S&P 5000 – Here We Come

Authored by Michael Lebowitz and Lance Roberts via RealInvestmentAdvice.com,

Markets are opening mixed this morning as investors await the Fed’s Jackson Hole Conference. Markets may be lifeless today and tomorrow as they await Powell’s speech on Friday and importantly his stance on tapering QE. Some investors have mentioned the Fed might delay tapering due to the delta variant. While a possibility, there is potentially some good news on that horizon. Florida and other hard-hit states are starting to see the number of cases decline or at least stabilize.

S&P 5000

In the rush to be the first person to put a S&P 5000 target price out, analysts are pushing 2022 price targets markedly higher despite slowing economic growth rates and high valuations.

“Wells Fargo’s Chris Harvey raised his year-end S&P 500 price target to 4,825 from 3,850, as reported by Bloomberg’s Lu Wang. This move follows a weekend note by David Lefkowitz, head of equities for the Americas at UBS Wealth Management, who raised his year-end price target for the S&P 500 to 4,600 from 4,500.

Lefkowitz also raised his June 2022 price target to 4,800 from 4,650, with the real headline coming from his year-end 2022 S&P 500 price target — 5,000.

‘Yes, the rally off the COVID-19 bottom in March 2020 has been extraordinary, but we think there are further gains ahead,’ Lefkowitz writes. ‘Solid economic and corporate profit growth, in conjunction with a still-accommodative Fed, means that the environment for stocks remains favorable. As a result of our higher EPS estimates, we raise our targets for the S&P 500 for December 2021 by 100 points to 4,600 and June 2022 by 150 points to 4,800. We initiate our December 2022 target of 5,000, representing about 13% price appreciation from current levels.’

With this 2022 outlook, Lefkowitz joins Credit Suisse’s Jonathan Golub who earlier this month put a price target of 5,000 on the S&P 500 for the end of 2022. The equity strategy team at Goldman Sachs also garnered headlines earlier this month in raising their year-end price target to 4,700 from 4,300 while putting a year-end 2022 price target on the benchmark index of 4,900.

Like Golub, Lefkowitz sees earnings growth — not multiple expansion — as the driving force behind the market’s rally in the year ahead.

‘Our price targets assume a forward P/E multiple of about 20x, slightly below current levels of 21x,” Lefkowitz adds. “We expect valuations to remain above historical averages mostly due to the very low interest rate environment. Said another way, stocks continue to look appealing relative to bonds.'” – Yahoo

Money Flows Declining As Price Rises

While the market has indeed rallied over the last few days, as investors bought the 40-dma “dip,” volumes have declined sharply along with money flows. As we have witnessed over the last several months, these “buy the dip” run from the moving average to the top of the 2-standard deviation Bollinger Bands before correcting. If you haven’t bought the exact bottom of the dips, the gains have remained quite muted.

As noted, there is a large divergence between “price” and the“advance-decline volume,” with the “advance-decline line” breaking below its 50-dma.

At some point, the 50-dma will fail. The drop to the 200-dma will be very fast as liquidity remains problematic. While “sellers live higher,” in this market, “buyers live a lot lower.”

More Pressure on Powell

Add Bloomberg to the list of people and groups asking Powell to taper sooner rather than later. The powerful message from Bloomberg’s editorial board states the following:

*

He ought to nudge expectations in the direction suggested lately by some other top Fed officials. Short of making a formal announcement, he should say he’d prefer tapering to start soon and be completed by the spring.

*

It isn’t the right tool for current conditions, and leaving the program in place serves to narrow the Fed’s options as conditions change.

*

Asset prices have surged and the risk of bubbles and financial instability is growing. All this suggests it’s past time to start dialing back the Fed’s commitment to maximum stimulus.

2000 Redux

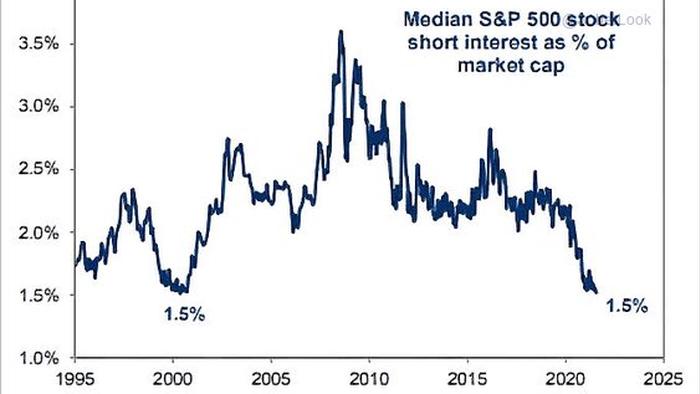

It is not just equity valuations that are near or have already exceeded levels from 2000. The graph below, courtesy of the Daily Shot, shows that investor willingness to bet against the market is also at levels last seen 20 years ago.

Tis the Season of Volatility

As Market Ear’s graph below shows, the season of higher volatility is upon us. Their seasonality graph jibes well with others that show markets tend to have their worst few months of the year during September and October.

A Bigger Short

It has been revealed that Michael Burry, portrayed in the book and movie The Big Short, has a large short position in U.S. Treasury bonds. His stance is not surprising given he has been vocal about inflationary concerns. Burry’s expectations are largely in line with Wall Street. Per a Bloomberg article on this topic: The median forecast in a Bloomberg survey is for the 10-year yield to end the year at 1.60%…”

Bill Farrell rule #9- “When all the experts and forecasts agree — something else is going to happen”

Office Space Trouble?

The graph below, courtesy of Jim Bianco and Kastle, shows that well over half of the office space in major cities is being underutilized. Per Kastle’s data, nationwide only a third of office space is being used and no major city is above 50%. If the trends do not revert to normal over the coming year or two, the amount of vacant office space will become problematic, especially in the larger cities.

IPO Frenzy

The following graph and commentary from GMO, show that over the last year corporations have been taking advantage of higher share prices.

Interestingly, IPO issuance is currently running at the same pace as the market peak in 2000. Massive issuance from existing stocks is largely responsible for the big difference between total issuance today versus 2000. Tyler Durden Wed, 08/25/2021 - 08:47

http://dlvr.it/S6Hynd

No comments:

Post a Comment