Earnings Season Shocker: FAAMG Earnings Grew By 2% While EPS For The Other 495 S&P Companies Plunged 38% Tyler Durden Mon, 08/10/2020 - 15:05

Goldman, which over the weekend turned incrementally more bullish on the economy and hiked its GDP forecast as it now expects that a covid vaccine will be discovered and widely distributed in Q1 2021, resulting in what Goldman believes will be a sharp jump in consumption in the first half of next year (whether that actually happens in a country where more than half refuse to get vaccinated is a different story completely), has done a post-mortem on Q2 earnings season and also found some more "good news."

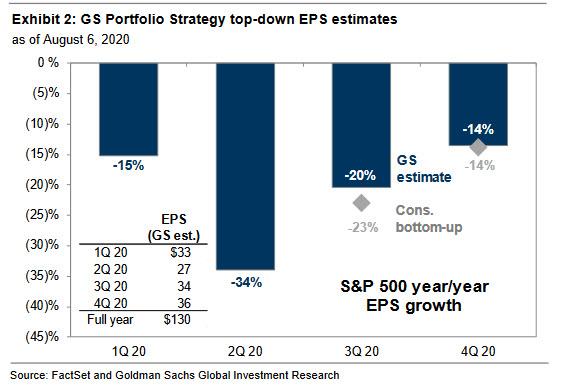

First, after expecting a 60% plunge in EPS in Q2, Goldman's David Kostin was delighted to report that S&P 500 EPS declined by "only" 34% year/year, well above both consensus expectations for a -45% decline, and Goldman's own forecast of a nearly double drop.

Some more details on soon to be concluded Q2 earnings season: with 445 companies representing 88% of S&P 500 market cap having reported, 58% of firms beat consensus EPS expectations by more than a standard deviation of estimates. This beat rate is well above the long-term average of 47% and nearly matches the previous record high from 2009 post-Financial Crisis. However, as even Kostin concedes, this only happened because consensus bottom-up earnings estimates were drastically cut ahead of 2Q earnings season. As a result of low expectations, companies that beat EPS estimates have only outperformed the market by 36 bp on average during the day following reports, below the historical average of 110 bp.

Aggressive estimate cuts aside, Goldman notes that strict cost management helped S&P 500 margins decline by less than expected, read lower input costs as well as aggressive layoffs.

Company managements across a variety of industries highlighted this theme in their earnings transcripts, ranging from employment and wages (e.g. DAL, KSU, HST) to discretionary expenditures (e.g., ALLE, GM). Both COGS and SG&A expenses as a share of revenues came in below consensus expectations, contributing to positive margin surprises in the quarter.

Kostin then suggests that the composition of the S&P 500 helps explain why 2Q results were stronger than what we expected based on the state of the economy.The US economy contracted by 10% year/year in the second quarter, setting a post-war record. Based on the historical relationship, S&P 500 EPS would have been expected to decline by roughly 60%. However, the shock to economic growth has had a particularly pronounced impact on small firms compared with large firms. The relatively strong balance sheets and elevated profit margins of large-cap stocks helped insulate their profits in 2Q.

And here is the first big surprise: while S&P 500 EPS fell by 34%, Russell 2000 EPS declined by 97%. Looking forward, small businesses continue to face elevated risk from the pandemic. As an example. a recent survey by GS 10,000 Small Businesses survey found that 84% of PPP loan recipients expected to exhaust funding by the first week of August. Further small business weakness could threaten the recoveries of both the US labor market and large-cap revenue growth.

But while small business remain crushed, large businesses are flourishing, and nowhere is this more evident than in the following fascinating observation from Goldman:

The strength of technology broadly and specifically the market-leading FAAMG stocks has also helped S&P 500 earnings fare better than what the economic environment would normally indicate. Info Tech is the largest S&P 500 sector by earnings weight (27% in 2Q) and actually grew earnings by 1% in the quarter, led by strong results within Semiconductors. Excluding Info Tech, S&P 500 EPS fell by 41% in 2Q. The five largest stocks in the S&P 500 (FB, AMZN, AAPL, MSFT, and GOOGL, or “FAAMG”) account for 16% of S&P 500 EPS, and each of those companies beat consensus sales and EPS estimates by more than one standard deviation in the quarter.

The punchline: In aggregate, FAAMG EPS grew by 2% year/year in 2Q compared with an aggregate decline of -38% for the other 495 S&P 500 companies: "The FAAMG stocks benefit from secular trends expedited by the coronavirus, such as cloud spending and e-commerce, and continue to capture an increasing share of their respective market."

In other words, for the "Big 5" techs, the pandemic shutdowns were precisely what the doctor ordered to not only crush what's left of their small and medium enterprise competition, but to boost their own WFH-based earnings.

Earnings shocker aside, Goldman used this unexpected strength in earnings (of really just a handful of companies), to lift its 2020 S&P 500 EPS estimate from $115 to $130 (-21% growth vs. 2019), and adds that of the $15 increase, $11 reflects better 2Q earnings results.

On a quarterly basis, we now expect year/year S&P 500 EPS growth of -20% in 3Q (vs. -30% previously) and -14% in 4Q (vs. -17% previously). High-frequency activity indicators, such as consumer spending measures, have improved since April, but softened in July as virus case counts have surged. Our estimates compare with consensus forecasts of -23% and -14%. Excluding Financials and Utilities, we forecast S&P 500 full-year 2020 sales growth of -4% and net profit margins of 9.1% (-157 bp). However, most investors are looking beyond 2020 and to the outlook for earnings in 2021 and 2022.

The better-than-expected Q2 results also gave Goldman confidence in its above-consensus 2021 EPS estimate of $170, which is largely driven by the bank's above-consensus 2021 economic forecast:

Our economists’ estimates for real US GDP growth in 2020 (-5.0%) and 2021 (+5.6%) are above both Blue Chip consensus and the median from the FOMC’s Summary of Economic Projections. We forecast S&P 500 sales growth of +10% and net profit margins of 10.9% (+181 bp) in 2021. Consensus has already started to revise 2021 EPS estimates higher. At the start of earnings season, bottom-up estimates implied 2021 EPS of $162, but that has increased to $165 today.

The bank also notes that revisions have been most positive in Energy, Consumer Discretionary, Materials, and Info Tech, and "while positive consensus EPS revisions are rare, they typically occur as the economy emerges from recessions."

Finally, Kostin admits that the US election and a reversal of the 2017 corporate tax cut pose substantial downside risks to both the S&P 500 EPS and the bank's earnings forecast. Even a best case scenario, however, means that it will take nearly two years for earnings to fully recovery: "While we expect aggregate S&P 500 earnings to reach 2019 levels by the end of 2021, we do not expect every sector to recover this quickly. Based on our top-down earnings model. we forecast Info Tech (+10% 2019-2022 CAGR) and Health Care (+10%) earnings will surpass 2019 levels by the end of 2021. However, we expect a more gradual earnings growth in cyclical sectors."

http://dlvr.it/RdNGtY

No comments:

Post a Comment