Existing Home Sales Preview: Highest Since 2006 Tyler Durden Tue, 09/22/2020 - 08:24

Submitted by Christophe Barraud

On Tuesday, the National Association of Realtors (NAR) will release the Existing Home Sales (EHS) report for August. According to the Bloomberg consensus, EHS should increase by 2.6% MoM to 6.01M SAAR.

* Proxies confirm that EHS should be close to 6.0M in August, which would be the highest since December 2006.

* Local/state data and different reports also point to a jump of median home sales price amid a continued decline in inventory.

1. Buyers benefited from favorable market conditions

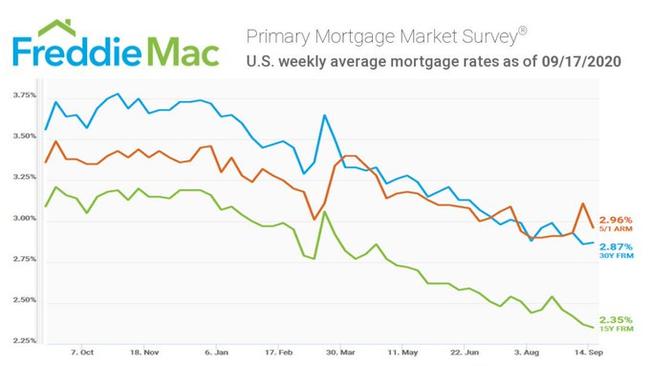

Fundamentals improved with a sharp decline of mortgage rates. According to Freddie Mac, the average for a 30-year fixed-rate loan remained below 2.90%, which is close to the lowest level on record. In this context, Freddie Chief Economist highlighted that “Despite the recession, low rates have spurred first-time homebuyer activity, up 19% in August from July.”

The avg. 30-Yr FRM holds at 2.87% https://t.co/Cj2GH9Tofy

Chief Economist @TheSamKhater: "Despite the recession, low rates have spurred first-time homebuyer activity, up 19% in August from July. This rebound in the housing market comes at a critical time for the economy." pic.twitter.com/ThZSowKoOx — Freddie Mac (@FreddieMac) September 17, 2020

2. Another increase in Existing Home Sales would be coherent with the bounce in Pending Home Sales

As the National Association of Realtors (NAR) noted, “The Pending Home Sales Index (PHS), a leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos, and co-ops. Because a home goes under contract a month or two before it is sold, the Pending Home Sales Index generally leads Existing-Home Sales by a month or two.” In this context, It would be coherent if EHS finally catch up with PHS as suggested by the chart below.

3. Local/state reports confirm that sales kept rising on a YoY basis in August

Local/state figures suggest that national existing home sales (non-seasonally adjusted: NSA) are likely to have risen on a YoY basis in August (second straight increase). There is anecdotical evidence that many households chose to relocate due to coronavirus pandemic with some of them prefering suburbs. Using my sample of local/state data and a seasonal adjustment factor lower than last year (more favorable due to fewer business days), I expect August EHS to increase by ~2.0% (seasonally adjusted: SA).

4. Median home sales price jumped amid a drop in inventory

The latest Redfin report underlined that “The national median home price rose 11% year over year to $328,400 in August—the largest annual increase since February 2014“. In the meantime, “Active listings—the count of all homes that were for sale at any time during the month—fell 22.0% year over year to their lowest level on record in August, the 12th-straight month of declines.” Meanwhile, Adam Contos, CEO of RE/MAX Holdings also highlighted that “The demand for houses is easily eclipsing the available inventory in metro areas across the country. Buyers are moving forward in record numbers, unfazed by inventory challenges and consistently higher prices.”

For our full analysis of the August housing market, read our latest report 📊https://t.co/5SkLuhpCys — Redfin (@Redfin) September 17, 2020

Home sales in August were 🥓 sizzling 🥓!

👉 Check out the RE/MAX National Housing Report for August here:https://t.co/0zADYdlot0 pic.twitter.com/OjXHumqWoI — RE/MAX (@remax) September 17, 2020

http://dlvr.it/Rh6hX7

No comments:

Post a Comment