What Goes Up, Occasionally Comes Down

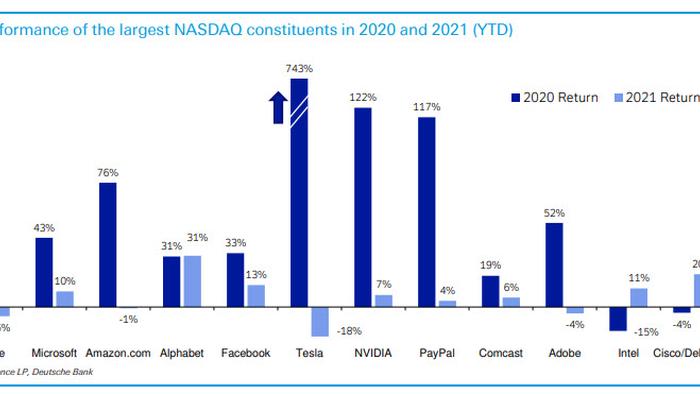

In today’s chart of the day from Deutsche Bank's Jim Reid, the chief credit strategist shows the dramatic performance reversal some of the most beloved stocks of 2020 have suffered in 2021 by mapping the return of the largest NASDAQ constituents in these past two years with the graph cut-off to reflect Tesla’s outsized +743% gain in 2020. So far in 2021 it’s the worst performer amongst these names (-18.1%), as the first shall be last.

As Reid notes, "technology shares have been battling the cross currents of strong growth and higher yields all year. Throw in heroic valuation levels in many names and 2021 is proving to be much more of a struggle than 2020... Even peerless companies like Apple and Amazon, which have announced two very strong quarters of results so far this year, have slightly declined in 2021."

Reid then reminds readers that at the start of the year, his two biggest worries were "notably higher yields and a bubble bursting in tech shares. As we get closer to midyear, yields are indeed a lot higher across the globe and tech is deflating from its February peaks. However, this has so far had minimal impact on many other risk assets."

His rhetorical conclusion:

"Could you continue to get buoyant markets, higher yields and falling tech? Or will the latter two become greater risks as we move into and through H2?"

For most, the answer should be obvious, and in case it isn't: yes, the Fed will do "whatever it takes" for the bursting tech bubble not to lead to a broader market crash, especially after the Fed confirmed in its latest FOMC notes that the market is indeed the economy"

"A couple of participants remarked that, should investor risk appetite fall, an associated drop in asset prices coupled with high business and financial leverage could have adverse implications for the real economy."

Translation: it is now the Fed's mandate to defend the "real economy" by ensuring that there is never a "drop in asset prices." Tyler Durden Wed, 05/19/2021 - 15:30

http://dlvr.it/S00KzF

No comments:

Post a Comment