Harbin, We Have A Problem: Chinese Junk Bond Yields Hit 11 Year High

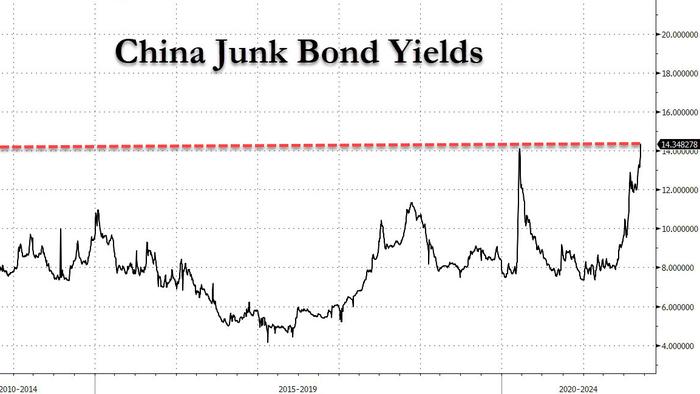

Back in March 2020, when China's junk bond yields doubled effectively overnight from 7% to 14%, the catalyst was the unprecedented lockdown of China's economy in response to the covid pandemic, which credit investors speculated could lead to a tidal wave of defaults but Beijing's aggressive response which culminated with trillions in new debt injected into the economy, ended up being a tempest in a teapot and over the next few months, China's junk bond yields gradually faded back to normal.

Fast forward to today when after weeks of tentatively creeping higher, China's junk bond yields not just surged higher overnight, but have just surpassed the 2020 highs, printing 14.34% overnight, and the highest level since the great repo rate crisis of 2011.

Well, in a word - and the only word that matters - it's Evergrande, and while contagion is clearly present (finally, as investors realize that the $300 billion creditor is about to default) it really is mostly Evergrande. Consider the following stunning facts:

Evergrande is the largest high-yield dollar bond issuer in China, accounting for 16% of outstanding notes, according to Bank of America. Should the company collapse, that alone would push the default rate on the country’s junk dollar bond market to 14% from 3%.

It's not just the dollar bond market: the stakes are even higher on the mainland, where as Bloomberg calculates, the yuan-denominated credit market is about 15 times the size at $12 trillion. While Evergrande is less of a whale onshore, a collapse would force banks to cut their holdings of corporate notes and even freeze money markets, the plumbing of China’s financial system. We are already seeing signs of that with China's 7-day repo rate which spiked to the highest since June, forcing the PBOC to inject the most liquidity, some 90BN yuan, overnight - the most since February.

If the Evergrande spillover leads to a freeze in the interbank market, the government or central bank would be forced to act, an outcome which Evergrande's investors are desperately hoping for as it is the only hope they have of recouping some of the money. Banks involved in property lending may come under pressure, leading to an increase in soured loans. Smaller banks exposed to Evergrande or other weaker developers may face “significant” increases in non-performing loans in the event of a default, according to Fitch Ratings.

Which brings up another point: in a world where 85% of US junk bonds now have a negative real rate...

... and where there is virtually no real yield to be found across the entire USD-denominated credit spectrum, yield-starved investors should be sprinting into China, to buy their 14% junk bonds.

Why aren't they? Simple: unlike in the west where they know central banks will bail them out, a rather socialist approach to what once were "capital markets" but are now "capital Marxists, in China they have no such guarantees, which is actually rather ironic - for all its "socialist characteristics", China may be the only place where true market capitalism - where failure means failure, if not for state-backed companies of course - can still be found. Tyler Durden Fri, 09/17/2021 - 12:25

http://dlvr.it/S7mSWl

No comments:

Post a Comment