Turkey And Hungary's Harbinger Hikes Tyler Durden Sun, 10/11/2020 - 09:20

By Variant Perception

Given the scale of demand destruction in the wake of the global health pandemic, central banks should be nowhere near tightening monetary policy. For those that are, policy rate hikes are indicative of intensifying currency stresses and risks of a destabilizing inflation surge. Charts Source: Bloomberg, Macrobond and Variant Perception

Turkey and Hungary fired the first salvo last month when the central banks from both countries unexpectedly lifted interest rates. In the face of persistent currency pressure, Turkey raised the 1-week repo rate 200bp to 10.25%, alongside a 50% drawdown in hard currency reserves since the beginning of the year. Hungary, meanwhile, left the base rate (main policy rate) and O/N deposit rates unchanged at 0.60% and -0.05%, respectively, but increased the rate on one-week forint deposit tenders by 15bp to 0.75% in a move widely seen as an attempt to temper recent HUF weakness. Charts Source: Bloomberg, Macrobond and Variant Perception

While both Turkey and Hungary have faced severe economic contractions in the first half of the year, the forint has fared much better than the lira. However, with liquidity growth running at a double dip clip in both cases (M2 growth in Turkey reached 41% YoY August and for Hungary it was a still lofty 16% YoY in July), the risks of a sharp surge in inflation are mounting.

When a central bank feels compelled to tighten monetary policy to stabilize a currency and tame inflation (particularly in instances when weak economic activity instead necessitates policy accommodation), it is often a last resort measure. Moreover, rarely is it the case that a one-shot policy rate hike is sufficient to stop the rot (unless accompanied by other policy measures). Charts Source: Bloomberg, Macrobond and Variant Perception

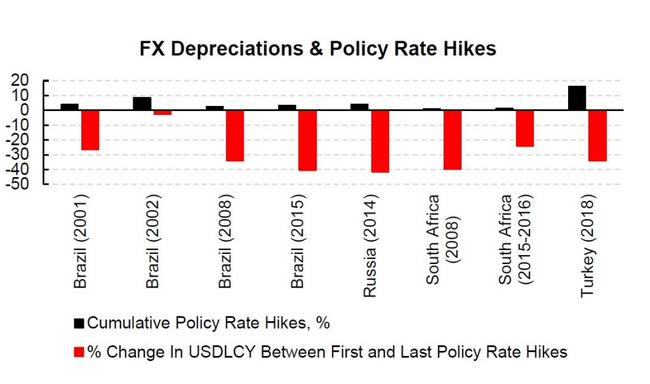

With that in mind, we have taken a look at previous instances where central banks have raised the main policy rate in a bid to stem currency depreciation and curb inflationary pressures within the high yield space (Brazil, Russia, Turkey and South Africa) Charts Source: Bloomberg, Macrobond and Variant Perception

We have only considered cases over the last 20 years where a currency has lost at least 30% against the USD over a 12-month period and the central bank has raised policy rates. For ease of comparison, we only go as far back as the current policy rate history allows (2013 for Russia and 2010 for Turkey). In all of the cases in our sample, policy rates were raised by a cumulative 100-1600bp (averaging 500bp) and the currency lost a further 2-40% (averaging 30%) between the first and last policy rate hikes.

http://dlvr.it/RjNP4H

No comments:

Post a Comment