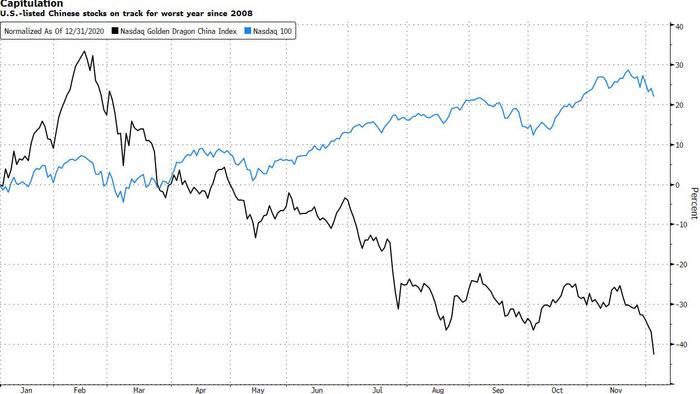

Didi, Alibaba, Evergrande Crush Traders: What To Watch In China

By Sofia Horta e Costa, Bloomberg analyst and reporter

For traders, all the bad China news is hitting at once -- just as concern over U.S. tapering deflates the most speculative investments globally.

Beijing’s demand that Didi delist its U.S. shares helped trigger the biggest plunge in the Nasdaq Golden Dragon China Index since 2008 on Friday. Alibaba, whose mysterious slump last week was already drawing attention, sank to its lowest level since 2017. The same day, Evergrande said it plans to “actively engage” with offshore creditors on a restructuring plan, suggesting it can no longer keep up with debt payments. That’s as stress returns to China’s dollar junk bond market, with yields above 22%. Evergrande bonds trade near 20 cents on the dollar.

The developments highlight the risks in betting that Chinese assets have already priced in negative news. HSBC, Nomura and UBS all turned positive on the nation’s stocks in October, citing reasons including cheap valuations and receding fear of regulation from Beijing. T. Rowe Price Group and Allianz Global Investors were among money managers taking advantage of the recent turmoil to add Chinese developer bonds.

A lack of transparency is adding to nervousness. Didi’s delisting notice comprised just 127 words. There were no details of how and when a move to Hong Kong would work. Evergrande’s statement was barely longer, and made no mention of whether the embattled developer would meet upcoming debts, including two interest payments due Monday. The Economic Daily said Premier Li Keqiang’s comments about a potential reserve ratio cut doesn’t indicate China will ease monetary policy.

There’s no shortage of symbolism. Alibaba, the largest-ever Chinese listing in the U.S. and the country’s most valuable company less than 14 months ago, has lost about $555 billion in value since its 2020 record. Its ADRs trade at record low valuations. (The company just replaced its CFO.) Didi, which was China’s second-largest U.S. listing -- is being yanked at the request of the government. That comes as regulators in both countries put pressure on Chinese firms listed in the U.S.

December is shaping up to be a testing time, just as traders around the world look to book profits after a frenzied year. Along with the plunge in Chinese equities and concern over what’s next for Evergrande, another developer Kaisa is on course for default this week unless it can reach a last-minute agreement with creditors to delay payment. The firm has $11.6 billion in outstanding dollar debt, making it the nation’s third-largest issuer of such notes among property firms. Tyler Durden Sun, 12/05/2021 - 22:37

http://dlvr.it/SDpzxD

No comments:

Post a Comment