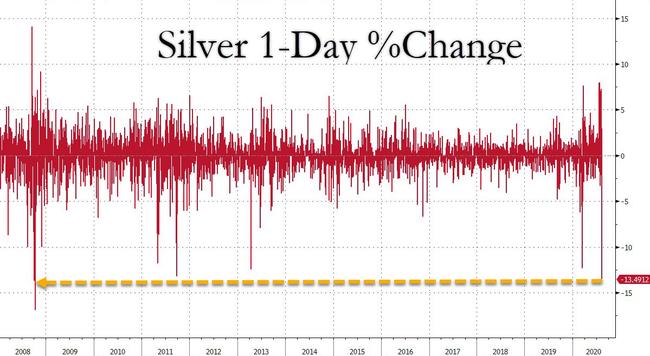

Silver Crashes Most Since Lehman Bankruptcy Tyler Durden Tue, 08/11/2020 - 14:20

Just as retail daytraders started to flood into precious metals, with Robinhood's retail army making SLV one of their most popular positions just last Friday...

... we got a very vivid reminder of just how fickle retail mood can be, and with gold hitting a near-decade high of $30 just a few days ago, the precious metal is down as much as $4...

... with today's drop as much as 13.5%, the biggest since the Lehman bankruptcy.

Needless to say, we expect the next update of Robinhood users holding SLV to show a dramatic plunge.

Silver is not alone, with gold also sliding below $2,000 as CTAs reverse and sell programs kick in...

... however the drop is far more measured, and as a result the gold/silver ratio is spiking.

Of course, since this is a forced liquidation it is providing great arb opportunities to the coming round of buyers (if anyone thinks the Fed is really about to allow 3% inflation which will destroy the bond market, we have a gold-plated bridge to Brooklyn to sell to you), real rates indicate that gold is now about $60 cheap.

http://dlvr.it/RdRrkR

No comments:

Post a Comment