US Futures Slide After Debate Chaos Tyler Durden Wed, 09/30/2020 - 08:08

US equity futures and most global markets dropped after an chaotic and acrimonious American presidential debate, which CNN's Dana Bash described as a "shitshow" on air, which did little to change voters minds but highlighted the risk of a contested vote in November. Safe assets, such as the yen and dollar also rose as a continued rise in COVID-19 spooked some traders although strong factory surveys boosted China’s markets.

S&P 500 futures were last 0.6% lower, with Dow Jones and Nasdaq 100 futures down by as much as 1%. Asian trading had been choppy rather than outright weak but Europe sank 0.5% early on amid worries too over the steep rises in coronavirus infections across the region again, although a wave of buying managed to bring European markets back to even.

While futures initially rose, they kneejerked lower after the end of the debate as Trump cast doubt on whether he would accept the election’s outcome if he lost.

"What we’ve seen from the debate is the reinforcement that if Biden wins, Trump is not going to accept that," said Chris Weston, head of research at Pepperstone Group Ltd. in Melbourne. “People positioned for an ugly contest afterwards have been validated....I don’t think we were expecting anything else from Trump. He continues to put that contested (result) risk premium back into the market.”

They have since rebounded however, as the first presidential debate offered little trading cues for bond and currency markets, according to Jun Kato, chief market analyst at Shinkin Asset Management, who noted that Trump’s performance was in line with his usual behavior and it was unclear if Biden emerged superior in the debate.

"The debate just added to the confusion about how the election will run," said SEB investment management’s global head of asset allocation Hans Peterson. "But financially it doesn’t change anything."

"The share market normally prefers the incumbent (president) to win,” said Shane Oliver, head of investment strategy at AMP Capital in Sydney. “U.S. futures initially rose, as perhaps Trump delivered some punches, but it wasn’t enough,” he said.

To be sure, the debate was an absolute mess with 69% of people in a CBS poll said they were annoyed with the event, "which featured expletives, name calling, insults and shouting that made it hard to hear what was actually being said."

More to the point, and as we asked if the debate actually matters, Bloomberg's John Authers writes that the debate "appears to have changed little" who shows trading over the last 24 hours on the Predictit contract for which party wins the election. Volume was heavy during the debate, and yet it translated into a just-perceptible improvement for the Democrats, nothing more.

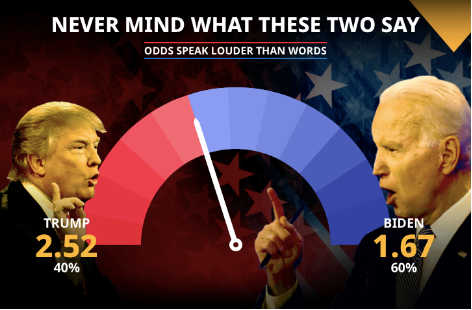

Bookies reported much the same thing; betting markets had been slightly more optimistic for Donald Trump than the prediction markets, but now they are in exact alignment. Like Predictit, the Betfair exchange now puts Biden’s victory chance at 60%. Before the debate, Biden’s odds were 4/5 on (56%). They are now 4/6 (60%). Trump’s odds, if you fancy a bet, widened from 11/8 to 6/4. Biden is ahead but not by the kind of margin that anyone would want to risk a lot of money on.

The presidential debate yielded no clear winner and barely moved the needle in betting markets, which project a narrow Biden victory. Odds maker Smarkets slightly lowered Trump’s chance of re-election to 40% after the debate from 42% beforehand.

As we said last night, and as Authers repeats this morning, Biden succeeded by "surviving the debate" and giving the president one less opportunity to bring him down in future, and while both made statements that might be usable against them, it was hard to hear what either of them were saying for lengthy tracts of the debate. The conclusion: "It’s hard to see how any genuinely undecided voter would have changed their mind on the basis of this."

Perhaps more market moving was the latest Chinese official and Caixin PMI, both of which hit just before China goes on vacation for a week. The September Manufacturing PMIs from both the National Bureau of Statistics (NBS) and Caixin signaled continued solid expansion of manufacturing activity. The NBS non-manufacturing PMI rose in September as well with the services PMI climbing to the highest level since mid-2012. The China NBS purchasing managers’ indexes (PMIs) suggest manufacturing activity continued to expand at a solid pace in September:

* The NBS manufacturing PMI headline index was at 51.5 in September, vs 51.0 in August.

* The NBS non-manufacturing PMI (comprised of the service and construction sectors at roughly 80%/20% weightings, based on our estimates) rose 0.7pp to 55.9 in September on a stronger services PMI. The services PMI climbed to 55.2, the highest level since June 2012.

The Caixin manufacturing PMI released later in the morning came in at 53.0, only slightly lower than 53.1 in August which was the highest level since early 2011. Similar to the NBS manufacturing survey, the Caixin manufacturing survey suggest stronger new export orders, higher employment sub-index and higher input cost pressures. The new export order sub-index in the Caixin manufacturing survey surged to 54.4 in September, the strongest reading since September 2014.

As Goldman concludes, "manufacturing PMIs suggest overall activity continued to recover in September in the manufacturing sector, on the back of persistent strength in exports. Services sector activity recovery has been catching up, as suggested by the higher services PMI under the NBS PMI survey."

Alas, there were less good news on the US jobs front, following several blockbuster layoff announcements. Walt Disney made one of the deepest workforce reductions in not only the Covid-19 era but in history, when it announced it was firing 28,000 workers. Oil giant Royal Dutch Shell said it will cut as many as 9,000 jobs as it struggles with low demand and tries to restructure towards low-carbon energy. Dow also said it would cut 6% of its workforce, while Marathon Petroleum also started layoffs.

* * *

Back to market globally, most of which are headed for their first monthly retreats since March’s meltdown, either deepened losses or pulled back from highs scaled after data showed China’s economic recovery remains on track. MSCI’s broadest index of world shares dropped 0.2% for a 4% September loss. Oil is down just over 10% this month while gold’s 4.1% drop will make it its worst month since late 2016.

Asia had held its ground overnight, led by a 0.8% gain in Hong Kong, though Japan’s Nikkei fell 1.5% and Australia’s S&P/ASX 200 lost over 2%. Chinese property developers gained, led by a 15% jump in Evergrande shares after the heavily-indebted giant reached a deal to ease cash crunch concerns, as noted last night. China’s factory activity expansion accelerated in September, helped by rising export orders.

In Europe, declines in industrial-goods and tech shares outweighed gains in utilities.

In FX, options trade points to a volatile November. Two-month dollar/yen volatility, a gauge of expected moves in the yen, is elevated, and its premium over one-month volatility is near record levels. Major currencies eased against the dollar after the debate, The euro dipped from a one-week high to $1.1736 and the risk-sensitive Australian dollar fell 0.2% to $0.7118, heading for its worst month since March.

In rates, Treasuries barely budged, with yields remaining within a basis point of Tuesday’s closing levels ahead of U.S. data raft including September ADP employment change and 2Q GDP. Yields were higher by less than 1bp at long end, steepening 5s30s by ~1bp; 10-year yields steady around 0.65%, outperforming bunds and gilts by less than 1bp. Price action was choppy but not sustained during first U.S. presidential debate late Tuesday, leaving yields slightly cheaper at long end. The long end may draw support toward end of U.S. trading day from month-end index rebalancing.

In commodities, oil prices fell amid rising concerns about fuel demand as the coronavirus pandemic worsens. Brent crude futures were last down 0.9% at $40.66 a barrel and U.S. crude futures were down 0.7% at $39.00 a barrel. Gold slipped 0.4% to 1,890 an ounce.

Market Snapshot:

* S&P 500 futures down 0.9% to 3,305.50

* STOXX Europe 600 down 0.4% to 360.02

* MXAP down 0.6% to 169.28

* MXAPJ up 0.09% to 553.65

* Nikkei down 1.5% to 23,185.12

* Topix down 2% to 1,625.49

* Hang Seng Index up 0.8% to 23,459.05

* Shanghai Composite down 0.2% to 3,218.05

* Sensex up 0.5% to 38,156.23

* Australia S&P/ASX 200 down 2.3% to 5,815.94

* Kospi up 0.9% to 2,327.89

* German 10Y yield rose 0.4 bps to -0.541%

* Euro down 0.1% to $1.1728

* Italian 10Y yield fell 2.7 bps to 0.648%

* Spanish 10Y yield rose 0.4 bps to 0.229%

* Brent futures down 1.8% to $40.30/bbl

* Gold spot down 0.6% to $1,886.96

* U.S. Dollar Index up 0.3% to 94.16

Top Overnight News from Bloomberg:

* President Donald Trump and former Vice President Joe Biden hurled insults and repeatedly interrupted each other in their first debate, sparring over topics ranging from health care to the economy and their families as moderator Chris Wallace tried mostly in vain to control the conversation

* Trump Sees Wide Vote Fraud That Doesn’t Exist: Debate Fact Check

* Boris Johnson is braced for defeat in Parliament over his controversial plan to re-write the Brexit withdrawal agreement, a blow that could throw negotiations with the European Union into chaos at a critical time

* Japan’s industrial production increased for a third month in August as the economy continued to reopen, though the gains slowed from July’s record jump

* The European Union’s historic 1.8 trillion-euro ($2.1 trillion) budget and stimulus package is in danger of being delayed due to a disagreement among member states about how to enforce the adherence to democratic values, according to a spokesman for the German government

* Italy plans to bring its budget deficit back into line with European Union rules in 2023 after a dramatic increase in spending dictated by the coronavirus outbreak

* Oil held below $40 a barrel on rising concerns that it will be some time before there’s a meaningful recovery in demand

A quick look at global markets courtesy of NewsSquawk

Asian equity markets were mixed with participants indecisive as focus centred on the US Presidential Debate where US President Trump faced off with former VP Biden on a range of topics including COVID-19, the economy, taxes and foreign dealings of former VP Biden’s son. The debate featured plenty of bickering and highlighted no love lost between the candidates with President Trump criticizing Biden’s son and with Biden referring to Trump as a clown on several occasions, while marginal upside was seen in US equity futures early in the debate as the widely viewed front-runner Biden showed a more composed tone with President Trump seemingly disruptive and interrupting Biden and the moderator a few times, which favoured the notion of a Blue Sweep. However, all the gains were later pared at the end of the debate which descended into chaos with plenty of disruptions and President Trump also suggested the idea of a contested election which could last for months. As such, ASX 200 (-2.3%) and Nikkei 225 (-1.5%) were negative with Australia dragged lower by losses in the energy sector and with financials also underperforming, while Tokyo sentiment was lacklustre following Industrial Production data which despite beating expectations, still showed a double-digit percentage contraction Y/Y. Hang Seng (+0.7%) and Shanghai Comp. (-0.2%) were initially both positive on the eve of Golden Week as participants digested better than expected Chinese Official PMI data and although Caixin Manufacturing PMI slightly missed, the data showed new export orders rose by the most in 3 years and the employment gauge returned to growth; however, gains in Shanghai were pared back. Finally, 10yr JGBs traded lacklustre as prices reversed some of yesterday’s gains but with downside stemmed amid the BoJ’s presence in the market today and after the central bank also kept its purchase intentions for October unchanged.

Top Asian News

* CLSA Exodus Deepens as Beijing Tightens Grip, Reins In Pay

* Alibaba Expects First Profit From its Cloud Arm This Year

* Armenian-Azeri Fighting Continues, Ignoring Cease-Fire Appeals

* Japan’s Factory Output Rises for Third Month in August

A relatively choppy session thus far for European stocks, albeit with losses somewhat contained (Euro Stoxx 50 -0.6%), as sentiment was dampened overnight amid the fallout from the US Presidential debate, whilst fresh catalysts during European hours remain scarce. That being said, the EU released their report on rule of law deficiencies which singles out Hungary and Poland – a move which could threaten the swift implantation of the EU Recovery Fund as unanimity is needed to roll out the package. Meanwhile, China opened an antitrust probe into Google (-1.8% pre-market) over market dominance. European bourses see varying degrees of losses, with FTSE 100 (-0.1%) cushioned by a softer Sterling, and Spain’s IBEX (-0.1%) supported by gains in large-cap stocks including Telefonica (+0.6%) after reports said it is mulling the sale of an additional stake in its mobile telephone mast unit Telxius. Thus the telecom sector outperforms, with added tailwinds from gains in Orange (+0.7%), Bouygues (+0.9%) after the French Telecom Regulator said prices for the 5G spectrum are up by EUR 220mln following the first round of auctions, with the latter also buoyed by its disposal of Alstom (-2.2%) shares. IT meanwhile resides on the other side of the spectrum following earnings from Micron (-4.7% pre-mkt) despite beating on both top and bottom line is afflicted more-so on sub-par guidance. As such, Infineon (-1.2%), SAP (-1.2%) and STMicroelectronics (-1.2%) are subdued. Travel and Leisure also resides towards the bottom of the pile amid the ongoing woes for the sector with regards to rising COVID-19 infections. In terms of individual movers, Suez (+6.5%) is a top gainer in the Stoxx 600 after Veolia (+1.8%) upped its offer for the Co. to EUR 18/shr from EUR 15.50/shr. Shell (+0.5%) sees modest gains despite a rather gloomy Q3 update, but with upside potentially on further cost-cutting measures including global job losses of up to 9,000 employees by end-2022.

Top European News

* Damning Report Set to Worsen Spat Over EU’s Jumbo Recovery Fund

* ECB to Consider Allowing Inflation Overshoot, Lagarde Says

* SNB Spent 90 Billion Francs on Interventions as Virus Took Hold

* Merkel’s Old Foe May Finally Get His Chance to Undo Her Legacy

In FX, the Dollar and index by design seem to have found their footing after extending declines amidst all the bickering between incumbent US President Trump and rival Biden overnight. The DXY has revisited 94.000, albeit just within a 94.180-93.789 range and could be seeing late if not last minute rebalancing demand for the end of September and Q3 alongside a touch of safe-haven buying as broad risk sentiment wavers. Ahead, a busy US data schedule including ADP before Friday’s BLS report and more Fed speak via current FOMC voters Kashkari, Bowman and Kaplan.

* CHF/GBP - Lagging fellow G10 currencies, and perhaps surprisingly given the Swiss KOF indicator easily beating consensus and advancing further above the 100.0 mark, while revised UK GDP was not quite as abject as the initial estimates and a degree of Brexit positivity persists following reports that chief EU negotiator Barnier sees an improvement in the atmosphere, more engagement from the UK side and a fresh ’buzz’ in talks. However, the Franc is back under 0.9200 and Cable has tested support ahead of 1.2800, as Eur/Gbp consolidates above 0.9100. For the record, nothing new whatsoever from BoE’s Haldane – see headline feed at 9.30BST for bullets and a link to the full speech.

* NZD/AUD - In contrast to the above, recoveries in NZ business sentiment and the outlook for activity, not as weak as forecast Aussie building approvals and better than expected Chinese PMIs that are helping the YUAN claw back losses vs the Greenback towards 6.8100, are all keeping the Antipodes afloat. Nzd/Usd has been over 0.6600 and Aud/Usd up to 0.7150, albeit off peaks as their US counterpart continues to regain poise.

* JPY/CAD/EUR - The Yen remains rangebound vs the Buck and flanked by decent option expiry interest from 105.60-70 (1.1 bn) to 105.15-00 (1.3 bn) following moderately firmer than anticipated Japanese ip data, while the Loonie is still attempting to contain losses around 1.3400 ahead of Canadian monthly GDP and the Euro is striving to maintain 1.1700+ status in the face of stronger sell signals vs the US Dollar.

* SCANDI/EM - Little reaction to Sweden’s NIER upgrading its 2020 jobless rate projection or a reduction in Norges Bank daily FX purchases for October, as Eur/Sek straddles 10.5400 and Eur/Nok holds off 11.1100+ highs on the aforementioned single currency retracement. Elsewhere, EMs are correcting higher after recent heavy depreciation vs the Usd, and even the tormented Rub and Try as trouble across the Armenian-Azeri border rumbles on.

In commodities, crude futures remain softer in early European hours as the rising COVID-19 cases continue to weigh on demand prospects for the complex, with some added pressure for the lackluster sentiment across markets following the US debate. Price saw another leg lower on reports that Beijing is said to be preparing an antitrust investigation into Google, in a sign that US-Sino relations are getting no better. Elsewhere, Norway's Industri Energi and Safe Labour unions said its workers will not go on strike after agreeing on a wage deal, but Lederne Labour union said its workers will go ahead with strikes and will potentially escalate the situations at today’s meeting. This could cut the country's oil output by some 470k BPD, according to the Norwegian Oil and Gas Association. WTI Nov resides just sub-39/bbl whilst Brent Dec sees itself marginally above USD 41/bbl. Precious metals meanwhile succumb to the firmer Buck, with spot gold around the USD 1880/oz mark having had drifted from a high of USD 1899/oz; spot silver underperforms but remains north of USD 23.50/oz (vs. high USD 24.32/oz). LME copper prices edge lower in tandem with losses across the stock markets coupled with a firmer Dollar, whilst Dalian iron ore futures rose some 5% amid rekindled fears of supply disruptions.

US Event Calendar

* 8:15am: ADP Employment Change, est. 649,000, prior 428,000

* 8:30am: GDP Annualized QoQ, est. -31.7%, prior -31.7%

* 9:45am: MNI Chicago PMI, est. 52, prior 51.2

* 10am: Pending Home Sales MoM, est. 3.1%, prior 5.9%; Pending Home Sales NSA YoY, est. 17.6%, prior 15.4%

DB's Jim Reid concludes the overnight wrap

I’m a proud father this morning. One of the twins came home from nursery yesterday with a big badge pinned on him, rewarded for an achievement. As I got closer to it to see what it was for I wondered which advanced skill was being recognised. Had he counted? Had he recognised a word? Had he sung in tune or perhaps been thoughtful towards another child? No, his badge simply said on it “well done for not shouting”. To be fair our twins are so loud that any moment they are not screaming is an achievement and the nursery obviously now feel the same way.

Talking of screaming and shouting, welcome to the post US Presidential debate break out room just a couple of hours after it came to an end. We discussed in our CoTD yesterday (Link here ) how irrelevant these debates have been over the last 40-50 years to candidates’ electoral chances. Well this isn’t stopping us from making last night’s debate the headline story even if it’s more of a show than anything else. Remember polling suggested Trump lost all three debates comprehensively in 2016 and snap polling by YouGov last night suggested Biden won with 48% and Trump with 41% - not far off the current poling averages. A CNN snap poll had a much bigger win for Biden but at this stage you have to be wary of sampling issues.

In a raucous debate that was indeed full of shouting, it is unclear that either President Trump or Vice President Biden changed the trajectory of the election last night. The President came into the night down -6.8% in the fivethirtyeight.com national polling average while trailing in many of the battleground states, and we will track how polls change in the next few days. There was very little substance in the debate and almost no new information proffered. The story of the debate will likely surround the President’s consistent interruption, though Mr Biden was not able to stay above the fray and traded insults at times with Mr Trump. Acrimony ruled.

Outside of the debate, we have seen China’s official September PMIs overnight with both the manufacturing (at 51.5 vs 51.3 expected) and non-manufacturing (at 55.9 vs. 54.7 expected) beating consensus expectations and reaffirming the message that the country’s recovery remains on track aided partly by strong exports. In details of the manufacturing PMI, new export orders climbed to 50.8 (vs. 49.1 last month), marking the first time it has printed above 50 this year while the new orders index also rose to 52.8 (vs. 52.0 ). Overall, the official composite PMI printed at 55.1 (vs. 54.5 last month). Alongside, the official PMIs we also saw China’s Caixin manufacturing PMI which came in a touch softer (0.1pt) than expectations at 53.0.

The Hang Seng (+1.18%) and Shanghai Comp (+0.45%) are trading up this morning following the PMI beat. Other markets in the region are mostly trading lower with the Nikkei (-0.84%) and Asx (-1.82%) both down while India’s Nifty (-0.05%) has opened weak. South Korea’s markets are closed for a holiday. Futures on the S&P 500 are also trading weak at -0.67% following the Presidential debate and European futures are pointing to a weak open (Stoxx 50 -0.44% and Dax -0.38%). Meanwhile, oil prices are trading down c. -1%. Elsewhere, Micron Technology said overnight that it has recently halted shipments to China’s Huawei. The company also announced a cut in its capital spending plans and warned about weaker demand from some corporate customers and forecast possible oversupply in a key market next year. Shares of the company fell -3.9% in afterhours trading due to this. In terms of other overnight data, Japan’s September retail sales printed at +4.6% mom (vs. +2.0% mom expected).

Ahead of the debate, risk assets fell back yesterday as markets were unable to maintain the strong momentum from Monday, with negative news on the coronavirus seemingly outweighing more positive consumer confidence numbers. By the close, equities had lost ground on both sides of the Atlantic, with the S&P 500 (-0.48%) and the STOXX 600 (-0.52%) both falling back. Energy stocks led the moves lower thanks to falling oil prices, as both Brent Crude (-3.30%) and WTI (-3.23%) underwent major falls, while banks also struggled to follow-through on their strong start to the week.

Starting with Covid, yesterday saw some negative news from the US, with the daily positivity rate in New York City rising above 3% yesterday for the first time in months, according to Mayor de Blasio. The threshold is a significant one, as de Blasio has said that the city’s schools will shut if the positivity rate is above 3% on a rolling 7-day average basis, though for now that still remains at 1.38%. The US overall has seen hosptilisations plateau at 30,000 after falling from nearly 60,000 in the middle of the summer. With cases again increasing marginally in the US over the last 2-3 weeks attention will shift to hospital capacity as the weather grows colder in the northern US. Meanwhile in Germany, Chancellor Merkel recommended that private parties were limited to 25 people, and in the UK a record 7,152 cases were reported yesterday, which also drove the 7-day average above 6,000. There was some weekend catch up to this data though. Best to look at the 7-day rolling number in the table below for the best state of play.

There was some good news overnight on the pharmaceutical front. A Regeneron Covid-19 antibody cocktail, still in early stage trials, saw positive data that it helped reduce viral levels and improved symptoms. At the same time, data from phase 2 testing showed that the Moderna vaccine triggered a “strong antibody” response in adults, with “severe” side effects in one volunteer. Meanwhile, in a sign of the pandemic’s lasting impact on the hospitality industry, Walt Disney said overnight that it is laying off 28,000 employees in its US resort business, marking one of the deepest workforce reductions of the pandemic. The cuts span the company’s theme parks, cruise ships and retail businesses and will include executives; however, 67% of those being terminated are part time employees.

In the world of central banks, Dallas Fed president Kaplan indicated that he did not expect the US economy to get back on track from the pandemic until late-2022 or even 2023. While not advocating for higher rates, Kaplan said that the Fed should remain accommodative but that may not mean keeping rates at zero. He warned that there were “real costs” to near-zero rates for elongated periods of time, specifically it can “adversely impact savers, encourage excessive risk taking and create distortions in financial markets." We also heard from New York Fed president Williams who is not worried about inflation, though acknowledged they would deal with it if it came. Williams had a similar time frame for full recovery as Kaplan of 3 years and again seemed to call on fiscal stimulus help, saying that the recovery needed “all the official support it can get.”

And there was some more positive news on the prospects of US fiscal stimulus, with Speaker Pelosi’s deputy chief of staff tweeting that Pelosi and Treasury Secretary Mnuchin spoke yesterday morning on the phone for around 50 minutes, and agreed to speak again today. There will be a floor vote in the Senate on a relief package of some sort later this week according to reports, either the Democrat-written $2.2 trillion fiscal bill or a more bipartisan effort if one can come together. In spite of a lack of stimulus, data from the Conference Board showed US consumer confidence index experiencing the biggest monthly jump in 17 years, with a stronger-than-expected rise to 101.8 in September.

Staying with yesterday, there were some significant headlines from Europe, as a spokesperson for the German presidency of the Council of the European Union said on the recovery fund that “The timetable is in danger of slipping. A delay of the EU budget and the Recovery fund is becoming increasingly likely”. Remember that the package needs to be agreed unanimously, but there’ve been disputes over the possibility of rule-of-law conditions, and yesterday a letter was published from Hungarian PM Orban which called for the Commission Vice President for Values and Transparency to be sacked, after she called Hungary a “sick democracy”.

Over in the fixed income sphere, sovereign bonds rallied yesterday as investors moved out of risk assets. Perhaps the biggest headline came from Italy, where the country’s 30yr yield fell to a fresh all time record low of 1.74%. However there was a strong performance across the board, with yields on 10yr bunds (-1.7bps), OATs (-1.5bps) and BTPs (-2.7bps) all falling back. 10yr Treasury yields also fell -0.3bps, their 4th successive move lower. This came as the US dollar fell -0.41% Tuesday, to start the week with its worst 2-day performance since 31 Aug, however the currency is still set to record its first monthly gain since March.

On Brexit, the 9th round of negotiations began yesterday between the UK and the EU in Brussels, with Bloomberg reporting that the UK has submitted 5 confidential draft legal texts. Negotiations continue until Friday, and the question this week will be whether enough progress can be made for the two sides to be able to reach agreement by Prime Minister Johnson’s self-imposed deadline of October 15, when a summit of EU leaders takes place.

Wrapping up with some of Europe’s data from yesterday, German inflation fell to a 5-year low of -0.4% in September, which was below the -0.1% reading expected and will only add to concerns about weak price pressures in the Euro Area. That said, the European Commission’s economic sentiment indicator for the Euro Area rose for a 5th straight month in September, up to 91.1 (vs. 89.0 expected). Finally in the UK, consumer credit data showed that net borrowing was weaker-than-expected in August, coming in at £0.3bn (vs. £1.5bn expected).

To the day ahead now, and the highlights include an array of central bank speakers, including ECB President Lagarde, chief economist Lane, and the ECB’s Muller, Rehn and Kazimir. Otherwise, there’s also the Fed’s Bowman, Bullard, and Kashkari, along with the Bank of England’s chief economist Haldane. In terms of data, we’ll get the preliminary September CPI readings from France and Italy, the September change in unemployment from Germany, while from the US there’s the third reading of Q2 GDP, August’s pending home sales, the MNI Chicago PMI for September and the ADP employment change for September.

http://dlvr.it/RhfnQ8

No comments:

Post a Comment