A Historic Divergence Emerges On Wall Street

It was just six months ago when when the March Bank of America Fund Manager Survey found a record number of respondents expecting a stronger economy...

... and continued stock market outperformance.

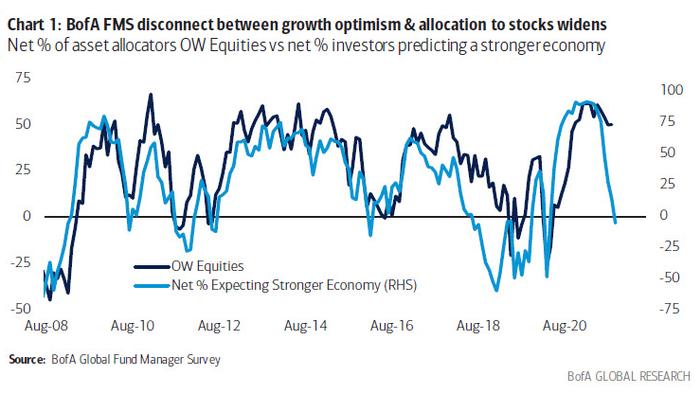

So fast forward to today when a lot has changed since the halcyon days of March, because according to the latest FMS published today by BofA's Michael Hartnett in which he polled a record 430 panelists managing $1.3 trillion, Wall Street professionals are now the least bullish since Oct’20 as growth expectations turn negative for the first time since April 2020 on inflation and China pessimism.

And yet even though FMS cash levels jump to 12-month high, the allocation to bonds slumps to an all-time low - on expectations of a stagflationary spike in rates - in what may be the most striking divergence observed in the survey series, the allocation to stocks is just shy of all time highs!

Going through the various segments of the survey, BofA's Michael Hartnett starts with the Macro, where he finds respondents to be bearish - as net 6% of investors now say global growth to weaken next 12-months, the lowest level since Mar’20, down from 91% peak in Mar’21, and down big 19ppt in the past month...

... 15% say profit growth to slow (worst margin outlook since May’20), down from the 89% peak in Mar’21, down huge -27ppt in past month. As Hartnett notes "FMS global GDP & EPS readings show macro momentum weakest since COVID shock of spring’20."

... net 51% of investors think margins will decrease, down a massive 29% past month...

... as predictions of a “boom” drop to 61% (still expect above-trend growth & above-trend inflation, but down from peak of 76% in June) as “stagflation” or below-trend growth & above-trend fears up big 14ppt on month to 34%.

.... as gap between “transitory” vs“permanent” inflation continues to narrow (58% vs 38% respectively).

To Hartnett, the above suggest that banks are vulnerable to high inflation causing weaker growth, because while FMS investor exposure to banks in past 15 years has gone up and down with their expectations of “Goldilocks” - high growth & low inflation - that is clearly not the case today.

Hartnett then looks at respondents views on Policy, where he finds they are less bullish as markets price in a Fed taper and eventual hike in ’22. A net 85% now expect higher short-term rates (vs 65% last month), the most since Nov’18...

... and the majority now expecting one Fed rate hike in ‘22 (in Nov, was Feb’23)...

... while forecasts for steeper yield curve drop to just 23% (vs 48% last month), the lowest since Jun’19...

... in no small part because hopes for a US fiscal stimulus drop from $1.9tn to $1.7tn, as investors got more bearish on the passing of the bipartisan bill and the reconciliation package given the missed deadline.

And yet despite all these bearish signs, BofA finds that when it comes to asset allocation, Wall Street is outright risk-on, perhaps because by now everyone knows that the market is completely disconnected from everything except the size of the Fed's money printing program.

Hartnett finds that the allocation to commodities jumped to net 28%...

... to stocks remain high 50% (but the picture does get more nuanced when looking at hedge fund net equity exposure which has dropped drastically in October to 26% from 41% last month)...

... to cash up to 27% (15-month high).

... and to bonds -80% = all-time low;

At the same time, FMS cash holdings shot up to 4.7% from 4.3%; driven by a massive drop-off in bond allocation (the BofA Bull & Bear Indicator down slightly to 5.0 from 5.1. Cash levels are one of three components going into the Bull & Bear indicator; the other 2 are cyclical vs defensive sectors and equities vs bonds).

Looking at sectors, BofA finds a big rotation to banks & energy from healthcare & staples...

... banks now #1 global sector (highest OW since May’18), healthcare #2, energy surges to #3 (highest OW since Mar’12); utilities & staples big UW’s;

Geographically, Europe is #1 equity region, OW to US @ 12-month high, but EM exposure slumps to lowest since Sep’18.

Finally, looking at what the consensus thinks is the biggest Risks and most crowded trade, the majority, or 48%, say inflation is the clear #1 “tail risk”, China is now #2 (23%) , COVID down to #5 (at just 3%)...

... with inflationary fears surging...

... while long tech, long ESG, short China/EM top 3 “crowded trades”.

Tyler Durden Tue, 10/19/2021 - 15:45

http://dlvr.it/S9vJxN

No comments:

Post a Comment