The Endless Melt Up: Gold Soars, Global Stocks Turn Green For 2020; Apple $2 Trillion Any Second Tyler Durden Thu, 08/06/2020 - 16:09

Yesterday we compared this centrally-planned joke of a "market" to a physical class, one in which Newton's first law was on full display, to wit:

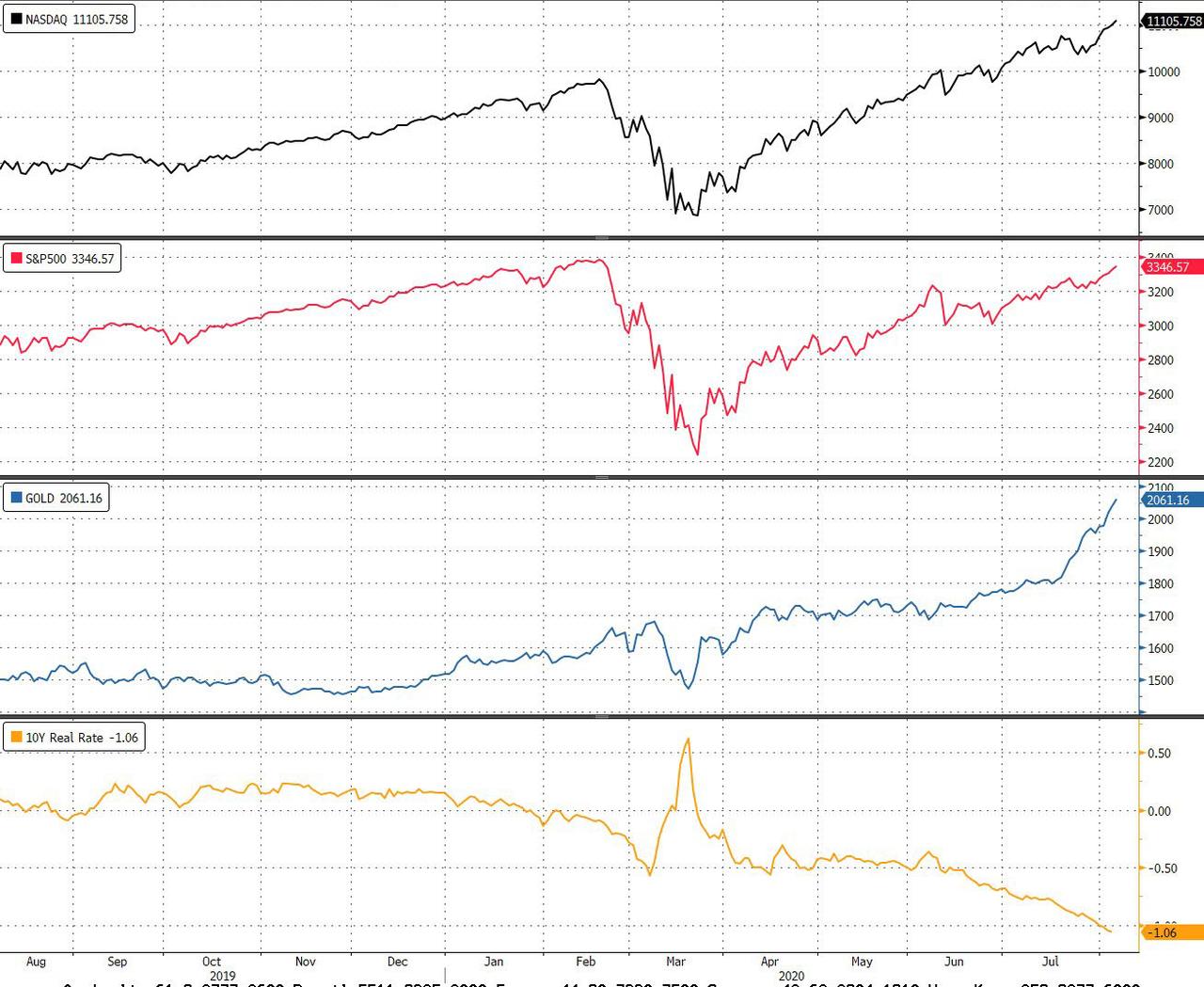

These days Newton's first law is as applicable in physics as it is in capital markets, because despite growing concerns about a new wave of covid infections, chaos and confusion over the passage of a new stimulus wave, a V-shaped surge in projected earnings, not to mention the all too real possibility that Joe Biden will be US president in 3 months, stocks continue to move in an upward motion, unperturbed by anything, with the Nasdaq hitting its 31 new all time high of 2020 and rising above 11,000 for the first time ever on the back of the 5 FAAMG stocks but mostly the AAPL juggernaut, which despite taking a rest today on a BofA downgrade is up a staggering quarter of a trillion dollar in market cap just since its earnings report last Thursday.

Fast forward to today when there clearly wasn't a sufficient powerful force to change the market's inertia, and the meltup has continued across all asset classes, with investors flooding into stocks, bonds, and pet rocks...

... send the MSCI All-Country Index green for the year, as if the biggest economic crash since the Great Depression never happened...

... with AAPL - whose market cap alone is now 7% of the entire S&P500 - is more than 100% higher from its March 23, lows, adding a third of a trillion dollars in market cap in the past week alone, and now just fractions away from a $2 trillion market cap.

All of this is happening as expectations of a deflationary singularity have sent the 10Y real rate to a new all time record low of negative -1.10%

Gold has benefited mightily from the collapse in real yields, and has hit another all time high today...

... and up 14 of the past 15 days.

Meanwhile, unlike yesterday when the S&P went catatonic after the overnight ramp, today the Emini which is now just over 1% or some 40 points away from its all time high, spiked higher in the afternoon, led as usual by the old faithful FAAMGs.

Finally, while the dollar did not crater today for a change, it was the Lira's turn to enter freefall mode, plunging to a record low against the dollar as investors bet on a total collapse of the Turkish economy next.

And while there has been a bit of a nudge higher in currency volatility...

... Overall, it was an extremely boring day, in which the VIX dropped to a new post crisis low, which is precisely what one would expect from centrally-planned markets.

http://dlvr.it/Rd7zR0

No comments:

Post a Comment