America Runs Low On Chicken. Blame Surging Demand And Labor Shortages

By now, Americans are pretty used to living in a third-world country where supply chain disruptions have produced soaring prices for certain foods or even created shortages. It seems like every week, another company is complaining about surging prices for raw materials or shortages. So far, consumers have yet to lash out, but the next nationwide shortage materializing could do just that.

Bloomberg reports a massive chicken shortage could be developing as fast-food chains have already reported shortages. KFC says it's struggling to keep up with soaring demand as supplies are tightening. At 750 Bojangles locations, the chain is suffering a "system-wide shortage" of chicken.

The most popular meat in the US was broiler chicken, at about 96.4 pounds per capita in 2020. So any shortage and or price surge would easily upset tens of millions of Americans.

COVID has resulted in a demand surge for chicken. McDonald's Corp. and KFC, owned by Yum! Brands Inc. reported this week that fried chicken products were selling like hotcakes. There is no direct evidence why chicken demand at fast-food shops is soaring - but one can assume that with millions of Americans still out of work and can barely afford to eat, they're going buck wild with their stimulus checks at cheap fast food joints.

"Demand for the new sandwich has been so strong that, coupled with general tightening in domestic chicken supply, our main challenge has been keeping up with that demand," Yum Chief Executive Officer David Gibbs told investors on a Wednesday.

McDonald's said this week that its new chicken sandwich line is "far exceeding expectations."

Bloomberg notes poultry companies have been struggling to keep up with demand from fast-food chains. According to Pilgrim's Pride Corp., the second-biggest US chicken producer, they can't expand capacity due to labor shortages.

Under a Biden administration, millions of people are getting paid more to sit on their couch and play Xbox or trade crypto than actually find a job. This is already having significant implications on the labor market recovery and the economic recovery as a whole.

Wingstop Inc.'s chairman, Charles Morrison, warned:

"Suppliers are struggling just as many in our industry are, to hire people to process chicken, thus placing unexpected pressure on the number of birds that can be processed and negatively affecting the supply of all parts of the chicken in the US, not just wings."

America is running low on chicken, and a mass shortage appears to be brewing.

Google search term "chicken shortage" has exploded to new highs as people across the country panic search why there's no more chicken at their favorite fast food shops.

So maybe, just maybe, a combination of huge demand and labor shortages at poultry houses creates a massive chicken shortage that could freak out millions of people.

People on Twitter are not happy about the shortages.

I can deal with not being able to breath through my nose but @Bojangles going through a chicken supreme shortage makes me draw the line — Taylor Gallyon (@taylor_gallyon) April 29, 2021

I just heard about the supreme shortage & I’m upset. @Bojangles fix this🥺 — Erica Koenig (@ericaaakoenig) April 29, 2021

Chip shortage, chicken shortage, housing shortages, and many other shortages. Shortages are used to raise consumer prices. What is sad its working. — Cal (@kkalverta) April 30, 2021

We are having a chicken shortage. Vitamin shortage , cat food shortage among others

Even some bare shelves for dog food — StillWaters777 (@stillwaters777) April 30, 2021

That’s a National chicken wing shortage & I don’t know how to feel.... I might pass away lol — Kakez 🐺 (@WolfKayy) April 30, 2021

Is it time to panic hoard chicken? Tyler Durden Fri, 04/30/2021 - 15:30

http://dlvr.it/Rynjgh

Friday, April 30, 2021

Biden Bans Travel From India Amid COVID Crisis As Vaccine Supplies Run Dry

Biden Bans Travel From India Amid COVID Crisis As Vaccine Supplies Run Dry

The COVID-19 situation in India has continued to worsen late this week as the country reported another daily record of nearly 400K (386.6K) newly confirmed COVID-19 cases on Friday, while more than 3K new deaths were recorded.

And while multiple Indian states close vaccination sites due to shortages of supplies, Reuters reports that President Joe Biden is expected to impose new travel restrictions on India starting Tuesday that will bar most non-US citizens from entering the US, according to White House sources.

The new restrictions are being imposed on the advice of the CDC "in light of extraordinarily high COVID-19 case loads and multiple variants circulating in India,” the official said. A formal announcement is expected on Friday and the policy will take effect on Tuesday, May 4.

The policy means most non-US citizens who have been in one of those countries - and now India - within the last 14 days are not eligible to travel to the US China and Iran are also both covered by the policy.

Biden in January issued a similar ban on most non-US citizens entering the country who have recently been in South Africa. He has also reimposed an entry ban on nearly all non-US travelers who have been in Brazil, the UK, Ireland and 26 countries in Europe that allow travel across open borders.

Meanwhile, India - the country that has more vaccine-producing capacity than any other in the world - has reportedly run out of vaccines, leaving residents who signed up for a jab unable to get one.

The shortage is undermining a plan to ramp up and widen inoculation from Saturday. Mumbai's government announced that 94 vaccination centers in the city would be closed from Friday through Sunday due to "non-availability of vaccine stock." Shortages cropped up in other places, including New Delhi and other states.

Only about 9% of its 1.4 billion people have had a dose. India has struggled to increase capacity beyond 80 million doses a month due to lack of raw materials and a fire at the Serum Institute, which makes the AstraZeneca vaccine.

Of course, while Indian states have run out of vaccines, many states in the US are watching unused jabs pile up.

Total deaths have surpassed 200K this week and cases are nearing 19MM, nearly 8MM new cases since February alone as mutant strains and a number of "super spreader" events - political rallies and Hindu religious celebrations - are believed to have triggered the latest run-up in cases. Medical experts say real numbers may be five to 10 times higher than the official tally. Patients have been begging for spaces in hospitals while oxygen tanks are scarce and prized.

Other countries have imposed similar travel restrictions on India, including the United Kingdom, Germany, Italy and Singapore, while Canada, Hong Kong and New Zealand have suspended all commercial travel with India. Tyler Durden Fri, 04/30/2021 - 15:15

http://dlvr.it/RynglD

http://dlvr.it/RynglD

Dogecoin Is The Perfect Currency For The United States Of America In 2021

by Michael Snyder, The Economic Collapse Blog: If you wanted to design a perfect currency for the farce that our financial system has become, you couldn’t do better than Dogecoin. It was created as a joke, it has no real value, but investors are feverishly gobbling it up as if it was the greatest investment […]

http://dlvr.it/RynCXN

http://dlvr.it/RynCXN

Biden’s Tax Cuts Won’t Hurt the Rich, but They Will Hurt You

by Jeffrey Folks, American Thinker: Like those looters in Portland, Seattle, and other U.S. cities, progressives in Washington think the property of others is theirs for the taking. They control a majority in both house of Congress and the presidency, so they believe they have the right to take whatever they wish. They have plans to eliminate […]

http://dlvr.it/RymyKm

http://dlvr.it/RymyKm

Exposed: The Myth Of "Efficient Markets"

Exposed: The Myth Of "Efficient Markets"

Authored by James Rickards via The Daily Reckoning,

What took Wall Street so long to figure out something I’ve been saying for months?

Six months ago, even before the presidential election in November, I began warning my readers that Joe Biden was going to double the capital gains tax.

It wasn’t a difficult prediction. Biden said so himself in his campaign website as one of a long list of policy proposals.

Of course, the mainstream media didn’t report this because they were all-in for Biden and were determined to beat Donald Trump (remember how they covered up the Hunter Biden laptop report?).

The media were careful to cover-up any Biden policies that might prove unpopular with voters. Still, Democratic Party progressives knew about the plan and were all for it.

One Simple Rule

My rule for making policy forecasts is simple. If a politician tells you he’s going to do something, believe him.

Policies don’t drop out of the sky. They’re the result of intense internal debate and compromise by competing factions. Once a policy makes it to a candidate’s website, you can bet they will try to deliver.

This doesn’t mean that every proposal becomes law because there can be opposition in Congress and the courts. However, it does mean the politician will work to achieve his stated goals.

With the White House and both houses of Congress in the Democrat’s hands, the odds of this doubling of the capital gains tax becoming law look very good.

Despite my forecasts (which fortunately left my readers well-prepared), Wall Street didn’t seem to pay attention until last Thursday, when the Dow Jones index plunged 210 points in a matter of hours after the Biden tax plan was formally announced.

That’s a good example of how so-called “efficient markets” are not efficient at all.

Not so Efficient After All

Mainstream economists have insisted for decades that markets are highly efficient, and they do a nearly perfect job of digesting available information and correctly pricing assets today to take account of future events based on that information.

In fact, nothing could be further from the truth. Markets do offer valuable information to analysts, but they are far from efficient.

Markets can be rational or irrational. Markets can be volatile, irrationally exuberant, or in a complete state of panic depending upon the emotions of investors, herd behavior, and the specific array of preferences when a new shock emerges.

If markets were so efficient, why was Wall Street surprised when it was obvious to anyone paying attention that Biden was going to raise the capital gains tax?

The capital gains tax increase information had been there for all to see for six months, but it took a press release to get Wall Street to sit up and take notice.

It should have been priced in long before, and the announcement just would have confirmed market expectations.

So the next time you hear about efficient markets, take it with a large grain of salt.

But my forecast from six months ago was wrong in one respect.

Even Worse Than I Thought

I said the tax rate on capital gains would almost double from 20% to 39.6%. It turns out the rate will actually be 43.4% once a 3.8% investment income surtax is added on top. That surtax is a holdover from Obamacare.

If one were to add state and local income taxes, the combined rate on capital gains could exceed 50%, depending on the jurisdiction.

Of course, capital gains taxes are imposed on investments you make from after-tax dollars, so even the initial investment has already been taxed. And the corporations whose stock you buy pay corporate income tax too.

When those burdens are included, you’re lucky to get even 25% of your gains back net of taxes. This will be a headwind to stock markets for the foreseeable future.

The big question is, is the stock market in a bubble?

A $100 Million Deli?

When I first saw a recent story about a deli in New Jersey that was worth $100 million, I couldn’t believe it.

I assumed the deli must have a big-ticket franchising deal with McDonald’s or Subway to expand to 1,000 locations under the original name brand. That type of deal might justify a sky-high valuation for a one-store operation.

But, no, there was no franchise deal or other licensing deal that might explain the price. It’s just a deli with about $35,000 in annual sales.

As one analyst said, “The pastrami must be amazing.” Does anyone in their right mind think a deli with $35,000 in annual sales could be worth $100 million?

Well, it turns out that the owner of the deli created a company called Hometown International, and its shares trade over-the-counter. Recently, investors have bid up the stock price from $9.25 per share to $14.00 per share, giving the deli company a market capitalization of $113 million.

Hoping For a Greater Fool

But this story is not really about delis or pastrami. It’s about market bubbles and ridiculous valuations that can result when retail investors bid up stocks in the hope that a greater fool will pay them even more when they cash out.

In these situations, the market capitalization becomes completely detached from fundamental value, projected earnings or any other tool used in securities analysis.

It’s just a bubble with inevitable losses for the last buyers. But does that mean you should sell all your stocks now because the bubble will pop any day now?

No, not really. Bubbles can last longer than many believe because there is a continual flood of new buyers who hope that they won’t be the last ones to run for the exits.

The bigger issue is whether this kind of bubble in one stock indicates a broader market indices trend. The Dow Jones Industrial Average, the S&P 500 and the NASDAQ Composite are all at or near all-time highs.

But this does not automatically mean the stock market indices are in bubble territory, although, many objective metrics, including the ratio of market cap to GDP and the Shiller CAPE price-earnings ratio, indicate that is the case.

No One Rings a Bell at the Top

Saying that markets are overvalued is not the same as saying they’re ready to crash.

It will take some external shock such as higher interest rates, a geopolitical crisis, or an unexpected bankruptcy of a major company to bring markets back to earth.

We know that such events do occur with some frequency. But, it’s probably not a good idea to short the market, because it could go even higher. That’s the way bubbles work. No one rings a bell at the top. There’s no precise formula to tell you the day they’ll pop.

So, I’m not suggesting that you sell everything and head for the hills. Having said that, it’s a good idea to reduce your exposure to stocks, diversify with cash and gold and just bide your time.

When the crash comes, you’ll be greatly outperforming those who are all-in with stocks – including delis.

Then we’ll see how efficient markets really are. Tyler Durden Fri, 04/30/2021 - 08:02

http://dlvr.it/RymHJk

http://dlvr.it/RymHJk

Thursday, April 29, 2021

Outlet Funded by Soros, Gates, and Google Provides China With Steady Stream of Content

by Luis Miguel, The New American: A media outlet that has been the recipient of funding and written contributions from George Soros, Bill Gates, the United Nations, and Google is involved in “media partnership” deals with various Chinese state-run media outlets. The outlet in question, Project Syndicate, was founded in 1995 and has been lauded by the […]

http://dlvr.it/Ryjpky

http://dlvr.it/Ryjpky

34 Million Fewer People Watched Biden Speech Compared To Trump's First SOTU

34 Million Fewer People Watched Biden Speech Compared To Trump's First SOTU

Authored by Paul Joseph Watson via Summit News,

34 million fewer people watched Joe Biden’s speech last night compared to Donald Trump’s first State of the Union address.

Ratings show that 11.6 million watched Biden’s speech compared to 45.6 million who watched Trump’s first address to Congress in 2018.

The lowest number of Americans who watched a Trump State of the Union throughout his term in office was 37 million.

Biden barely managed to beat the viewership for this year’s Oscars (9.8 million), even though that set a new record low for the Academy Awards

On the bright side, Biden beat the lowest-rated Oscars viewing of all time by 2 million 🤷♂️ — Greg Price (@greg_price11) April 29, 2021

Biden’s speeches and public appearances have become notorious for their poor ratings and lack of engagement, unless you’re talking about the overwhelming number of people who downvote videos on the official White House YouTube channel.

As a reminder, Biden officially received 81 million votes during the presidential election, the most a presidential candidate has ever received and over 11 million more than Barack Obama achieved in 2008.

Respondents to the announcement of the viewing figures expressed their surprise, given Biden’s overwhelming ‘popularity’ in 2020.

“Most popular president of all time,” commented one.

“Just wait, Dominion is finding more viewers as we tweet,” joked another.

“Biden’s speech to Congress was not only boring, but the chamber was mostly empty. Even the Democrats who showed up couldn’t stay awake,” remarked another.

* * *

Brand new merch now available! Get it at https://www.pjwshop.com/

* * *

In the age of mass Silicon Valley censorship It is crucial that we stay in touch. I need you to sign up for my free newsletter here. Support my sponsor – Turbo Force – a supercharged boost of clean energy without the comedown. Also, I urgently need your financial support here. Tyler Durden Thu, 04/29/2021 - 15:20

http://dlvr.it/RyjpDZ

http://dlvr.it/RyjpDZ

Trump To Restart MAGA Rallies As Early As May, Calls Potential 2024 GOP Opponent ‘Total Loser’

from ZeroHedge: Former President Donald Trump is preparing to resume MAGA rallies as early as May, according to CNN, and told podcast host Dan Bongino on Wednesday that he would wait until after the 2022 midterm races to announce whether he’ll run for president again. According to CNN, Trump and his advisers have been in […]

http://dlvr.it/RyjJlX

http://dlvr.it/RyjJlX

US Investigating 'Havana Syndrome' Directed Energy Attack Near White House

US Investigating 'Havana Syndrome' Directed Energy Attack Near White House

Since 2017 controversy and speculation has abounded over the legitimacy of the so-called "Havana syndrome" story, which involved some 50 diplomatic officials working at the US Embassy in Cuba coming down with strange illnesses and symptoms - from headaches to vomiting to 'brain trauma' - which was blamed on high tech covert 'sonic attacks' by nefarious actors. Officials were quick to blame either Russian intelligence or Cuban operatives in what sounded like a wild James Bond style bit of futuristic espionage.

Last week the allegations returned to national media spotlight after defense officials said they believe Russia is likely behind "directed energy" attacks on US troops in northeast Syria. Apparently some US troops occupying the country began reporting "flu-like symptoms" which caused the DoD to investigate possible linkage to microwave or directed energy weapons on the battlefield of Syria. Politico reported that "officials identified Russia as a likely culprit, according to two people with direct knowledge of the matter."

And now CNN is reporting what is perhaps the most bizarre and outlandish instance of this yet - a 'sonic attack' which sickened a top administration official while standing just outside White House grounds. Via NBC

"That incident, which occurred near the Ellipse, the large oval lawn on the south side of the White House, sickened one National Security Council official, according to multiple current and former US officials and sources familiar with the matter," CNN writes.

The report says the symptoms experienced by the unidentified official were consistent to those reported in Havana at the embassy years ago. The original Havana Syndrome incident involved personnel saying they experienced everything from vomiting to concussions to extreme nausea to chronic headaches and even minor brain injuries. However, analysts and scientists have remained deeply divided on the issue, with speculation ranging from high pitched sounds from crickets or even mass hysteria causing the illness.

At the same time the US-funded National Academy of Sciences concluded that "microwave radiation" was most likely the source of the strange illnesses in Havana. Should this be the case, what makes it hugely alarming for US national security is that it's invisible, soundless, and thus undetectable.

So theoretically it could be used even against the White House without the Secret Service or US intelligence and law enforcement knowing in real-time. But despite years of this being investigated, including top generals most recently briefing Congressional leaders wherein they pointed the finger at Russia, there's yet to be any hard evidence presented to the public.

Below is an image of the Ellipse, officially known as President's Park South, located directly to the South of the White House...

NEWS: The US is investigating a possible incident that occurred near the Ellipse in November, where an NSC official was sickened with symptoms similiar to "Havana Syndrome" that have affected dozens of US personnel abroad, w/ @KatieBoWillCNN https://t.co/KVgSKNwpuV — Jeremy Herb (@jeremyherb) April 29, 2021

Apparently this latest White House incident was not the first suspected 'sonic attack' in the area, as CNN details:

Multiple sources familiar with the matter tell CNN that while the Pentagon and other agencies probing the matter have reached no clear conclusions on what happened, the fact that such an attack might have taken place so close to the White House is particularly alarming.

...In a separate 2019 episode, a White House official reported a similar attack while walking her dog in a Virginia suburb just outside Washington, GQ reported last year.

The October 2020 GQ report was somewhat comically titled, "The Mystery of the Immaculate Concussion".

It detailed that "According to three sources familiar with the incident, a White House staffer was hit while walking her dog in Arlington, Virginia. Her dog started seizing up. Then she felt it too: a high-pitched ringing in her ears, an intense headache, and a tingling on the side of her face."

The mystery of the Havana Syndrome: https://t.co/W71FyzW7jb pic.twitter.com/CruEWuBYU9 — The New Yorker (@NewYorker) November 11, 2018

Example of a US Air Force experimental directed energy weapon:

Again, despite the wealth of what is perhaps anecdotal evidence and testimony, and with at this point the original Havana episode serving as the clearest evidence yet of a large group of people saying they experienced bizarre unexplainable symptoms all at once, it remains that US intelligence and defense officials have failed to produce known evidence that Russia or a US enemy zapped Americans with an advanced microwave weapon. Tyler Durden Thu, 04/29/2021 - 11:15

http://dlvr.it/Ryj1mL

http://dlvr.it/Ryj1mL

Wednesday, April 28, 2021

CEO Of $2 Billion Startup Fired For "Microdosing" On LSD At Work

CEO Of $2 Billion Startup Fired For "Microdosing" On LSD At Work

Psychedelic drugs have been a hot topic in the financial press this week. Between the hallucinatory experiences of a German billionaire, and the market debut of 'magic mushroom' company MindMed eliciting talk of a "shroom boom", most of that coverage has been refreshingly positive. But that changed Tuesday morning when Bloomberg reported that the CEO of a $2 billion startup has been unceremoniously fired for "microdosing" with LSD at work.

The board of Marketing startup Iterable dismissed the CEO, Justin Zhu, for taking LSD before a meeting back in 2019. Zhu told Bloomberg he had "experimented" by taking a small amount of the drug (a practice known as "microdosing") in an attempt to boost his focus. Looking back, he probably should have kept this information to himself.

Because in an email to staff, co-founder Andrew Boni said Zhu’s dismissal was over unspecified violations of "Iterable’s Employee Handbook, policies and values."

As a result, the board replaced Zhu with Boni, who will take over as CEO, according to Bloomberg's sources. A spokeswoman for the San Francisco-based company didn't respond to calls for comment.

But in a note obtained by Bloomberg, Boni attacked his former partner, writing that Zhu's "behavior also undermined the board’s confidence in Justin’s ability to lead the company going forward..." While he praised Zhu as a "world-class innovator and creative thinker" whose "vision, creativity and passion will remain a core part of our culture", Boni said Zhu's cavalier abuse of drugs on the job was too much for the board to overlook.

LSD has been growing in popularity among the startup set ever since the late Apple co-founder Steve Jobs told his biographer that "taking LSD was a profound experience, one of the most important things in my life." The FDA is currently trying to assess whether MDMA, known on the street as "ecstasy", can be used to effectively treat PTSD.

Iterable was founded in 2013 and has grown quickly, attracting customers such as DoorDash and Zillow. The firm's backers include Index Ventures, Charles River Ventures and Viking Global Investors. According to Pitchbook, Iterable is valued at $2 billion.

We suspect Zhu will depart with a golden parachute, leaving him plenty of space for self-exploration...or listening to old Grateful Dead bootlegs...before starting his search for a new gig. Tyler Durden Wed, 04/28/2021 - 15:05

http://dlvr.it/RydqV1

http://dlvr.it/RydqV1

"Vaccidents" now wrecking roadways with stroked-out vaccine takers who lose brain function behind the wheel

(Natural News) As post-vaccine deaths are now ravaging India and Brazil, across the United States people are noticing a sudden surge in automobile accidents on roadways. People are driving off the roads and striking trees. They’re veering into other cars for head-on collisions. And they are apparently losing cognitive function while behind the wheel. Clif...

http://dlvr.it/RydqRs

http://dlvr.it/RydqRs

“It’s About To Get Much Worse”: Supply Chains Implode As “Price Doesn’t Even Matter Anymore”

from ZeroHedge: The number of container ships stuck at anchor off Los Angeles and Long Beach is down to around 20 per day, from 30 a few months ago. Does this mean the capacity crunch in the trans-Pacific market is finally easing? Absolutely not, warned Nerijus Poskus, vice president of global ocean at freight forwarder […]

http://dlvr.it/RydM6n

http://dlvr.it/RydM6n

Goldman Is Surprised At How "Narrow" Biden's $1.8TN American Families Act Is: Full Reaction

Goldman Is Surprised At How "Narrow" Biden's $1.8TN American Families Act Is: Full Reaction

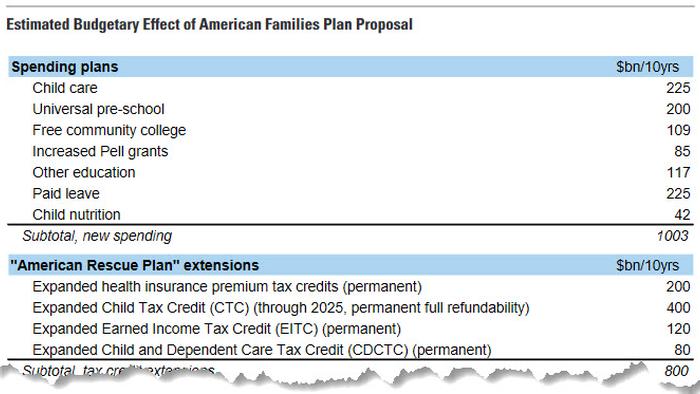

Earlier today, we previewed Joe Biden’s American Families Plan (AFP) which provides $1.8 trillion over ten years in new benefit spending and tax credits.

Commenting on the proposal, Goldman economist Alec Phillips writes that he was surprised by the focus of the released plan which is "somewhat narrower than we had initially expected several weeks ago, as it omits any housing or Medicare proposals and focuses solely on child care and nutrition,education, paid leave, and extending a number of the tax credits Congress enacted earlier this year."

On the payment side, the White house proposes $1.5 trillion over ten years in additional taxes to cover most of the cost, with a capital gains tax hike contributing to this, but in today’s release the White House has provided few new details on the topic. The $303BN funding balance will come from an increase in the US budget deficit.

Biden will present the plan when he addresses a joint session of Congress at 9pm ET tonight.

Below we list the main points from the plan as summarized by Goldman:

1. The spending would be spread roughly evenly over the next ten years.

The White House release provides no details on the timing of spending, but judging by the types of spending President Biden proposes, it appears that the spending will be spread roughly evenly over the next ten years. An exception would be the expanded child tax credit that Congress recently enacted, which Biden proposes to extend only through 2025 (he proposes to make permanent a less expensive aspect of recent expansion). However, in essentially all other cases, the White House appears to propose to make these policies permanent. Some policies appear to phase in over several years (e.g., the paid leave proposal). The plan would increase federal spending (including tax credits) by around 0.75% of GDP in 2023-2024, and by a bit less in 2022, according to Goldman calculations.

2. The proposed savings from IRS enforcement are likely to look smaller once they reach Congress.

The White House estimates the proposal would produce $1.5 trillion in additional revenue, of which $700bn would come from closing the gap between what taxpayers owe and what they pay. The White House proposes to require banks to increase reporting of financial flows to the IRS, and to increase funding for IRS enforcement activities (media reports indicate this would raise $80bn over ten years, but the proposal does not include a figure). But according to Goldman, Congressional Democrats might have to look elsewhere to gain this much revenue. A reporting requirement is probably beyond what is allowed to be included in a reconciliation bill, and congressional budget scorekeepers seem unlikely to credit additional IRS funding with $700bn in new revenue. (Last year, CBO estimated a $40bn/10yr bump in funding would produce $100bn in additional revenue, for total savings of $60bn.)

3. The proposed capital gains tax hike also looks likely to face resistance.

President Biden proposes to tax capital gains and dividends at the top marginal rate (39.6%) and to tax gains greater than $1mn at death (under current law, the basis of an asset steps up at death to the transfer value, so the recipient has no taxable gain upon receiving it). The Tax Policy Center has estimated such a policy would raise around $370bn/10yrs. Even with exceptions for active businesses and even with a long payment schedule for any payments due—a recent congressional proposal would allow such taxes to be paid over 15 years — it seems likely that at least a few Democrats will raise concerns about the impact on family businesses and farms. In our view, a capital gains tax increase looks more likely to come in around 28% and to eliminate the step-up in basis at death but to stop short of actually taxing those gains upon death.

4. Health care is notably absent from the proposal.

The proposal includes an extension of the recently expansion of health insurance subsidies, but it omits the other Biden campaign proposals, like lowering the Medicare eligibility age to 60. The proposal also omits a substantial drug pricing reform proposal that the House passed last year and which might have cut Medicare drug spending by as much as $500bn over ten years. The omission is likely due to expected resistance from a few congressional Democrats whose support would have been necessary to pass the bill, and the fact that some of the proposal also omits the Medicare eligibility change. That said, there is still a chance that Congress will include more incremental savings measures in the upcoming legislation.

5. Congress will want to add and subtract.

At a minimum, we expect that congressional Democrats will want to add a reinstatement of the deduction for state and local taxes (SALT) that congressional Republicans capped in 2017. The policy would cost on the order of $80bn per year, or $400bn to reinstate it through 2025, after which it is already set to revert to the pre-2017 policy. Since most of the benefit would go to those with very high incomes, it looks unlikely that there will be sufficient support to fully reinstate it. Instead, we expect Congress to raise the cap to something like $50k,or reinstate it for taxpayers under a certain income threshold, which could be done at a fraction of the cost. Congressional Democrats might also have to choose among some of the new spending proposals, since Senate rules prohibit reconciliation bills from adding to the deficit after ten years. If the capital gains tax hike is scaled back or the IRS enforcement funding raises less revenue than the White House claims, some provisions will need to be made temporary or dropped from the bill.

6. The legislative strategy should be clearer in a few weeks.

Goldman outlined three potential scenarios for passing the White House proposal:

* pass one large reconciliation bill comprising the American Jobs Plan and the American Families Plan;

* pass two smaller reconciliation bills dealing with those separately, or

* pass bi-partisanbills dealing with traditional infrastructure and, separately, manufacturing and R&D incentives, with the remainder passing in a single reconciliation bill.

All 3 options appear to be under discussion. The congressional committees that handle infrastructure are assembling legislation they hope to pass under regular order (i.e., with bipartisan support), as are the committees dealing with manufacturing and R&D. They appear to be aiming for passage by late May or June.

7. The details will probably remain in flux until Q3.

Over the next several weeks, additional information on these proposals (particularly the scope of potential tax increases) is likely to come in three forms. First, informal comments in the media from centrist Democrats might clarify where the boundaries are on some issues. Second, at some point in May, the Biden Administration should submit a formal budget to Congress (so far the White House has sent only a partial proposal). This is also likely to include more technical detail on the proposed tax increases. Third, the committees with jurisdiction over some of the relevant issues—such as the tax-writing committees—are likely to begin to release details of their legislation that builds on the Biden proposal. However, the most important step in the process won’t come until July or September, which is when we expect the Senate to debate and pass the reconciliation bill. This process can be unpredictable, since congressional Republicans are apt to offer hundreds of amendments to the bill, some of which centrist Democrats might feel political pressure to support. Tyler Durden Wed, 04/28/2021 - 11:07

http://dlvr.it/Ryd3wF

http://dlvr.it/Ryd3wF

Tuesday, April 27, 2021

Democrats are pushing to pack Supreme Court with left-wing activists, financed by "dark money" donors trying to buy our government

(Natural News) Once upon a time, the most cynical Americans among us often quipped that our government “is the best that money can buy.” But nowadays, it’s not just the cynical who say that. Increasingly, ordinary Americans are conceding, publicly and privately, that we have completely lost control over any aspect of government because so much...

http://dlvr.it/RyYsR9

http://dlvr.it/RyYsR9

Juror in Chauvin trial proves that America is now governed by mob rule: Forget getting a fair shake ever again if you're on the "wrong side" of an issue

(Natural News) The rule of law in America was already under assault before the trial of former Minneapolis police officer Derek Chauvin began in recent weeks, but after it was over, it has become crystal clear that the institution itself is no longer valid. Chauvin absolutely does bear responsibility in many respects for the death...

http://dlvr.it/RyYsMv

http://dlvr.it/RyYsMv

'Health Experts' Encourages Permanent Mask Mandates As CDC Lifts Outdoor Restrictions

'Health Experts' Encourages Permanent Mask Mandates As CDC Lifts Outdoor Restrictions

Update (1220ET): Just as Fauci had hinted at, fully vaccinated people can venture outdoors without masks, according to updated guidance from the Centers for Disease Control and Prevention issued Tuesday. The guidance applies to fully vaccinated individuals, which health officials classify as two weeks after the second dose of the Pfizer or Moderna vaccines and two weeks after the single-dose Johnson & Johnson vaccine.

Vaccinated people can unmask while:

*

Doing physical activities outdoors alone or with members of your household like walking, running, hiking or biking.

*

Attending a small outdoor gathering either with fully vaccinated people or a mixture of vaccinated and unvaccinated people.

*

Dining at an outdoor restaurant with friends from multiple households.

*

Current guidelines on vaccinated people indoors and traveling still applies.

"CDC cannot provide the specific risk level for every activity in every community, so it is important to consider your own personal situation and the risk to you, your family and your community before venturing out without a mask," CDC director Rochelle Walensky said in prepared remarks.

Stay sane America...

Staying healthy while staying sane is hard. pic.twitter.com/h6q6gwZFqZ — Seth Dillon (@SethDillon) April 27, 2021

* * *

Authored by Paul Joseph Watson via Summit News,

Health experts are insisting that the CDC should implement permanent mask mandates even after the COVID-19 pandemic ends.

Despite many areas of the U.S. beginning to open up again and anecdotal evidence suggesting a significant drop in the number of people routinely wearing masks, some are loathe to go back to normal.

“We have seen benefits of masking that occur,” Health Director Dr. Nicole Alexander-Scott told The Providence Journal.

“So there may be a new form of normalcy where masks don’t necessarily have to go away.”

His sentiments were echoed by Dr. Leonard A. Mermel, medical director of epidemiology and infection control at Rhode Island Hospital, who said making people wear masks all the time was worth it to stop the spread of other viruses aside from COVID-19.

“Within the Lifespan system we are seeing far fewer of all the respiratory viruses than we are used to seeing at this moment in the calendar year… So it’s impressive: the COVID preventative strategies are having an impact on other respiratory viruses, which just makes sense: they spread in a similar fashion,” said Mermel.

“It would not surprise me if that became a recommendation from the CDC,” he said.

“It’s a pretty low price to pay to try to reduce the risk to oneself and to particularly loved ones who may be at particular risk of these sorts of infections causing harm,” he added.

Other experts have argued that the impact of viruses will only be more severe in the long run if human immune systems are prevented from being tested by new infections, harming herd immunity.

Medical professionals are still attempting to have mask mandates become part of the “new normal” despite Dr. Anthony Fauci acknowledging yesterday that it would be “common sense” for the CDC to start relaxing measures.

“I mean, if you are a vaccinated person, wearing a mask outdoors, I mean, obviously, the risk is minuscule,” Fauci told ABC’s This Week.

“Obviously the risk is really very low, particularly if you’re vaccinated,” he added.

Meanwhile, a new study by the Massachusetts Institute of Technology has found that there is “little benefit” to 6 meter social distancing rules and that people who are as much as 60 feet away face the same risks.

“The distancing isn’t helping you that much and it’s also giving you a false sense of security because you’re as safe at 6 feet as you are at 60 feet if you’re indoors,” MIT engineering professor Martin Bazant told CNBC.

* * *

Brand new merch now available! Get it at https://www.pjwshop.com/

* * *

In the age of mass Silicon Valley censorship It is crucial that we stay in touch. I need you to sign up for my free newsletter here. Support my sponsor – Turbo Force – a supercharged boost of clean energy without the comedown. Also, I urgently need your financial support here. Tyler Durden Tue, 04/27/2021 - 12:22

http://dlvr.it/RyYMSG

http://dlvr.it/RyYMSG

Futures Hit All Time High In Sleepy, Overnight Session

Futures Hit All Time High In Sleepy, Overnight Session

For the second day in a row, U.S. equity futures are starting the day barely changed, up just 0.1% and at new all time highs, alongside Treasury yields as earnings reports added to positive sentiment regarding an economic recovery in the developed world despite some disappointment in the latest TSLA results. The S&P 500 and the Nasdaq closed at record levels on Monday, with the tech-heavy Nasdaq completing a full recovery from its 11% correction that began in February.

At 07:15 a.m. ET, Dow E-minis were up 12 points, or 0.04%, S&P 500 E-minis were up 4.5 points or 0.1% to 4,184, trimming earlier gains that pushed the Emini as high as 4,192.5, and Nasdaq 100 E-minis were up 20 points, or 0.14%.

Russell 2000 futs led advances in the premarket as yields rose across the curve, while staying below recent peaks. The dollar increased for the first time in three days.

Some notable pre-market movers:

* Gamestop soared 8% in early New York trading after completing an “at-the-market” equity offering. Amazon Inc., which will release its profit report this week, also climbed.

* Tesla dropped about 3% in premarket trading after it marginally beat analysts’ expectations for quarterly revenue, helped by a jump in environmental credit sales to other automakers and liquidating some bitcoins.

* Cryptocurrency-exposed stocks rose in premarket as Bitcoin extended its bounce back from recent lows and after Tesla renewed its commitment to the token.

Four out of five S&P 500 Index companies that have announced results so far have either met or beaten expectations, and after soft results from Tesla on Monday, all eyes will be on Microsoft and Alphabet which are due to report after trading closes. Apple, Facebook and Amazon.com are slated to report later in the week. The five companies combined account for about 40% of the S&P 500’s market capitalization. While equity investors offered a sluggish response to the reports, it only served to highlight traders’ lofty expectations than doubt over the outlook. Some of the names reporting earnings Tuesday include Alphabet, Invesco, MSCI and Visa.

“Muted stock-price reaction to the robust numbers is largely due to already elevated expectations going into the reporting season,” strategists led by Mark Haefele, chief investment officer at UBS Global Wealth Management, wrote in a note. “The strong results give us greater confidence that (U.S.) corporate profits will grow more than 30% in 1Q.”

In Europe, the Stoxx Europe 600 slipped 0.2% as of 10:37 a.m. in London, with travel and leisure stocks rising the most among sectors. Here are some of the biggest European movers today:

* Evolution Gaming shares jump as much as 11.1% after the company topped both revenue and margin estimates, with Live Casino reaching a record high growth rate, Morgan Stanley (overweight) says after the company’s 1Q earnings report.

* Michelin shares fall as much as 3.3% in Paris and the French tiremaker is the day’s worst-performing stock on the Stoxx 600 Automobiles & Parts Index as analysts note an in-line 1Q sales update and see limited changes to consensus.

* Stratec shares rise as much as 16.1%, the most in just over a year, after the automation solutions company reported 1Q results that Commerzbank says were a strong beat, with newsflow expected to remain positive.

* DSV Panalpina shares soar as much as 9.9% to a record after the Danish company reported 1Q results that exceeded expectations, prompting higher FY guidance. DSV also announced the $4.1b acquisition of Agility Logistics, a move welcomed by analysts.

* EDF shares rise as much as 6.6% in Paris following a report that a deal on the energy group’s reform is close, which Barclays says is likely to viewed “very positively.” France and the European Commission agree they need to “go fast” in their talks over the reorganization of EDF, Le Figaro reported, citing an unnamed person close to the matter.

In Asia, equities benchmarks in Shanghai and Taiwan climbed, while peers in Japan, Hong Kong and South Korea slipped, as Asian stocks headed toward their first decline in four trading sessions with investor sentiment weighed down by the resurgence of Covid-19 cases and China’s widening internet crackdown. Japan was among the worst performers, sending the Topix Index down by 0.8%. An analyst at SMBC Nikko Securities is wary about the country’s domestic demand as it repeatedly entered into states of emergency to control the pandemic. Political uncertainty also put investors on edge given that Prime Minister Yoshihide Suga faces weakening support. Also dragging down Asia’s benchmark was Chinese tech heavyweight Tencent, after the country’s antimonopoly probe into Meituan cast a shadow on other internet bellwethers. That said, Meituan erased an earlier decline of as much as 2.8%, rebounding to close up 2.6%. Meanwhile, the health care sector dropped 1.3%, set to be the biggest loser on the MSCI Asia Pacific Index on Tuesday. China’s drug maker Wuxi Biologics Cayman Inc. was one of the biggest decliners, as the stock sank after shareholders sold holdings worth $1.5 billion. “Asia-Pacific markets remain jittery about surging coronavirus cases in India and new state-of-emergency measures in Japan,” said Margaret Yang, a strategist at DailyFX. “Investors digested mixed earnings from Tesla and Huarong’s credit downgrade, both of which weighed on sentiment.” However, India stocks rose for a second day on optimism the U.S. decision to offer vaccine support will aid the nation’s effort to control the world’s largest surge in coronavirus infections.

Japanese stocks fell as the nation’s relatively slow vaccination rollout left investors with few incentives to pick up shares. Electronics makers and chemical-related companies were leading drags on the Topix, which dipped back below the closing level from Friday when the gauge capped its worst weekly rout since February. SoftBank Group and Shin-Etsu Chemical helped push down the Nikkei 225 Stock Average. Shares held losses after the Bank of Japan left its main policy levers unchanged while cutting its price forecast for this year as the nation enters a renewed virus emergency. Investor sentiment remained weak despite a two-day rally on Wall Street that lifted U.S. shares to a record amid solid corporate earnings and confidence that the Federal Reserve will remain accommodative. “Japan being slow in responding to the coronavirus outbreak is serving as a reason for the market’s move,” said Fumio Matsumoto, chief strategist at Okasan Securities Co. in Tokyo. “But it’s more because the performance of Japanese equities has become dull that foreign investors are losing their interest in local stocks.” Investors also remained reluctant to buy shares amid signs of weakening support for Prime Minister Yoshihide Suga. Losses in three special elections for parliamentary seats over the weekend have left the leader in search of a way to quickly boost support or risk joining a long list of short-serving premiers. The result “could possibly be seen as cracks in the wall for Suga and his administration,” said Takeo Kamai, head of execution services at CLSA Securities Japan Co. in Tokyo. “With how the government has been handling the Covid situation -- from the state of emergencies, the vaccination process to the Olympics -- clearly the people are disgruntled.”

Meanwhile, the latest GDP data this week are expected to show growth accelerated to an annualized 6.8% in the first quarter. A Conference Board measure Tuesday may show U.S. consumer confidence surged for a fourth successive months to the highest level since March 2020. That said, such reports aren’t shifting the Federal Reserve’s highly accommodative stance, with the central bank expected to keep policy unchanged at this week’s meeting.

In rates, Treasury yields were cheaper by more than 1bp across long-end of the curve after futures drifted lower during Asia session and European morning. Price action and volumes were muted as Japan’s Golden Week holiday nears. 10-year yield around 1.58% is ~1bp cheaper on the day; gilts broadly keep pace with bunds little changed. Treasury’s 7-year note sale at 1pm ET concludes a compressed auction cycle ahead of Wednesday’s FOMC decision.

In FX, the Bloomberg Dollar Spot Index climbed for the first day in three after slipping to a two-month low on Monday, and the U.S. currency advanced against all its Group-of-10 peers; the euro extended a loss in European trading. The pound fell the most in nearly a week against a stronger dollar, as allegations of sleaze continued to swirl around the U.K. government. Sweden’s krona largely shrugged off the Riksbank which underlined its commitment to keeping monetary stimulus in place, as it pointed to a “slightly brighter” economic outlook but warned that the pandemic “is not over”. The yen slipped as Bank of Japan’s new forecasts showed Haruhiko Kuroda will fail to reach stable 2% price growth during his term. The Australian dollar pared a decline as gains in oil and iron ore helped revive demand for commodity currencies.

In commodities, oil and the dollar also rose. Copper led the Bloomberg Commodity Index higher, as the growth-sensitive metal extended a rally on the U.S. administration’s plans for a large infrastructure package. Oil climbed after OPEC+ projected a strong recovery beyond near-term demand destruction from India’s Covid-19 surge.

Looking at the day ahead, there are an array of earnings releases to watch out for including Microsoft, Alphabet, Visa, Eli Lilly, Texas Instruments, UPS, Amgen, Starbucks, Raytheon Technologies, General Electric and 3M. Data highlights from the US include the Conference Board’s consumer confidence indicator for April, the FHFA house price index for February and the Richmond Fed’s manufacturing index for April. Central bank speakers include Bank of Canada Governor Macklem and the ECB’s Hernandez de Cos.

Market Snapshot

* S&P 500 futures up 0.1% to 4,184.25

* STOXX Europe 600 little changed at 440.25

* German 10Y yield rose 0.4bps to -0.251%

* Euro down 0.2% to $1.2061

* Brent Futures up 0.8% to $66.15/bbl

* Gold spot down 0.2% to $1,778.60

* U.S. Dollar Index up 0.24% to 91.03

* MXAP down 0.4% to 208.32

* MXAPJ little changed at 702.48

* Nikkei down 0.5% to 28,991.89

* Topix down 0.8% to 1,903.55

* Hang Seng Index little changed at 28,941.54

* Shanghai Composite little changed at 3,442.61

* Sensex up 1.0% to 48,885.83

* Australia S&P/ASX 200 down 0.2% to 7,033.83

* Kospi little changed at 3,215.42

Top Overnight News from Bloomberg

* Central bankers worldwide will be watching the Wednesday decision of the Federal Reserve for signals on timing of QE taper

* China’s local authorities have slowed the pace of debt sales to finance infrastructure projects this year, evidence of a gradual tightening of fiscal policy as the government shifts its focus toward risk control

* The Fed is expected to announce it will begin trimming its $120 billion in monthly asset purchases before the end of the year as the U.S. economy recovers strongly from Covid-19, according to economists surveyed by Bloomberg

* Prime Minister Mario Draghi has just a few days to refine what he calls a “historic” plan to rescue Italy’s economy from the pandemic and fix long-lasting structural weaknesses, with 261.1 billion euros ($315.6 billion) of chiefly European Union funds

* France and Germany support the U.S. proposal of a 21% minimum tax on multinational companies, French Finance Minister Bruno Le Maire and his German counterpart Olaf Scholz told Le Figaro and Die Zeit in a joint interview released on Tuesday

* Insurers, pension systems and high-grade credit managers in the U.S. and Europe are buying bigger amounts of junk-rated debt to offset shrinking yields, forcing high-yield investors to jostle for allocations of BB rated bonds -- the safest and largest part of their class with 60% of the market

* The U.K.’s sale of long-dated debt couldn’t have come at a better time. Solid over-subscription rates in recent offerings and juicy yields suggest demand for gilts maturing in 2051 on Tuesday is going to be healthy. Supply, meanwhile, promises to be limited after the U.K. pared bond sale plans for the fiscal year on Friday, an added boon for investors

Quick look at global markets courtesy of Newsquawk

Asia-Pac stocks failed to take impetus from the mostly positive close and fresh record levels stateside, whereby the regional bourses remained cautious heading into the looming risk events and amid ongoing COVID-19 concerns. ASX 200 (-0.2%) was pressured with the index dragged lower by underperformance in tech and industrials but with losses stemmed as the mining-related sectors were kept afloat by the recent surge in copper and iron ore prices, while M&A newsflow provided some support with Bingo Industries underpinned after it entered into scheme implementation deed regarding the AUD 2.3bln buyout offer from MIRA and Tabcorp was also lifted after it received a proposal valued at AUD 3.5bln from Entain. Nikkei 225 (-0.5%) was subdued amid the ongoing state of emergency for key areas and unsurprising BoJ policy announcement although the downside was cushioned by a softer currency. Hang Seng (-0.1%) and Shanghai Comp. (U/C) conformed to the uninspired mood initially in-spite of a surge in Industrial Profits for March which was likely due to base effects and with sentiment also dampened by crackdown concerns for the tech sector after China’s market regulator launched an anti-monopoly investigation into Meituan. However, HSBC shares were a notable mover with gains of around 2% following strong Q1 earnings; and the Shanghai Composite did recoup this earlier losses by the close. Finally, 10yr JGBs languished after the prior day’s retreat beneath the 151.50 level, with demand hampered after T-note futures slightly pulled back and following the lack of fireworks at the BoJ policy announcement where the central bank refrained from any policy tweaks but lowered the current fiscal year Core CPI estimate, as expected.

Top Asian News

* Macquarie Buys Australian Waste Firm Bingo for $1.76 Billion (2)

* HSBC Signals It May Have to Hike Pay in Asia Amid Talent War

* Kotak Mahindra Shares Fall as India Caps Founder-CEOs’ Term

* Hong Kong to Reopen Bars, Nightclubs to Vaccinated People

Major bourses in Europe have been drifting lower (Euro Stoxx 50 -0.4%) following yet another uninspiring cash open in what is seemingly the quiet before the storm as earnings are set to pick up pace and the FOMC looms. State-side, futures are relatively flat with the RTY eking ahead as participants await the US entrance alongside a slew of corporate updates. Back to Europe, the region sees no standout performers, although the UK’s FTSE 100 (+0.1%) is kept afloat amid earnings from heavyweights HSBC (+1.9%) and BP (+1.1%), with the former topping its revenue and profit forecasts and announcing ECL release of USD 400mln vs a charge of USD 3bln last year. Meanwhile, BP is bolstered by all-around firm metrics alongside the announcement of a USD 500mln share buyback in Q2, whilst its CEO said a pre-COVID level dividend could be on the table next year. Sectors in Europe are mixed with no overarching theme. Travel & Leisure reside as the top performer – with reports suggesting that UK Transport Secretary Shapps has called for a meeting between G7 counterparts at the June 11th summit to form a global travel system that would form international standards for 'green list' countries accepted digital vaccination/test proof as a condition of entry. Further, Sweden’s Evolution Gaming (+10%) provides the sector with tailwinds post-earnings. On the flip side, the Auto sector lags amid the ongoing supply shortage coupled with some pre-market downside for post-earnings Tesla (-2.5%). Further, the financial sector is the red despite HSBC’s gains as UBS (-2.7%) shares are pressured after reporting a USD 744mln hit in relation to the Archegos default. In terms of individual stocks, earnings-related movers include ABB (+2%). Novartis (+1%), Novozymes (8%) and Maersk (+1.6%). Elsewhere, Entain (+0.5%) sees modest gains after submitting a revised AUD 3.5bln bid for Tabcorp.

Top European News

* DSV Agrees to Buy Agility’s Logistics Unit for $4.1 Billion

* Hungary Shifting Billions in Funds Decried as ‘Theft’

* Putin’s Drive to Ditch Dollar Picks Up as Exports Move to Euros

* Draghi Bets 261 Billion Euros to Redesign Italy’s Economy

In FX, the Dollar index has now climbed above the 91.000 level that was proving elusive after a narrow miss at 90.989 on Monday, but whether it can sustain gains above and the close higher remains to be seen given chart resistance in the form of the 100 DMA and 21 WMA at 91.025 and 91.070 respectively vs a 91.072 peak thus far. However, the Greenback continues to outpace low yielders and perhaps more encouragingly has also clawed back some lost ground against high beta, commodity and cyclical currencies that started the week so well. Moreover, the Buck is holding up well considering impending month end rebalancing flows that are unusually negative for April, according to Citi’s hedging model with a 1.7 SD seen only 5% of the time since 2004. Ahead, US consumer confidence and the 7 year note auction after somewhat mixed 2 and 5 year results yesterday could keep Treasury yields on a firmer footing before attention reverts to the FOMC tomorrow.

* SCANDI - Firmer oil prices appear to be helping the Nok stay close to 10.0000 vs the Eur, but the Sek remains below 10.1000 in wake of the latest Riksbank policy meeting where rates, QE and the projected repo path were all left unchanged, as low inflation pressures countered a slightly better assessment of the economic outlook – see headline feed at 8.30BST for more details, analysis, initial market reaction and a link to the full statement. Meanwhile, Swedish data may also be weighing on the Crown that is now slipping towards 10.1550, with unemployment rising in March and the trade surplus narrowing.

* NZD/CHF/AUD - The Kiwi has derived little in the way of added impetus following the reopening of NZ markets from the long ANZAC Day weekend, as Nzd/Usd fades on the 0.7200 handle and Aud/Nzd stays elevated nearer 1.0800 than 1.0750 in the run up to trade data. Nevertheless, the Aussie is also waning vs its US counterpart after relinquishing 0.7800+ status and eyeing Q1 CPI for some independent direction to supplement or offset underlying support via copper and other base metals. Elsewhere, the Franc is still tracking external moves in the main, around 0.9150 against the US Dollar and 1.1050 vs the single currency.

* CAD/GBP/EUR/JPY - All conceding ground to the firmer Greenback recovery, with the Loonie back below 1.2400 ahead of comments from BoC Governor Macklem that could revive its hawkish vibes, while Sterling, the Euro and Yen are striving to hold above 1.3850, 1.2050 and 108.50 respectively, latter largely shrugging off the on hold BoJ. Note also, Eur/Usd will be looking for some technical traction via the 100 DMA close to the half round number if not leverage from the Eur/Gbp cross that is probing 0.8700 again, while Usd/Jpy should be capped by decent option expiry interest at the 108.75 strike (1.4 bn) if 108.50 is cleared convincingly.

In commodities, WTI and Brent front month futures eke mild gains as participants gear up for today’s JMMC (13:00BST/08:00EDT) in what was a last-minute change to the schedule, with the OPEC+ meeting still currently set for tomorrow according to OPEC’s website. As a reminder, the JMMC only makes recommendations rather than policy decisions. Nonetheless, today could see a flurry of sources – with market expectations skewered towards no change in quotas – however, it’s worth noting that OPEC+ has surprised markets at most meeting this year thus far. Aside from OPEC headlines, participants will be eyeing the weekly Private Inventory data as a scheduled catalyst. Further, there has been reports that an oil ship has reported an oil leak off Saudi’s Yanbu port, although later reports suggested this was not an attack. Further, a cargo vessel reportedly rammed into a tanker carrying 1mln barrels off the coast of Qingdoa in China. However no immediate price action was seen in wake of these reports. WTI resides off best levels now under the USD 62.50/bbl mark (vs range 61.91-62.74/bbl) while its Brent counterpart trades on either side of USD 66/bbl (vs range 65.66-66.44/bbl). Elsewhere, spot gold and silver are uneventful within recent ranges in the run-up to the FOMC announcement tomorrow. Meanwhile, copper continues to turn heads as LME prices eye USD 10,000/t to the upside. Analysts at ING note that the relative strength in LME vs Shanghai copper has led to an open export arbitrage for some players, which could deter some speculative buying in London in the very short term.

US Event Calendar

* 9am: U.S. FHFA House Price Index MoM, Feb., est. 1.0%, prior 1.0%

* 9am: U.S. S&P CS Composite-20 YoY, Feb., est. 11.80%, prior 11.10%

* S&P/Case-Shiller US HPI YoY, Feb., no est., prior 11.22%

* S&P/CS 20 City MoM SA, Feb., est. 1.10%, prior 1.20%

* 10am: U.S. Conf. Board Consumer Confidence, April, est. 113.0, prior 109.7; Expectations, April, no est., prior 109.6; Present Situation, April, no est., prior 110.0

* 10am: U.S. Richmond Fed Index, April, est. 22, prior 17

DB's Jim Reid concludes the overnight wrap

It’s always fun to come downstairs for an afternoon cuppa whilst WFH. There’s usually a surprise or a crisis to watch unfold. However yesterday I was greeted by the blowing up of about the fifth blow up pool (via Amazon) since lockdown started. The other four had irreparable punctures and only one caused by Bronte’s claws. This one has an impressively large blow up slide. However I can’t help thinking that an actual swimming pool will end up being cheaper at this rate.

There are yet to be any real punctures in the global risk balloon at the moment and ahead of tomorrow’s Federal Reserve meeting and a raft of corporate earnings releases this week, global equities resumed a gentle upward march yesterday. Both the S&P 500 (+0.18%) and the MSCI World index (+0.34%) reached new all-time highs. We’ll have to wait and see if these upcoming events might throw this off course, but positive news on potential travel arrangements this summer helped travel-sensitive stocks outperform, as cyclicals more broadly led the moves higher on the back of growth optimism on either side of the Atlantic. Indeed, a key New York Times report from the weekend that we mentioned yesterday, where European Commission President von der Leyen said that vaccinated US tourists would be able to travel to the EU, helped the STOXX 600 Travel & Leisure index to climb +1.76%, well ahead of the performance of the broader STOXX 600, which was only up +0.26%.

Optimism on the coming recovery sent copper prices (+2.47%) to their highest level in nearly a decade, whilst bitcoin (+10.7%) staged a big rebound from its recent declines in its own best day since early February. Tech stocks had a strong day too, with the NASDAQ (+0.87%) similarly reaching a record high by the close. Small-cap stocks still outperformed to send the Russell 2000 up +1.15%. Under the surface, there was a rotation from safer/defensive industries such as household products (-1.33%) and food staples (-1.26%) into risker and more cyclical industries such as semiconductors (+1.53%), banks (+0.71%) and retailers (+0.68%). After the close, we got the first big earnings release of the week from Tesla. The most valuable car maker showed a record profit last quarter, while announcing plans to ramp up production. However shares slid just over -3% in after-market trading as the company declined to offer delivery estimates and concerns grow about competition in the EV market. One interesting note was that the automaker registered a $101 million gain from selling 10% of their bitcoin holdings over the quarter, which accounts for $0.25/share of the $0.93/share reported EPS. Today’s main earnings highlights will include Microsoft and Alphabet, both of which are also after the US close.

Asian markets are trading weaker this morning with the Shanghai Comp (-0.54%) underperforming while the Nikkei (-0.13%), Hang Seng (-0.15%) and Kospi (-0.34%) are also trading slightly lower. The underperformance of the Shanghai Comp is likely due to the broadening antitrust crackdown by the Chinese government which is now investigating food-delivery giant Meituan for suspected monopolistic practices. Similar investigations on Alibaba had led to a record fine on the group. Futures on the S&P 500 are up +0.07% but European ones are pointing to a slightly weaker open with those on the Stoxx 50 down -0.15%.

We also saw the BoJ policy decision this morning where there were no surprises with the central bank leaving its interest rate and asset purchase settings unchanged. Meanwhile, the BoJ raised their growth forecast for the fiscal year (started this month) to 4% from 3.9%, despite the renewed emergency restrictions recently introduced in 4 prefectures, including the Tokyo region. The central bank’s latest CPI forecasts also show that it is unlikely to reach its price target in the current governor Kuroda’s term.

Back to yesterday, and sovereign bonds sold off as investors moved out of safe havens, with yields on 10yr US Treasuries up +0.9bps to 1.567%. The move was driven by higher inflation expectations (+2.4bps), with real yields actually falling back (-1.6bps). Treasury yields were as high as 1.597% mid-session prior to a pair of bond auctions. $121bn of issuance came across 2-year and 5-year notes and although interest was perhaps slightly weak the fact that it got absorbed helped the market rally after. Over in Europe, yields moved higher as well, with those on 10yr bunds (+0.4bps), OATs (+0.4bps) and BTPs (+1.8bps) all rising on the day.

In Germany, with less than 5 months now until the federal election in September, yet another poll out yesterday indicated that the Greens had overtaken Chancellor Merkel’s CDU/CSU bloc, suggesting that the initial poll showing that last week wasn’t just a fluke. Der Spiegel reported yesterday that a Civey poll showed that the CDU/CSU were down 6 points on 24%, whereas the Greens had surged to 29%, up 5 points from the last poll. And that follows a Kantar survey for the Bild am Sonntag newspaper over the weekend, which also showed a Green lead over the CDU/CSU of 29% to 28%. So there are obviously the usual caveats as to whether this will last, not least since the SPD saw their own temporary surge in 2017 after selecting their chancellor candidate, but the signs are pointing to a definite shift in position for the time being. Will a more successful vaccination program help the CDU/CSU gain ground as it has the U.K. government?

There wasn’t a great deal of news on the pandemic yesterday, though global case rates continue to remain at some of the highest we’ve seen to date. India has reported 323,144 cases over the past 24 hours, and has now reported over 300k cases for the 6th day in a row. In Germany, Chancellor Merkel said that vaccines would be available to everyone from June onwards, and that the country would relax rules for the vaccinated, saying they wouldn’t need tests for shopping or the hairdressers. Over in Turkey, President Erdogan exacted a 3-week lockdown starting from this Thursday, with all students going to remote schooling. According to the President the economy should only reopen once new daily cases fall under 5k per day, which is a good deal lower than the over 38k new cases recorded on Sunday. During a visit to a local school, President Macron hinted at a potential timeline for reopening in France. He said restaurants would gradually begin reopening between May and early June, with cultural venues reopening from mid-May and the current 7pm-6am curfew pushed back around the same time if virus circulation is brought under control.

Looking ahead, a highlight today will be remarks from President Biden on the pandemic, and CNN are reporting sources saying that he’ll announce new CDC guidance on whether vaccinated people needed to wear masks outdoors. Also out of the US, it was reported yesterday that the nation is planning to begin sharing its store of AstraZeneca vaccine with the world. Once the vaccine clears federal safety reviews, the White House has said it will make as many as 60 million doses available for export over the summer.

The Ifo Institute’s business climate indicator in Germany rose by less than expected to 96.8 in April (vs. 97.8 expected). That’s the strongest reading since June 2019, but although the current assessment number rose to 94.1 (vs. 94.4 expected), which is the strongest since the pandemic began, the expectations reading fell back to 99.5 (vs. 101.2 expected). Over in the US meanwhile, the preliminary durable goods orders figure for March only rose by +0.5% (vs. +2.3% expected). Finally, the Dallas Fed’s manufacturing index rose to 37.3, which is the highest since June 2018, while the new orders index rose to 38.5, which is the highest since the survey first began 17 years ago.

To the day ahead now, and there are an array of earnings releases to watch out for including Microsoft, Alphabet, Visa, Eli Lilly, Texas Instruments, UPS, Amgen, Starbucks, Raytheon Technologies, General Electric and 3M. Data highlights from the US include the Conference Board’s consumer confidence indicator for April, the FHFA house price index for February and the Richmond Fed’s manufacturing index for April. Central bank speakers include Bank of Canada Governor Macklem and the ECB’s Hernandez de Cos. Tyler Durden Tue, 04/27/2021 - 07:46

http://dlvr.it/RyXQY2

http://dlvr.it/RyXQY2

Monday, April 26, 2021

When Will The Fed Begin Tapering: Here's What 10 Wall Street Strategists Think

When Will The Fed Begin Tapering: Here's What 10 Wall Street Strategists Think

When it comes to the Fed's Wednesday FOMC statement, economists agree that this meeting should largely serve as a status check of the economic recovery relative to the substantial forecast upgrades that the FOMC unveiled at their March meeting, but things will then heat up in the summer and certainly the fall, when Powell may have no choice but to address the roaring inflation and - gasp - even hint at a taper, risking another bond (and stock) market tantrum.

In any event, after the Bank of Canada became the "taper trial balloon" when it said last week it would scale back its purchases of government debt and accelerate the timetable for a possible rate increase, the Fed is expected to begin trimming its $120 billion in monthly asset purchases before the end of the year as the US economy recovers strongly from Covid-19, according to economists surveyed by Bloomberg. That’s a bit earlier than forecast in the March survey but leaves Fed asset purchases untouched for several more months, with the first interest-rate increase still not expected until 2023.

Ok, but when exactly?

To answer this question, Bloomberg has sifted through and compiled the thoughts of ten of Wall Street's top rates strategists and economists for their outlooks when the Fed will broach the subject of tapering. Here are the results:

Bloomberg (Carl Riccadonna)

* Our view is that the tapering happens in the first quarter of next year.

* This will give plenty of opportunity to pre-announce/forewarn/hint/etc. starting from the July semi-annual testimony, through Jackson Hole and over the course of the second half.”

Bank of America (Bruno Braizinha and Mark Cabana, April 23 report)

* “Recent rate decline does not change our view for higher yields this year”

* For 10-year, current range of 1.4%-1.7% should move to 1.75%-2.10% as economy improves and Fed signals on taper during second half of year

* Recommends “to use dips in the newly established trading range to position for higher rates”

Barclays (Anshul Pradhan, others, April 22 report)

* Recommends trades “for a rangebound environment”

* Front end is “still being too aggressive in pricing in inflation and hikes,” while long end has “room to push real yields higher” based on “scope for the growth outlook to be revised higher”

* Recommends 2yr forward 10s30s swap curve steepeners, which “look too flat even assuming that the hiking cycle starts in two years”

Citi (Jason Williams, April 23 report)

* Treasury to “take precautionary measures and reduce the size of the 20y auction,” which has experienced “a clear and consistent concession” in contrast to the 30- year

* “There is a clear demand for long-duration bonds, but the 20y does not appear to be fulfilling that role for investors”

* Treasury may “foreshadow a reduction in 20s for the August refunding, with a risk that it does a marginal cut this quarter”

Goldman Sachs (Praveen Korapaty, others, April 23 report)

* “There appears to be a good case for some asymmetry on the outlook for real rates vis-à-vis inflation,” in which further inflation upside doesn’t move liftoff pricing forward very much “but a softer outlook could see the timeline shift further out”

* More bullishness on inflation “would likely have a greater impact on the pace of hiking beyond liftoff rather than pulling forward the liftoff date by much”

JPMorgan (Jay Barry, Phoebe White, Natalie Matejkova, April 23 report)

* Treasury yields “need a new catalyst” to move higher from current levels, and “tightening labor markets and a Fed tapering could spark such a move, but we do not see this driving Treasuries until the summer”

* Meanwhile, “investor position technicals are short and could bias yields lower over the near term”

* Favors lower-beta carry-efficient ways to position for higher yields and recommends holding 3s7s steepeners

* 20-year bond introduced last year has been successful and its liquidity “should continue to improve”; any changes to issuance pattern should be modest and no earlier than August

Morgan Stanley (Guneet Dhingra, April 23 report)

* “The complete lack of reaction to the recent upside surprises in economic data shows the high degree of optimism embedded in Treasury yields”

* Risks of prolonged virus challenges “will be enough to keep the Fed a lot more patient than the optimistic path priced by the Treasury market”

* Rate-hike expectations are likely to move “deeper into 2023,” and 5- and 10-year yields “could be around 65bp and 140bp if the market prices the first hike in June 2023”

* Continues to favor 5s30s steepeners and EDM2/EDM3 flatteners

NatWest (John Briggs, April 24 report)

* Recommends short positions in Treasuries, especially intermediates, based on rising expectations that Fed will begin to discuss tapering asset purchases in September, following similar moves by Canada and possibly U.K. in the meantime

* Tapering “will lead to the market pricing in more hikes down the road,” beginning in 2023, “and then as in 2013, just roll that rate hike pricing over time until we actually get there”

Soc Gen (Subadra Rajappa, others, April 22 report)

* “With the U.S. economy at an ‘inflection point’ and bond yields at the lower end of the recent range, we see room for yields to rise on strong data”

* Fed “is set to take baby steps towards preparing the markets for a taper announcement, while the ECB retains a more cautious stance,” which should lead to U.S.-German 10-year spread widening

TD Securities (Priya Misra, Gennadiy Goldberg, Penglu Zhao, April 23 report)

* It’s too soon to expect any sign on tapering asset purchases from the FOMC meeting

* Recent price action “is just a temporary breather in the longer-term trend towards higher rates” driven by economic improvement, increased supply of duration and higher inflation risk premium

* Expects 10- year yield to reach 2% by year end, 5s30s curve to steepen

Meanwhile, Bloomberg summarizes the result of its survey noting that more than two-thirds of the economists surveyed expect the FOMC will give an early-warning signal of tapering this year, with the largest number - 45% - looking for a nod during the July-September quarter.

That could come from either the July or September FOMC meetings, or Powell’s semi-annual testimony to Congress. Another option is the Kansas City Fed’s annual late-August Jackson Hole Economic Symposium, which has been used as a venue to deliver signals in the past. The Fed chair typically gives the keynote speech and Powell has so far continued that tradition. Tyler Durden Mon, 04/26/2021 - 14:59

http://dlvr.it/RyV4Rs

http://dlvr.it/RyV4Rs

El-Erian: Fed Should Start Tapering Now... But It Won't

El-Erian: Fed Should Start Tapering Now... But It Won't

Authored by Mohamed Al-Erian, op-ed via Bloomberg.com,

I suspect that Federal Reserve officials are not the only ones looking for an uneventful policy meeting this week. The majority of market participants are also expecting an undramatic event that will include an upgrade of the economic outlook, a reiteration of uncertainties and the signaling of nothing new on policies. Unfortunately, it’s an outcome that kicks the policy can further down the road when the central bank should be thinking now about scaling back its extraordinary measures.

Although Fed officials raised their growth estimates significantly at their last meeting, they will most likely upgrade their economic outlook for 2021 again after the recent string of strong economic data. This will be accompanied by the usual Covid-related qualifications when accelerating vaccine deployment continues to race against growing infections and the threat of new variants of the virus.

The further improvement in the economic outlook is unlikely to change the Fed’s policy guidance, however.