FOMC To Provide "Advance Notice" For November Tapering; May Deliver Two Potential Hawkish Surprises

At the conclusion of tomorrow's 2-day meeting, the FOMC is likely to provide the promised "advance notice" that tapering is coming, paving the way to announce the start of tapering at its November meeting, writes Goldman referencing a recent trial balloon by the WSJ which effectively reached the same conclusion.

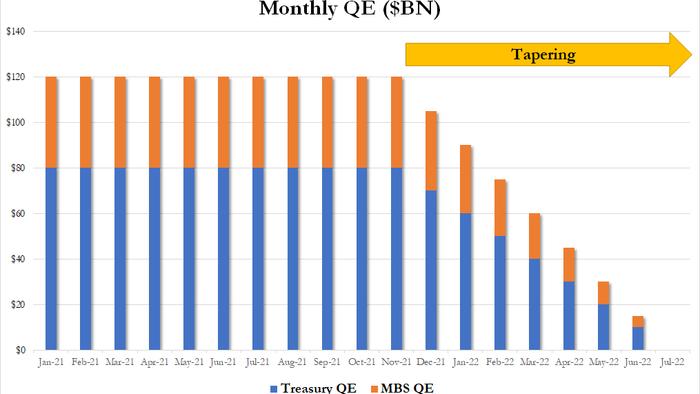

As we reported last weekend, the bank's standing forecast is that the FOMC will taper at a pace of $15bn per meeting, split between $10bn in UST and $5bn in MBS, ending in September 2022, although one possible alternative is for the Fed to accelerate the pace of tapering and cut each month instead of each meeting, thereby concluding its bond buying by next July.

As Goldman's David Mericle writes, "while the start date now appears set, the pace of tapering is an open question.Our standing forecast is that the FOMC will taper at a pace of $15bn per meeting, split between $10bn in UST and $5bn in MBS, ending in September 2022. But a number of FOMC participants have called instead for a faster pace that would end by mid-2022, and we now see $15bn per meeting vs. $15bn per month as a close call."

Specifically, Goldman expects that the September FOMC statement will include language similar to that used in July 2017 to foreshadow the start of balance sheet normalization at the next meeting. For example, it might say something along the lines of, “The Committee expects to begin reducing the pace of its asset purchases relatively soon, provided that the economy evolves broadly as anticipated." Separately, Goldman does not expect the FOMC to reveal the pace this week, though the minutes to the September meeting might eventually provide a clue.

Moving down the list, the Fed's Summary of Economic Projections is likely to incorporate the recent stagflationary shifts in the economy, namely the large upside surprise to inflation and the large downside surprise to GDP growth over the last few months.

As Goldman shows in the chart below, the bank's 2021 GDP growth forecast has fallen over 2pp on a Q4/Q4 basis since June, and we expect the FOMC to cut its 2021 projection substantially as well.

Some more details here:

Exhibit 3 shows that our GDP growth forecast for 2021 on a Q4/Q4 basis—the measure that Fed officials include in their projections—has come down by over 2pp since the FOMC’s June meeting. Both the disappointment on 2021Q2 growth and our downgrade to our 2021Q3 tracking estimate largely reflect the impact of supply chain disruptions on US production, especially auto production, which has resulted in a large drawdown of inventory to meet current demand. The Delta variant has also weighed on further recovery in the service sector, though the August retail sales report suggests that the impact on total consumer spending is likely to be more limited than we had initially feared.

These delays in rebuilding inventory and reopening consumer services imply somewhat stronger growth in 2022, though the path forward for consumer spending now looks more difficult because government income support has dropped off and the remaining depressed service sectors, mainly very high-contact and office-adjacent services, are unlikely to recover rapidly during the winter virus season.

As for the Fed's core PCE inflation projection for 2022, it is expected to remain stable at 2.1% in keeping with the Fed's narrative of "transitory" inflation, with some participants forecasting greater inflation momentum into next year and others forecasting more payback for stretched prices this year (Goldman expects the core PCE path will peak at a slightly higher 2.2% further ahead).

Away from tapering, Goldman warns that the dots are an even closer call because a single participant could tip the balance upward relative to the bank's forecasts, which are shown in Exhibit 6. For 2022, only two participants would have to add a hike for the median to show a half-hike and three for the median to show a full hike. But the best guess here is that most of the potential marginal voters who could swing the balance are Governors at the Fed Board, and they are likely to join Chair Powell in submitting a no-hike baseline. After all, as Mericle notes, "it would be surprising if Powell showed a hike next year just weeks after his dovish speech at Jackson Hole reiterated his view that inflation pressures are likely to be transitory."

In light of the above, Goldman expects the median dot to show no hikes in 2022, 2 hikes in 2023, and 3 hikes in 2024, anticipating that a quarterly pace of tightening back toward the neutral rate will be appropriate if everything goes well. While this would put the dots well above market pricing, Goldman does not expect much of a market reaction because the dots are a modal forecast corresponding to an economic baseline in which most participants will assume that the conditions for tightening will be met. They are not directly comparable to market pricing, a probability-weighted mean of a range of scenarios, including many in which the Fed would not hike. Moreover, Goldman rates strategists recently showed that markets have tended to put little weight on the Fed’s three year ahead dots in the past.

In a similar vein, Standard Chartered's Steven Englander writes overnight that he expects seven FOMC participants to indicate two 25bps hikes in 2022 – five a single hike and six no hikes. The median is a single 2022 hike, but with a hawkish lean given so many participants pointing to two hikes. There is a risk that the hawkish 2022 skew could be even more pronounced, "but we do not think the 2022 dots will show a two-hike median. We estimate that about 18bps is priced by end-2022, somewhat low given what we expect"

While Goldman is generally sanguine about tomorrow's FOMC, the banks concedes the bank catuions that risks to its expectations are tilted in a hawkish direction (more below). Some Fed officials have expressed greater concern about inflation recently, reflecting stronger wage pressures, increases in some short-term measures of inflation expectations, and the possibility that supply chain disruptions could last well into next year, as even the Fed realizes that inflation at this point is anything but "transitory."

The two most likely hawkish risks according to Goldman would be

* if the FOMC reveals next week that it intends to taper at a faster pace or

* if the 2022 median dot shows a hike.

However, client surveys suggest that the majority do not view either of these as the base case, meaning that either would be hawkish surprises to current market expectations, prompting a selloff and as everyone knows, that's what the Fed will avoid at all costs. The Fed leadership has historically preferred to avoid delivering hawkish surprises at FOMC meetings to the extent that it can, preferring the information to be priced in advance (like it did with the WSJ leak last weekend). While the dots are sometimes out of the leadership’s control, in this case we think it can probably prevent either of these two potential hawkish surprises from materializing this week. Tyler Durden Tue, 09/21/2021 - 13:53

http://dlvr.it/S80tCc

No comments:

Post a Comment