The Roadmap To The Next Recession

After repeated calls by this website that the Fed is hiking (as much as "six or seven" times to paraphrase Jamie Dimon) right into a slowdown and eventually, a recession, last week Deustche Bank's head of thematic research Jim Reid went the next step and published his monthly chartbook called “The road to the next recession" (available to pro subscribers), and writes that "with inflation rampant, the US employment and output gaps as good as closed, the Fed playing catch-up, and the yield curve flattening, it’s fair to say that the classic ingredients for the next recession are falling into place."

However, where Reid diverges with our - and BofA CIO Michael Hartnett view - that a recession could strike as soon as the second half, his chartbook suggests that those waiting for the cycle to roll over imminently will likely have to be patient.

The reason for that is that Reid's guesstimate for when the next recession might start was mid-2024. If true, he writes, this expansion would be only just over 4 years. While this may feel short, Reid shows in the following chart that this would still be the 8th longest US cycle out of the 35 over the last 170 years. And that, of course, assumes that the events of March 2020 were sufficient to reset the business cycle - the longest one in US history, which started in June 2009 and ended with the covid crash - instead of merely pushing the US economy into "super late stage" on the back of a trillions of brand new debt, without the critical deleveraging which marks the true reset of the business cycle which of course never happened.

Reid then observes that all four of the previous cycles (since 1982) have been in the top six longest of all time so what’s to stop this current cycle lasting as long? Here are the things he lists:

* First, the output and employment gaps have closed much earlier in this cycle than the other four;

* Second, interest rate rises (likely) and yield curve flattening are generally happening much earlier;

* Third, inflation is accelerating at a pace not seen at this stage in these previous cycles. The third point is probably the swing factor. Over the 1982-2020 period and four very long cycles, inflation was largely controlled by exogenous disinflationary forces. As such whenever the economy looked likely to roll over, the authorities had carte blanche to loosen policy to extend the cycle. It doesn’t look likely they’ll be so fortunate this time and will have to choose between tackling inflation or reducing economic risks.

As an interesting aside, the third longest cycle in history occurred in the mid-to-late 1960s when the Fed responded to equity market weakness by cutting rates rather than continuing to raise them in what was an inflationary environment. This extended the cycle but arguably locked in higher inflation before we even got to the inflationary 1970s. CPI ended the 1960s at 6.2% - roughly where it is now - and had already forced a hawkish Fed pivot. They arguably had to hike more aggressively than they might have needed to a few years earlier and this led to the delayed onset of the recession.

Finally, here are a handful of useful visual themes highlighted by Reid, charting the progression to the next recession:

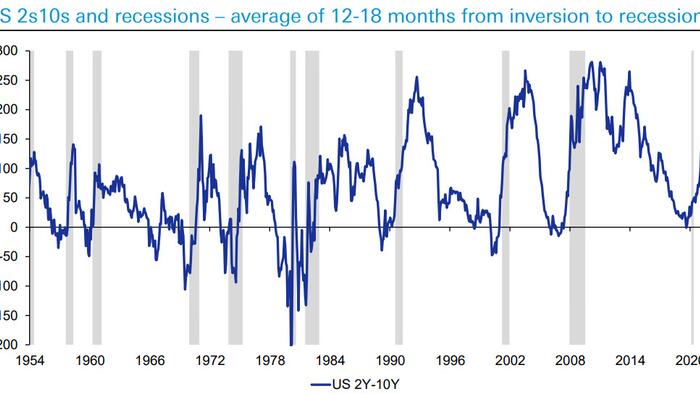

* Every recession in the last 70 years has only happened AFTER 2s10s has inverted... Good news we’re still at c.+75-80bps, bad news we were at +160bps last March. Fed hikes in ‘22 could invert curve in H1 ‘23, especially if history is to be believed (see next slide)…

* Average movement in 2s10s US yield curve in Fed Tightening Cycles since 1955 by month (bp change)... the curve almost always flattens after the Fed hikes, on average c.80bps in the first year.. So, could we invert in H1 ‘23 and start the countdown clock to recession?

* Assuming 2s10s stays inverted for 3 months, the lead time to recession is relatively tight between 8-19 months apart from ‘08 (25 months) and mid-late 1960s when Fed re-steepened curve by cutting due to equity market weakness even though inflation was rising (i.e. policy error); a brief inversion is a less strong signal, but still can’t be ignored

* Looking at curve moves, the average movement in 10yr US Treasury yields in Fed Tightening Cycles since 1963 by day (absolute percentage point change). Yields fairly flat into the first hike but then rise after until they fall again in the second and third year.

Average S&P 500 Performance in Fed Tightening Cycles since 1955 by day: the weakness starts to materialise 9-10 months after the first hike and lasts a year or so. At around 8-9 months equities down in only 1 (1976) out of 13 hiking cycles… 1994 (shock rate hikes) around zero though.

That said, this time is different - the current Fed policy is the loosest since the 1950s and only looser around the start and end of WWII

* Meanwhile, the US labor market is acting like it’s already well through full employment: Was the decision to move to FAIT fighting the battle of the last war? Without FAIT would the Fed have tightened earlier due to lead indicators? Quits data has been much better lead indicator of labour tightness than u/e rate.

* Yet even as US inflation has surged and been missed, Q4 2022 expectations risen only slightly over last 12 months. Economists still believe in transitory to a large degree…

* Perhaps the most important chart, and why we don't think this is a new cycle at all - the Covid M2 spike has taken us well beyond pre-covid trend. Note that the GFC period saw no such spike. Back then banks, consumers were aggressively de-levering and governments soon moved to austerity. It's a very different this time with helicopter money and no de-leverering…

* Another remarkable observation: the US output and employment gap likely now closed, the quickest in history after the slowest post GFC. A very different cycle to the post GFC one. The inflationary consequence at the same stage of the cycles should be totally different… So by definition we are mid-late cycle earlier.

* Some bad news for central bankers: inflation will struggle to sharply mean revert. Primary rents and owners’ equivalent rent (OER) make up around a third of the basket (40% for core) and our own forecast (see "What Rental Hyperinflation Looks Like: "Soaring Prices. Competition. Desperation"" from August 2021) suggest > 5.5% in 2022..

* A decoupling: Oil has been a big driver of inflation expectations over the last decade, but an interesting decoupling in 2022 though: Fed are lowering breakevens but oil marches on. This is likely due to the jump in Real Rates as the Fed pulls back on TIPS purchases, which in turn is forcing Breakevens (a plug) to slump.

* So will the market get rate hikes right this time. Historically, traders have been mostly too hawkish since the GFC. Will this time be the polar opposite?

* What about the Fed? QT interrupted one of the biggest bull markets in history - Will it have a similar impact this time? Note though it took 9 hikes and a year of QT for turmoil in markets, but inflation was far, far lower.

* And while we wait for the next recession, we have bad news for tech stock fans: the FAANG index has a long way to drop as it follows the upcoming collapse in the Fed's balance sheet.

Much more in the full presentation, available to professional subs.

Tyler Durden

Thu, 02/03/2022 - 19:20

http://dlvr.it/SJLgbj

No comments:

Post a Comment