Goldman Sees Oil Price Spiking On UAE/OPEC+ Deal

Oil suffered its biggest drop in 2.5 months today after the EIA reported that in the latest week, gasoline demand in the US unexpectedly tumbled by 760,000 barrels a day from the record 10 million barrels a day a week, to 9.28 million barrels a day to get back to levels in late June.

While algos focused on the sharp drop, what they ignored was that the number was largely meaningless, since the reporting week included July 5, a day off for Americans. Additionally, the EIA’s estimate, known as product supplied, is derived from other data rather than being a direct measurement of consumption. Since that method often leads to erratic numbers, some observers prefer to use the 4-week rolling average. That measure was 9.485 million barrels a day, which was about equal to the same week in 2019

None of that mattered, however, as CTAs quickly joined in the selling frenzy and completely erasing the earlier jump on the far more important news of an OPEC+ deal.

Just how important was the Reuters report that the UAE and Saudi Arabia are close to reaching a production agreement, one which sees both the higher baseline requested by the UAE (of 3.65 mb/d starting in April 2022) as well as an extension of the output agreement requested by Saudi (through December 2022). Important enough that in a note released late on Wednesday, Goldman said that the deal would remove the low-probability tail risks of potential price war, and "represents $2 to $4/bbl upside risk to our $80/bbl summer and $75/bbl 2022 Brent price forecasts."

In the note from Goldman commodity analysts Damien Courvalin and Jeff Currie, the two also write that the expected agreement “as the first of likely four potential bullish supply catalysts over the coming month” that would more than offset higher North American production. Additionally, although some OPEC+ details remain uncertain, like August and September quotas or baselines of other countries, “these are of limited magnitude and importance to the global oil market outlook, which the bank continues to see as supportive of higher oil prices”

Piling on the bullish cash, Courvalin writes that an OPEC+ deal that offers a higher baseline for the UAE, as well as an extension of output agreement through December 2022 - such as the one being contemplated - would be bullish relative to Goldman’s base case

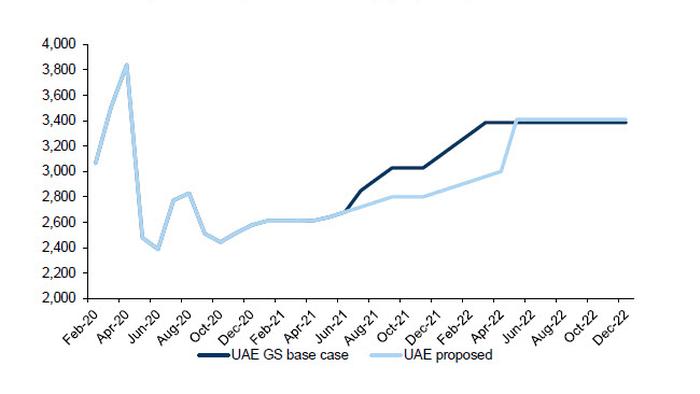

And speaking of Goldman's forecasts, the bank had assumed a 500kb/d ramp-up starting in August as well as a gradually rising UAE baseline from 3.17m b/d to 3.3m b/d in August to 3.65m b/d by the end of 1Q 2022. As a result, such a deal would imply downside risk to its OPEC+ production forecast of 400k-600k b/d on average for 3Q 2021-1Q 2022, depending on whether the lack of August production hike is compensated for in September. Needless to say, that too is bullish for the price of oil... and yet one look at the collapse in oil prices today and one would be left shocked at just how dumb the algos have become.

Finally, it's not just the UAE/OPEC+ deal that makes Goldman's commodities team hopeful - the bank’s other three potential bullish supply catalysts are listed as:-

* Upcoming shale earnings season, which may reaffirm greater incentive toward returning cash to shareholders over production growth

* That progress on the U.S. reaching an agreement with Iran has stalled, setting back the potential ramp up of exports

* Bank’s view that consensus expectations for global production outside of North America and core-OPEC remain too optimistic

Below we excerpt from the full note:

The UAE and Saudi Arabia appear close to reaching a production agreement, with Reuters reporting progress towards a deal that would allow for both the higher baseline requested by the UAE (of 3.65 mb/d starting in April 2022) as well as an extension of the output agreement requested by Saudi (through December 2022). We assume that the such a deal - if confirmed - would likely come alongside a gradual 0.4 mb/d monthly ramp-up in production through December 2021, as all OPEC+ members had already supported this decision.

Such an agreement would help bridge the (modest) divide between both countries and help remove the (low probability) OPEC+ tail risks of a potential price war or insufficient production growth, as we expected. While some details remain uncertain, like the August and September quotas or the baseline of other countries, these are of limited magnitude and importance to the global oil market outlook, which we continue to see as supportive of higher oil prices.

Importantly, such an OPEC+ agreement would be bullish relative to our base-case, as we had assumed (1) a 0.5 mb/d ramp-up starting in August as well as (2) a gradually rising UAE baseline from 3.17 mb/d to 3.3 mb/d in August to 3.65 mb/d by the end of 1Q22 (given its clear inequity). As a result, a deal as described above would imply downside risk to our OPEC+ production forecast of 0.4 to 0.6 mb/d on average for 3Q21-1Q22 (depending on whether the lack of August production hike is compensated for in September).

All else equal, this would represent $2 to $4/bbl upside risk to our $80/bbl summer and $75/bbl 2022 Brent price forecasts.

* While the lack of definitive OPEC+ production agreement (and the potential modest downside demand risk from the Delta COVID variant) leave our forecasts unchanged, we see such an OPEC+ agreement as the first of likely four potential bullish supply catalysts over the coming month that would more than offset higher recent realized North American production.

* Second is the upcoming US shale earnings season, which has the potential to further illustrate the higher US marginal costs and greater incentive towards returning cash to shareholders than production growth. This is presaged by the lack of horizontal oil rig count increase in recent months, with such discipline increasingly imposed on HY producers by the ratings agencies and potentially binding for IG producers if they announce higher dividend payouts.

* Third, progress on the US reaching an agreement with Iran has stalled, with the likely delay of the seventh round of negotiations till at least August creating risks that the potential ramp-up in Iran exports is later than our October base-case (and altogether less likely). The next OPEC+ agreement is further likely to state an offset provision for a potential ramp-up in Iran exports, further limiting the bearish impact of a potential return to the JCPOA agreement. For reference, a lack of Iran supply deal would increase our 2022 price forecast by $10/bbl.

* Fourth, we believe consensus expectations (as proxied by the IEA) for global production outside of North America and core-OPEC remain too optimistic. We expect (1) non-OPEC+ exc. North America production to only increase by 0.6 mb/d from May to August 2021, 0.8 mb/d less than the IEA, and further (2) expect 60% of OPEC+ members accounting for 20% of production to fall below their production quotas as low drilling activity reduces productive capacity by early 2022. Such an outcome would lay bare the need in 2022 for both a decline in OPEC’s spare capacity to below its 10-year range as well as a sharp rebound in shale production growth, both bullish outcomes relative to market forwards.

As a result, we believe that risks to our bullish oil price forecasts are skewed to the upside, with the catalyst for such a move higher shifting from the demand to the supply side. While our bullish view this year had been driven by our well above consensus demand growth forecast, this is no longer the case with (1) the sharp rebound in global oil demand that has taken place since May, from 95 to 98 mb/d currently and near our 99 mb/d end of summer forecast, mostly played out, with (2) the IEA expecting similar peak summer demand, and with (3) the EM vaccine led demand uplift set to only play out gradually through 1Q22.

A shift in market focus to the supply will make increasingly evident that the industry’s costs have reset sharply higher, due to (1) poor accumulated returns of the past 5 years, (2) the inflationary impact of internalizing carbon emissions and (3) the rising uncertainty and pessimism on long-term oil demand. As a result, we initiate a new trade recommendation to be long Dec-22 Brent forwards, currently trading at $67.06/bbl. This entry point is below our Dec-22 spot forecast of $75/bbl due to backwardation and further offers a proxy trade for a re-setting higher of the oil market’s marginal costs. Tyler Durden Wed, 07/14/2021 - 22:30

http://dlvr.it/S3lR2f

No comments:

Post a Comment