US Losing 1.2 Million Workers To Early Retirement

According to a brand new analysis from Goldman's economists, the US is on pace to experience a permanent loss of about 1.2 million workers from early retirement and reduced immigration. That's the bad news; the good news - according to Goldman - is that younger workers who have been reluctant to return to the workforce are still likely to do so once temporary disincentives to work disappear (most later this year). As a result, Goldman is looking for the labor force participation rate to rise by 100bps over the next year-plus to 62.6% (if still 0.8% below the 63.4% pre-pandemic rate).

Why does this matter? Because while the labor market currently is a total shitshow due to Democrat policies that pay potential workers more to do nothing than to work, leading to a record 9.3 million job openings...

... and as a result there is a historic labor shortage, this is expected to change in September when extended unemployment benefits run out. That's why, consensus generally expects that the recovery in labor force participation will accelerate in the coming months as generous unemployment insurance benefits expire and other pandemic-related labor supply disincentives like school closures and health risk exposure fade away.

But looking beyond the near term - 6 or so months from now - should we expect a full recovery in the labor supply? That's what Goldman tries to answer in its latest economic note.

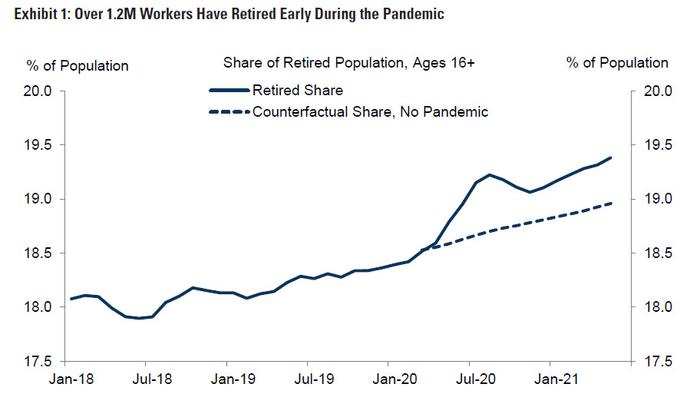

The vampire squid starts off by reminding us that in December, it warned about a surge in early retirements that was likely to be a lingering drag on the labor force participation rate (LFPR). Since then, the number of excess retirees - defined as the difference between the actual number of retirees and the number of retirees implied by the age-specific retirement rates observed in 2019 - has soared to 1.2 million, a 0.5% hit to the labor force participation rate in addition to the roughly 0.2% structural drag from population aging since the pandemic began.

Because most early retirements reflect permanent labor force exits, the labor force drag from early retirements will persist until it unwinds through fewer new retirements.

Some more details:

First, of the 2.7 million non-retiring workers who have left the labor force since the start of the pandemic (reflecting a 1.0% drag on the LFPR), 1.4 million say they don’t want a job now. However, many of these workers are aged 55+ (600k; a 0.2% drag) and are likely not working due to health concerns. In contrast, the share of prime-age and younger people who say they don’t want a job (a 0.3% drag) has increased only modestly and currently stands at mid-2019 levels (bottom chart, left).

Second, among those workers who have left the labor force but still want a job (1.2 million; a 0.5% drag), most haven’t searched recently (over 900k; a 0.4pp drag), suggesting that they are postponing their job search until UI benefits expire and pandemic-related disincentives fall away (right chart, below). This, just in case there are still idiots who think that Biden's generous claims aren't behind the collapse in labor supply. The good news - for now - is that very few fall into the discouraged worker category that might indicate more persistent scarring and pose a threat to a full labor market recovery. This is of course intuitive: it is hard to imagine large numbers of workers dropping out in despair over a lack of job opportunities, as happened after the financial crisis, in an environment in which jobs are so abundant. Then again, this unstable equilibrium will flip soon enough once benefits run out and there is surge in labor supply and a sharp drop in wages.

Looking beyond pandemic-driven changes in the labor force, Goldman sees scope for two tax policy changes to affect the labor supply of parents.

* First, the American Rescue Plan (ARP) increased the Child Tax Credit (CTC), made it fully refundable, and removed its earned income-requirements for 2021 (chart below, left), and the upcoming fiscal package is expected to extend these changes through 2025. Prior academic research finds that the earned-income requirements of the CTC have had a significant impact on maternal labor supply, so removing these incentives could put downward pressure on female labor force participation. Although this effect will partially be offset by increased work incentives from the increased Earned Income Tax Credit (EITC), earned income incentives will likely be reduced on net.

* Second, the ARP also made the Child and Dependent Care Tax Credit (CDCTC) much more generous by allowing households to claim 50% of child care expenses up to $8k for one child and $16k for two or more children as a refundable tax credit (chart below, right). These changes could have large positive effects on maternal labor supply if they are extended beyond 2021.

Here, Goldman says that its best guess is that the labor supply incentives from the CTC and CDCTC roughly offset each other, with some potential for a rotation in female labor supply from lower-income households (who should be most affected by the changes to the CTC) to middle-income households (who should benefit most from the changes to the CDCTC). However, there are some risks in both directions, depending on the details and permanence of each potential tax change.

Overall, Goldman economists expect the Labor force participation rate to eventually rise from 61.6% now to a peak of 62.6% by the end of 2022, which however will still be 0.8% below the 63.4% pre-pandemic trend, with the gap in participation primarily reflecting early retirements and demographic shifts and other negative consequences resulting from Biden's fiscal policies. It may also explain why there has been a concerted push to cut the work week from 5 to 4 days.

In an amusing twist, Goldman "goes there" and writes that although immigration has only a small effect on the labor force participation rate (since it affects both the labor force and population), the bank expects the collapse in visa issuance during the pandemic (Exhibit 4) will reduce the labor force for the next few years. Quantified, GS economists expect that the drop in temporary worker visas currently is creating an effective labor force drag of 450k workers, although this hit will unwind through fewer expiring visas going forward. They also estimate that the drop in immigration visas has reduced the labor force by 300k through May, and since the loss in immigration in 2020 won’t be offset by higher immigration going forward, most of this drag will persist

Finally, the next chart shows Goldman's labor force forecast relative to the US demographic trend: here, Goldman continues to expect that most of the pandemic-driven exits will reverse in the coming months as pandemic- and policy-related obstacles to participation fade but that drags from early retirements and slower migration will keep the labor force over 1.2 million workers below trend by the end of 2022.

How and when that transitions to a full-blown socialist state - which is the aim of most progressive democrats - where the government pays tens of millions not to work with the funding coming courtesy of the intellectual fraud that is MMT (Magic Money Tree), remains unclear although it will likely require an even bigger shock than the covid pandemic. War with China may just suffice. Tyler Durden Tue, 06/22/2021 - 19:05

http://dlvr.it/S2G4wq

No comments:

Post a Comment