Goldman Expects A Structural Bull Market For Commodities In 2021, Sees Gold Hitting $2300 Tyler Durden Thu, 10/22/2020 - 12:00

A weaker U.S. dollar, rising inflation risks and demand driven by additional fiscal and monetary stimulus from major central banks will spur a bull market for commodities in 2021, Goldman's chief commodity strategist Jeffrey Currie said on Thursday, also predicting that "all commodity markets are in, or moving toward, a deficit with inventories drawing in all but cocoa, coffee and iron ore."

The bank, which notes that markets are increasingly concerned about the return of inflation, forecast a return of 28% over a 12-month period on the S&P/Goldman Sachs Commodity Index (GSCI), with a 17.9% return for precious metals, 42.6% for energy, 5.5% for industrial metals and a negative return of 0.8% for agriculture.

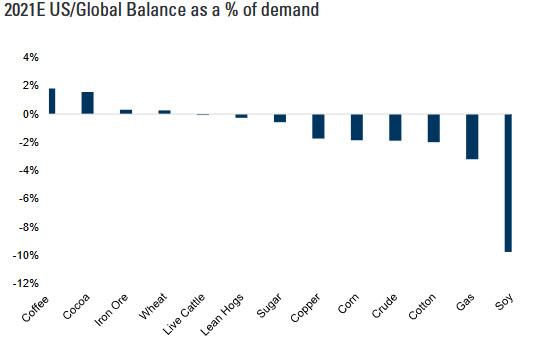

A key catalyst for the bank's bullish call is that "nearly all commodity markets are in, or moving toward, a deficit with inventories drawing in all but cocoa, coffee and iron ore."

As Currie adds, "such broad-based deficits are usually only seen late in the business cycle, underscoring the unique environment markets are in. Given that inventories are drawing this early in the cycle, we see a structural bull market for commodities emerging in 2021." In the strategist's view, the bull market will be driven by three major themes:

* structural under-investment in the old economy,

* policy driven demand and

* macro tailwinds from a weakening dollar and rising inflation risks. "These drivers remain consistent with the bank's bullish views from the start of this year, and have now been intensified by COVID-19 disruption and the subsequent global policy response."

Some more thoughts from Currie on the tightening in commodity markets:

Commodity markets have been mostly range bound since this summer, in our view caught between a longer-term bullish outlook for 2021 and near-term concerns around the timing of a vaccine amid rising COVID cases across Europe and the US Midwest (see Exhibit 4). However, it is important to emphasize that nearly all commodity markets are in, or moving toward, a global deficit with inventories drawing in all but cocoa, coffee and iron ore. Such broad-based deficits are usually only seen late in the business cycle,underscoring the unique environment markets are in.

As global demand remains tepid for consumer-related commodities like oil, the deficits further underscore how significant the drop in supply has been and how the supply response function has changed. For oil, the sharp drop in capex is now having an impact on non-OPEC decline rates, with capital markets refusing to fund shale drilling, only debt rollovers. In metals, we have seen a sharp drop in maintenance capex and supply disruptions dragging into 2021. This suggests that even if demand falters in coming weeks as winter exacerbates COVID-19, markets will likely continue to rebalance, barring an outright collapse in demand. In our view, base metals and agriculture have more near-term upside than oil, with smaller inventories to move through before prices begin to rise.

Goldman then shows the following chart which reveals the growing deficit across key commodities, as well as the key macro catalysts for higher commodity prices in coming months:

Hedging that even if demand falters in coming weeks as winter exacerbates COVID-19, Goldman still expect markets will continue to rebalance, "barring an outright collapse in demand." Goldman takes a more contained view on energy saying that while inventories of oil remain high, "upside in energy prices will likely come after winter." However, non-energy commodities face immediate upside as balances have tightened ahead of expectations, driven by large Chinese demand and adverse weather shocks, according to the Goldman strategist.

Focusing on Gold, Currie said that expansionary fiscal and monetary policies in developed market economies continue to drive interest rates lower and create demand for hedging the tail risks of inflation, lifting demand for precious metals. As a result, Goldman forecasts gold prices at an average of $1,836 per ounce in 2020 and $2,300 per ounce in 2021, and expects silver prices to be at around $22 per ounce in 2020 and $30 per ounce next year.

Non-energy commodities could see an “immediate upside” as the market balances tighten ahead of expectations on strong demand from China and weather-driven risks, the Goldman Sachs analysts said.

The bank maintained a “neutral” view on commodities in the near term and “overweight” in the medium term.

http://dlvr.it/Rk7HGf

No comments:

Post a Comment