Morgan Stanley Asks "What Exactly Do You Mean By Stagflation"

By Andrew Sheets, Chief Cross-Asset Strategist for Morgan Stanley, the first in three posts for today by Wall Street banks scrambling to address the elephant in the room.

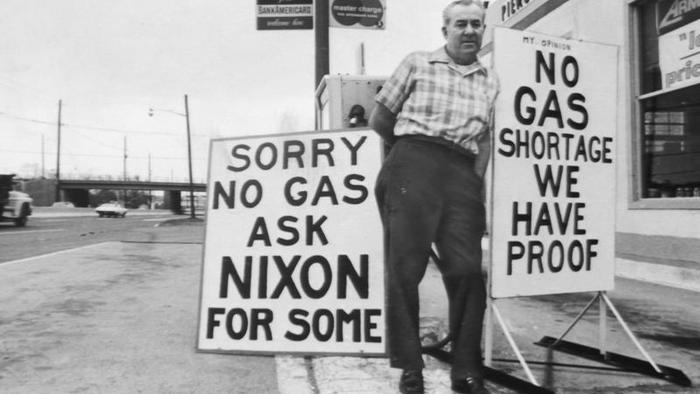

Near where I live in London, service stations are out of petrol. In Europe, natural gas prices have tripled in the last three months. Year over year, consumer price inflation is +5.3% in the US, +5.8% in Poland, +7.4% in Russia and +9.7% in Brazil. It’s not hard to see why one term seems to come up again and again in conversations with investors: stagflation.

Yet it’s equally hard to miss that this widely cited fear isn’t well defined. If 'stagflation' means 'the 1970s', a time of wage-price spirals and high unemployment, this clearly isn’t it. Unemployment is falling around the world, and inflation markets imply that pressures will moderate over time, rather than spiral.

Asset pricing also couldn’t be more different. Over the last century, the 1970s represented an all-time high for nominal interest rates and an all-time low for equity valuations. Today we’re near a low in yields and a high in those valuations. Saying “it’s not the 1970s” isn’t that bold a statement; If you think it is the 1970s, stop reading this and pick up the phone as there are trades to do!

Instead, what if we say that ‘stagflation’ is a period where inflation expectations are rising and growth is slowing? That’s appealing as a softer definition, easier to apply. There’s just one problem: it hasn’t necessarily been happening.

In the US, inflation breakevens have been broadly stable, and are roughly where they were in early June. US manufacturing PMI, meanwhile, has risen over the last two months. The euro area has seen rising inflation expectations and falling PMIs in recent months, but expected inflation is still low and those PMIs are still well above average.

This clearly isn’t a simple story. But we think that there are three takeaways for investors:

*

First, recall that ‘stagflation’ was a hot topic in 2004-05. PMIs surged in 2003 as growth (and markets rebounded). But by mid-2004, those PMIs peaked as the rate of change on growth slowed. Meanwhile, rising energy prices started to push up inflation, at the same time that rates markets moved to price in a more hawkish Fed path. Today offers some important differences, but other elements certainly rhyme. By spring 2005, the market started to worry that it could be the worst of both worlds. In April 2005, CPI hit 3.5%Y while the US manufacturing PMI had fallen to 52. 'Stagflation' graced the cover of The Economist. These fears eventually passed as growth rebounded and inflation moderated, but we think that 2005 may provide a useful reference point for a scare that comes far short of the 1970s. Equity multiples de-rated throughout 2004-05, consistent with the current forecasts for my colleague Mike Wilson and our US equity strategy team.

*

Second, inflation is already showing up and impacting monetary policy. In just the last three weeks, central bank rates have increased by 25bp in New Zealand, 25bp in Russia, 50bp in Peru, 50bp in Poland, 75bp in the Czech Republic and 100bp in Brazil. All this is keeping my colleagues in macro strategy busy, and they like short EUR/RUB as a positive carry pair to benefit from further rate divergence (and recent commodity strength). We continue to forecast higher US Treasury yields, targeting 1.80% by year-end.

*

Third, while stagflation means different things to different people, past periods of rising inflation and slowing growth often had one thing in common: higher energy prices. As such, we think that some of the best cross-asset hedges for stagflation lie in the energy space.

Specifically, we follow the lead of Martijn Rats and our commodity strategists to focus further out the commodity curve. Energy commodity curves imply that prices will fall sharply over time as supply pressures ease, with Brent oil markets implying that prices will fall 9% over the next year, and 16% over the next two years. For investors, buying longer-dated oil provides a hedge against a scenario where high price pressures aren’t transitory, and does so with positive carry. Our commodity team likes owning Dec ’22 Brent, while energy over gold remains a key strategic view supported by our systematic indicators.

The market is focused on stagflation, it just hasn’t quite decided what that term really means. The 1970s are a long way away from our expectations or market pricing. Scenarios of slowing growth and rising inflation clash with our global forecasts of the opposite. Recent moves in inflation expectations and PMIs don’t fit the story as nicely as one would like.

Instead, focus on three things: 2005 is an interesting, recent example of a stagflation scare after a mid-cycle transition. Inflation is impacting central banks outside the G3, creating movement and opportunity. And owning longer-dated oil provides a positive carry hedge against scenarios that current disruptions turn more persistent. Now with that out of the way, I’m off to find some petrol. Tyler Durden Sun, 10/10/2021 - 16:00

http://dlvr.it/S9GqgH

No comments:

Post a Comment