The Urban Exodus – Will They Or Won't They Come Back? Tyler Durden Wed, 09/30/2020 - 21:20

Submitted by Philip Fischer, founder of eBooleant Consulting, LLC; previously he was Managing Director, Head of Fixed Income And Municipal Bond Strategy, Global Bank & Markets, at Bank of America Merrill Lynch.

Years before this pandemic began, I gave a speech at the Library of Congress in Washington DC on “Science and the Literary Imagination.” It was an exploration of the ways in which the limits of literary thought were stretched by the possibilities introduced by scientific discovery.

Now, I think it is timely to think how this era of great scientific discovery has stretched the risk and return potentialities in economics. The growth of the tech giants makes the return potential clear. But the scientific risk component of systemic risk is also clear.

There should be no doubt that I favor the acquisition of scientific knowledge and in any event, we have little, if any, ability to keep the Genie in the bottle. But the acquisition of knowledge creates new states of nature to price. These include genetic manipulation and air conditioning.

Here we should note that discoveries are discoveries specifically because they are uncorrelated with current events. As such, scientific discoveries are unhedgable. In my last blog entry, I commented on the role that pandemics play in inducing mass migrations. Whether this virus itself is a “natural” or man- made disaster remains unresolved. The pandemic, however, was clearly facilitated by the amalgamated collection of technology facilitating its spread. And the role of technology in this cycle of municipal depopulations needs to be considered carefully in light of the many discoveries made in recent years.

They are leaving because they can

The press is replete with stories about the exodus from major American cities. And has been so for a long time. A September 2019 Forbes article “New Yorkers Are Leaving The City In Droves: Here's Why They're Moving And Where They're Going” seems almost quaint now.1 The Mayor of New York was trying to run for President of the United States while the moving vans were going into overdrive on the East Side of Manhattan. Much of the interstate migration was the product of tax policy in the blue states. And that was in the good times.

And, then as now, economists disregarded the depleting populations of the large American population centers. “It has long been a tenet of municipal finance that residents so love their cities that they are largely indifferent to their taxes. This is belied by the experience of the past two decades.”2

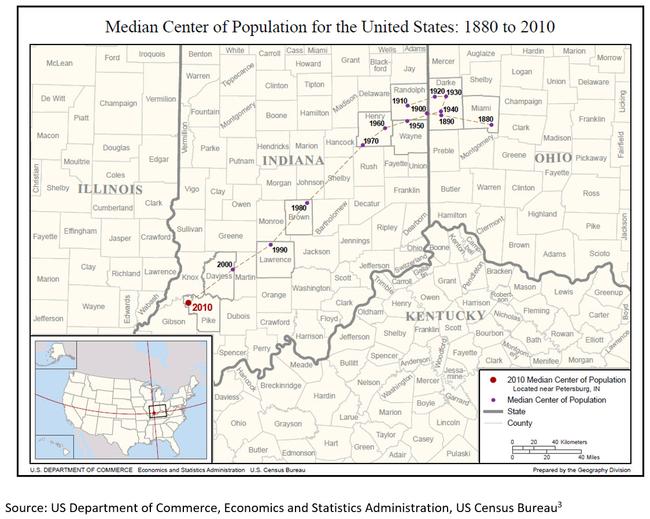

While a few places like New York City and Boston have managed to buck the general malaise, most cities in the Northeast and North Central United States have faced a multigenerational decline. In fact, the Census Department’s graph of the center of the US population, illustrates as well as any, the relentless thrust of the population west and south.

While the westward shift of the population occurs for many reasons, we are concerned with one particular item. That is the role of technology in the decline of the Eastern states. And here one invention is particularly relevant. While there are many places where air conditioning drove demographics, the deserts of the Southwest for example, it is in the East where its impact is most relevant. The invention of air conditioning was an important factor in the Eastern cities losing their relative advantage to the South.

Perhaps the best example was Washington DC where the adoption of air conditioning was a significant factor in converting a sleepy southern city into a governmental mega city.4

And the analog to air conditioning this time is telecommunications. Those leaving the cities add the ability to work remotely to the increasing taxes and decreasing quality of life in deciding whether to return. Municipal finance needs to respect the change in technology. It adds another credit negative to these cities.

A discussion of municipal credit and technology can be very extensive and there will be a plethora of topics to consider in this blog. Nevertheless, we should note the point I made at the Library of Congress. Science imposes a discipline in our risk analysis. Ordinarily in financial analysis the black swans, low probability events, are just that, unlikely. In a more rigorous sense, however, we have to consider that discovery shortens our time horizon. In the limit, if innovation is fast enough, we are driven to say that if it is now possible that something can happen, it must happen.

* * *

[1] New Yorkers Are Leaving The City In Droves: Here's Why They're Moving And Where They're Going

[2] Schramm, Carl. “Save America’s Dying Cities.” Issues in Science and Technology 36, no. 4 (Summer 2020): 62–70. https://issues.org/americas-dying-cities-carl-schramm-revitalizing-competitiveness/

[3] https://www.census.gov/library/visualizations/2010/geo/center-of-population-1880-2010.html

[4] Air-Conditioning Comes to the Nation's Capital, 1928–60, Joseph M. Siry, Journal of the Society of Architectural Historians (2018) 77 (4): 448–472. https://doi.org/10.1525/jsah.2018.77.4.448

http://dlvr.it/Rhj0k1

Wednesday, September 30, 2020

"Tremendously Low" Rates Send Pending Home Sales Soaring To Record Highs

"Tremendously Low" Rates Send Pending Home Sales Soaring To Record Highs Tyler Durden Wed, 09/30/2020 - 10:10

US Pending Home Sales soared 8.8% MoM (massively better than the 3.1% rise expected and 5.9% rise in July)...

Source: Bloomberg

This sent the YoY rise in pending home sales to +20.5% - the biggest annual gain since April 2010...

All of which sent pending home sales to a new record high...

Source: Bloomberg

“Tremendously low mortgage rates have again helped pending home sales climb,” said Lawrence Yun, NAR’s chief economist.

http://dlvr.it/RhgC9M

http://dlvr.it/RhgC9M

The Fed's Bazooka Is Broken – Will Direct Lending Be Next?

The Fed's Bazooka Is Broken – Will Direct Lending Be Next? Tyler Durden Wed, 09/30/2020 - 09:54

Authored by Michael Lebowitz and Jack Scott via RealInvestmentAdvice.com,

One of the Fed’s congressionally charted objectives is to promote stable prices for the goods and services we all purchase. Investors have been lulled to sleep for over 20 years by “price stability.” As a result, few investors have an appreciation for how inflation can impact their investments.

Despite stable price increases for the last two decades, the Fed now wants more inflation.

Given the negative impact inflation has on our wealth, why does the Fed wish to boost inflation? Maybe more important, how can they generate inflation?

Before progressing, we explain the hypocrisy between the Fed’s 2% inflation target and true price stability. For this, we lean on David Rosenberg quoting Alan Greenspan:

“When asked at the July ’96 FOMC meeting the level of inflation that truly reflects price stability, he said, “I would say the number is zero, if inflation is properly measured.”

What is Money?

The capacity for the Fed to generate more inflation can be appreciated in a straightforward statement:

ALL MONEY IS LENT INTO EXISTENCE.

Ruminating on that statement helps you understand why inflation is not running rampant despite Fed “printing presses” running at full steam. It also provides a glimpse as to how the Fed can change that. But first, let’s consider how money is created.

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” Those oft-quoted words by Milton Friedman define the root cause of inflation. To paraphrase, it means more money chasing fewer goods creates inflation.

Most economists agree with Friedman’s theory. The question, however, is what constitutes money? The problem facing the Fed is that they do not create money. Strike that; the Fed does not yet create money.

The Fed only provides banking reserves, or “toner,” so to speak. It is up to banks to use the reserves to make loans and create new money.

Money is Born

The following lesson of how money comes into existence is from our article, Why QE Is Not Working.

“Under the traditional fractional reserve banking system run by the U.S. and most other countries, money is “created” via loans. Here is a simple example:

*

John deposits a thousand dollars into his bank

*

The bank is allowed to lend 90% of their deposits (keeping 10% in “reserves”)

*

Anne borrows $900 from the same bank and buys a widget from Tommy

*

Tommy then deposits $900 into his checking account at the same bank

*

The bank then lends to someone who needs $810 and they spend that money, etc…

After Tommy’s deposit, there is still only $1,000 of reserves in the banking system, but the two depositors believe they have a total of $1,900 in their bank accounts. The bank’s accountants would confirm that. To make the bank’s accounting balance, Anne owes the bank $900. The money supply, in this case, is $1,900 despite the amount of real money only being $1,000.

That process continually feeds off the original $1,000 deposit with more loans and more deposits. Taken to its logical conclusion, it eventually creates $9,000 in “new” money through the process from the original $1,000 deposit.”

If you notice, the multiplying, or creation, of money is solely dependent on banks. At each step in the process, a bank must decide to lend the latest deposit. With each additional loan, the money supply increases. If a bank does not lend, the money supply does not grow.

In the same way that banks create money, it can vanish. Money dies when a debt is paid off or when a default occurs.

Unproductive Debt Needs Inflation

The foundation of the modern U.S. economy is debt. That is not necessarily good or bad, but it does raise a couple of essential questions:

*

Was the debt productive and used to generate future economic activity to service and repay the debt?

*

Was it unproductive and used to purchase something that provides little or no income generation in the future?

Assessing every single loan outstanding for its productivity and income generation is impossible. However, there are easy ways to qualify debt in aggregate. The graphs below show the ratio of Federal Debt to GDP and Corporate Debt to GDP.

If the debt were productive in aggregate, GDP would rise faster than debt. That is not the case nor the trend for the last 50 years. Therefore, we can say with some certainty that a majority of debt is unproductive.

It should, therefore, be no surprise that productivity growth rates inversely track the growth of the debt ratios above.

Under our economic construct, unproductive debt needs more debt at lower interest rates to sustain it. At some point, and we are likely near, or at the point, it needs inflation to reduce its burden.

More debt, especially at cheaper interest rates, allows debtors to service and pay down old debt. Inflation affords debt holders the ability to service and pay back debt with money worth less than when the loan was originated. Is it any wonder why the Fed has brought rates to zero and continually yearns for more inflation?

Back To The Fed

So with an understanding of how banks create money, and the role debt plays in the economy, we come back to the Fed.

The Fed, believing they are responsible for managing economic growth, encourages ever-increasing debt levels to keep the debt scheme going. As we said, a reduction of debt would reduce the money supply and result in deflation and further defaults. The economic fallout would be terrible.

To ensure debt balances rise, the Fed encourages new debt with low-interest rates. In 2008, zero interest rates were not enough to promote debt. During the 2008 crisis and ever since the Fed has decided to push reserves onto the banking system via quantitative easing (QE). The “logic” is that if the banks have reserves, they will gladly use them to make loans.

A Bump in the Road

Money is born when a bank makes a loan. If banks are not making loans, money is not being created. This explains why, despite the Fed’s massive efforts, inflation has yet to take hold.

Bank of America recently summed up the Fed’s problem well.

“At the current low rates, even if the Fed were to set all Treasury rates to 0bp, how many new borrowers and spenders would emerge? This is the problem of the zero lower bound that has worried the Fed and other central banks for years.”

The graph below shows that since February, reserves at banks have grown faster than the amount of reserves the Fed is adding to the banking system via QE. If banks were using newly added reserves to create loans, reserve growth would be well below the growth of QE.

The next set of graphs shows that banks have been aggressively tightening lending standards on business and consumer loans. Also, the Mortgage Bankers Association’s (MBA) Mortgage Credit Availability Index is at a six-year low.

Worsening matters, debt is being defaulted upon due to the COVID shutdowns, and money is vanishing. Further, the savings rate is noticeably higher, and citizens are being prudent and paying off debts.

The banks have enough excess reserves to make trillions of dollars in loans. However, the banks are on the hook for defaults and solvency issues arising from such loans. Banking margins are at historically tight levels, interest rates at record lows, and the unemployment rate is up to levels rarely seen. To make matters worse, the Fed is begging for inflation, which would raise future interest rates to the detriment of bank profits. Should we expect banks to loan in such an environment? Of course not.

Bypass the Banks

“…if I was trying to create deflation like I’m in this evil Darth Vader, like ‘Let’s create deflation,’ I would have done exactly what the Fed did from 2012 until a couple of years ago.” – Stan Druckenmiller, CNBC June 2019

What can the Fed do if they cannot persuade the banks to lend, create money, and generate inflation? Ben Bernanke once told us that the Fed could print money and distribute it to the public. He referred to this as “helicopter money,” thus granting him the nickname “Helicopter Ben”.

Helicopter money may not be today’s order of business, but the Fed has hinted they may choose to become a bank and lend directly to borrowers. If the banks will not do their job, why not do it for them?

The Fed does not care about gains and losses, that’s our problem. It is a problem most citizens will not understand until they are using Benjamins in their fireplace. If the Fed loses money on a bad loan, they can print more money to offset it. Whether money is lent directly to Joe Schmo on main street, a large corporation, or the government, it would represent a new weapon in the fight for more inflation.

Think of it this way, if the Fed offered you a $100,000 “loan” at a zero percent interest rate, would you take it? No doubt many would, and as such, the supply of money and inflation would surge. Dare we say, “mission accomplished.”

Summary

If the Fed manages monetary policy with the same tools of the last decade, inflation is not likely to rise meaningfully. The Fed understands the trap its monetary policy leaves them in. To escape, the Fed may consider printing money. We suspect doing this via direct lending efforts is their way out of the trap.

A popular rebuttal to our synopsis is that it is illegal for the Fed to make direct loans. That is very true, but neither is the Fed allowed to buy corporate bonds. They chose not to abide by the Federal Reserve Act and Congress did not stop them.

As long as congressional oversight is weak and the public is blind, the Fed has the tools. If the Fed wants inflation, they can get it.

As investors, we try to anticipate what the Fed will do. Next, we try to assess the implications of those actions. This year has been one long reminder that tomorrow might not look like yesterday. Much has changed and is changing. Our decisions as investors should account for the probability that those who manage monetary policy do so for their constituents, and not being a bank, we are not their constituent.

En garde.

http://dlvr.it/Rhg6yw

http://dlvr.it/Rhg6yw

Two Crucial Things Emerged From The First Presidential Debate

Two Crucial Things Emerged From The First Presidential Debate Tyler Durden Wed, 09/30/2020 - 08:58

Authored by Andrea Widburg via AmericanThinker.com,

The short version of the debate is that Biden did well if one ignored that almost every other statement he made was a lie or fantasy; Trump dominated him, almost too aggressively; and Chris Wallace may have been the worst and most obviously biased moderator since Candy Crowley. Most significantly, though, Biden and Trump each made a critical point. Biden’s was a tacit admission that, if he is elected president, he will preside over the end of the filibuster, allowing Democrats to pack the courts and add two new Democrat-majority states. Trump’s point was that he’s holding damning evidence about the Democrats’ coup attempt.

Let’s begin with Biden, whose squirming on court-packing and the filibuster promises the end of the American experiment. Chris Wallace, in one of the few tough questions he posed to Biden, said this:

So my question to you is, you have refused in the past to talk about it, are you willing to tell the American tonight whether or not you will support either ending the filibuster or packing the court?

Biden refused to answer, something the Trump quickly challenged. Here’s the colloquy:

BIDEN: Whatever position I take on that, that’ll become the issue. The issue is the American people should speak. You should go out and vote. You’re voting now. Vote and let your Senators know strongly how you feel.

TRUMP: Are you going to pack the court?

BIDEN: Vote now.

TRUMP: Are you going to pack the court?

BIDEN: Make sure you, in fact, let people know, your Senators.

TRUMP: He doesn’t want to answer the question.

BIDEN: I’m not going to answer the question.

TRUMP: Why wouldn’t you answer that question? You want to put a lot of new Supreme Court Justices. Radical left.

BIDEN: Will you shut up, man?

TRUMP: Listen, who is on your list, Joe? Who’s on your list?

WALLACE: Gentlemen, I think we’ve ended this-

BIDEN: This is so un-Presidential.

TRUMP: He’s going to pack the court. He is not going to give a list.

Presidential debate ERUPTS when @JoeBiden REFUSES to say he won't "pack the court" if @realDonaldTrump's SCOTUS nominee Amy Coney Barrett is confirmed.

"Would you shut up, man?"

😱😱😱 pic.twitter.com/yE30PUJsY7 — The First (@TheFirstonTV) September 30, 2020

You can see that Biden made a nonsense statement to avoid answering whether he will preserve the filibuster and the Supreme Court’s current system of nine justices. Shamefully, Wallace let him get away with not answering. Wallace surely understands that Biden’s handlers plan to end the filibuster so that they can pack the court and add D.C. and Puerto Rico as states.

Packing the court ends the American experiment as we know it. It means that the Supreme Court will be a political body that will exist solely to put its imprimatur on Democrat policies. And for those who say, “Well, if they pack the Court, then Republicans will pack it more when they’re in power,” that’s sadly foolish.

If Democrats pack the Court, there are no more Republicans. The whole democratic republic will be over. Once Democrats pack the Court, they never again need to persuade American voters to support their policies. One of their first policies in that new era will be to add hard-left Washington D.C. and Puerto Rico as the 51st and 52nd American states. That means four more Democrat Senate votes and a permanent Democrat party majority.

You see, the hard-left Democrat party views our American political system the same way Turkey president Recep Tayyip Erdoğan viewed democracy before becoming a dictator for life: “Democracy is like a train. We shall get out when we arrive at the station we want.” This time around, once the Democrats win, they will change the rules so they can never lose again.

Heed this warning: If Biden wins, our constitutional America is gone. We will be a socialist country. If you don’t believe me, just read the Democrat platform. They’re not hiding their goals.

Trump, though, might have some aces up his sleeve. When the subject of a “transition” came up (based on Biden's assumption that he will win), Trump stated that he’d been denied a transition period. Instead, there was a coup attempt (emphasis mine):

There was no transition because they came after me trying to do a coup. They came after me spying on my campaign. They started from the day I won and even before I won. From the day I came down the escalator with our First Lady. They were a disaster. They were a disgrace to our country. And we’ve caught ‘em. We’ve caught ‘em all. We’ve got it all on tape. We’ve caught ‘em all.

"We've Caught em All. We've Got It All On Tape. We've Caught em All."-@realDonaldTrump pic.twitter.com/qg2O1DuM0k — John Basham 🇺🇲 (@JohnBasham) September 30, 2020

Maybe Trump’s exaggerating, but I don’t think so. And maybe he’s going to keep that evidence secret, but I don’t think that either.

My guess is that this October, the Trump administration is going to release one piece of evidence after another showing that the Democrat party, from Hillary to Obama, and from the FBI to the CIA to the DOJ, and everywhere in between, engaged in a massive, seditious conspiracy to overturn the results of the 2016 election. Indeed, the information cascade has already begun with the release of DNI John Ratcliffe’s letter about Hillary’s conceiving of the Russia hoax.

In sum, amidst all the sound and fury of the debate, these two important points emerged:

(1) If he wins, Biden will almost certainly sign off on ending the filibuster to pack the courts and add two new states for a permanent Democrat majority that will leave the Constitution behind.

(2) Trump may have announced that he’s about to reveal that the Democrats, from Obama on down, engaged in a coup against an American president.

http://dlvr.it/RhfyPP

http://dlvr.it/RhfyPP

US Futures Slide After Debate Chaos

US Futures Slide After Debate Chaos Tyler Durden Wed, 09/30/2020 - 08:08

US equity futures and most global markets dropped after an chaotic and acrimonious American presidential debate, which CNN's Dana Bash described as a "shitshow" on air, which did little to change voters minds but highlighted the risk of a contested vote in November. Safe assets, such as the yen and dollar also rose as a continued rise in COVID-19 spooked some traders although strong factory surveys boosted China’s markets.

S&P 500 futures were last 0.6% lower, with Dow Jones and Nasdaq 100 futures down by as much as 1%. Asian trading had been choppy rather than outright weak but Europe sank 0.5% early on amid worries too over the steep rises in coronavirus infections across the region again, although a wave of buying managed to bring European markets back to even.

While futures initially rose, they kneejerked lower after the end of the debate as Trump cast doubt on whether he would accept the election’s outcome if he lost.

"What we’ve seen from the debate is the reinforcement that if Biden wins, Trump is not going to accept that," said Chris Weston, head of research at Pepperstone Group Ltd. in Melbourne. “People positioned for an ugly contest afterwards have been validated....I don’t think we were expecting anything else from Trump. He continues to put that contested (result) risk premium back into the market.”

They have since rebounded however, as the first presidential debate offered little trading cues for bond and currency markets, according to Jun Kato, chief market analyst at Shinkin Asset Management, who noted that Trump’s performance was in line with his usual behavior and it was unclear if Biden emerged superior in the debate.

"The debate just added to the confusion about how the election will run," said SEB investment management’s global head of asset allocation Hans Peterson. "But financially it doesn’t change anything."

"The share market normally prefers the incumbent (president) to win,” said Shane Oliver, head of investment strategy at AMP Capital in Sydney. “U.S. futures initially rose, as perhaps Trump delivered some punches, but it wasn’t enough,” he said.

To be sure, the debate was an absolute mess with 69% of people in a CBS poll said they were annoyed with the event, "which featured expletives, name calling, insults and shouting that made it hard to hear what was actually being said."

More to the point, and as we asked if the debate actually matters, Bloomberg's John Authers writes that the debate "appears to have changed little" who shows trading over the last 24 hours on the Predictit contract for which party wins the election. Volume was heavy during the debate, and yet it translated into a just-perceptible improvement for the Democrats, nothing more.

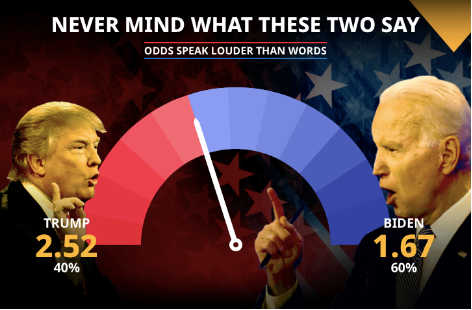

Bookies reported much the same thing; betting markets had been slightly more optimistic for Donald Trump than the prediction markets, but now they are in exact alignment. Like Predictit, the Betfair exchange now puts Biden’s victory chance at 60%. Before the debate, Biden’s odds were 4/5 on (56%). They are now 4/6 (60%). Trump’s odds, if you fancy a bet, widened from 11/8 to 6/4. Biden is ahead but not by the kind of margin that anyone would want to risk a lot of money on.

The presidential debate yielded no clear winner and barely moved the needle in betting markets, which project a narrow Biden victory. Odds maker Smarkets slightly lowered Trump’s chance of re-election to 40% after the debate from 42% beforehand.

As we said last night, and as Authers repeats this morning, Biden succeeded by "surviving the debate" and giving the president one less opportunity to bring him down in future, and while both made statements that might be usable against them, it was hard to hear what either of them were saying for lengthy tracts of the debate. The conclusion: "It’s hard to see how any genuinely undecided voter would have changed their mind on the basis of this."

Perhaps more market moving was the latest Chinese official and Caixin PMI, both of which hit just before China goes on vacation for a week. The September Manufacturing PMIs from both the National Bureau of Statistics (NBS) and Caixin signaled continued solid expansion of manufacturing activity. The NBS non-manufacturing PMI rose in September as well with the services PMI climbing to the highest level since mid-2012. The China NBS purchasing managers’ indexes (PMIs) suggest manufacturing activity continued to expand at a solid pace in September:

* The NBS manufacturing PMI headline index was at 51.5 in September, vs 51.0 in August.

* The NBS non-manufacturing PMI (comprised of the service and construction sectors at roughly 80%/20% weightings, based on our estimates) rose 0.7pp to 55.9 in September on a stronger services PMI. The services PMI climbed to 55.2, the highest level since June 2012.

The Caixin manufacturing PMI released later in the morning came in at 53.0, only slightly lower than 53.1 in August which was the highest level since early 2011. Similar to the NBS manufacturing survey, the Caixin manufacturing survey suggest stronger new export orders, higher employment sub-index and higher input cost pressures. The new export order sub-index in the Caixin manufacturing survey surged to 54.4 in September, the strongest reading since September 2014.

As Goldman concludes, "manufacturing PMIs suggest overall activity continued to recover in September in the manufacturing sector, on the back of persistent strength in exports. Services sector activity recovery has been catching up, as suggested by the higher services PMI under the NBS PMI survey."

Alas, there were less good news on the US jobs front, following several blockbuster layoff announcements. Walt Disney made one of the deepest workforce reductions in not only the Covid-19 era but in history, when it announced it was firing 28,000 workers. Oil giant Royal Dutch Shell said it will cut as many as 9,000 jobs as it struggles with low demand and tries to restructure towards low-carbon energy. Dow also said it would cut 6% of its workforce, while Marathon Petroleum also started layoffs.

* * *

Back to market globally, most of which are headed for their first monthly retreats since March’s meltdown, either deepened losses or pulled back from highs scaled after data showed China’s economic recovery remains on track. MSCI’s broadest index of world shares dropped 0.2% for a 4% September loss. Oil is down just over 10% this month while gold’s 4.1% drop will make it its worst month since late 2016.

Asia had held its ground overnight, led by a 0.8% gain in Hong Kong, though Japan’s Nikkei fell 1.5% and Australia’s S&P/ASX 200 lost over 2%. Chinese property developers gained, led by a 15% jump in Evergrande shares after the heavily-indebted giant reached a deal to ease cash crunch concerns, as noted last night. China’s factory activity expansion accelerated in September, helped by rising export orders.

In Europe, declines in industrial-goods and tech shares outweighed gains in utilities.

In FX, options trade points to a volatile November. Two-month dollar/yen volatility, a gauge of expected moves in the yen, is elevated, and its premium over one-month volatility is near record levels. Major currencies eased against the dollar after the debate, The euro dipped from a one-week high to $1.1736 and the risk-sensitive Australian dollar fell 0.2% to $0.7118, heading for its worst month since March.

In rates, Treasuries barely budged, with yields remaining within a basis point of Tuesday’s closing levels ahead of U.S. data raft including September ADP employment change and 2Q GDP. Yields were higher by less than 1bp at long end, steepening 5s30s by ~1bp; 10-year yields steady around 0.65%, outperforming bunds and gilts by less than 1bp. Price action was choppy but not sustained during first U.S. presidential debate late Tuesday, leaving yields slightly cheaper at long end. The long end may draw support toward end of U.S. trading day from month-end index rebalancing.

In commodities, oil prices fell amid rising concerns about fuel demand as the coronavirus pandemic worsens. Brent crude futures were last down 0.9% at $40.66 a barrel and U.S. crude futures were down 0.7% at $39.00 a barrel. Gold slipped 0.4% to 1,890 an ounce.

Market Snapshot:

* S&P 500 futures down 0.9% to 3,305.50

* STOXX Europe 600 down 0.4% to 360.02

* MXAP down 0.6% to 169.28

* MXAPJ up 0.09% to 553.65

* Nikkei down 1.5% to 23,185.12

* Topix down 2% to 1,625.49

* Hang Seng Index up 0.8% to 23,459.05

* Shanghai Composite down 0.2% to 3,218.05

* Sensex up 0.5% to 38,156.23

* Australia S&P/ASX 200 down 2.3% to 5,815.94

* Kospi up 0.9% to 2,327.89

* German 10Y yield rose 0.4 bps to -0.541%

* Euro down 0.1% to $1.1728

* Italian 10Y yield fell 2.7 bps to 0.648%

* Spanish 10Y yield rose 0.4 bps to 0.229%

* Brent futures down 1.8% to $40.30/bbl

* Gold spot down 0.6% to $1,886.96

* U.S. Dollar Index up 0.3% to 94.16

Top Overnight News from Bloomberg:

* President Donald Trump and former Vice President Joe Biden hurled insults and repeatedly interrupted each other in their first debate, sparring over topics ranging from health care to the economy and their families as moderator Chris Wallace tried mostly in vain to control the conversation

* Trump Sees Wide Vote Fraud That Doesn’t Exist: Debate Fact Check

* Boris Johnson is braced for defeat in Parliament over his controversial plan to re-write the Brexit withdrawal agreement, a blow that could throw negotiations with the European Union into chaos at a critical time

* Japan’s industrial production increased for a third month in August as the economy continued to reopen, though the gains slowed from July’s record jump

* The European Union’s historic 1.8 trillion-euro ($2.1 trillion) budget and stimulus package is in danger of being delayed due to a disagreement among member states about how to enforce the adherence to democratic values, according to a spokesman for the German government

* Italy plans to bring its budget deficit back into line with European Union rules in 2023 after a dramatic increase in spending dictated by the coronavirus outbreak

* Oil held below $40 a barrel on rising concerns that it will be some time before there’s a meaningful recovery in demand

A quick look at global markets courtesy of NewsSquawk

Asian equity markets were mixed with participants indecisive as focus centred on the US Presidential Debate where US President Trump faced off with former VP Biden on a range of topics including COVID-19, the economy, taxes and foreign dealings of former VP Biden’s son. The debate featured plenty of bickering and highlighted no love lost between the candidates with President Trump criticizing Biden’s son and with Biden referring to Trump as a clown on several occasions, while marginal upside was seen in US equity futures early in the debate as the widely viewed front-runner Biden showed a more composed tone with President Trump seemingly disruptive and interrupting Biden and the moderator a few times, which favoured the notion of a Blue Sweep. However, all the gains were later pared at the end of the debate which descended into chaos with plenty of disruptions and President Trump also suggested the idea of a contested election which could last for months. As such, ASX 200 (-2.3%) and Nikkei 225 (-1.5%) were negative with Australia dragged lower by losses in the energy sector and with financials also underperforming, while Tokyo sentiment was lacklustre following Industrial Production data which despite beating expectations, still showed a double-digit percentage contraction Y/Y. Hang Seng (+0.7%) and Shanghai Comp. (-0.2%) were initially both positive on the eve of Golden Week as participants digested better than expected Chinese Official PMI data and although Caixin Manufacturing PMI slightly missed, the data showed new export orders rose by the most in 3 years and the employment gauge returned to growth; however, gains in Shanghai were pared back. Finally, 10yr JGBs traded lacklustre as prices reversed some of yesterday’s gains but with downside stemmed amid the BoJ’s presence in the market today and after the central bank also kept its purchase intentions for October unchanged.

Top Asian News

* CLSA Exodus Deepens as Beijing Tightens Grip, Reins In Pay

* Alibaba Expects First Profit From its Cloud Arm This Year

* Armenian-Azeri Fighting Continues, Ignoring Cease-Fire Appeals

* Japan’s Factory Output Rises for Third Month in August

A relatively choppy session thus far for European stocks, albeit with losses somewhat contained (Euro Stoxx 50 -0.6%), as sentiment was dampened overnight amid the fallout from the US Presidential debate, whilst fresh catalysts during European hours remain scarce. That being said, the EU released their report on rule of law deficiencies which singles out Hungary and Poland – a move which could threaten the swift implantation of the EU Recovery Fund as unanimity is needed to roll out the package. Meanwhile, China opened an antitrust probe into Google (-1.8% pre-market) over market dominance. European bourses see varying degrees of losses, with FTSE 100 (-0.1%) cushioned by a softer Sterling, and Spain’s IBEX (-0.1%) supported by gains in large-cap stocks including Telefonica (+0.6%) after reports said it is mulling the sale of an additional stake in its mobile telephone mast unit Telxius. Thus the telecom sector outperforms, with added tailwinds from gains in Orange (+0.7%), Bouygues (+0.9%) after the French Telecom Regulator said prices for the 5G spectrum are up by EUR 220mln following the first round of auctions, with the latter also buoyed by its disposal of Alstom (-2.2%) shares. IT meanwhile resides on the other side of the spectrum following earnings from Micron (-4.7% pre-mkt) despite beating on both top and bottom line is afflicted more-so on sub-par guidance. As such, Infineon (-1.2%), SAP (-1.2%) and STMicroelectronics (-1.2%) are subdued. Travel and Leisure also resides towards the bottom of the pile amid the ongoing woes for the sector with regards to rising COVID-19 infections. In terms of individual movers, Suez (+6.5%) is a top gainer in the Stoxx 600 after Veolia (+1.8%) upped its offer for the Co. to EUR 18/shr from EUR 15.50/shr. Shell (+0.5%) sees modest gains despite a rather gloomy Q3 update, but with upside potentially on further cost-cutting measures including global job losses of up to 9,000 employees by end-2022.

Top European News

* Damning Report Set to Worsen Spat Over EU’s Jumbo Recovery Fund

* ECB to Consider Allowing Inflation Overshoot, Lagarde Says

* SNB Spent 90 Billion Francs on Interventions as Virus Took Hold

* Merkel’s Old Foe May Finally Get His Chance to Undo Her Legacy

In FX, the Dollar and index by design seem to have found their footing after extending declines amidst all the bickering between incumbent US President Trump and rival Biden overnight. The DXY has revisited 94.000, albeit just within a 94.180-93.789 range and could be seeing late if not last minute rebalancing demand for the end of September and Q3 alongside a touch of safe-haven buying as broad risk sentiment wavers. Ahead, a busy US data schedule including ADP before Friday’s BLS report and more Fed speak via current FOMC voters Kashkari, Bowman and Kaplan.

* CHF/GBP - Lagging fellow G10 currencies, and perhaps surprisingly given the Swiss KOF indicator easily beating consensus and advancing further above the 100.0 mark, while revised UK GDP was not quite as abject as the initial estimates and a degree of Brexit positivity persists following reports that chief EU negotiator Barnier sees an improvement in the atmosphere, more engagement from the UK side and a fresh ’buzz’ in talks. However, the Franc is back under 0.9200 and Cable has tested support ahead of 1.2800, as Eur/Gbp consolidates above 0.9100. For the record, nothing new whatsoever from BoE’s Haldane – see headline feed at 9.30BST for bullets and a link to the full speech.

* NZD/AUD - In contrast to the above, recoveries in NZ business sentiment and the outlook for activity, not as weak as forecast Aussie building approvals and better than expected Chinese PMIs that are helping the YUAN claw back losses vs the Greenback towards 6.8100, are all keeping the Antipodes afloat. Nzd/Usd has been over 0.6600 and Aud/Usd up to 0.7150, albeit off peaks as their US counterpart continues to regain poise.

* JPY/CAD/EUR - The Yen remains rangebound vs the Buck and flanked by decent option expiry interest from 105.60-70 (1.1 bn) to 105.15-00 (1.3 bn) following moderately firmer than anticipated Japanese ip data, while the Loonie is still attempting to contain losses around 1.3400 ahead of Canadian monthly GDP and the Euro is striving to maintain 1.1700+ status in the face of stronger sell signals vs the US Dollar.

* SCANDI/EM - Little reaction to Sweden’s NIER upgrading its 2020 jobless rate projection or a reduction in Norges Bank daily FX purchases for October, as Eur/Sek straddles 10.5400 and Eur/Nok holds off 11.1100+ highs on the aforementioned single currency retracement. Elsewhere, EMs are correcting higher after recent heavy depreciation vs the Usd, and even the tormented Rub and Try as trouble across the Armenian-Azeri border rumbles on.

In commodities, crude futures remain softer in early European hours as the rising COVID-19 cases continue to weigh on demand prospects for the complex, with some added pressure for the lackluster sentiment across markets following the US debate. Price saw another leg lower on reports that Beijing is said to be preparing an antitrust investigation into Google, in a sign that US-Sino relations are getting no better. Elsewhere, Norway's Industri Energi and Safe Labour unions said its workers will not go on strike after agreeing on a wage deal, but Lederne Labour union said its workers will go ahead with strikes and will potentially escalate the situations at today’s meeting. This could cut the country's oil output by some 470k BPD, according to the Norwegian Oil and Gas Association. WTI Nov resides just sub-39/bbl whilst Brent Dec sees itself marginally above USD 41/bbl. Precious metals meanwhile succumb to the firmer Buck, with spot gold around the USD 1880/oz mark having had drifted from a high of USD 1899/oz; spot silver underperforms but remains north of USD 23.50/oz (vs. high USD 24.32/oz). LME copper prices edge lower in tandem with losses across the stock markets coupled with a firmer Dollar, whilst Dalian iron ore futures rose some 5% amid rekindled fears of supply disruptions.

US Event Calendar

* 8:15am: ADP Employment Change, est. 649,000, prior 428,000

* 8:30am: GDP Annualized QoQ, est. -31.7%, prior -31.7%

* 9:45am: MNI Chicago PMI, est. 52, prior 51.2

* 10am: Pending Home Sales MoM, est. 3.1%, prior 5.9%; Pending Home Sales NSA YoY, est. 17.6%, prior 15.4%

DB's Jim Reid concludes the overnight wrap

I’m a proud father this morning. One of the twins came home from nursery yesterday with a big badge pinned on him, rewarded for an achievement. As I got closer to it to see what it was for I wondered which advanced skill was being recognised. Had he counted? Had he recognised a word? Had he sung in tune or perhaps been thoughtful towards another child? No, his badge simply said on it “well done for not shouting”. To be fair our twins are so loud that any moment they are not screaming is an achievement and the nursery obviously now feel the same way.

Talking of screaming and shouting, welcome to the post US Presidential debate break out room just a couple of hours after it came to an end. We discussed in our CoTD yesterday (Link here ) how irrelevant these debates have been over the last 40-50 years to candidates’ electoral chances. Well this isn’t stopping us from making last night’s debate the headline story even if it’s more of a show than anything else. Remember polling suggested Trump lost all three debates comprehensively in 2016 and snap polling by YouGov last night suggested Biden won with 48% and Trump with 41% - not far off the current poling averages. A CNN snap poll had a much bigger win for Biden but at this stage you have to be wary of sampling issues.

In a raucous debate that was indeed full of shouting, it is unclear that either President Trump or Vice President Biden changed the trajectory of the election last night. The President came into the night down -6.8% in the fivethirtyeight.com national polling average while trailing in many of the battleground states, and we will track how polls change in the next few days. There was very little substance in the debate and almost no new information proffered. The story of the debate will likely surround the President’s consistent interruption, though Mr Biden was not able to stay above the fray and traded insults at times with Mr Trump. Acrimony ruled.

Outside of the debate, we have seen China’s official September PMIs overnight with both the manufacturing (at 51.5 vs 51.3 expected) and non-manufacturing (at 55.9 vs. 54.7 expected) beating consensus expectations and reaffirming the message that the country’s recovery remains on track aided partly by strong exports. In details of the manufacturing PMI, new export orders climbed to 50.8 (vs. 49.1 last month), marking the first time it has printed above 50 this year while the new orders index also rose to 52.8 (vs. 52.0 ). Overall, the official composite PMI printed at 55.1 (vs. 54.5 last month). Alongside, the official PMIs we also saw China’s Caixin manufacturing PMI which came in a touch softer (0.1pt) than expectations at 53.0.

The Hang Seng (+1.18%) and Shanghai Comp (+0.45%) are trading up this morning following the PMI beat. Other markets in the region are mostly trading lower with the Nikkei (-0.84%) and Asx (-1.82%) both down while India’s Nifty (-0.05%) has opened weak. South Korea’s markets are closed for a holiday. Futures on the S&P 500 are also trading weak at -0.67% following the Presidential debate and European futures are pointing to a weak open (Stoxx 50 -0.44% and Dax -0.38%). Meanwhile, oil prices are trading down c. -1%. Elsewhere, Micron Technology said overnight that it has recently halted shipments to China’s Huawei. The company also announced a cut in its capital spending plans and warned about weaker demand from some corporate customers and forecast possible oversupply in a key market next year. Shares of the company fell -3.9% in afterhours trading due to this. In terms of other overnight data, Japan’s September retail sales printed at +4.6% mom (vs. +2.0% mom expected).

Ahead of the debate, risk assets fell back yesterday as markets were unable to maintain the strong momentum from Monday, with negative news on the coronavirus seemingly outweighing more positive consumer confidence numbers. By the close, equities had lost ground on both sides of the Atlantic, with the S&P 500 (-0.48%) and the STOXX 600 (-0.52%) both falling back. Energy stocks led the moves lower thanks to falling oil prices, as both Brent Crude (-3.30%) and WTI (-3.23%) underwent major falls, while banks also struggled to follow-through on their strong start to the week.

Starting with Covid, yesterday saw some negative news from the US, with the daily positivity rate in New York City rising above 3% yesterday for the first time in months, according to Mayor de Blasio. The threshold is a significant one, as de Blasio has said that the city’s schools will shut if the positivity rate is above 3% on a rolling 7-day average basis, though for now that still remains at 1.38%. The US overall has seen hosptilisations plateau at 30,000 after falling from nearly 60,000 in the middle of the summer. With cases again increasing marginally in the US over the last 2-3 weeks attention will shift to hospital capacity as the weather grows colder in the northern US. Meanwhile in Germany, Chancellor Merkel recommended that private parties were limited to 25 people, and in the UK a record 7,152 cases were reported yesterday, which also drove the 7-day average above 6,000. There was some weekend catch up to this data though. Best to look at the 7-day rolling number in the table below for the best state of play.

There was some good news overnight on the pharmaceutical front. A Regeneron Covid-19 antibody cocktail, still in early stage trials, saw positive data that it helped reduce viral levels and improved symptoms. At the same time, data from phase 2 testing showed that the Moderna vaccine triggered a “strong antibody” response in adults, with “severe” side effects in one volunteer. Meanwhile, in a sign of the pandemic’s lasting impact on the hospitality industry, Walt Disney said overnight that it is laying off 28,000 employees in its US resort business, marking one of the deepest workforce reductions of the pandemic. The cuts span the company’s theme parks, cruise ships and retail businesses and will include executives; however, 67% of those being terminated are part time employees.

In the world of central banks, Dallas Fed president Kaplan indicated that he did not expect the US economy to get back on track from the pandemic until late-2022 or even 2023. While not advocating for higher rates, Kaplan said that the Fed should remain accommodative but that may not mean keeping rates at zero. He warned that there were “real costs” to near-zero rates for elongated periods of time, specifically it can “adversely impact savers, encourage excessive risk taking and create distortions in financial markets." We also heard from New York Fed president Williams who is not worried about inflation, though acknowledged they would deal with it if it came. Williams had a similar time frame for full recovery as Kaplan of 3 years and again seemed to call on fiscal stimulus help, saying that the recovery needed “all the official support it can get.”

And there was some more positive news on the prospects of US fiscal stimulus, with Speaker Pelosi’s deputy chief of staff tweeting that Pelosi and Treasury Secretary Mnuchin spoke yesterday morning on the phone for around 50 minutes, and agreed to speak again today. There will be a floor vote in the Senate on a relief package of some sort later this week according to reports, either the Democrat-written $2.2 trillion fiscal bill or a more bipartisan effort if one can come together. In spite of a lack of stimulus, data from the Conference Board showed US consumer confidence index experiencing the biggest monthly jump in 17 years, with a stronger-than-expected rise to 101.8 in September.

Staying with yesterday, there were some significant headlines from Europe, as a spokesperson for the German presidency of the Council of the European Union said on the recovery fund that “The timetable is in danger of slipping. A delay of the EU budget and the Recovery fund is becoming increasingly likely”. Remember that the package needs to be agreed unanimously, but there’ve been disputes over the possibility of rule-of-law conditions, and yesterday a letter was published from Hungarian PM Orban which called for the Commission Vice President for Values and Transparency to be sacked, after she called Hungary a “sick democracy”.

Over in the fixed income sphere, sovereign bonds rallied yesterday as investors moved out of risk assets. Perhaps the biggest headline came from Italy, where the country’s 30yr yield fell to a fresh all time record low of 1.74%. However there was a strong performance across the board, with yields on 10yr bunds (-1.7bps), OATs (-1.5bps) and BTPs (-2.7bps) all falling back. 10yr Treasury yields also fell -0.3bps, their 4th successive move lower. This came as the US dollar fell -0.41% Tuesday, to start the week with its worst 2-day performance since 31 Aug, however the currency is still set to record its first monthly gain since March.

On Brexit, the 9th round of negotiations began yesterday between the UK and the EU in Brussels, with Bloomberg reporting that the UK has submitted 5 confidential draft legal texts. Negotiations continue until Friday, and the question this week will be whether enough progress can be made for the two sides to be able to reach agreement by Prime Minister Johnson’s self-imposed deadline of October 15, when a summit of EU leaders takes place.

Wrapping up with some of Europe’s data from yesterday, German inflation fell to a 5-year low of -0.4% in September, which was below the -0.1% reading expected and will only add to concerns about weak price pressures in the Euro Area. That said, the European Commission’s economic sentiment indicator for the Euro Area rose for a 5th straight month in September, up to 91.1 (vs. 89.0 expected). Finally in the UK, consumer credit data showed that net borrowing was weaker-than-expected in August, coming in at £0.3bn (vs. £1.5bn expected).

To the day ahead now, and the highlights include an array of central bank speakers, including ECB President Lagarde, chief economist Lane, and the ECB’s Muller, Rehn and Kazimir. Otherwise, there’s also the Fed’s Bowman, Bullard, and Kashkari, along with the Bank of England’s chief economist Haldane. In terms of data, we’ll get the preliminary September CPI readings from France and Italy, the September change in unemployment from Germany, while from the US there’s the third reading of Q2 GDP, August’s pending home sales, the MNI Chicago PMI for September and the ADP employment change for September.

http://dlvr.it/RhfnQ8

http://dlvr.it/RhfnQ8

Tuesday, September 29, 2020

The Fed Has Given Big Business A Huge Advantage

The Fed Has Given Big Business A Huge Advantage Tyler Durden Tue, 09/29/2020 - 21:05

Authored by Bruce Wilds via Advancing Time blog,

The last few months have been painful for small businesses across America. These businesses often have a difficult time getting a bank loan. Bubbling up to the surface is the recognition the Fed has played a major role in pushing inequality higher. This was highlighted when Federal Reserve chairman Jerome Powell admitted it's tough for the Fed to boost lending to smaller businesses. “Trying to underwrite the credit of hundreds of thousands of very small businesses would be very difficult,” Powell said. He acknowledged that many of these small loans are really nothing more than the personal promises of people struggling to keep the doors of their business open.

And it's gone!

As the financial pain from the pandemic and government restrictions placed on businesses continue, much of the money thrown out to ease our pain has rapidly flowed into the hands of Wall Street and big business. The reality that most small businesses close in failure underlines the risk involved in loaning money to such concerns. Still, it is difficult to deny the importance of small business in the overall economy. It plays a major role in communities by both creating jobs and allowing individuals to better their lot in life.

During a recent exchange between House Financial Services Committee Chairwoman Rep. Maxine Waters of California and Powell, it became evident that Powell was not rushing to implement changes in the way things are done in an effort to aid small businesses and level the playing field. Waters suggested the Fed and Treasury Department lower the minimum size of the loans under the Main Street Lending Program to $100,000 from the current $250,000 to help a larger number of small companies that have been hurt by the pandemic. Powell even went so far as to claim there was little demand for loans below $1 million.

A business owner struggling to pay his three workers would dispute Powell's statement about little demand for smaller loans. Both Powell and Treasury Secretary Steven Mnuchin have also voiced concern about the commercial real estate sector and how they both indicated it is not easy for the federal government to craft an aid program to blunt the damage growing in this part of the economy. Mnuchin said the PPP program has played a role in enabling firms to continue paying their rent so landlords can pay their mortgages. There is fear building in the area of commercial real estate that defaults will send property values into a downward spiral.

Sadly, the same policies that dump huge money into larger businesses because it is an easier and faster way to bolster the economy give these concerns a huge advantage over their smaller competitors. A big problem is that this often is enough to put smaller companies out of business. The damage this is doing to society is something that will be difficult to remedy. Once businesses close a series of negative events generally unfold such as buildings going empty and debts not being paid. This tends to impact the economy and communities for years.

On Thursday Powell and Mnuchin appeared before the Senate Banking Committee and answered even more questions about the hardship the coronavirus has brought upon the economy. While they see significant support for legislation that supports jobs and extending the PPP the recognized the gap between the House and Senate negotiations. Still, they gave little doubt more money and fiscal support will be needed and they are ready to act. This includes looking at ways to expand the Main Street lending facility and make the programs more flexible. This means we will probably see more money flowing into a forgivable loan or grant programs. Both indicated the need to get more PPP money to businesses with decreased revenue saying it would be very important in the effort to save jobs.

The recession this year due to covid-related shutdowns is bizarre in nature due to the extreme intervention of central banks and governments. We have seen many small businesses devastated at the same time personal incomes have soared. Usually, a recession is marked by a fall in incomes or consumers being tapped out and unable to spend. The massive fiscal stimulus that has been unleashed by the U.S. government has led to the biggest surge in personal income in history. In fact, government transfer payments have soared to where they constitute an unheard of 30% of all personal income.

Government Transfer Of Payments Has Soared

To put this into context, the transfer of payments has been rising for decades but the covid-19 crisis has allowed it to explode. During the 50s and 60s, it was around 7%. for a short period in the mid70s and following the 2008 financial crisis it hit the high teens. as the chart on the left indicates this is far above any intervention we have experienced in the past. This is why in this bizarre economy nobody should consider the GDP as an indicator of our economic health.

In short, the Fed has been subsidizing the 1% at a heightened pace for the past decade and this has both spurred inequality and given big business a huge advantage in the ability to fund its needs. It also means the government has been funding the lives of every American to a greater extent. From the talk now being bantered around, it sounds like all these people are talking about again releasing trillions of dollars into the economy. We should all be aware that the longer this goes on the more power is shifted away from the people and the small businesses that line Main Street.

A final thought, it is all very difficult to square this with what Richmond Fed President Tom Barkin said on Thursday, "The U.S. recession was severe but also short and is now over."

Ironically, this is also the same day that St. Louis Fed President James Bullard claimed the economy could fully recovery on some metrics by the end of this year. In my opinion, more important than squaring such talk is the fact small business has taken the brunt of pain dished out while Wall Street and big business have eaten their lunch.

http://dlvr.it/Rhd77d

http://dlvr.it/Rhd77d

US Consumer Confidence Jumps Most Since 2003 As Hope Soars

US Consumer Confidence Jumps Most Since 2003 As Hope Soars Tyler Durden Tue, 09/29/2020 - 10:07

After August's major disappointment, The Conference Board's Consumer Confidence for September was expected to rebound from its lowest level since 2014. And rebound it did with the headline confidence print screaming higher from 84.8 to 101.8 (smashing expectations of 90.0).

Hope dominated the headline beat:

*

Present situation confidence rose to 98.5 vs 85.8 last month

*

Consumer confidence expectations rose to 104.0 vs 86.6 last month

But, despite the bounce, current conditions remain seriously impaired post-COVID...

Source: Bloomberg

This was the biggest jump since 2003...

Source: Bloomberg

Jobs Plentiful (vs 'hard to get') has jumped back into positive territory for the first time since March, and hopes that the stock market will be higher in 12 months also jumped.

http://dlvr.it/RhbKTX

http://dlvr.it/RhbKTX

Kentucky AG Complies With Order To Release Grand Jury Records From Breonna Taylor Case

Kentucky AG Complies With Order To Release Grand Jury Records From Breonna Taylor Case Tyler Durden Tue, 09/29/2020 - 09:32

The AP just reported that, in a landmark decision that will inevitably heap more scrutiny on the grand jury's decision in the Breonna Taylor case, Kentucky AG Daniel Cameron has agreed to comply with a judge's order to release grand jury proceedings from the case after a juror filed a motion on Monday demanding the materials be released.

According to media reports, the unnamed juror filed the motion on Monday seeking release of the records because they felt Cameron had misled the public during his press briefing announcing the grand jury's decision to charge one of the officers indicted in Taylor's death with wanton reckless for firing gunshots into a neighboring apartment.

Breaking: A member of the Breonna Taylor grand jury just filed a remarkable motion asking a judge to release the entire proceedings of the grand jury. The motion strongly suggests that Attorney General Cameron's public comments contradict what was presented to the grand jury. — Radley Balko (@radleybalko) September 28, 2020

As the tweet above notes, the motion to release the proceedings was filed by a member of the Grand Jury in a motion that suggested the AG's public comments about the case didn't align with the evidence presented to the Grand Jury. It essentially accuses AG Daniel Cameron of manipulating the outcome of the decision by, among other things, limiting the discussion of charges.

During the press conference where Cameron announced the charges, the juror alleges that the AG misrepresented what evidence was shown to the grand jury. It might be an attempt to deflect blame amid a vicious public backlash to the decision. On the other hand, many on the left will likely take it as proof that Cameron tampered in the decision in an attempt to bolster his own political ambitions.

It's worth noting that many legal experts doubted the officers would be charged with murder in Taylor's death due to the fact that her boyfriend fired first. Kentucky has strict 'stand your ground' laws.

Here's the complete motion...

Scanned.motion.gj.Release (1) by Zerohedge on Scribd

...We now wait for the grand jury materials to be released by the AG's office, or leaked to the NYT, whichever happens first.

http://dlvr.it/RhbDHc

http://dlvr.it/RhbDHc

US Home Prices Surge At Fastest Pace Since 2018

US Home Prices Surge At Fastest Pace Since 2018 Tyler Durden Tue, 09/29/2020 - 09:04

After three straight months of deceleration, US home prices re-accelerated in July (according to the latest Case-Shiller home price index data), rising 0.55% MoM (vs +0.1% MoM exp).

The 20-City Composite index surged 3.95% YoY - the best annual gain since Dec 2018.

Source: Bloomberg

Phoenix, Seattle, Charlotte reported highest year-over-year gains among 19 cities surveyed.

New York was the only major city to see MoM decline in home prices.

http://dlvr.it/Rhb5CL

http://dlvr.it/Rhb5CL

Second Woman Accuses Nikola Founder Trevor Milton Of Sexual Abuse, Files Formal Complaint

Second Woman Accuses Nikola Founder Trevor Milton Of Sexual Abuse, Files Formal Complaint Tyler Durden Tue, 09/29/2020 - 07:47

Several days ago we were the first to ponder the question whether Nikola founder Trevor Milton had abruptly resigned from his position as Executive Chairman of the company as a result of imminent #MeToo claims, not just due to allegations raised about the company's business practices raised by Hindenburg Research. It now looks like that could indeed be the case.

On Monday evening, CNBC posted a lengthy article detailing allegations of "sexual abuse" against Milton, by two women who have now filed complaints. One of the two allegations had never been reported on in the past. The new allegation involves a woman who is now 32 years old and is a lawyer, who alleged that Milton "digitally penetrated" her in 2004, when she worked for Milton, who was 22 while she was 15.

“I kind of put that whole scenario of memory in a dark place, locked it up and tried to just forget about it,” the victim told CNBC. “He was in a position of power and he would give me a ride home from that job and this happened at the end of one of the days that I worked there and I was somewhat at his mercy because I couldn’t even go home until he was going to give me a ride home.”

A former friend of Milton's claims that he remembered Milton bragging about the incident. “He told me he fingered her. He kept going on, saying I like young girls and I like virgins because they are naive,” Milton's former friend, Tyler Winona, said.

Trevor Milton's spokesperson said he "strongly denies" the "false allegations” and said that “at no point in his life has Mr. Milton ever engaged in any inappropriate physical contact with anyone.”

Recall, about a week ago, a first woman's claims were reported by The Wall Street Journal after Milton's first cousin, Aubrey Smith, took to Twitter to allege sexual assault that took place in 1999:

On Monday, new allegations about Mr. Milton’s conduct emerged when a woman accused him on Twitter of sexually assaulting her when the two were younger.

Aubrey Smith, who says she is Mr. Milton’s first cousin, claimed in a series of tweets that he inappropriately touched her when she was 15 and visiting Utah for their grandfather’s funeral in September 1999. She says Mr. Milton was 18 years old at the time.

When reached by phone, Ms. Smith confirmed to The Wall Street Journal that she had made the posts on Twitter and said she wanted to go public now as other questions about Mr. Milton’s conduct have surfaced. Another family member also confirmed Mr. Milton is her cousin.

The Wall Street Journal spoke with two people who said that Ms. Smith told them about the alleged incident months afterward.

Seemingly corroborating the first woman's claims, the CNBC story pointed out that while the #MeToo movement was in full force in 2017, Smith took to Facebook to make a post about the alleged assault. The post, now almost 3 years old, said: “When I was assaulted I was 15. I didn’t want to tell anyone, because I figured I should have known better” and that the person “only apologiz[ed] because he was my cousin.”

Both women filed formal complaints in Holladay, Utah, where the alleged assaults took place.

Meanwhile, in a series of Tweets posted late Monday night, Hindenburg Research lambasted the numerous people who are still involved with the Nikola story, including investment bank Cowen, "value investing legend" Jeff Ubben and former GM executive Steve Girsky - all of whom claimed to have done due diligence before working with Milton and Nikola.

"$NKLA's brand has gone from tarnished to toxic," they concluded, asking "Will GM put its 112-year brand at risk for $NKLA stock that will likely be worthless by the time $GM can sell, and for cash that likely won’t be there when it comes time to spend?".

$NKLA's brand has gone from tarnished to toxic.

Mary Barra should answer: Will GM put its 112-year brand at risk for $NKLA stock that will likely be worthless by the time $GM can sell, and for cash that likely won’t be there when it comes time to spend? pic.twitter.com/l9TkMfTIB6 — Hindenburg Research (@HindenburgRes) September 29, 2020

http://dlvr.it/RhZr29

http://dlvr.it/RhZr29

Monday, September 28, 2020

Will Biden 'Corruption' Be Off-Limits In First Debate?

Will Biden 'Corruption' Be Off-Limits In First Debate? Tyler Durden Mon, 09/28/2020 - 21:00

Authored by Frank Miele via RealClearPolitics.com,

Chris Wallace, America is watching!

When the “Fox News Sunday” host takes the stage on Tuesday to moderate the first presidential debate of 2020, he will for 90 minutes be the most important person in the world.

His questions, his demeanor, his raised eyebrow will signal to millions of voters how they are to assess the two candidates — President Donald John Trump and former Vice President Joseph Robinette Biden Jr.

If his questions are piercing for both, if his skepticism is applied equally to both the Republican and Democrat, then all is well in this corner of the world of journalism. But if instead Wallace accuses Trump and coddles Biden, we will have one more instance of media bias, which has become so rampant that President Trump had to christen it with a pet name — Fake News.

Every day, the supposedly professional press corps cozies up to Biden with softball questions (“Why aren’t you more angry at President Trump?” has to be my favorite!) while accusing Trump of being a mass murderer, a racist and a Putin puppet. So conservatives are entirely justified in having low expectations for the debate and for Wallace, who has exhibited symptoms of Trump Derangement Syndrome more than once.

Wallace can ask anything he wants of Trump. I am confident the president will acquit himself admirably, but the litmus test for Wallace playing fair in the debate will be whether or not he asks any hard-hitting questions of Biden — especially about the new Senate report on the corrupt activities of his son Hunter in Ukraine and elsewhere.

If you have heard anything about the Biden report on CNN and MSNBC, or read about it in your newspapers, chances are you came away thinking that Republicans had made up a series of fake charges against the Bidens. “Nothing to see here. Move along.”

The Washington Post, as usual, was at the front of the pack for Fake News coverage. The Post used its headline to focus entirely on Hunter’s position on the board of the corrupt Ukrainian energy company Burisma, and claimed that the report doesn’t show that the cozy arrangement “changed U.S. policy” — as if that were the only reason you would not want a vice president’s son enriching himself at the trough of foreign oligarchs.

The story then spent most of its 35 paragraphs excusing Hunter’s behavior either directly or through surrogates such as Democrat senators, and most nauseatingly by quoting Hunter Biden’s daughter, Naomi, who “offered a personal tribute to her father” in the form of a series of tweets, including the following:

“Though the whole world knows his name, no one knows who he is. Here’s a thread on my dad, Hunter Biden — free of charge to the taxpayers and free of the corrosive influence of power-at-all-costs politics. The truth of a man filled with love, integrity, and human struggles.” Oh my, that’s convincing evidence of innocence of wrongdoing. I imagine she also endorses her grandfather for president, for what it’s worth.

The three reporters who wrote the Post piece also spin the facts like whirling dervishes. They say that the report by Sens. Ron Johnson and Chuck Grassley “rehashes” known details of the matter. They quote Democrats to say without evidence that the report’s key findings are “rooted in a known Russian disinformation effort.”

The following passage in particular shows how one-sided the story is:

“Democrats argue that Johnson has ‘repeatedly impugned’ Biden, and they pointed to his recent comments hinting that the report would shed light on Biden’s ‘unfitness for office,’ as reported by the Milwaukee Journal Sentinel, to argue that the entire investigation was orchestrated as a smear campaign to benefit Trump.”

Using the “shoe on the other foot” test, can you ever imagine a similar statement being made in the Washington Post about the Trump impeachment investigation? Let’s see. How would that go?

“Republicans argue that Rep. Adam Schiff has ‘repeatedly impugned’ Trump, and they pointed to his recent comments hinting that the report would shed light on Trump’s ‘unfitness for office’ to argue that the entire investigation was orchestrated as a smear campaign to benefit Biden.”

Oh yeah, sure! The chance of reading that paragraph in the Washington Post news pages would have been absolutely zero.

Perhaps even more insidious was the decision by the editors to push the most significant news in the report to the bottom of the Post’s story. That is the lucrative relationship that Hunter Biden established in 2017 with a Chinese oil tycoon named Ye Jianming. Biden was apparently paid $1 million to represent Ye’s assistant while he was facing bribery charges in the United States.

Even more disturbing, “In August 2017, a subsidiary of Ye’s company wired $5 million into the bank account of a U.S. company called Hudson West III, which over the next 13 months sent $4.79 million marked as consulting fees to Hunter Biden’s firm, the report said. Over the same period, Hunter Biden’s firm wired some $1.4 million to a firm associated with his uncle and aunt, James and Sara Biden, according to the report.”

Then, in late 2017, “Hunter Biden and a financier associated with Ye also opened a line of credit for Hudson West III that authorized credit cards for Hunter Biden, James Biden and Sara Biden, according to the report, which says the Bidens used the credit cards to purchase more than $100,000 worth of items, including airline tickets and purchases at hotels and restaurants.”

The Post also glossed over payments received by Hunter Biden from Yelena Baturina, who the story acknowledges “is the widow of former Moscow mayor Yuri Luzhkov and is a member of Kazakhstan’s political elite.” What the story doesn’t say is that the payments received by Hunter Biden’s companies while Joe Biden was vice president totaled close to $4 million. Does anyone have even the slightest curiosity why Hunter’s companies received these payments from a Russian oligarch? As Donald Trump Jr. noted, if he had the same record of taking money from foreign nationals, he “would be in jail right now.”

In other words, the headline and the lede of the Washington Post story were entirely misleading. What readers should have been told is that there is a pattern of corruption and inexplicable enrichment in the Biden family that has continued for years and that Joe Biden has turned his back on it.

Seems worthy of the attention of the voters who will determine the nation’s leadership for the next four years. So the most important question at the debate Tuesday night is the following: Will Chris Wallace take the same cowardly path as the Washington Post, or will he demand an answer from candidate Biden as to why influence peddling, conflicts of interest and virtual money laundering are acceptable?

Based on Wallace’s track record, I’m not holding my breath that we will get either the question or the answer, but if we do, I will happily applaud him as the tough-as-nails journalist he is supposed to be.

http://dlvr.it/RhYDrZ

http://dlvr.it/RhYDrZ

Chinese State Media Outlet Throws Support Behind Black Lives Matter

Chinese State Media Outlet Throws Support Behind Black Lives Matter Tyler Durden Mon, 09/28/2020 - 09:50

Authored by Paul Joseph Watson via Summit News,

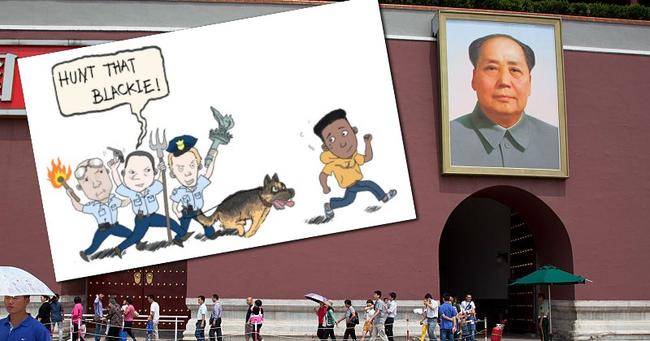

Chinese state media outlet Xinhua has thrown its support behind Black Lives Matter with a cartoon that depicts police officers armed with pitchforks and torches hunting down a black man.

“Statistics show, time and again, that some are disproportionately prejudiced against in the U.S. #FightRacism,” tweeted the official Xinhua News account.

The image shows three white police officers and a dog hunting down an African-American male to the refrain of “hunt that blackie!”

Statistics show, time and again, that some are disproportionately prejudiced against in the U.S. #FightRacism pic.twitter.com/e5HS4R7raL — China Xinhua News (@XHNews) September 27, 2020

Following the death of George Floyd and the explosion of BLM riots and demonstrations that followed, Chinese media and Communist political figures threw their weight behind the movement as a means of criticizing America’s human rights record.

This is pretty rich given that China literally incarcerates dissidents in re-education gulags and harvests the organs of political prisoners.

Respondents to the tweet pointed out the revolting irony.

“So how are the Uighurs doing up in Xinjiang?” asked one.

Another respondent pointed out how China literally removes black people from promos for Hollywood movies.

American poster on the left, ChyNa on the right.

Oh no! Where'd the black actor go?? pic.twitter.com/NioxsGCVIp — Rob Smithson (@RobSmithson6) September 27, 2020

China is one of the most racist countries in the world towards black people.

As this Spectator article documents, even Chinese people with darker skin are treated badly, with children being called “monkeys” if they don’t have a pale complexion.

Racism in China is “so commonplace it can seem almost cheerful,” writes Carola Binney, who spent a year in China teaching English, adding that racism is a “standard undercurrent of public debate.”

* * *

In the age of mass Silicon Valley censorship It is crucial that we stay in touch. I need you to sign up for my free newsletter here. Also, I urgently need your financial support here.

http://dlvr.it/RhWTC2

http://dlvr.it/RhWTC2

Rocket Attacks On Baghdad's Green Zone Stepped Up Amid US 'Warning' It'll Shutter Embassy

Rocket Attacks On Baghdad's Green Zone Stepped Up Amid US 'Warning' It'll Shutter Embassy Tyler Durden Mon, 09/28/2020 - 09:35

Rumors seemed to fly all day Sunday on Mideast social media channels based on unnamed US sources that a major attack on the US Embassy in Baghdad's Green Zone was imminent.

This at the same time it's being widely reported that the State Department is actually considering shuttering the embassy's operations altogether, angry at the Iraqi government's inability to reign in the Shia paramilitary groups likely responsible for repeat mortar and missile attacks on the area.

BREAKING: Local sources in Iraq are reporting of a plot to storm the US Embassy in Baghdad and take hostages. The Green Zone may be evacuated. https://t.co/VDOuPdAJIz — Scott Stedman (@ScottMStedman) September 27, 2020

And now Monday more Katyusha rockets have been launched targeting the embassy, though they are being reported to have landed somewhere in the Green Zone off target.

This after the prior day The Wall Street Journal reported the following:

The Trump administration has warned Iraq it is preparing to shut down its embassy in Baghdad unless the Iraqi government stops a spate of rocket attacks by Shiite militias against U.S. interests, Iraqi and U.S. officials said Sunday, in a fresh crisis in relations between the two allies.

Secretary of State Mike Pompeo delivered the warning in recent calls to Iraqi President Barham Salih and Iraqi Prime Minister Mustafa al-Kadhimi, the officials said. US Embassy in Baghdad, via AP

We doubt the majority of Iraqis will miss the American presence, given in recent years anti-American demonstrations have grown, demanding the end of US troop presence.

Given the US "warning" to Baghdad, it's now much more likely the rocket attacks and rumors of a Benghazi style ground assault upon the embassy complex will grow.