January Payrolls Preview: It Will Be A Bloodbath

One month ago, when discussing the lousy December payrolls print, we said that "it’s important to consider that through the December employment survey period, the Covid case count was up 50% relative to the relevant November period. In early January, it is already up 440% relative to December, so the Covid drag will be an order of magnitude larger in the January data and could easily push net payrolls into negative territory for the next few months."

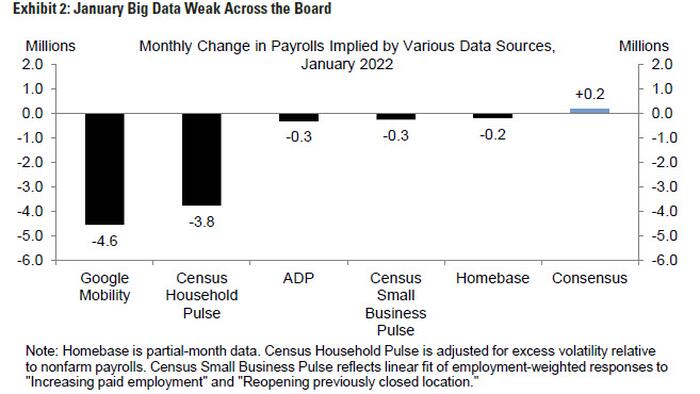

And sure enough, after several stark warnings by both the Fed and the White House about January's payrolls report due at 830am on Friday, following a catastrophic ADP print of -301K (which prompted Rabobank to spell out stagflation), we are looking at a payrolls abyss, with increasingly more banks expecting negative prints, while big data estimates based on Google Mobility and the Census Small Household Business Pulse, suggesting a devastating print of -4.6 million and -3.8 million, respectively.

While the median consensus expectation points to about a still respectable 133K (down from 150K just a few days ago) and down from 199K last month...

... prominent banks such as Goldman are now guiding much lower, expecting the worst jobs report since the covid crash. As Goldman chief economist Jan Hatzius writes today, "nonfarm payrolls declined by 250k, 400k below consensus of +150k. Our forecast reflects a large and temporary drag from Omicron on the order of 500-1000k, as survey data indicate a surge in absenteeism during the month. Dining activity also slowed sharply, and all of the Big Data indicators we track are consistent with an outright decline in payrolls." Needless to say, Goldman wouldn't take such a contrarian, and reputation damaging, view without justification, and we are confident that this time, Goldman will be on the money with the payrolls print coming at or below the bank's forecast.

Other banks are just as negative: TD analysts cite "temporary Omicron fallout" in looking for a -200K headline, adding that they see "downside risk to our -200k estimate."

Academy Securities' analyst Peter Tchir writes that while the "average estimate is 54k, if you look at avg estimate of those submitted/updated in February it is -89k (recent submissions reflect more up to date info)... I wouldn't be surprised to see a big NEGATIVE headline number in the establishment survey, not the same issue in household survey."

While the above estimates are likely on the money, they are incomplete as they all assign the January weakness to Omicron, which is now well on its way out, and thus should have a temporary impact. We disagree: we are confident that the US economy is now rapidly slowing and has already contracted (as the Atlanta Fed's latest GDPNow indicated) only not because of Omicron, but because the US consumer is finally tapped out, as the gargantuan, record surge in credit card usage indicated.

Still, for at least the next 3-4 months we are living in the "economic weakness is transitory" narrative (just like "inflation is transitory" last year, remember that), and it's why several Fed officials have already made clear that they will discount weak data as temporary.

Also, as TD writes, there is upside risk on average hourly earnings, with an already strong trend likely to be added to by temporary Omicron effects relating to the composition of payrolls and the length of the workweek. As such, the bank's 0.6% m/m estimate for hourly earnings implies 5.3% y/y, up from 4.7% y/y in December, a number which will be interpreted as further pouring gasoline on the Fed's hawkish fire, when in reality it is just an artifact of an excel model desperately trying to make sense of confusing data.

And while both Wall Street and the Fed will ignore tomorrow's dismal number - pretending that it is all due to Omicron - the reality is that just like last year, both will be making a huge mistake (for the second year in a row) as the true state of the US economy will be perfectly reflected in tomorrow's dismal number.

Sermon aside, here is what Wall Street expects will happen tomorrow and how it will impact markets, courtesy of Newsquawk

* Traders will use the January jobs report to assess whether the market’s aggressive Fed bets are appropriate.

* Money markets currently expect the FOMC to fire the equivalent of four 25bps rate hikes in 2022 to curb upside pressures to inflation, with some risk of a fifth.

* The Fed is more focused on the inflation part of its mandate and that implies that there may be greater attention on the average hourly earnings measures within the jobs report, particularly since participants generally agree that the US is effectively at maximum employment.

* The Omicron impact has tainted January’s economic data readings, presenting downside risks to the NFP headline (expected 134k from 199k), and upside risks to wage metrics (+0.5% M/M expected with the annual rate seen rising to +5.2% Y/Y from 4.7%; average hours worked is seen unchanged at 34.7hrs). Meanwhile, seasonal adjustments may provide support for the headline.

* It may be difficult to interpret the underlying health of the labor market by using the January jobs data; the market reaction will be based on a combination of how the headline fares in the context of the wage pressures; a headline miss accompanied by further upside to wages would likely embolden hawkish Fed bets; conversely a more resilient headline combined with less upside in wages may have the opposite impact.

HEADLINE:

* The pace of payrolls additions has been easing, with the 3-month average currently 365k, the 6-month average at 508k, and the 12-month average at 537k, which many think is more a function of labour market tightness rather than a major downturn.

* The pace is likely to slow even further in January, with the consensus expecting to see 150k nonfarm payrolls added, and the unemployment rate expected to be unchanged at 3.9%.

* Many economic data prints for January have been negatively impacted by the Omicron wave, and that is likely to be reflected in the January jobs report too. White House economic advisor Deese has warned that Americans need to be prepared for January employment data that "could look a little strange". This theme was certainly reflected in the ADP gauge of private payrolls, which saw a reading of -301k in January against an expected +207k.

* ADP explained that the Omicron effect was to blame, with most of the job losses in the Leisure & Hospitality sectors after hefty gains in Q4; but ADP judged that the impact of Omicron was likely to be temporary.

Forecast by bank:

* HSBC +225K

* CS +200K

* Daiwa +200K

* Mizuho +200K

* AP +170K

* SocGen +155K

* BNP +150K

* DB +150K

* JPM +150K

* RBC +150K

* BMO +100K

* Citi +70K

* Median +70K

* Barx +50K

* UBS +50K

* Nom -50K

* Scotia -100K

* WF -100K

* BofA-150K

* Jeff -200K

* TD -200K

* MS -215K

* GS -250K

* NW -350K

OMICRON IMPACT: For the week that traditionally coincides with the BLS employment situation report survey, initial jobless claims jumped to 290k from 231k and continuing claims rose to 1.675mln from 1.624mln. Pantheon Macroeconomics said that this Omicron impact would not last long, however, given that cases have begun to fall back, but still noted that the near-term outlook remains uncertain. "The jump in claims is consistent with the message from the Homebase data for the week which suggests payrolls will be reported falling by about 300K, and that's after we allow for the usual upward revisions to the initial Homebase data."

SEASONAL ADJUSTMENTS: Analysts have pointed out that there could be some seasonal adjustments in January that could give support to the headline; Citi thinks the adjustment could add around 3mln jobs; "if fewer than usual layoffs occur in some industries this year, perhaps reflecting that the level of employment is already lower than desired given worker shortages, adjusted figures would show a large increase," the bank explains. There is even more uncertainty this month however, given that the January jobs data will also include revisions to the establishment survey; Citi therefore cautions about trying to over-interpret what the January jobs report is saying about the true health of the underlying labour market.

WAGES ARE KEY: Average hourly earnings are expected to rise +0.5% M/M in January (prev. +0.6%), and to 5.2% Y/Y (prev. 4.7%). With most FOMC participants agreeing that US labour market conditions are consistent with maximum employment, and with the recent upside in price pressures which has resulted in the FOMC pivoting in a hawkish direction, the nonfarm payroll headline will only be part of the story in January. Many analysts will be paying more attention to the average hourly earnings metrics for a gauge on how wages have responded to higher prices amid a tight labour market; the theory is that surging wages will likely lead to FOMC participants leaning towards the more aggressive end of monetary policy expectations (where the possibility of a 50bps incremental rate hike, and/or possible hikes at every meeting this year, and/or a potential acceleration of the balance sheet wind down), whereas slowing wage metrics may see some of the aggressive Fed bets pared back (currently, money markets are pricing the equivalent of four 25bps rate hikes this year, although pricing suggests there are risks for a fifth hike too).

UPSIDE RISKS TO WAGES: The Omicron impact is likely an upside risk to wages in January. Compositional issues imply that low-paid workers who do not receive sick pay will have dropped out of the wage calculations, as White House economic advisor Deese recently noted, and that would likely result in the average moving upwards for the sample; any downside to average workweek hours could exacerbate this effect (the consensus expects average workweek hours to be unchanged at 34.7hrs). Additionally, overtime pay could also be higher if healthier staff were paid to cover their sick colleagues.

ARGUING FOR A WEAKER-THAN-EXPECTED REPORT:

* Arguing for a weaker-than-expected report: Omicron. Covid infections rose sharply in December and remained high during the January survey period. And as shown in Exhibit 1, the Household Pulse survey from the Census indicates a surge in absenteeism during the month. Based on the historical relationship between the household survey question “not at work due to own illness/other” (plotted in Exhibit 1) Goldman is assuming a drag from Omicron of 500-1000k in tomorrow’s report.

* Big Data. High-frequency data on the labor market indicate an outright decline in payrolls (see Exhibit 2). We believe the Google series overstated the January employment decline due to a shift to work-from-home this month (these workers are still counted as employed in the nonfarm payroll figures). Relatedly, workers who used sick leave are also counted as employed.

* Dining activity. Dining activity pulled back sharply in January—falling to 20% below 2019 levels. Coupled with the drop in ADP’s estimate of leisure and hospitality jobs, we expect a large pullback in leisure sector payrolls in tomorrow’s report (our estimates embed a drag of 350k).

* ADP. Private sector employment in the ADP report decreased by 301k in January, against consensus expectations for a 150k increase and likely reflecting a meaningful Omicron drag.

* Employer surveys. The employment components of business surveys generally decreased in January. Our services survey employment tracker decreased 0.8pt to 53.0 and our manufacturing survey employment tracker decreased 1.7pt to 56.2. The Goldman Sachs Analyst Index (GSAI) fell by 8.7pt to 68.2 in January, and the employment component declined by 9.2pt to 73.2.

ARGUING FOR A BETTER-THAN-EXPECTED REPORT:

* End-of-year layoffs. The tight labor market likely catalyzed some employers to retain workers who would normally leave at the end of the year. The BLS seasonal factors assume 3mn net job losses in a typical January. And while initial jobless claims rebounded during the month (227k on average vs. 204k in December) the level is considerably lower than a typical year. Continuing claims in regular state programs also decreased 46k from survey week to survey week—despite a likely boost from Omicron.

* Education seasonality. Education weighed on job growth during the fall, likely because some janitors and support staff declined to return for the new school year. Many of these individuals typically stop working for the January survey period, implying a seasonally adjusted gain in education payrolls in tomorrow’s report (we assume +50k, public and private).

NEUTRAL/MIXED FACTORS:

* Job cuts. Announced layoffs reported by Challenger, Gray & Christmas decreased by 16% month-over-month in January but had increased by 23% in December (SA by GS).

* Job availability. The Conference Board labor differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—decreased by 0.4pt to 43.8. JOLTS job openings increased by 150k in December to 10.9mn and remained higher than the pre-pandemic peak.

Tyler Durden

Thu, 02/03/2022 - 22:40

http://dlvr.it/SJM07k

No comments:

Post a Comment