Goldman Finds Most Financial Tightening On Record Already Priced Into Markets

Last week's strong NFP print coupled with the BoE and ECB joining the Fed's hawkish pivot has sparked a panic-scramble across the bond market to price in the unthinkable.

Short-term interest rates are pricing in 5 rate-hikes this year (and a 25% chance of a 6th) as well as a 30% chance that The Fed surprises in March with a 50bps hike...

The Bank of England is expected to hike 5 more times by November 2022 and European rates see a 75% chance of 5 rate-hikes by The ECB this year.

These are dramatic pivots from just a few months ago, and every asset-class is coming to terms with the realization central banks are serious this time (for now).

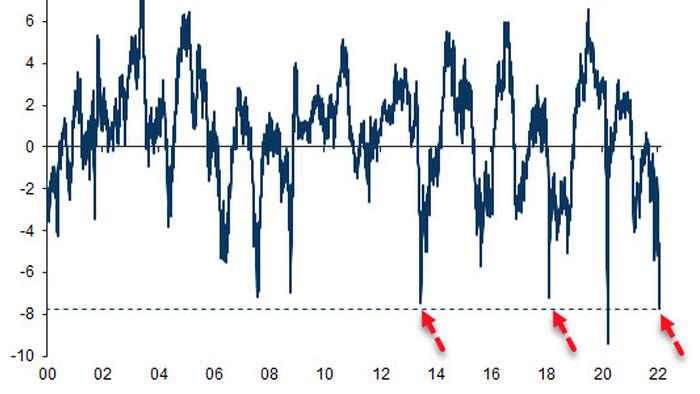

In fact, as Goldman Sachs'Cecilia Mariotti notes her latest strategy research note, our RAI PC2 "Monetary policy" is signaling the most hawkish pricing across assets on record (outside the COVID-19 shock)...

However, Mariotti points out that while equities have been more under pressure, it is mostly longer duration, growth pockets of the market that have suffered - value has outperformed and cyclicals are flat vs. defensives.

The current level of extreme monetary tightness expected by the market is the same as was priced-in in 2014 and 2018 - during which both times The Fed flip-flopped and reversed its hawkish stance (in the interest of 'financial stability')...

The difference is... they had room then because 'global growth' was still positive (and obviously inflation under control).

However, this time growth is already negative and declining...

As Goldman concludes:

We believe markets have entered a regime in which monetary policy will no longer support equity (and risky assets more broadly), and while a large part of the hawkish shift has likely been priced by equities, any rally from here will have to be supported by improving growth expectations...

...and there is little on the horizon to make that seem likely as Washington is mired in gridlock into the midterms.

In fact, as BofA recently noted, their global EPS model predicts deceleration from 40% last summer to 0-10% by summer (with a 40% probability that global EPS growth negative in H2)...

Which doesn't give stocks any room for complacency that any bounce is other than for selling.

Tyler Durden

Mon, 02/07/2022 - 20:20

http://dlvr.it/SJZ2qs

No comments:

Post a Comment