"Leadership Is Shifting": Goldman Says Business Sentiment, Job Growth And QE Have Peaked - What Happens Next

Two weeks after Goldman speculated that this market was "as good as it gets" when it joined other big banks - such as Deutsche Bank, Morgan Stanley and JPMorgan - in turning bearish and warning of a market drop in the coming months, the bank has doubled down and as Goldman strategist Chris Hussey writes, after an April of ‘regular way’ trading, "the S&P 500 reverted to it pro-cyclical tilt that we have seen for the majority of the year with mega-cap Tech actually losing ground on the week at the same time that Industrials, Financials, and Energy stocks posted notable gains."

What is even more interesting is that the rotation chose last week to resume (as confirmed by Modnay's even more dismal action) with a vengeance given three pieces of news that seemingly work against the pro-cyclical trade:

* Business sentiment may have peaked. We started the week with a notable down-tick in the ISM Manufacturing index to 60.7 from 64.7

* QE may have peaked. The move also came at the same time as the first major.central bank — the BoE — surprisingly reduced its QE program — signaling a turning point in UK monetary policy. Meanwhile, as BofA's Michael Hartnett calculates, the big 4 central banks' QE is set to fall from $8.5tn in ‘20 to $3.4tn in ‘21 to just $0.4tn in ’22, and in Q2/Q3 "the stronger the macro the quicker & bigger the taper."

* Job growth may have peaked. We finishing last week with a very surprisingly disappointing April Payrolls report which showed only 266k net new jobs were created against expectations for an increase of 1 million jobs or more. The unemployment rate also bumped up to 6.1% (because more people are now looking for work) and average hourly earnings grew by 0.7% mom versus consensus expectations (at least among economists) for no growth (as not enough low-paying jobs were created).

Yet potentially peaking growth and signs of an end to low central bank-enabled interest rates was apparently no obstacle to leaning further into stocks that should benefit from a post-pandemic growth phase. Well, in retrospect that's not very surprising - the market lost its ability to discount the future a few months into QE1 when the Fed would simply step in any time there were "market conditions" in the market, i.e., more sellers than buyers.

Then again, on the flip side of the procyclical trade sits mega-cap Tech with 3 of the 5 FAAMG stocks declining in value last week led by a 4%+ drop in AMZN, a drop which continued for another 3% on Monday, and pushing the stock into a deep correction from its all time highs just over a week earlier when the company reported blow out earnings. Not even today's announcement that Amazon would sell $18.5BN in bonds to repurchase stock did anything to boost the share price.

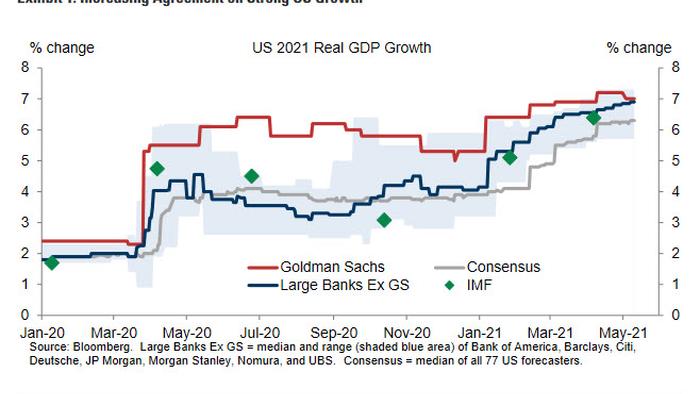

Picking up on this theme, on Monday afternoon Goldman's chief economist Jan Hatzius also offered a somewhat downbeat assessment of market conditions, writing that the bank's biggest call for 2021 has been its US growth forecast, which stood about 2% above the Bloomberg consensus for much of the past year. However, over the last few months, the gap has shrunk as many private and official forecasters have upgraded their numbers on the back of rapid vaccinations, easier US fiscal policy and—until recently—stronger data.

More importantly, the latest news fits the narrative of shifting growth leadership. The European health situation has begun to improve sharply, with surging vaccinations and declining new infections. The PMIs continue to rise, and Goldman expects GDP growth "to accelerate to 13% on a quarter-on-quarter annualized basis in Q3. And there is plenty of spare capacity that should be relatively easy to fill in, especially in the service sector. "

All this means that the continent is well-placed for a period of substantially above-trend growth if the path of the virus in coming months resembles what we have seen in other economies with successful vaccination programs, with the UK perhaps the most relevant example.

By contrast, and in keeping with the them of changing leadership, the US has stopped beating expectations, and the daily pace of vaccinations has fallen from 3.4 million in mid-April to 2 million now. Meanwhile, activity indicators have started to come in on the softer side, not only because of Friday’s disappointing jobs report but also because both ISM surveys fell in April, albeit to still-high levels of above 60. This is consistent with Goldman previously noted view that GDP growth is set to peak in Q2 at 10½% on a quarter-on-quarter annualized basis, with gradual deceleration in subsequent quarters. On a monthly basis, March currently looks likely to be peak for Goldman's current activity indicator (CAI), although this could still shift to sometime in Q

Curiously, here Goldman is quick to dismiss Friday's ugly NFP print, saying "it looks inconsistent" with other timely indicators of labor demand and spending, including jobless claims, ISM services employment, and Goldman's high-frequency measures of retail sales and service sector activity

Why Goldman's jobs complacency? Two reasons:

* First, employers might be prioritizing post-pandemic hiring over the seasonal hiring which normally takes place in the spring and which is incorporated in the Labor Department’s seasonal adjustment process (note that payrolls did grow nearly 1.1million on a seasonally unadjusted basis).

* Second, the $300/week unemployment benefit top-up is keeping the replacement ratio—total unemployment benefits as a percentage of take-home pay—above 100% in low-wage industries. Elevated job vacancies, elevated quit rates, continued strength in wages, and many anecdotes suggest that the top-up is making it more difficult to fill open positions than one wouldexpect at a 6.1% unemployment rate.

Combining these two points, Goldman concludes that both factors should be temporary: first, if seasonal hiring is lower than assumed in the seasonal factors in the spring, seasonal layoffs will also be lower than assumed in the fall, boosting seasonally adjusted job growth. Second, the $300/week top-up is scheduled to expire in early September, and some Republican - dominated states are already scrapping it. Together with continued health improvement— Goldman still thinks 70-80% of the US population will have immunity to covid by the fall - and a close-to-normal 2021-2022 school year that makes it much easier for parents to work, will help labor supply recover starting in the fall. This should result in stronger payroll gains as well as a reduction in wage pressures

Hand in hand with the projection for stronger payrolls gains, is Goldman expectation of renewed downward inflation pressure as the bank's trimmed-mean index still shows benign underlying inflation trends, the temporary boosts gradually wane, and healthcare costs—a key component of the core PCE index—slow more notably on the back of the expiration of the covid-related payments to medical providers.

The bank therefore is comfortable with its forecast that core PCEinflation will return to about 2% by the end of 2021, which should likewise keep Fed officials comfortable with a tapering schedule that starts in Q1 and runs for about a year (in short, the market is freaking out that in 7 month the Fed's liquidity injections will decline from $120BN to... $100BN.(The horror). Rate hikes become a live option during 2023, although we think the economic data will push liftoff into 2024.

Putting this all together, from a market perspective Goldman's forecasts limited inflation risk and dovish monetary policy — with Fed tapering starting in early 2022 and Fed hikes starting in early 2024—are now at least as important as the remaining gap in US growth forecasts.

Looking forward, Goldman's strongest market views take their cue from the broadening of the global recovery. The bank's commodity strategists have been vocal about their positive views on oil and copper, while FX strategists have expressed renewed confidence in a meaningful euro appreciation and a return to broad dollar weakness over the balance of the year. In rates, Goldman still thinks the market prices the first Fed hike too early but we view back-end real yields astoo low, with a 5-year 5-year forward TIPS yield of just 0.1%. In credit, valuations are elevated but nevertheless retain a down-in-quality bias, as economic forecasts should support corporate cash flows and central banks remain highly supportive. And similarly, the equity market has taken a good amount of creditfor the economic improvement but still see further upside in both DM and EM marketsgiven the ongoing global expansion and the friendly policy environment. Tyler Durden Mon, 05/10/2021 - 17:10

http://dlvr.it/RzTQjy

No comments:

Post a Comment