This Is "Market Nirvana": JPMorgan Now Sees S&P Rising Up To 4,500 By End Of 2021 Tyler Durden Mon, 11/09/2020 - 13:40

Behold one of the best examples of Wall Street revisionism.

Exactly two weeks ago ago, in his latest weekly note JPMorgan strategist Dubravko Lakos-Bujas bucked Wall Street's conventional wisdom which had a "Blue Wave" outcome as the best possible result from the election, and stunned traders when he predicted that "an orderly Trump victory was the most favorable outcome for equities (upside to ~3,900)" while arguing that a Blue Wave is viewed "as short-term neutral but long-term negative, as the expected Biden tax policy outweighs the benefits from a larger than expected stimulus package. SPX may have upside to ~3400, but it would have larger downside depending on the details of the package, potentially to ~2,500." Meanwhile, the JPMorgan strategist also said that a split congress, widely viewed at the time as the worst possible scenario, would also lead to a continuation of the status quo and ascribed a 3,600 price target to it.

For those who missed it, this is the full breakdown:

*

Biden / Blue Wave – The market likely views this as short-term neutral but long-term negative, as the expected Biden tax policy outweighs the benefits from a larger than expected stimulus package. SPX may have upside to ~3400, but it would have larger downside depending on the details of the package, potentially to ~2,500.

*

Biden / GOP Senate – The market likely views the GOP Senate as being a net-positive as we may not see any changes to tax policy while having stimulus-related upside. SPX may hit 3,600.

*

Trump / Dem Senate – This scenario is positive, too. Here, we may see a larger fiscal package, potentially up to Pelosi’s $2.2T request, but without the negative tax consequences since Dems would not have the votes to override a Presidential Veto. SPX may hit 3,600 or higher.

*

Trump / GOP Senate – The “status quo” scenario is positive for risk-assets. We may see a larger fiscal package than under a Biden/GOP Senate administration and potential improvements to the existing tax policies. SPX to 3,900.

*

Trump / Red Wave – Similar to the above scenario, this is positive for risk-assets. SPX to 3,900.

*

Trump / Red Wave – Similar to the above scenario, this is positive for risk-assets. SPX to 3,900

Readers may be shocked to learn that all of that changed with the flick of a (buy) switch over the weekend, when Dubravko - perhaps while watching the bullish euphoria following the collapse of the blue wave - pulled a 180 and in a note overnight said that a Joe Biden presidency but without Democratic control of the Senate may be "one of the better scenarios" for equities as it limits Biden’s ability to execute some of the possibly market-negative policies, such as tax hikes or regulation, JPMorgan strategists led by Mislav Matejka say in note.

He added that under Biden, trade uncertainty is likely to come down, dollar could potentially weaken, "and while the scale of next round of stimulus is likely to be reduced, it will still be coming, as both Republicans and Democrats will want to be seen as supportive of economic recovery."

That particular take lasted for about a few hours, and early this morning in the aftermath of the Pfizer news and the market's blistering surge higher, the chief JPM strategist published yet another note titled "Vaccine Rotation, Subsiding Risks, Market Nirvana" which true to its name, predicted nothing but continued surging from this point on. This is his latest thesis in a nutshell:

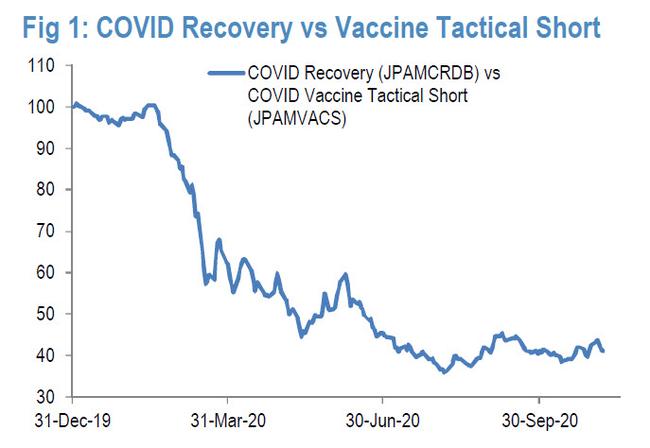

The equity market is facing one of the best backdrops for sustained gains in years. After a prolonged period of elevated risks (global trade war, COVID-19 pandemic, US election uncertainty, etc.), the outlook is significantly clearing up, especially with news of a highly effective COVID-19 vaccine. We expected an imminent vaccine outcome and a rotation out of COVID-19 beneficiaries /

Momentum and into Epicenter / Value stocks including Vaccine Tactical Short (JPAMVACS ) and COVID Recovery baskets.

We view a confirmed Biden victory with a likely legislative gridlock as a goldilocks outcome for equities, a “market nirvana” scenario. With an even balance of power in the legislature, major tax increases and regulatory changes will be difficult to pass, while at least some easing of the global trade war should be expected. Global central bank policy remains very supportive (rates to remain at zero with ongoing QE).

The prospect for another round of fiscal stimulus has improved as well, though scope and size should be narrower. Corporate earnings (i.e. 3Q, see details below) and labor market recovery (i.e. October jobs) continue to come in ahead of expectations. This recovery process should remain underpinned by easing of COVID-19 restrictions (i.e. US QMI has entered business cycle expansion phase, see below). USD continues to normalize, acting as an earnings tailwind for US multinationals. S&P 500 cash balance is almost back to record highs, with potential for increasing buyback and M&A activity in 2021.

Equity positioning remains at below-average levels with ample room for mechanical re-leveraging as volatility levels subside (Volatility Targeting ~10th percentile, HF equity beta ~20th percentile, and CTAs ~40th percentile, see report).

In light of all these developments, JPMorgan now sees the S&P 500 surpassing its previous, September price target of 3,600 before year-end and reaching 4,000 by early next year, "with a good potential for the market to move even higher (~4,500) by the end of next year."

The bank is revising up its 2021 EPS estimate by $8 to $178 (well above the consensus of $168.26) and introducing 2022 EPS of $200 (consensus $194.69).

So in this market nirvana are no risks left? Almost: according to Dubravko, "the most significant short-term risk we see for equity markets remains the Georgia Senate races." And here, in yet another case of revisionsim, the formerly "best case" scenario, the Blue Sweep, is now the worst, to wit: "the loss of both Republican seats could result in a “blue sweep” outcome, which would pose downside risk and clouds the above described base case."

However, even this risk is likely overstated according to JPM, "as the GOP is expected to capture at least one of the two senate seats in the Jan 5th run-off. Indeed, it is possible that vote recount for one of the seats may settle the outcome in GOP’s favor even before the run-off. Plus there is a chance that John James in Michigan may recapture the lead, giving GOP an additional Senate seat." Meanwhile, the GOP deficit in the House continues is narrowing, a sign that the legislature is moving towards the center – generally positive for risky assets.

In short: the outcome that JPM said was "meh" as recently as two weeks ago - even with the advent of a vaccine which the bank repeatedly said was coming - is now not only the absolute best one, but is in fact "market nirvana." We wonder how quickly the "nirvana" will change to "purgatory" once the 10Y blasts off above 1% and slams all duration-sensitive names, which include the market leaders for the past four or so years, and whose plunge would drag everything lower.

http://dlvr.it/RlKj36

No comments:

Post a Comment