Buffett's Berkshire Slashes Wells Fargo Stake By 42% Tyler Durden Fri, 09/04/2020 - 17:37

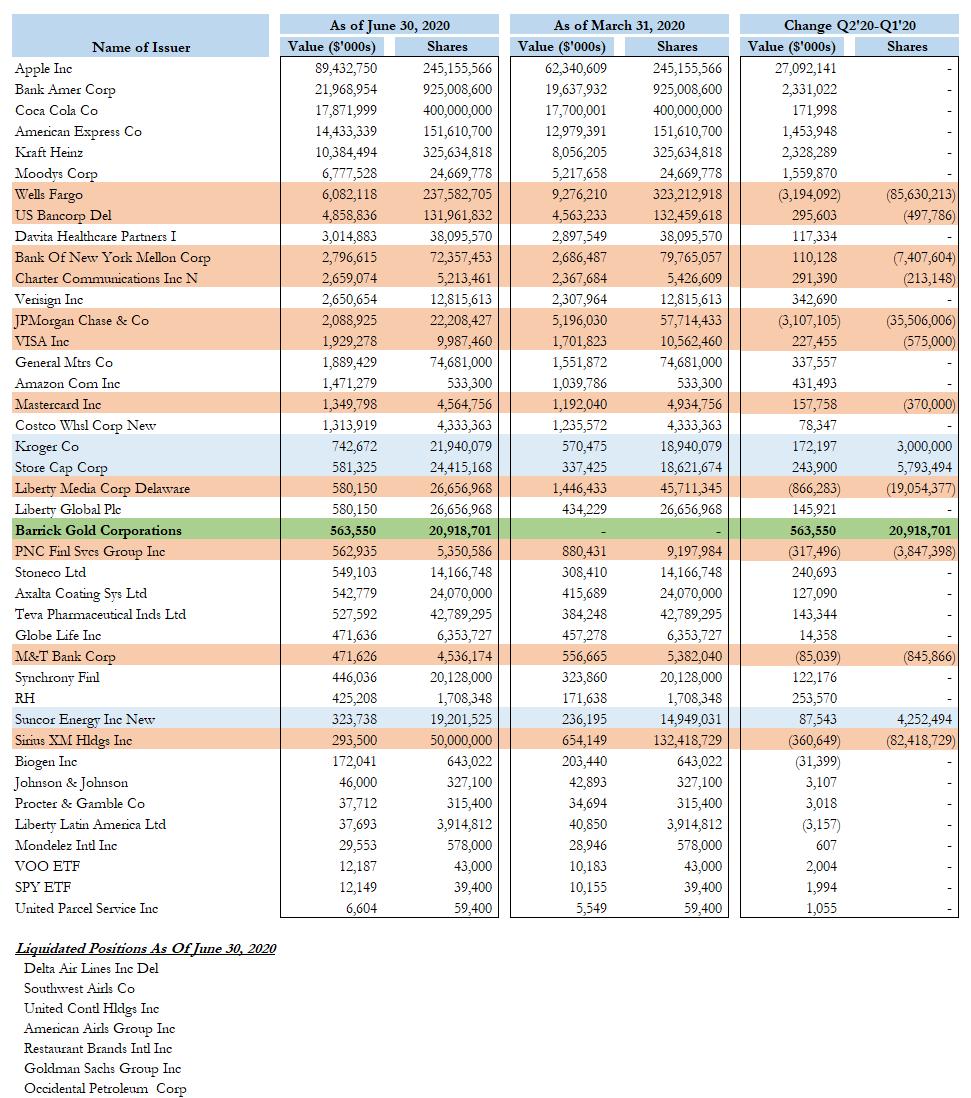

Two weeks after jaws dropped across Wall Street when the latest Berkshire 13F revealed that the Warren Buffett, now 90, had dumped his entire stake in Goldman and trimmed most of his other bank holdings (including cutting his Wells Fargo holdings by about a quarter) while buying Barrick Gold in a bet on "hard assets" that was formerly seen as anathema for Buffett...

... moments ago it emerged that Buffett has continued to pare his bank exposure and according to its latest Berkshire 13G filing, Berkshire Hathaway showed that as of Sept 4 it had sold another 100 million shares of Wells, taking its position to just 136.3 million. The reduction is a 42% drop in Berkshire's last disclosed position of 237.6 million shares; Berkshire's stake is now 3.3% of Wells stock, down from 5.96% previously.

Considering that for years Wells Fargo was synonymous with Buffett's long-running bet on US banks - and on America in general - the move is certainly ominous for all those predicting an imminent bank stock renaissance (and comes at a time when Buffett is also pivoting toward Japan's largest trading houses).

The 13G showed that in addition to 136.3 million shares held by Berkshire, another 1.2 million shares were held directly by Warren Buffett, and another 7.7 million shares by Nebraska Furniture Mart, The Fechheimer Brothers Company and BH Finance LLC.

As a reminder, heading into Q2, Buffett trimmed his stake from 323.2 million as of March 31 to 237.6 million shares at the end of Q2. The continued liquidation of about 100 million share every month suggests that Buffett is well on its way to dumping his entire Wells stake. The question now is whether Buffett was also dumping other US banks - failing to see a rebound catalyst - or his liquidation was confined solely to the bank which has emerged as the most distressed among US money center banks.

http://dlvr.it/Rg0WsL

No comments:

Post a Comment