Election Contention Can Catch Volatility Off Guard Tyler Durden Fri, 09/25/2020 - 09:25

By Laura Cooper, macro strategist who writes for Bloomberg

Investors’ U.S. election playbooks should look different this year with a lengthy contested outcome an underpriced tail risk that can spike equity volatility through early 2021. Narrowing polls, a surge in mail-in ballots and amped up partisanship make a challenged U.S election outcome a risk not seen in nearly 150 years, but it’s yet to be captured in bets on S&P 500 volatility.

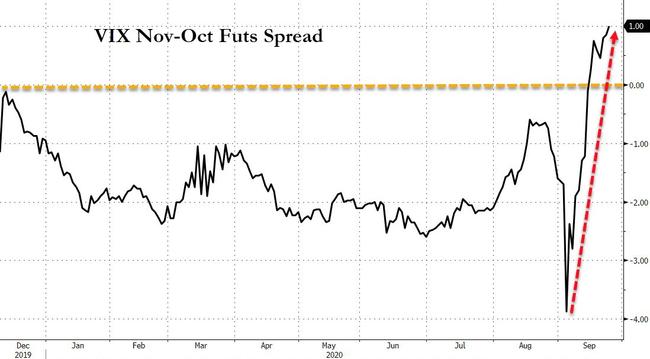

Widely traded CBOE VIX futures, which capture the market’s expected swings in the S&P 500 over 30 days, show investors bracing for uncertainty around the Nov. 3 vote. The spread between the front-month futures contract and spot VIX is near the highest since 2012, but it’s more muted further out the curve.

Traders aren’t commanding a higher-than-normal volatility premium beyond the second-month contract, which matures in November. The shape of the VIX curve at the December and January contracts relative to spot VIX aren’t outliers to history.

A fractious political climate aggravated by President Trump’s pending Supreme Court nomination adds a layer of uncertainty in this election cycle, particularly in light of an already ambiguous dispute resolution mechanism.

The last contested election was in the 2000 race between Republican George W. Bush and Democrat Al Gore and centered on voting count disputes. It landed in the Supreme Court, which stopped a recount in Florida on Dec. 12. If that hadn’t happened, the dispute could’ve ended up in Congress, which has ultimate responsibility for counting electoral college votes.

This time could be different, with one having to go as far back as the 1876 election between Rutherford B. Hayes and Samuel Tilden to find a precedent, according to a 2019 Ohio State working paper. Back then, the deadlock lasted until just two days before the inauguration. Should Congress receive conflicting electoral vote counts from some states this time, the constitutional provisions for resolving the conflict are ambiguous and "vulnerable to partisan posturing."

The timeline of the current three-phase resolution process suggests the risk of a deadlock extending through early 2021 is non-negligible, but it still isn’t captured in longer-dated volatility futures contracts. The spread between the December-expiring contract and the November one remains deeply negative.

The addition of a wave of mail-in ballots because of the coronavirus only amplifies the chances of a disputed vote count amid warnings that the results may not be known "for months or for years."

Modeling political uncertainty is a fool’s errand. But prediction markets can act as a proxy for contested election risks. A narrowing spread between the absolute probability of a Trump presidency and a Biden win raises uncertainty, increasing the perceived odds of a coin-flip outcome. Mapping this proxy against the spot VIX shows a surprising degree of co-movement.

Of course, a smooth, uncontested outcome is possible. And it’s worth noting that the poll-tracking website FiveThirtyEight gives Biden a 77% chance of winning.

But the tail risk of a prolonged disputed election outcome widened this week, and hedging through relatively cheap longer-dated volatility bets looks prudent. After all, this could turn out to be a once in a 144-year event.

http://dlvr.it/RhLHv4

No comments:

Post a Comment