Fed Makes No Changes To Policy, Sees Economic Activity "Continuing To Recover" Tyler Durden Thu, 11/05/2020 - 14:04

Since the last FOMC Statement, in September, the USDollar is very modestly higher but in a strange coincidence, gold, bond prices, and stocks are all down almost exactly the same amount...

Source: Bloomberg

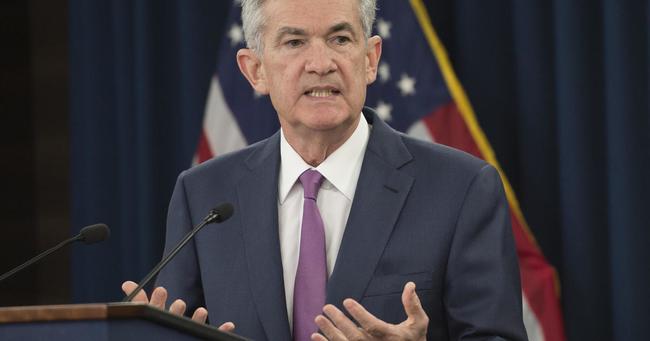

The Fed balance sheet has gone nowhere for four months and after this week's death of the blue-wave, we suspect pressure will come back on Powell and his pals to jawbone QE expansion back into the narrative...

Source: Bloomberg

And in the last month or more, while 'soft' survey data has soared higher, 'hard' real data has serially disappointed...

Source: Bloomberg

Today's FOMC is widely expected to be a non-event.

There is little chance of further policy action beyond the half-point surprise rate cut on March 3 and the full-point cut on March 15 that took the target range to 0.00%-0.25%. Analysts expect a sustained ZIRP position for the foreseeable future, especially now given the shift to average inflation targeting that would imply zero-rates beyond the return of inflation to 2%. Fed officials and the projections in the dots have indicated rate hikes are not expected for years.

The market will focus closely on the statement and ensuing press conference for further insights on forward guidance and any action on QE, which is increasingly being priced in as expected now that the blue-wave fiscal tsunami is out of the window.

So what did they say?

Not Much!

The Fed, as expected, held rates unchanged and did not change the terms of the bond-buying programs.

Additionally, The Fed repeated its commitment to using its full-range of tools.

The Fed continues to see economic activity and employment recovering.

The following redline shows the statement was practically unchanged too...

With the only textual changes as follows:

"Economic activity and employment have continued to recover" changed from "picked up in recent months" ... "but remain well below their levels at the beginning of the year.

"Weaker demand and earlier declines in oil prices" changed from "significantly lower oil prices" ... "have been holding down consumer price inflation."

" Overall financial conditions remain accommodative" changed from "have improved in recent months"

This decision was unanimous (because Neel Kashkari is on paternity leave).

http://dlvr.it/Rl4S8T

No comments:

Post a Comment