masks despite the ongoing rollout of the COVID-19 vaccines and decline in coronavirus deaths.

White House coronavirus task force leader Dr. Anthony Fauci is now promoting “double masking”, despite saying in March of last year that wearing ANY masks wouldn’t prevent the spread of COVID.

“So, if you have a physical covering with one layer, you put another layer on, it just makes common sense that it likely would be more effective and that’s the reason why you see people either double masking or doing a version of an N95,” Fauci said this week.

“Inside Edition” also lauded Biden, Mitt Romney, and Tom Cruise for double masking recently.

And the New York Times called for Americans to wear a second mask layer earlier this month in an op-ed titled, “One Mask Is Good. Would Two Be Better?“

With “double masking” now being openly pushed, a new slippery slope of mask wearing has been introduced, with some articles beginning to promote TRIPLE masking to prevent the spread of COVID-19.

Sen. Rand Paul (R-Ky.) pushed back against the mask insanity earlier this month, urging Americans, “if you’ve had the disease or you’ve been vaccinated and you’re several weeks out from the second dose, throw your mask away.” Tyler Durden Sun, 01/31/2021 - 22:00

http://dlvr.it/RrlKRr

http://dlvr.it/RrlKRr

Morgan Stanley Reveals The "Three Rules For The New D.C."

Morgan Stanley Reveals The "Three Rules For The New D.C."

By Michael Zezas, Head of U.S. Public Policy Research at Morgan Stanley

New presidential administration, same investor hand-wringing: what might come out of DC to push financial markets? If you’re struggling to pull some signal from the noise that is lawmakers hedging statements and debating mundanities like ‘budget reconciliation’, you’re not alone. So here are three shortcuts for making sense of the policy debates in DC that will affect markets in 2021.

*

The rule of two Joes: What’s the difference between an aspirational and enacted policy? In our view it is the difference between those espoused by President Joe Biden and those of Senator Joe Manchin, who along with other senators (i.e., Tester, Sinema, Kelly, Warner) represents the Democratic party’s more centrist cohort. With Democrats in control of the White House and Congress, they can pass a lot of legislation…assuming all 50 Democratic senators can agree on its content. The most progressive and most moderate member must agree, as losing either’s support will tank legislation. We think that the legislative power accrues towards the electorally vulnerable center, then, consistent with historical analogues.

*

Deficits break deadlocks: Even proposals which appear to have party consensus, like infrastructure and healthcare spending, face a challenge…there’s agreement to spend the money, but not how to finance it. Progressives and moderates appear far apart on their tolerance for tax increases. But we don’t expect that this will prevent policy enactment. Deficits will bridge the gap. Expanding the deficit does not appear to be a political liability, as surveys show that voters may permit such action in exchange for popular policies. This dovetails with the new economic orthodoxy of the party, where progressives’ flirtation with MMT and moderates’ Keynesianism for the moment agree that the US can push deficits further before inflation becomes a challenge. Said differently, we don’t think that Democrats will let tax and deficit disagreements get in the way of their spending agenda.

*

Boundaries from budget reconciliation: There are plenty of reasons to not expect Democrats to be able to get enough Senate Republican votes for any of their major initiatives to avoid a filibuster. This actually helps to clarify the policy path for investors, as it means viable legislation is only that which can be passed by a simple majority through a workaround called ‘budget reconciliation’. At the risk of oversimplifying, it helps to think about this process as one where legislators can change the numbers on the federal income statement, but not add or subtract any line items. Because of its painstaking process, reconciliation typically can only be executed once per fiscal year. With those boundaries, investors should expect two major pieces of legislation in 2021 with a focus on reconcilable items: stimulus first and then either infrastructure or healthcare after the October start of the next fiscal year.

In our view, one clear takeaway from these rules is that 2021 will be another year of US fiscal expansion: Applying those rules to the plans of the new administration and its allies in Congress, we think you end up with a policy path that is net supportive to US growth in 2021. Fiscal stimulus can likely get done earlier in the year, though the final number after intra-party negotiation (‘the rule of two Joes’) is likely closer to US$1 trillion than the US$1.9 trillion proposal. An infrastructure or healthcare plan can likely follow, but not until later in the year (‘boundaries from budget reconciliation’) and likely with more moderate tax hikes than progressives espouse (‘the rule of two Joes’) that don’t fully cover the spending (‘deficits break deadlocks’).

Importantly, this policy course reinforces the US growth path and outlook for a multi-year bull market, though it does not preclude a near-term correction: As our economists have pointed out, the economy is increasingly on solid footing, with substantial excess household savings ready to be deployed once vaccines enable the normalization of economic behavior later this year. Further fiscal support only underscores that the US economy is accelerating into a new, sustained growth cycle, which should support a multi-year bull market.

Yet this outlook is not without risk to markets, particularly in the short term. As our equity strategy colleagues have pointed out, there are pockets of the market where excessive optimism is priced in, warranting investor caution. US policy issues are one potential catalyst to watch. In the coming weeks, investors could easily conflate banal headlines about legislative negotiation with the more legitimate risk that Democrats are at an impasse on stimulus. Unless such headlines also reference a shift in view among moderate Democrats that improvement in the COVID-19 outlook has mitigated the need for further action, we would fade such confusion and view any related market weakness as an opportunity.

[ZH: translation - despite the record drop in US hospitalizations and plunge in covid cases, expect the fearmongering to only get worse in order to allow the Dems the green light to pass trillions more in stimulus.] Tyler Durden Sun, 01/31/2021 - 20:20

http://dlvr.it/Rrl9D0

http://dlvr.it/Rrl9D0

There Is No Pandemic

by Nick Kollerstrom, The Unz Review: 2020 saw 14% more deaths than average, last year in England & Wales and that amounted to seventy-five thousand extra deaths. We here use the Office of National statistics figures, as it gives total weekly deaths, plus also for comparison an average value of corresponding weekly deaths over the previous five […]

http://dlvr.it/RrkgG3

http://dlvr.it/RrkgG3

Twitter’s ‘Birdwatch’ Community Fact-Checking Feature is Crowdsourcing Censorship

by Patrick Henningsen, 21st Century Wire: Now that Trump is out of office, many have been half expecting that mainstream media and Silicon Valley’s hyper-active ‘fact-check’ brigades might calm down, have a few wheat grass smoothies and bask in their momentous victory. Unfortunately, this new class of self-styled thought police are just getting warmed up. […]

http://dlvr.it/Rrj5gG

http://dlvr.it/Rrj5gG

Saturday, January 30, 2021

The Destructive Plan Behind the Biden Russia Agenda

by F. William Engdahl, New Eastern Outlook: The new Biden Administration has from day one made it clear it will adopt a hostile and aggressive policy against the Russian Federation of Vladimir Putin. The policy behind this stance has nothing to do with any foul deeds Putin’s Russia may or may not have committed against […]

http://dlvr.it/Rrj0fk

http://dlvr.it/Rrj0fk

'Black Lives Matter' Nominated For The Nobel Peace Prize

'Black Lives Matter' Nominated For The Nobel Peace Prize

Authored by Monica Showalter via AmericanThinker.com,

If the Nobel committee's handing over of the Nobel peace prize to newly elected President Obama seemed like the nadir of the prize's prestige, there's now another thing coming.

According to The Guardian:

The Black Lives Matter movement has been nominated for the 2021 Nobel peace prize for the way its call for systemic change has spread around the world.

In his nomination papers, the Norwegian MP Petter Eide said the movement had forced countries outside the US to grapple with racism within their own societies.

“I find that one of the key challenges we have seen in America, but also in Europe and Asia, is the kind of increasing conflict based on inequality,” Eide said.

“Black Lives Matter has become a very important worldwide movement to fight racial injustice.

“They have had a tremendous achievement in raising global awareness and consciousness about racial injustice.”

That's right, a group led by self-described "trained Marxists" who literally spent time with Hugo Chavez in Venezuela and then triggered night after night of violent looting riots at a cost of at least 25 lives and a record $2 billion in insured property claims, (probably much more in uninsured property), and grotesque Red Guard-style repudiation scenes such as forcing restaurant diners to wave their fists in solidarity or face overturned tables and assault, is somehow ... is worthy of the world's top award for peace.

Back in 1964, when Martin Luther King, Jr. was awarded the same prize for calls to judge people on the content of their character over color, along with non-violent resistence, there was a recognizable standard for peace. Now, such approaches don't cut it anymore for this Norwegian bunch. And to place BLM in the same league as MLK, Jr., is kind of obscene.

The Norwegian pol who put the nomination out cited BLM's capacity to mobilize as his criteria. But that seems to be pretty shaky grounds, given that so many leftists out there really just wanted to Get Trump. BLM has since morphed into what appears to be a corporate shakedown racket and managed to get its Marxist identity politics party line into every corporate boardroom in America. But the capacity to use muscling community organizer tactics is no evidence of morality, or more pointedly, peace. BLM is never going to be satisfied no matter how much kowtowing is done, each victory it wins brings a bigger demand to its marks, without ceasing, until its will to absolute power is achieved. Sound like peace? Only of the grave.

What it highlights is how low the Nobel peace prize has fallen. Sure, this Norwegian socialist clown doing the nominating likely has no idea what's going on in the states, given that he lives in isolated Norway, takes in meetings with activists, and only reads the leftist press. The idiocy of his proposal tops that of the Norwegians handing out a Nobel prize to Barack Obama just for getting elected president for being black without doing anything else.

In both instances, the Nobel committee nominators seem to relish anyone with the ability to exert leftist power, equating that kind of power-mongering with 'peace.' It's a sorry act they've come to, to worship power over any semblance of authentic peace. If this is peace, what a sorry state of affairs we have, mau-mauing's triumph over actual creating of peace. Will all Nobel peace prize recipients have to show proof of starting riots to qualify now? How, exactly, is riot-making 'peace'? One likes to suppose that this nomination will go nowhere, but with the current nonsense going on, don't bet on it. Tyler Durden Sat, 01/30/2021 - 22:00

http://dlvr.it/RrhcxD

http://dlvr.it/RrhcxD

Viral Effect on Money Flows Could Blow Up Small Physical Silver Market

by Mike Gleason, Money Metals: Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason. Well, it’s been an extraordinary week in financial markets – and perhaps a pivotal one in the silver market. The big story wasn’t the Federal Reserve’s policy announcement or any other actions by central planners. Instead, all eyes were on […]

http://dlvr.it/RrhSSw

http://dlvr.it/RrhSSw

Reddit Preparing To Unleash "World's Biggest Short Squeeze" In Silver

Reddit Preparing To Unleash "World's Biggest Short Squeeze" In Silver

While all eyes have been focused on GameStop and a handful of other heavily-shorted stocks as they exploded higher under continuous fire from WallStreetBets traders igniting a short-squeeze coinciding with a gamma-squeeze, the last few days saw another asset suddenly get in the crosshairs of the 'Reddit-Raiders' - Silver!

On Thursday, we asked "Is The Reddit Rebellion About To Descend On The Precious Metals Market?" ... One WallStreetBets user (jjalj30) posted the following last night:

Silver Bullion Market is one of the most manipulated on earth. Any short squeeze in silver paper shorts would be EPIC. We know billion banks are manipulating gold and silver to cover real inflation.

Both the industrial case and monetary case, debt printing has never been more favorable for the No. 1 inflation hedge Silver.

Inflation adjusted Silver should be at 1000$ instead of 25$. Link to post removed by mods.

Why not squeeze $SLV to real physical price.

Think about the Gainz. If you don't care about the gains, think about the banks like JP MORGAN you'd be destroying along the way. ... Tldr- Corner the market. GV thinks its possible to squeeze $SLV, FUCK AFTER SEEING $AG AND $GME EVEN I THINK WE CAN DO IT. BUY $SLV GO ALL IN TH GAINZ WILL BE UNLIMITED. DEMAND PHYSICAL IF YOU CAN. FUCK THE BANKS.

Disclaimer: This is not Financial advice. I am not a financial services professional. This is my personal opinion and speculation as an uneducated and uninformed person.

...and judging by the unprecedented flows into the Silver ETF (SLV) they just got started...

SLV saw inflows of almost one billion dollars on Friday, almost double the previous record inflow for this 15 year-old ETF.

Source: Bloomberg

Which helped prompt a spike in SLV off Wednesday's lows of over 11% (and note that every surge in price was mimicked by gold, but gold was instantly monkey-hammered lower after the spike).

Source: Bloomberg

And judging by the asset flow, SLV has room to run here...

Source: Bloomberg

Just as short-interest in the ETF has been building...

Source: Bloomberg

This surge came after Reddit user 'TheHappyHawaiian' posted the following thesis on buying silver noting that "the worlds biggest short squeeze is possible and we can make history."

'TheHappyHawaiian' cites two reasons to buy - The Short Squeeze and Fundamentals.

The short squeeze:

Buy SLV shares (or PSLV shares) and SLV call options to force physical delivery of silver to the SLV vaults.

The silver futures market has oscillated between having roughly 100-1 and 500-1 ratio of paper traded silver to physical silver, but lets call it 250-1 for now. This means that for every 250 ounces in open interest in the futures market, only 1 actually gets delivered. Most traders would rather settle with cash rather than take delivery of thousands of ounces of silver and have to figure out to store and transport it in the future.

The people naked shorting silver via the futures markets are a couple of large banks and making them pay dearly for their over leveraged naked shorts would be incredible. It's not Melvin capital on the other side of this trade, its JP Morgan. Time to get some payback for the bailouts and manipulation they've done for decades (look up silver manipulation fines that JPM has paid over the years).

The way the squeeze could occur is by forcing a much higher percentage of the futures contracts to actually deliver physical silver. There is very little silver in the COMEX vaults or available to actually be use to deliver, and if they have to start buying en masse on the open market they will drive the price massively higher. There is no way to magically create more physical silver in the world that is ready to be delivered. With a stock you can eventually just issue more shares if the price rises too much, but this simply isn't the case here. The futures market is kind of the wild west of the financial world. Real commodities are being traded, and if you are short, you literally have to deliver thousands of ounces of silver per contract if the holder on the other side demands it. If you remember oil going negative back in May, that was possible because futures are allowed to trade to their true value. They aren't halted and that's what will make this so fun when the true squeeze happens.

Edit for more detail: let’s say there’s one futures seller who gets unlucky and gets the buyer who actually wants to take delivery. He doesn’t have the silver and realizes it’s all of a sudden damn difficult to find some physical silver. He throws up his hands and just goes long a matching number of futures contracts and will demand actual delivery on those. Problem solved because he has now matched the demanding buyer with a new seller. The issue is that the new seller has the same issue and does the exact same thing. This is how the cascade effect of a meltup occurs. All the naked shorts trying to offload their position to someone who actually has some silver. My goal is to ensure that I have the silver and won’t sell to them until silver is at a far higher price due to the desperation.

The silver market is much larger than GME in terms of notional value, but there is very little physical silver actually readily available (think about the difference between total shares and the shares in the active float for a stock), and the paper silver trading hands in the futures market is hundreds of times larger than what is available. Thus when they are forced to actually deliver physical silver it will create a massive short squeeze where an absurd amount of silver will be sought after (to fulfill their contractually obligated delivery) with very little available to actually buy. They are naked shorting silver and will have to cover all at once and the float as a percentage of the total silver stock globally is truly miniscule.

The fundamentals:

The current gold to silver ratio is 73-1. Meaning the price of gold per ounce is 73 times the price of silver. Naturally occurring silver is only 18.75 times as common as gold, so this ratio of 73-1 is quite high. Until the early 20th century, silver prices were pegged at a 15-1 ratio to gold in the US because this ratio was relatively known even then. In terms of current production, the ratio is even lower at 8-1. Meaning the world is only producing 8 ounces of silver for each newly produced ounce of gold.

Global industry has been able to get away with producing so little new silver for so long because governments have dumped silver on the market for 80 years, but now their silver vaults are empty. At the end of WW2 government vaults globally contained 10 billion ounces of silver, but as we moved to fiat currency and away from precious metal backed currencies, the amount held by governments has decreased to only 0.24 billion ounces as they dumped their supply into the market. But this dumping is done now as their remaining supply is basically nil.

This 0.24 billion ounces represents only 8% of the total supply of only 3 billion ounces stored as investment globally. This means that 92% of that gold is held privately by institutions and by millions of boomer gold and silver bugs who have been sitting on meager gains for decades. These boomers aren't going to sell no matter what because they see their silver cache as part of their doomsday prepper supplies. It's locked away in bunkers they built 500 miles from their house. Also, with silver at $23 an ounce currently, this means all of the worlds investment grade silver only has a total market cap of $70 billion. For comparison the investment grade gold in the world is worth roughly $6 trillion. This is because most of the silver produced each year actually gets used, as I have mentioned. $70 billion sounds like a lot, but we don’t have to buy all that much for the price to go up a lot.

**If the squeeze happens, it would be like 40 years worth of their gains in 4 months **

The reason that only 8 ounces of silver are produced for every 1 ounce of gold in today's world is because there aren't really any good naturally occurring silver deposits left in the world. Silver is more common than gold in the earth's crust, but it is spread very thin. Thus nearly every ounce of silver produces is actually a byproduct of mining for other metals such as gold or copper. This means that even as the silver price skyrockets, it wont be easy to increase the supply of silver being produced. Even if new mines were to be constructed, it could take years to come online.

Finally, most of this newly created silver supply each year is used for productive purposes rather than kept for investment. It is used in electronics, solar panels, and jewelry for the most part. This demand wont go away if the silver price rises, so the short sellers will be trying to get their hands on a very small slice of newly minted silver. The solar market is also growing quickly and political pressure to increase solar and electric vehicles could provide more industrial demand.

The other part of the story is the faster moving piece and that is the inflation and currency debasement fear portion. The government and the fed are printing money like crazy debasing the value of the dollar, so investors look for real assets like precious metals to hide out in, driving demand for silver. The $1.9 trillion stimulus passing in a month or two could be a good catalyst. All this money combined with the reopening of the economy could cause some solid inflation to occur, and once inflation starts it often feeds on itself.

What to buy:

I will be putting 50% directly into SLV shares, and 50% into the $35 strike SLV calls expiring 4/16.

This way the SLV purchase creates a groundswell into silver immediately that then rockets through a gamma squeeze as SLV approaches $35.

Price target of $75 for SLV by end of April if the short squeeze happens.

Edit: for the part of your purchases going into shares, some people recommend PSLV because they think SLV might start lying about having the silver in their vault. Or that the custodian will be double counting, ie claiming that the same silver belongs to multiple people (banking on the fact that people wont all try to get their silver at once). So if you buy SLV shares and calls, that's great. But I think it could be prudent for us to buy options in SLV (no options on PSLV) and shares in PSLV. It all depends on how paranoid you want to be. There is a lot of paranoia in the precious metals world.

Alternate options:

*

buying physical silver; this also works but you pay a premium to buy and sell so its less efficient and you take fewer silver ounces off of the market because of the premium you pay

*

going long futures for February or March; if you are a rich bastard and can actually take physical delivery of 1000s of ounces of silver by all means do so. But if you simply settle for cash you are actually part of the problem. We need actual physical delivery, which is what SLV demands and is why SLV is the way to go unless you are going to take delivery

*

miners; I don’t recommend buying miners as part of this trade. Miners will absolutely go up if SLV goes up, but buying them doesn't create the squeeze in the actual silver market. Furthermore, most silver miners only derive 30-50% of their revenue from silver anyways, so eventually SLV will outperform them as it gets high enough (and each marginal SLV dollar only increases miner profits by a smaller and smaller percentage)

Details on SLV physical settlement:

When SLV issues shares, the custodian is forced to true up their vaults with the proportional amount of silver daily. From the SLV prospectus:

"An investment in Shares is: Backed by silver held by the Custodian on behalf of the Trust. The Shares are backed by the assets of the Trust. The Trustee’s arrangements with the Custodian contemplate that at the end of each business day there can be in the Trust account maintained by the Custodian no more than 1,100 ounces of silver in an unallocated form. The bulk of the Trust’s silver holdings is represented by physical silver, identified on the Custodian’s or, if applicable, sub-custodian's, books in allocated and unallocated accounts on behalf of the Trust and is held by the Custodian in London, New York and other locations that may be authorized in the future."

'TheHappyHawaiian" ends with a call to (financial) arms:

Join me brothers. Lets take silver to the moon and take on the biggest and baddest manipulators in the world.

Please post rocket emojis in the comments as desired.

Disclaimer: do your own research, make your own decisions, everything here is a guess and hypothetical and nothing is guaranteed, not a financial advisor, I have ADHD and maybe other things too.

Bear case: silver does tend to sell off if the broader market plunges so it’s not immune to broad market sell off. It’s also the most manipulated market in the world so we are facing some tough competition on the short side

Interestingly, 'TheHappyHawaiian' dropped this update on 1/29:

Due to the manipulation and collusion of citadel, hedge funds, and brokers to change the rules and rig the game in their favor. Who likely knew ahead of time and bought puts right before and calls at the bottom, GME is too important to abandon still. SLV is still my next play but GME needs to go to $1000 and these people need to go to jail.

However, judging by the massive physical premiums for silver (APMEX) we are seeing this weekend...

...there are more than a few who are already rotating to SLV from GME.

If 100,000 Twitter users across the World order 100 ounces of physical Silver now, we could trigger a short of the whole system and bring down the banks.

I bought 101 ounces today. Let’s do this 💪 @maxkeiser @stacyherbert #silversqueeze #silvershortsqueeze #SilverDay $slv pic.twitter.com/gSIrjE7dH7 — #SilverSqueeze (@BitcoinDude5) January 29, 2021 Tyler Durden Sat, 01/30/2021 - 15:30

http://dlvr.it/Rrh18K

http://dlvr.it/Rrh18K

Friday, January 29, 2021

Will the Internet Corner the Physical Silver Market?

by Stefan Gleason, Money Metals: On the heels of a truly extraordinary social-media-fueled buying frenzy involving shares of GameStop and AMC Theaters, some attention is turning to physical silver. Could a short squeeze in silver be coming too? It’s fairly common knowledge that bullion banks have been perpetually short in the silver futures market, using their […]

http://dlvr.it/RrfDWj

http://dlvr.it/RrfDWj

The Resurgence of Silver

by Jim Rickards, Daily Reckoning: Most investors who focus on precious metals and commodities know that gold had a great year in 2020, up 24.6%. However, not as many know that silver did even better! Silver was up 47.4% in 2020, rising from $17.80 per ounce on January 2, 2020, to $26.35 per ounce on […]

http://dlvr.it/Rrf7M8

http://dlvr.it/Rrf7M8

Manhattan Retail Rents Plunge In "Prime" Shopping Areas

Manhattan Retail Rents Plunge In "Prime" Shopping Areas

Manhattan's "prime" retail real estate remained under pressure in the fourth quarter as the once too prominent shopping areas have transformed into "ghost towns."

According to Bloomberg, retail rents across every major shopping district in the borough are plunging as a revitalization of the local economy continues to stall.

Mayor DeBlasio's solution to mitigate the virus spread has been restricting or banning indoor capacity at restaurants and limit mass gathering. More government regulation has hindered the local recovery.

As if brick and mortar retail didn't have enough problems to deal with considering the massive push towards e-commerce during the pandemic, Soho retail rents in the fourth quarter dropped 22% to $290 a square foot over the same period last year, according to a report by brokerage Cushman & Wakefield Plc.

Rents in Soho have been sliding for four years. They may eventually pressure commercial real estate firms who own buildings as higher vacancies and lower rents could reduce rental income, making it harder for them to service mortgages.

Lower Fifth Avenue retail rents in the quarter dropped 20%. Rents in upscale Madison Avenue declined 16%. Source: Bloomberg

Considering the pandemic, strict social distancing measures from the city government, and the explosion in e-commerce, it is nearly impossible for most to open retail stores and do business in once prominent areas of downtown Manhattan.

Cushman & Wakefield said the supply of retail space in most areas is surging. Availability rates in Fifth Avenue, Soho, and Meatpacking are about 24%.

From 57th to 72nd streets, Madison Avenue had a shocking 40% availability rate for the second straight quarter.

Herald Square/West 34th Street was the only area in the borough that experienced a decline in available retail space.

With the retail bubble now popped, there were more than 9,300 retail department store closures across the US in 2020.

The retail space remains oversupplied with stores, and the consolidation of stores countrywide could continue for the next couple of years.

To sum up, the new normal in Manhattan will be high retail vacancies and lower rents with a local economy unable to recovery this year. Tyler Durden Fri, 01/29/2021 - 21:40

http://dlvr.it/RrdnkF

http://dlvr.it/RrdnkF

Ep. 1446 This Story Should Be Made Into a Movie – The Dan Bongino Show

from The Dan Bongino Show: TRUTH LIVES on at https://sgtreport.tv/

http://dlvr.it/RrdZSJ

http://dlvr.it/RrdZSJ

Dear WallStreetBets: Hedge Funds Are Very, Very Short Bitcoin

Dear WallStreetBets: Hedge Funds Are Very, Very Short Bitcoin

With the country following with bated breath every new development in the war between WallStreetBets and Wall Street, and specifically how an army of angry teenagers which targeted a handful of bearish hedge funds and steamrolled them into submission with trillions in excess liquidity, some are wondering what's next: after all there is only so much you can do with a handful of very shorted stocks (while even Wall Street is now trying to muscle in on the less shorted stocks with recos to buy these) after you have ramped them up and down and then back up again. What's the endgame.

Indeed, there is a sense that this trend is starting to get a little tired, and the most shorted names themselves are trading near session lows (although the latest round of Robinhood restrictions which laughably permits just 2 shares of bitcoin be purchased certainly has something to do with this).

So what next?

Here we respectfully bring to the attention of r/wallstreetbets something they may have missed in their search for shortable equities: move to futures, where on asset stands out. According to the CFTC's latest Traders in Financial Futures report, the net short position in bitcoin futures is now the biggest it has ever been.

What better way to hammer those evil hedge funds than to follow up the steamrolling their stock shorts got with a moon shot in bitcoin, which leads to even more billions in P&L losses.

Furthermore, now that Elon "#Bitcoin" Musk has shown just how much clout he has in the space, when one tweet...

In retrospect, it was inevitable — Elon Musk (@elonmusk) January 29, 2021

... managed to push bitcoin up by 15%, or almost $100 billion, a little strategic coordination between the world's most popular reddit forum and the world's richest man should successfully push the world's most valuable cryptocurrency above $100,000 in just a few days. Tyler Durden Fri, 01/29/2021 - 15:25

http://dlvr.it/Rrd2pv

http://dlvr.it/Rrd2pv

Thursday, January 28, 2021

Putin: World Risks "Fight Of All Against All" In "Grim Dystopia" Amid Growing Crises

Putin: World Risks "Fight Of All Against All" In "Grim Dystopia" Amid Growing Crises

Authored by Jack Phillips via The Epoch Times,

Russian leader Vladimir Putin warned that society risks a return to world war if there’s no international effort to ease existing global tensions and imbalances.

Speaking at the World Economic Forum’s virtual Davos Agenda conference on Jan. 27, he offered a grim prediction and noted that the current era shows parallels to the 1920s and 1930s before the “catastrophic World War II.”

“Nowadays, such a heated conflict is not possible, I hope,” Putin said. “Because it will mean the end of our civilization."

“But I’d like the reiterate that the situation might develop unpredictably and uncontrollably if we sit on our hands doing nothing to avoid it. There’s a possibility that we might experience an actual collapse in global development that might result in a fight of all against all.”

Such a prospect, he said, would result in a “grim dystopia.”

Wealth inequality, political polarization, and international tensions will exacerbate the problem, he said, and on top of that, the CCP virus pandemic is placing even more strain on society.

“The coronavirus pandemic has become a major challenge to mankind, and it has accelerated structural changes, the preconditions for which were already in place,” he said.

“We have every reason to believe that the tensions might be aggravated even further.

“International institutions are weakening, regional conflicts are multiplying, the global security system is degrading.”

He called for an increase in dialogue between different nations and groups to avoid a possible worldwide conflict.

“We need [to] ensure development following a different path—one that is positive, balanced, and constructive,” he said.

Russia currently finds itself amid growing internal tensions after Moscow arrested Putin critic Alexei Navalny after he returned to Russia from Germany.

During the Davos address, Putin seemingly made reference to sanctions and embargoes; several countries have placed sanctions on Russia.

“The use of trade barriers, illegitimate sanctions, restrictions in the financial, technological and information spheres—such a game without rules is dramatically increasing the risks of the unilateral use of military force, which is very dangerous,” Putin said.

Putin also faces an uncertain relationship with U.S. President Joe Biden, whom he spoke with earlier this week.

After their first phone call, Putin formally submitted a bill for the Russian parliament to extend the New START nuclear treaty with the United States by five years, according to Russian media.

“The presidents expressed satisfaction following today’s exchange of diplomatic notes on an agreement to extend the New START Treaty,” Putin’s office announced after his call with Biden, TASS reported.

“International topics included the United States’ unilateral withdrawal from the Open Skies Treaty, problems of keeping in place the Joint Comprehensive Plan of Action on the Iranian nuclear program, Ukrainian settlement, as well as Russia’s initiative to call a summit of the United Nations Security Council permanent members,” the Kremlin said. Tyler Durden Fri, 01/29/2021 - 02:00

http://dlvr.it/RrZYpc

http://dlvr.it/RrZYpc

How Ticketmaster Might Check Your Vaccine Status for Concerts

by Erin Elizabeth, Health Nut News: Editor’s note: Ticketmaster has now said that while they were exploring this idea, they are no longer going to go forward with this option. Many in the industry have stated publicly in main stream news that they believe the backlash is the reason why. Either way, we are glad […]

http://dlvr.it/RrZRQk

http://dlvr.it/RrZRQk

People Injured By COVID Vaccines In U.S. Will Not Receive Compensation From VICP

by Arjun Walia, Collective Evolution: The Facts:A new article published in the New England Journal of Medicine outlines why those injured by the COVID-19 vaccine won’t be eligible for compensation from the Vaccine Injury Compensation Program (VICP) while COVID is still an “emergency.” Reflect On:Is a COVID-19 vaccine requirement for travel, school attendance, employment and […]

http://dlvr.it/RrZ1fk

http://dlvr.it/RrZ1fk

Dallas DEA Makes Largest-Ever Meth Bust In North Texas

Dallas DEA Makes Largest-Ever Meth Bust In North Texas

The Drug Enforcement Administration's (DEA) Dallas field division reported this week the largest methamphetamine seizure ever in North Texas, according to local news WFAA.

DEA agents seized 1,950 pounds of meth, valued at $45 million, hidden within the bed of a refrigerated tractor-trailer off Interstate 35 in Denton County. A detection dog or sniffer dog pinpointed the large stash during a traffic stop, amounting to 663 packages.

"It's a staggering amount to be seized at one time," said Eduardo Chavez, the Special Agent in Charge for DEA Dallas. "They were like sausage links."

The bust was equivalent to 20% of the total amount the Dallas field division seized in 2020.

"I see a lot of lives saved when we can stack up kilograms of drugs like this on a table," Chavez said. "Unfortunately, methamphetamine is one of the largest threats in North Texas, so we would anticipate that a lot of it was destined for the market here."

Chavez said the drugs were likely intended for black markets in St. Louis, Chicago, and Atlanta. The DEA believes the drugs belonged to the Jalisco New Generation Cartel headed by Nemesio Oseguera-Cervantes, otherwise known as "El Mencho."

"No doubt, this got his (El Mencho) attention. A seizure like this, he most likely got a phone call," Chavez said. "We take one of these seizures and try to expand the network, try to identify perhaps what other ones have gotten through."

During the pandemic, the Trump administration cracked down on drug traffickers along a 'meth superhighway' controlled by Mexican cartels that stretched across the U.S. A six-month operation by the federal government seized thousands of pounds of meth, tens of millions of dollars, and hundreds of firearms.

During the pandemic, meth inflation surged from $4,000 in March to nearly $16,000 by May.

Meanwhile, deaths related to meth-overdoses have surged across the country, especially among Blacks and American Indians/Alaska Natives.

"While much attention is focused on the opioid crisis, a methamphetamine crisis has been quietly, but actively, gaining steam -- particularly among American Indians and Alaska Natives, who are disproportionately affected by a number of health conditions," said Dr. Nora Volkow, director of the U.S. National Institute on Drug Abuse (NIDA).

The Trump administration made a concerted effort among federal, state, and local leaders to combat drug traffickers and criminal cartels for violating U.S. sovereignty via breaching the southern border. However, it remains to be seen if the Biden administration will continue such policies. Tyler Durden Thu, 01/28/2021 - 19:23

http://dlvr.it/RrYnZg

http://dlvr.it/RrYnZg

Democrats Threaten To Move Forward With 'Very Strong' COVID Relief Package With Or Without GOP

Democrats Threaten To Move Forward With 'Very Strong' COVID Relief Package With Or Without GOP

Democrats are willing to 'go it alone' on a new COVID-19 relief package if Republicans refuse to move quickly on a 'very strong' relief bill.

In a Thursday warning, Senate Majority Leader Chuck Schumer (D-NY) threatened to circumvent the 60-votes required to pass major legislation by invoking a budget process known as reconciliation - which lets some bills bypass the legislative filibuster.

If Republicans "decide to oppose this urgent and necessary legislation, we will have to move forward without them."

"We have a responsibility to help the American people fast, particularly given these new economic numbers. The Senate will begin that work next week," he added.

“We have a responsibility to help the American people fast — particularly given these new economic numbers.” ⁰⁰JUST IN: Schumer says the Senate will start considering a Covid-19 relief funding bill next week pic.twitter.com/OqBZGnnyxF — Bloomberg Quicktake (@Quicktake) January 28, 2021

Schumer, speaking from the Senate floor, said that it was the "preference" of Democrats to work with Republicans on a sixth coronavirus relief package, but that if GOP senators wanted to move too slowly, or go smaller than Democrats think necessary, they will move more aid without GOP support. -The Hill

"The dangers of undershooting our response are far greater than overshooting ... so the Senate as early as next week will begin the process of considering a very strong COVID relief bill," said the 70-year-old Schumer, who likely won't be alive when the consequences of reckless spending fall on the shoulders of younger generations.

In order to proceed with reconciliation, Democrats will need to pave the way by passing a budget resolution which instructs committees to draft legislation.

On a Tuesday conference call, Schumer told his fellow Democrats to be prepared to vote on that resolution as soon as next week.

"In keeping our options open on our caucus call today I informed senators to be prepared that a vote on a budget resolution could come as early as next week," he said.

Democrats want to pass more coronavirus relief before beefed-up unemployment benefits expire in March. The Senate will also need to juggle passing legislation with former President Trump's second impeachment trial that will start the week of Feb. 8.

As Democrats appear poised to pass coronavirus relief with a simple majority, Republicans in a bipartisan Senate group appear frustrated that they could be sidelined.

The bipartisan group had a call with the White House last weekend and GOP senators said that the administration had provided them with data about their $1.9 trillion coronavirus plan. -The Hill

"I think it would be wise for the new administration to work to try to get a bipartisan proposal that can be moved. ... We're giving an opportunity to come together on important and timely legislation so why wouldn't you do that rather than trying to move it through with reconciliation and having a fully partisan product," said Sen. Lisa Murkowski (R-AK) in comments to reporters. Tyler Durden Thu, 01/28/2021 - 15:27

http://dlvr.it/RrYCPK

http://dlvr.it/RrYCPK

Wednesday, January 27, 2021

Turkey And Greece: Still More Peace Talks

Turkey And Greece: Still More Peace Talks

Authored by Burak Bekdil via The Gatestone Institute,

When traditional Aegean rivals, Turkey and Greece, agreed to launch "exploratory talks" to resolve their disputes, Iraq's president was Saddam Hussein, U.S. President George W. Bush called for a regime change in Iraq, 9/11 was only months in the past, the euro had just become the official currency of 12 of the European Union's members, former U.S. President Jimmy Carter had been awarded the Nobel Peace Prize and the Mars Odyssey had found signs of water ice deposits on Mars.

Ankara and Athens, starting in 2002, held 60 rounds of talks before their exploratory efforts came to a halt in 2016. After a five-year-long pause, the rivals agreed to resume talks on January 25, starting the 61st round. Rounds 61 and onward will probably be the most fragile of all peace talks for a number of reasons.

The talks had a bumpy start. According to Bloomberg, Turkey and Greece disagreed on the scope of January 25 talks. The Turkish government wants to discuss a range of outstanding issues with its fellow NATO member, but Athens has repeatedly said that it will only discuss maritime border delineation. Turkish Foreign Minister Mevlüt Çavuşoğlu accused Greece of raising obstacles to exploratory talks and trying to undermine the process for a thaw between the two countries. "It is not right to say that we are holding exploratory talks by narrowing the subjects to one issue," Çavuşoğlu said at a joint news conference with German Foreign Minister Heiko Maas in Ankara.

That was not a good start. As opposed to Athens' one-issue-only agenda, Ankara wants to bring several issues to the table, such as the continental shelf, airspace, territorial waters, demilitarization of Greek islands and islets, air traffic centers, and exclusive economic zones (EEZ), in addition to the broader territorial disputes around Cyprus.

After a three-hour first meeting in Istanbul, Turkey and Greece agreed to "explore more." The next round of exploratory talks will be held in Athens. In a tweet after the meeting, Turkish presidential spokesman Ibrahim Kalın said: "It is possible to solve all problems, including the Aegean." That looks like premature optimism.

According to Nikos Filis, director of Research Programs of the International Affairs Institute, Ankara's turn to the West is nothing but a tactical move not altogether to disrupt [shaky] relations with the West.

After the EU leaders gave Turkey an unambiguous warning in October, Turkish President Recep Tayyip Erdoğan chose to escalate tensions, bringing what otherwise would have been mere diplomatic issues to the level of a mini-clash of civilizations. In response, at a summit on December 10-11, EU leaders agreed to impose sanctions on an unspecified number of Turkish officials and entities involved in gas drilling in Cypriot-claimed waters -- but they deferred the bigger decisions such as trade tariffs until they consult with the new U.S. administration of President Joe Biden. At the December summit, EU foreign affairs chief Josep Borrell was tasked to prepare proposals on a broader approach to Turkey by March, giving the EU time to consult with Biden's national security team.

That window gave Erdogan a short, temporary relief. But in March, he will face a less patient EU leadership. Initial signs from Washington are not encouraging for Erdogan either.

Antony Blinken, Biden's choice for secretary of state, on January 20 accused NATO member Turkey of failing to act like an ally. Addressing legislators during his Senate Foreign Relations Committee confirmation hearing, Blinken said: "The idea that a strategic — so-called strategic — partner of ours would actually be in line with one of our biggest strategic competitors in Russia is not acceptable." Blinken also said Washington would consider whether further sanctions on Turkey would be implemented over its controversial purchase of the Russian S-400 air defense system.

"The EU and the United States should sanction the Turkish individuals most involved in dismantling the rule of law and interfering with the domestic politics of Western countries. This would be consistent with Turkey's commitments under the NATO and Council of Europe charters," wrote co-authors Marc Pierini, a visiting scholar at Carnegie Europe and Francesco Siccardi, a senior program manager at Carnegie Europe.

Turkey's efforts to augment its navy do not promise quieter waters in 2021 than the Aegean and Mediterranean seas were in most of 2020.

At a high-profile ceremony on January 23, Turkey launched its first locally-built frigate, the I-class TCG Istanbul. The TCG Istanbul will enter the Turkish Navy's inventory in 2023. It is the first of four frigates planned under the MILGEM program that will finally involve four corvettes and four frigates, all built indigenously. Speaking at the ceremony, Erdoğan said that Turkey had to keep its military deterrence at a maximum. "To be militarily, economically and diplomatically strong is not a choice for us, it is a must," he said.

Meanwhile, several other major naval programs are scheduled to reach critical milestones in 2021. For instance, Turkey's first indigenous Landing Helicopter Dock, the TCG Anadolu, the intelligence ship Ufuk and replenishment tanker Güngör Durmuş will be commissioned in 2021. The TCG Anadolu, an amphibious assault ship and a $1 billion naval ambition, is being built in Turkey under license from Spanish shipyards Navantia. In 2021, Turkey is also planning to launch Reis-class submarines, the Piri Reis, a Type-214TN platform that will be Turkey's first air-independent propulsion capable submarine.

"Turkey has adopted a strongly militaristic approach, making efforts toward conflict resolution increasingly unlikely," wrote Dimitris Tsarouhas, a professor of international relations, a Scientific Council member of the Foundation for European Progressive Studies in Brussels, and a World Bank consultant.

Now at their 61st round, there is good reason to believe that the Turks and Greeks will have to hold several dozen more exploratory talks before sustainable peace across the Aegean becomes a genuine possibility. Tyler Durden Thu, 01/28/2021 - 02:00

http://dlvr.it/RrVfbM

http://dlvr.it/RrVfbM

MyPillow CEO Mike Lindell ‘doesn’t exist’ on Twitter anymore

by Shepard Ambellas, Intellihub: Well-known Trump supporter and CEO banned from social media platform for violation of a company civic integrity policy MyPillow CEO Mike Lindell was suspended from Twitter on Tuesday for violating the company’s civic integrity policy. The policy clearly states: “You may not use Twitter’s services for the purpose of manipulating or […]

http://dlvr.it/RrVWs1

http://dlvr.it/RrVWs1

What Every Local Civic Leader In America Must Know About Technocracy’s Global Coup D’Etat

from Humans Are Free: I have said for years now that Technocracy is the clear and present danger that America is facing. Today, that clear and present danger is no longer future tense, but is here right now and in full force. There is only one possible line of defense left for you: local action. TRUTH LIVES on […]

http://dlvr.it/RrV5w2

http://dlvr.it/RrV5w2

The January FOMC and Gold

by Craig Hemke, Sprott Money: Wednesday brings the conclusion of the first FOMC meeting in 2021. As usual, we’ll get a summary at 2:00 pm EST followed by a press conference with Chairman Powell at 2:30 EST. What will he say, and what should we expect the impact to be on COMEX gold and silver […]

http://dlvr.it/RrTrmh

http://dlvr.it/RrTrmh

Delta Air Lines To Activate 400 Pilots By Summer Amid Travel Rebound Expectation

Delta Air Lines To Activate 400 Pilots By Summer Amid Travel Rebound Expectation

Delta Air Lines plans to activate 400 full-time pilots by this summer, reflecting vaccine optimism could lead to a rebound in air travel, according to a company memo, seen by Reuters.

John Laughter, senior vice president of flight operations, told employees last week that the company is positioning itself for recovery. "We saw an opportunity to build back additional pilot staffing in advance of summer 2022 by bringing 400 affected pilots back to active flying status by this summer," he said.

Laughter continued, "This is well ahead of when we originally estimated we would be able to convert pilots back to full flying status and is possible because of the PSP aid and available training capacity starting in March and April."

"We're cautiously optimistic that demand will increase as vaccinations roll out across the world, and we look forward to restoring all affected pilots back to full flying status as the recovery continues," he added.

Laughter expects average cash burn could be around $10-$15 million per day in the first quarter as customer demand will remain depressed.

The upbeat comments come as Delta experienced the largest ever annual loss of $12 billion in 2020. The airline hopes to return to profitability in the second half of 2021 as vaccines may give people more confidence to travel on planes.

"We are encouraged that Delta has begun recalling pilots that the pandemic has sidelined," the Air Line Pilots Association said in a statement.

"As career-long stakeholders, pilots want to see Delta back where it was before the virus exploded, at the top of the industry," the union added.

Despite the optimistic outlook, Delta shares were down more than 2% this afternoon as traders became spooked by new air travel restrictions in the US to mitigate the virus' spread.

Other airline CEOs are not as optimistic as Delta.

Global aviation data firm Cirium determined airline passenger traffic worldwide plunged to a two-decade low in 2020, with a likely continuation of depressed travel through early 2021.

Upon the rebound in air travel, passengers should expect airlines and governments will require travelers to have "COVID passports" before flying. Tyler Durden Wed, 01/27/2021 - 15:20

http://dlvr.it/RrTG0D

http://dlvr.it/RrTG0D

Tuesday, January 26, 2021

After COVID, Davos Moves to Great Reset

by F. William Engdahl, New Eastern Outlook: With the USA Biden Presidency, Washington has rejoined the Global Warming agenda of the Paris Accords. With China making loud pledges about meeting strict CO2 emission standards by 2060, now the World Economic Forum is about to unveil what will transform the way we all live in what […]

http://dlvr.it/RrQYHQ

http://dlvr.it/RrQYHQ

CNN's Brian Stelter and former Facebook official reveal the regime's next moves to silence political dissidents

(Natural News) The Globalist American Empire (GAE) has been amping up censorship efforts in the wake of the disputed 2020 election. So far, the most blatant act of tech totalitarianism has been the banning of the sitting President from most major social media platforms. This is hardly the final step in their plans, however. Not...

http://dlvr.it/RrQSTv

http://dlvr.it/RrQSTv

Quinn: The Fourth Turning Detonation, Part 1

Quinn: The Fourth Turning Detonation, Part 1

Authored by Jim Quinn via The Burning Platform blog,

“Americans today fear that linearism (alias the American Dream) has run its course. Many would welcome some enlightenment about history’s patterns and rhythms, but today’s intellectual elites offer little that’s useful. Caught between the entropy of the chaoticists and the hubris of the linearists, the American people have lost their moorings.” – Strauss & Howe – The Fourth Turning

“The ancients believed that each cyclical extreme, mirroring the hopes and fears of the other, helps generate the other. The night longs for the day, the day for night. In war, people yearn for relief from strife, leading to peace. In peace, people yearn to champion what they love, leading to war.” – Strauss & Howe – The Fourth Turning

When I started thinking about my annual beginning of the year article in early January, I tried to formulate a catchy title. Knowing we have entered the thirteenth year of this Fourth Turning, with the intensity of the crisis reaching an unparalleled level since November 4, I decided upon Fourth Turning Detonation. I immediately thought that might be too dire and figured I would change it later. After the first few weeks of the new year, I now think it might be grossly inadequate to describe what is coming in 2021.

It is easy to get distracted by the daily gyrations, ceaseless media propaganda, political theater, false narratives, and delusional beliefs of both the left and right, as this military empire built on debt and deceit spirals towards its fiery cataclysmic climax. Opposing forces have gathered themselves into position focusing on defeating their domestic enemies, with the left seeming to have strategic advantage but led by hubristic dullards, while numerous foreign adversaries circle like hungry vultures ready to pounce on the dying beast of an empire.

Last January I wrote a two-part article called 2020 – Year of Living Dangerously which harkened back to another article I had written eight years before 2012 – Year of Living Dangerously. I lamented the fact I had not understood Fourth Turnings will take their own sweet time on the way to a climax, with twists and turns which will differentiate it from previous Crisis periods in U.S. history. My impatience for the great battle to resolve this struggle has not and will not impact the timeline, but the three elements driving this Crisis remain firmly in control, as they have since 2008: debt, civic decay, global disorder.

My belief regarding the subtext of what has happened and is happening in this country has not changed. I certainly underestimated the lengths these psychopaths in suits would go to in 2020 to further pillage the world’s wealth while using a pandemic as cover to further their agenda of hegemony and turning the world into a virtual prison camp under constant technological surveillance. Despite the timing, I still believe that which is unsustainable will not be sustained.

“It seems I always underestimate the ability of sociopathic central bankers and their willingness to destroy the lives of hundreds of millions to benefit their oligarch masters. I always underestimate the rampant corruption that permeates Washington DC and the executive suites in mega-corporations across the land. And I always overestimate the intelligence, civic mindedness, and ability to understand math of the ignorant masses that pass for citizens in this country. It seems that issuing trillions of new debt to pay off trillions of bad debt, government sanctioned accounting fraud, mainstream media propaganda, government data manipulation and a populace blinded by mass delusion can stave off the inevitable consequences of an unsustainable economic system.”

I used to try and make specific predictions about the new year generally centered upon economic chaos, stock markets crashing, global conflict, and various other doom-like events. But those running this clown show somehow convince the masses all is well, the economy is healthy, inflation is non-existent, debt does not matter, college makes you smart, we’re energy self-sufficient, 100 million working age Americans not working – but unemployment was 3.5%, the stock market hitting all-time highs is good for you even though your real wages haven’t gone up in a decade, and America was great again.

It is amazing to me how effective propaganda is when multiple generations have been indoctrinated and socially engineered in the government school system and decades of boob tube fake news has been programmed into their pliably ignorant brains. Edward Bernays created the game plan and the techno-oligarch despots currently running the show are executing it to perfection.

“The conscious and intelligent manipulation of the organized habits and opinions of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country. …We are governed, our minds are molded, our tastes formed, our ideas suggested, largely by men we have never heard of.” – Edward Bernays – Propaganda

This Fourth Turning likely has another 5 to 10 years before some sort of convulsive resolution, unless it is accelerated like the Civil War Fourth Turning, with similar tragic consequences and mass casualties. Predicting the actual events which will occur over a short-term time frame is a fool’s errand, so I prefer to try and discern the direction and amplitude of the ongoing Crisis to gauge how we should prepare for what is coming.

I do admire writers like Jim Kunstler who really go out on a limb and make extremely specific forecasts for the coming year, like he did on January 1 with his Forecast 2021 — Chinese Fire Drills with a side of French Fries (Jacobin-style) and Russian Dressing. If even 25% of his predictions had come to fruition, 2021 would have gone down as one of the most earth shattering in history. But here we are a few weeks later and all his predictions about Trump going to war with the Deep State and winning a glorious victory for the American people failed to materialize. Trump is golfing at Mar-a- Lago, while the Deep State remains firmly in control and in the midst of consolidating their power by crushing dissent through Domestic terrorism legislation and complete control of social media platforms.

Even Kunstler acknowledges the Fourth Turning as a generational dynamic driving the events pushing the country and the world towards armed conflict. My high-level prognostications for 2020 certainly did not include a global pandemic used to introduce an Orwellian global dystopia and justification to steal a presidential election through mail-in ballot fraud and voting machine rigging.

Of course, Bill Gates predicted the pandemic in 2018 and his buddy Fauci, in 2017, said there was “no doubt” Donald J. Trump would be confronted with a surprise infectious disease outbreak during his presidency. I wonder why he had no doubt. Fauci, an unknown lifetime government bureaucrat, is now a media darling, despite being wrong about everything. And Gates’ wealth has soared during this plandemic. My big picture guesses last year were colored by the assassination of Iranian general Qasem Soleimani on January 3, expecting Middle East conflict to erupt. These were my main conjectures for 2020:

*

The Fed will continue to run their electronic printing presses at warp speed until the inevitable banquet of consequences is served to all.

*

We have entered the extreme greed phase of this debt-based Ponzi scheme. The stock market is in the blow-off stage, where earnings, valuations, and rational thinking are meaningless. Momentum and a delusional belief in the infallibility of the Fed are all that matter. Who knows how far it will go, but fear will eventually rear its ugly head, and a cascading collapse will make a lot of useful investing idiots very angry for the third time in the last two decades.

*

The Democrats and their Surveillance State co-conspirators have determined the best way to cover-up their treasonous acts are to stay on the offensive by impeaching Trump on bogus charges.

*

The social distress I noted last year continues unabated today as the glorification of abnormality reaches new heights. The flames of division and disarray are fanned unceasingly by the left-wing media to distract from the true desperate financial situation of the country.

*

Israel quietly foments discontent and turmoil across the region to keep the focus off itself. Russia and China support Iran economically and militarily to offset Americans dominance of the region. Confusion reigns.

*

Anyone with an ounce of critical thinking skills knows none of this is about freedom, democracy or doing the right thing. It’s about oil and it’s about the military industrial complex requiring enemies to keep the profits flowing.

*

The shale “miracle” is just another delusion built upon easy money pumped out by the Fed. No one can make profits on shale oil at $60 per barrel.

*

The months leading up to the election will be a circus. Propaganda, misinformation, and outright lies will be spread like manure. Of course, voting will not alleviate the issues which will continue to drive this Fourth Turning towards its climax – debt, civic decay, global disorder.

*

No matter the result of the upcoming election, neither side will accept the outcome.

*

There are no viable political solutions to our current dilemmas. It is just a matter of when and where the conflict goes hot and blood is spilled.

*

I do not know what events will dominate the coming year, but I do know the intensity of hate and vitriol will increase. I do know military conflict in the Middle East will expand. I do know the political machinations in this country will surge as the election approaches. I do know the Deep State will do everything in their immense power to undermine Trump. I do know the Fed will QE and Trump will cheer every new stock market record. I do know I will be lied to and propagandized by the mainstream corporate media.

I knew 2020 had the potential to be a chaotic year, but didn’t anticipate a flu with a 99.7% survival rate being used by totalitarian minded politicians to destroy the global economy, usher in Orwellian police state lockdown measures across the globe; a stock market crash followed by Fed created bubbles still growing ever bubblier through $4 trillion of money printing; adding $4 trillion to the national debt (with another $3 trillion on the way in 2021); paying millions to sit at home eating Cheetos and watching Netflix; destroying a few hundred thousand small businesses while enriching mega-corporations; putting a nail in the coffin of the 1st Amendment through censorship of conservative speech; and blatantly stealing a presidential election.

The globalist elite want to keep the fear at a high level to institute their global reset, where you will own nothing and be happy, or you will be brought to heel by the truncheon. This was the year it became crystal clear, the world is filled with good people, governed, and manipulated by bad people.

By delaying this article until after January 20 I allowed the Qanon Psyop of Trump using the military to rescue the country to pass into history as another delusion of hope over reason. I truly do not know whether the Qanon phenomena (it was not widely known by Trump supporters or most people) was just a LARP being played by former Dungeons & Dragons keyboard warriors or an FBI/CIA counter-intelligence operation designed to keep a segment of the population distracted and ever hopeful their white knight would rescue them from the clutches of the evil Deep State. I am reminded of the quote about hope from President Snow in the Hunger Games.

“Hope, it is the only thing stronger than fear. A little hope is effective, a lot of hope is dangerous. A spark is fine, as long as it’s contained.”

The elevation of Trump to president and the spark of hope he would truly drain the swamp, arrest the traitorous Deep State coup co-conspirators, lead his legions to victory over the forces of evil, and make America great again, kept half the people in the country hopeful for the last four years.

Meanwhile, the military industrial complex raked in hundreds of billions more from the American taxpayer; Wall Street bankers gorged on the trillions of free money, manufactured by their captured puppets at the Federal Reserve; the Silicon Valley despots consolidated their hold on commerce and communication; and the average American saw their standard of living continue its 50- year decline. The question is whether those constituting the “invisible government” allowed too much hope and needed the engineered pandemic to re-introduce fear as their primary control technique moving forward.

They believe they have contained the spark with their fraudulent election victory; installation of an empty senile vassal as their conduit for the great reset; having their media mouthpieces propagate the falsity of a right wing white supremacist insurrection at the Capital; crushing dissent by censoring the truth through totalitarian social media conglomerates; proceeding with an impeachment farce based on Trump telling his supporters to peacefully protest the fraudulent election outcome; and threatening to destroy the lives of all vocal Trump supporters.

I am highly doubtful they have contained the spark. I believe there are smoldering embers just waiting to be stirred into a conflagration which will engulf the entire world in a fiery purging of the existing social order, which has exhausted itself and needs to be cleansed. Jefferson understood the nature of Fourth Turnings two hundred years before Strauss & Howe put it to paper.

“Try to unlearn the obsessive fear of death (and the anxious quest for death avoidance) that pervades linear thinking in nearly every modern society. The ancients knew that, without periodic decay and death, nature cannot complete its full round of biological and social change. Without plant death, weeds would strangle the forest. Without human death, memories would never die, and unbroken habits and customs would strangle civilization. Social institutions require no less. Just as floods replenish soil and fires rejuvenate forests, a Fourth Turning clears out society’s exhausted elements and creates an opportunity.” – Strauss & Howe – The Fourth Turning

In Part Two of this article, I will examine the concept of the Grey Champion, their role in Fourth Turnings, and make some speculations as to the course of 2021 and the remainder of this Fourth Turning.

* * *

The corrupt establishment will do anything to suppress sites like the Burning Platform from revealing the truth. The corporate media does this by demonetizing sites like mine by blackballing the site from advertising revenue. If you get value from this site, please keep it running with a donation. Tyler Durden Tue, 01/26/2021 - 21:25

http://dlvr.it/RrQ7hv

http://dlvr.it/RrQ7hv

Situation Update, Jan 26th – Trump makes moves toward parallel presidency as Biden agenda blockaded

by Mike Adams, Natural News: The resistance to the corrupt Biden agenda is gaining steam and it’s now clear that numerous elements of the political machine are lining up to block Biden’s actions. For example, with two Democrat senators now stating that they will not support the removal of the filibuster rule, this means the […]

http://dlvr.it/RrPtgg

http://dlvr.it/RrPtgg

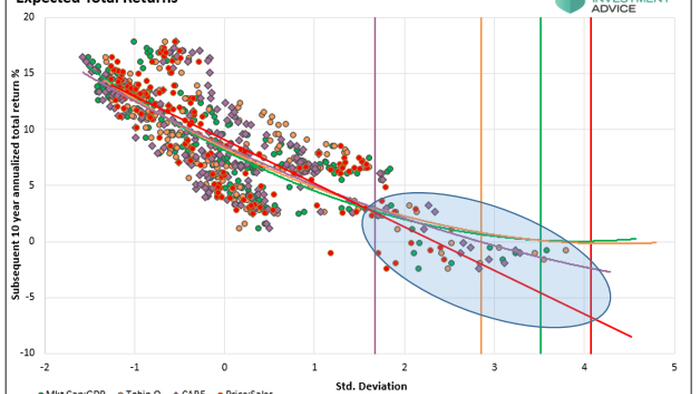

The Next Decade Will Likely Foil Most Financial Plans

The Next Decade Will Likely Foil Most Financial Plans

Authored by Lance Roberts via RealInvestmentAdvice.com,

There are many individuals in the market today who have never been through an actual “bear market.” These events, while painful, are necessary to “reset the table” for outsized market returns in the future. Without such an event, it is highly likely the next decade will foil most financial plans.

No. The March 2020 correction was not a bear market. As noted:

*

A bull market is when the price of the market is trending higher over a long-term period.

*