Here Are The Industries Crushed By Biden's "Generous Unemployment Benefits"

When even Goldman - which has a history of aligning with the White House and the prevailing political administration du jour - refutes the falsehoods spread by the Biden administration about the origins of the unprecedented labor shortage, it's time to change the narrative.

In a note published today by Goldman chief economist Jan Hatzius, observes what is well known, namely that the "much weaker-than-expected job growth and much stronger-than-expected wage growth in last Friday’s employment report suggests that the labor market is much tighter than a 6.1% headline unemployment rate suggests" but it is what he says next that insures no Goldman economist will receive an invitation to the White House for the next few years.

According to the bank, the current labor market tightness reflects not any of the trite, general and incorrect reasons spouted by the White House for the record labor shortage, but is a result of "unusually generous unemployment insurance benefits." And in case there is any confusion, here it is again:

The main reason for the current labor market tightness is that that labor demand has recovered quickly—as indicated by the elevated labor differential and high share of firms with hard to fill positions (left chart, Exhibit 1)—while many workers remain out of the labor force due to unusually generous unemployment insurance (UI) benefits and lingering virus-related impediments to working.

As a result, the ratio of unemployed workers searching for a job to job openings has fallen to 1.0 (light blue line; right chart, Exhibit 1)—a level typically associated with tight labor markets. If all workers who lost their job since the start of the pandemic (including those who have left the labor force) were looking for work, the ratio of job seekers to openings would be 1.7 (dark blue dotted line), a level that corresponded to 5.8%unemployment last cycle.

Hatzius also notes that "generous UI benefits have put upward pressure on wages, particularly for lower-income workers, whose average self-reported reservation wage—the lowest wage they would accept for a new job—has increased by 21% since the fall."

As a result, the Goldman economist says that "the ratio of unemployed workers to job openings has fallen to a level typically associated with tight labor markets, particularly in the low-wage service sectors that face more competition from UI benefits and account for a large number of remaining job losses."

Of course, none of it is news to anyone except perhaps for Biden's handlers and whoever writes the text for his teleprompter.

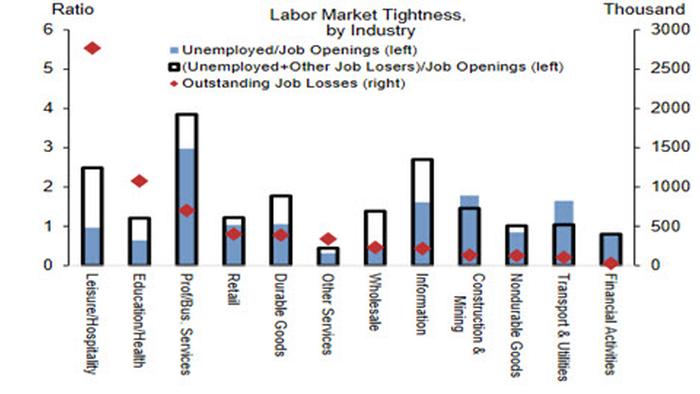

What we did find interesting is Goldman's analysts of which industries have been crushed the hardest by Biden's generous unemployment benefits which have forced the private sector to compete with Uncle Sam.

* In the chart below left, Goldman calculate the ratio of unemployed workers to job openings (blue bar) and the ratio of unemployed workers plus those previously employed but not currently searching to job openings, for each industry (black bar), with industries ordered according to outstanding job losses. The blue bars are generally lower and the difference between the blue and black bars is generally larger for industries on the left, meaning that the labor market is tighter in industries with a large number of outstanding job losses, in part because a larger share of job losers in those industries are not looking for work and therefore not counted as unemployed.

* In the chart below right, Goldman plots the ratio of unemployed workers to job openings against the wage replacement rate from UI benefits for the median worker in each industry. The negative relationship suggests that labor markets are tighter for lower-wage industries where employers face more competition from UI benefits when hiring workers.

Goldman concludes that "this imbalance between labor supply and demand is probably the cause of the surprising recent strength in wage growth."

Or, in other words - as we have said all along - it is Biden himself that is making it impossible for small firms to hire, and since they are competing with behemoths like McDonalds and Amazon for whom offering a $500 signing bonus is a walk in the park, Biden is actively facilitating the destruction of all those small and medium "mom and pop" businesses which managed to survive the decimation of the covid pandemic, and is making sure that whatever market share they have is promptly lost to publicly traded megafirms such as Amazon, WalMart and others.

If that news was bad, this is even worse: according to Goldman this state-sponsored destruction of small firms won't fade until September: "labor supply disincentives from UI benefits will persist until early September in most of the US, although 16 states have recently announced they will end the $300 federal payments in June. A further complication in identifying the role played by any single factor is that constraints interact positively, and the generous UI benefits were partially put in place so that households would not be forced to confront hard decisions about whether to work while pandemic-related health risks and child-care concerns persisted."

Bottom line: these supply constraints will keep labor markets tight and push up wage growth in the near term, before eventually fading around September "when most schools will have fully reopened, widespread vaccination will have dramatically reduced perceived health risk, and the $300 federal UI payments will have expired."

For all those small and medium businesses who can't afford to hike wages due to razor thing margins (thank you soaring inflation) yet who manage to fight off the massive conglomerates who will eagerly raise wages and offer signing bonuses to steal market share (paid for with a bond or two which will be lapped up by the market), congratulations. For everyone else, our condolences - we hope your stay in the USSA was pleasant. Tyler Durden Fri, 05/14/2021 - 13:58

http://dlvr.it/RzfYHd

No comments:

Post a Comment