Two Years Later, What Did Trump's China Tariffs Achieve?

By Paul Donovan, Chief Economist at UBS

Summary

* It is over two years since US President Trump imposed taxes on US importers of selected Chinese products.

* Looking at all the taxed products for which we have data, China has lost about a quarter of its pre-tax market share. This loss was gradual, spread overseveral months. Mexico, Taiwan and Vietnam gained market share at Mainland China's expense. The US does not appear to have replaced the imports with domestic production.

* Where alternative production facilities were available, China's loss of market share was faster and more severe. Where few alternative production facilities were available, China lost little or no US market share.

* This has lessons for localization. Technological change encourages the replacement of global supply chains with more local production. Practicalities suggest this will happen slowly.

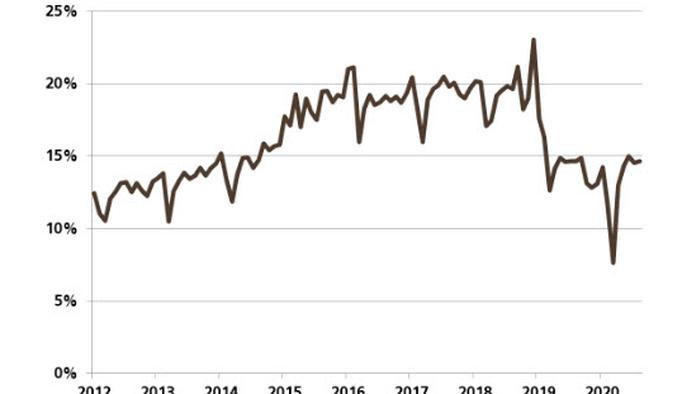

US President Trump imposed significant taxes on selected Chinese goods in September 2018, which are paid by US importers who have continued to purchase those goods. This means that we now have two years of data to assess how those trade taxes have altered global supply chains. Even with the distortions of the pandemic, there are some important insights. It is helpful to focus on China's market share of US imports, just for the goods subject to trade taxes. This reduces the distortions caused by weaker US demand during lockdowns.

If we look at all the goods that were subject to a tax (per the main chart), China's market share in the United States was not impacted for several months. The market share for all taxed products stayed around 20% until January 2019, and settled at around 15% market share from April 2019 onwards. Clearly, the tax had a significant impact on China's exports to the United States of the targeted items.

If the US government hoped that taxing goods from China would mean US producers could replace them, the tax policy was a failure. Until the pandemic disrupted global trade (and US demand), the value of imports (in the categories that were being taxed) stayed around pre-tariff levels. The value of imports spiked just before trade taxes were imposed (as US companies tried to minimize the damage). After that spike, imports of taxed products (from all economies) settled into the USD 70bn to USD 80bn range that has been the norm historically. Putting it differently, other countries simply replaced China in providing products to the United States.

With Mainland China losing around 5% market share of the taxed products, the big winners were Mexico (gaining around 2% market share of the taxed products) and Taiwan (gaining around 1% market share of the taxed products). Vietnam gained around 0.6% market share. It is worth noting that Chinese companies did not necessarily lose market share. Chinese companies may have made their products in different locations. Alternatively, if Chinese companies exported components to third parties (e.g. Canada) the finished product could be made there and exported to the United States. In that scenario, trade taxes would be avoided, US manufacturing would suffer and Canadian manufacturing would benefit.

For some products the loss of market share was sudden and more sizable than the overall figure. This happens where there is already an alternative production facility, with the capacity to meet US demand. If the US government hoped that taxing goods from China would damage the Chinese economy as well as the US economy, this is where such damage is most likely to show up. There is a straightforward substitution of supply. This is damaging for US consumers of imported product, as (presumably) the new locations are either more expensive or have lower quality products than producing in China —otherwise the products would have been made in these locations in the first place. Where the pandemic has caused production disruptions in alternative locations, some market share has been regained in recent months.

For other product, China lost little or no market share. This was where there was no alternative production facility. For such items, the US trade taxes had no impact other than to increase the taxes paid by US companies.

US trade taxes have therefore not converted imports into domestic production. They have either increased costs for US consumers (where China's market share is unchanged), or forced US consumers to seek alternative (presumably more expensive) suppliers. While the incoming US administration seems unlikely to change the general direction of US-China policy, it is possible that having an economist as Treasury Secretary will lead to a reassessment of trade taxes based on their economic merits (or lack thereof).

This pattern of supply shifts also tells us something about localization of supply chains. The automation and robotics of the fourth industrial revolution means that producing where labor costs are lower is far less important than in the past. This does not mean that third industrial revolution supply chains are replaced overnight, however. Rapid changes in supply chains only occur where facilities already exist—as we have seen with the reaction to US President Trump's trade taxes.

There will not be new, local production facilities ready to replace the global supply chains of the third industrial revolution as soon as the pandemic is over. This is obvious — localization is about a new way of producing (substituting capital for labor, and moving closer to the end customer). So searching for localization in the current trade data is pointless.

Increasing supply chain security by diversifying suppliers will also be slow—only where there are already alternative suppliers can diversification happen in the near-term. We should expect global trade patterns to reflect "business as usual" in the near term, with relatively few adjustments.

However, this may turn out to be the calm before the storm. Investment in localized production in the near term could change the way the world trades and reduce globalization from late 2022 onwards. Tyler Durden Sun, 01/17/2021 - 14:05

http://dlvr.it/RqmgpS

No comments:

Post a Comment