Three Reasons Why Banks Are Slumping Despite Stellar Earnings

Bank stocks slumped Thursday despite reporting huge beats on stellar trading revenues in Q1 (but mostly thanks to releasing billions loan loss reserves) and giving optimistic guidance.

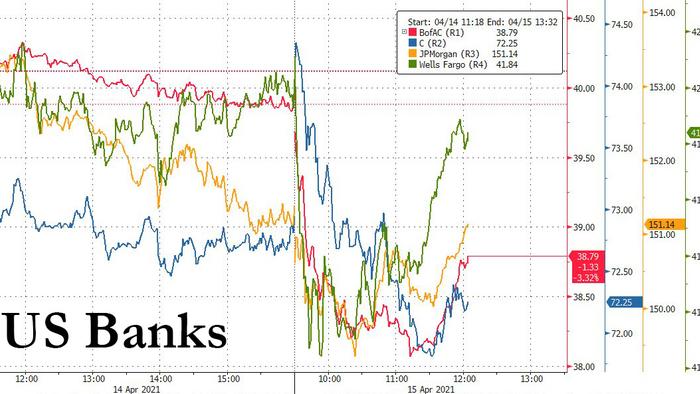

In fact, Financials were the worst performing among the S&P 500 Index’s main sectors even after Bank of America and Citigroup joined JPMorgan and Goldman Sachs in reporting better-than-expected first-quarter trading revenue. BofA was among the biggest losers with a decline of as much as 4.2%, while Citigroup dropped by about 0.6%, erasing an earlier gain of 2.5%. Wells Fargo fell 1.9% and JPMorgan and Morgan Stanley were both down by less than 1%. Among regional banks US Bancorp and Truist Financial dropped after reporting earnings results.

Three reasons (or rather four) were cited as the catalyst of the swoon.

1. The first reason was the very sluggish loan growth (or rather, contraction), which was especially evident with Bank of America where deposits in the consumer banking unit soared by 25% to $924 billion (largely a result of $120BN in QE per month as we will show shortly), while loans fell 8% to $291 billion...

... which is also why the bank’s net interest income, tumbled 16% to $10.2 billion.

“Like all banks, BofA is waiting for loan growth, which was weak this quarter,” said Alison Williams, a Bloomberg Intelligence analyst..

Additionally, customers have also been paying down holiday balances, with stimulus is contributing to paydowns. Needless to say, fewer loans is bad for banks who interest income comes form more loans being taken up by the broader public.

2. Bond yields tumbled across the curve, with the 10Y sliding 15bps this week alone and depressing band Net Interest Income, and pushing the KBW bank index 2.3% lower.

There were several reasons cited for the ongoing slide in yields despite the blockbuster economic data, one of which is that the market is now convinced that the Fed will indeed tolerate higher inflation and won't tighten financial conditions for a long time as it has repeatedly said, although a much more likely reason for the sharp drop in yields is that as noted earlier, is that CTAs have been aggressively covering their short Treasury positions.

3. Value no longer. The third for the poor bank performance today was proposed by Bloomberg's Heather Burke who says that following their impressive gains in Q1, banks have become expensive and results just weren't good enough to justify their reputation as a value sector. In short, as we said earlier this week, banks - like so many other stocks - have been priced to (beyond) perfection going into earnings and no matter what they reported would be viewed as disappointing.

Consider this: while S&P 500 Banks' 12-month fwd P/E at ~13 (nowhere near tech at ~27.6 or the S&P 500 at ~22.5), and has come come down from the recent 2020 peak of over 16, the P/E is a above the five-year average of ~11.8. Meanwhile, banks’ 12-month forward P/B, a metric some sector watchers prefer, at ~1.26 also sits above the ~1.12 average.

As Burke notes, while banks are nowhere near as frothy as, say tech, "their P/E ratios are being watched as a barometer of a post-pandemic economic and profit recovery. And, arguably, they’re being held to a high standard because of their dizzying run: banks are the best performing S&P 500 GICS 2 sector ytd after energy (another value play), both up over 20%."

Burke concludes that as earnings season unfolds, this scrutiny can extend throughout the value sector. The S&P 500 Value index trades at a decent premium to its average P/E and it’s significantly trailed the growth index this month. Results can offer an easy reason to sell companies and sectors that got too hot too soon. Tyler Durden Thu, 04/15/2021 - 13:19

http://dlvr.it/RxlLnv

No comments:

Post a Comment