Bridgewater Touts Chinese Assets As PBOC Diverges

By Ye Xie, Bloomberg Markets Live commentator and analyst

Three things we learned last week:

1. There was a new wave of bond-market carnage. When mainland Chinese investors return from the Lunar New Year holiday, they will be greeted by what was a renewed selloff in the global fixed-income market. The European Central Bank became the latest to turn hawkish, opening the door for rate hikes this year. The pivot trigged some dramatic bond moves. Both German and Japanese five-year yields climbed above zero on Friday for the first time in years. In the U.S., a stronger-than-expected jobs report Friday prompted traders to boost bets on a 50bp rate increase in March.

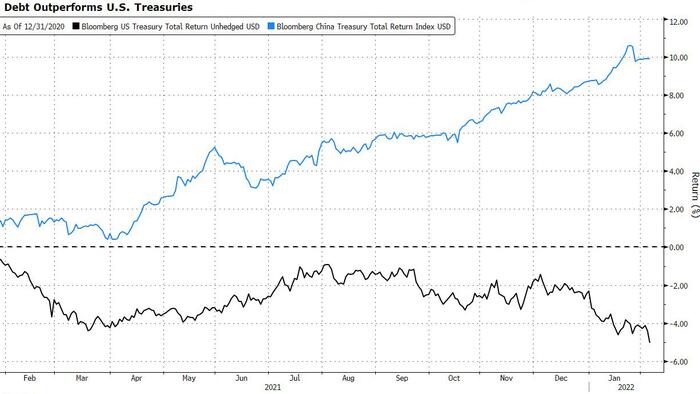

In contrast, China’s policy makers are firmly in easing mode, thanks to tamed inflation. In its 2022 outlook published last week, Bridgewater Associates touted Chinese assets, while sounding the alarm about risky assets in developed markets. “Chinese assets remain attractive relative to cash,” because bond yields still have room to fall, inflation remains relatively low, and policy makers face pressure to ease, the outlook said. “The differences in conditions versus the West” create “a high likelihood of continued diversification,” it said.

2. Global growth is moderating. Major central banks are tightening through a soft patch in global growth. It isn’t exactly a friendly environment for risky assets. The Global PMI manufacturing index declined to 53 in January, the lowest since October 2020. While that’s still a respectable number, and the waning of omicron infections may brighten the outlook, the tightening financial conditions nonetheless add to market volatility. The chart below plots the change in the manufacturing index and the S&P 500, when real yields rose more than 40 bps a month, as they did in January. It shows markets had more difficulty digesting higher yields when growth slowed than when the economy picked up. In China, data is expected to show on Monday that the service sector barely grew in January.

3. A hawkish Fed and ECB take some appreciation pressure off the yuan. The trade-weighted yuan fell 0.9% last week, the most since July 2020. The yuan is still supported by a lofty trade surplus, but the interest-rate differential is becoming less supportive. Surging crude oil is another negative for China, a major energy importer. All that suggests that there’s limited upside for the yuan, a result that Beijing may be happy about.

Tyler Durden

Sun, 02/06/2022 - 21:00

http://dlvr.it/SJVl1X

No comments:

Post a Comment