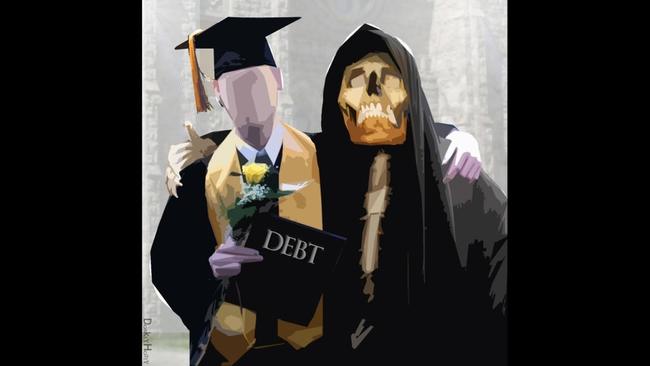

Student Loan Debt Continues Its Upward Climb (Despite Drop In Enrollment) Tyler Durden Wed, 11/11/2020 - 11:50

Via SchiffGold.com,

Student loan debt continues to surge despite falling college enrollment.

In Q3, student loan balances rose by $23 billion from the second quarter, according to the latest Federal Reserve data.

Forty-five million Americans now owe $1.7 trillion in student loan debt. Total outstanding student loan balances have surged by $54 billion year-on-year.

Enrollment in colleges and universities dropped by over 231,000 students to a total of 17.97 million between 2018 and 2019. The drop in enrollment between those two years continued a trend we’ve seen since university enrollment peaked in 2011. That year, 20.14 million students were enrolled in colleges and universities. Since then, enrollment has dropped by 10.8%.

One of the reasons student loan debt continues to increase despite falling college enrollment is the glut of student loan money pushed up the cost of a college education. The federal government pushed the widespread availability of student loans. It was supposed to make it possible for everybody to go to college. But there was an unintended consequence. It made a university education unaffordable and ended up saddling millions of Americans with crushing levels of debt. Studies have shown the influx of government-backed student loan money into the university system is directly linked to the surging cost of a college education.

Another reason student loan balances continue to surge upward is that borrowers aren’t making payments on their loan principal. This was a trend before the pandemic that has accelerated in the year. Many student loans were moved into automatic forbearance as the coronavirus economic chaos unfolded. President Trump signed an executive order extending interest-free federal student loan forbearance through Dec. 31, 2020.

More than 1 in 4 student loan borrowers are either in delinquency or default.

Joe Biden promised student loan relief on the campaign trail. The plan he outlined would forgive $10,000 of outstanding student loan debt for all borrowers. This would simply erase about one-third of student loan debt. His plan would also cut the repayment percentage from 10% to 5% of discretionary income for those making $25,000 per year or more and would defer payments interest-free for those making $25K or less.

As WolfStreet put it, “The story I keep hearing is that you’d be a moron to make payments on your student loans because they’ll be forgiven anyway. Mmmkay. So existing loans are not getting paid down, and new loans are being added, and the balances continue to balloon.”

It’s important to remember that student loan forgiveness doesn’t mean Joe Biden just waves a magic wand and erases the debt. The federal government backs these loans, but private lenders actually made them. The lenders will get their money – courtesy of Uncle Sam. In effect, the federal government will have to borrow the trillions of dollars necessary for student loan forgiveness and add it to its $27 trillion debt. In other words, the debt will simply be transferred from the student-borrower to the American taxpayer.

The student loan crisis is an economic timebomb waiting to go off.

In a speech in late 2018, Education Secretary Betsy DeVos revealed just how significant the level of student debt has become, noting that it comes with “significant risk.”

At 1.5 trillion dollars, FSA’s loan portfolio is now one-third of the Federal government’s balance sheet. Last year, uncollateralized student loans—which are all of them, by the way—accounted for over 30 percent of all federal assets. One-third of the balance sheet. Only through government accounting is this student loan portfolio counted as anything but an asset embedded with significant risk. In the commercial world, no bank regulator would allow this portfolio to be valued at full, face value. Federal Student Aid has a consumer loan portfolio larger than any private bank. Behemoths like Bank of America or J.P. Morgan pale in comparison. FSA also is the largest direct loan portfolio in the whole Federal government—by far—surpassing all other federal direct loans combined by 1.1 trillion dollars.”

DeVos admitted that the spiraling level of student debt has “very real implications for our economy and our future.”

The student loan program is not only burying students in debt; it is also burying taxpayers and it’s stealing from future generations.”

Simply waving a magic wand and declaring the debt forgiven won’t make the problem go away.

http://dlvr.it/RlTB65

No comments:

Post a Comment