Watch Real, Not Nominal Yields

In his daily note this morning, Deutsche Bank's chief credit strategist Jim Reid writes that he "donned his credit hat" and looked at the relationship between yields and credit spreads (and by extension risk assets) given how topical the yield discussion is. The charts below look at a long-term 2-year rolling correlation between the two for nominal and real yields. As can be seen there is no “one-size-fits-all” relationship. However, some important trends have occurred.

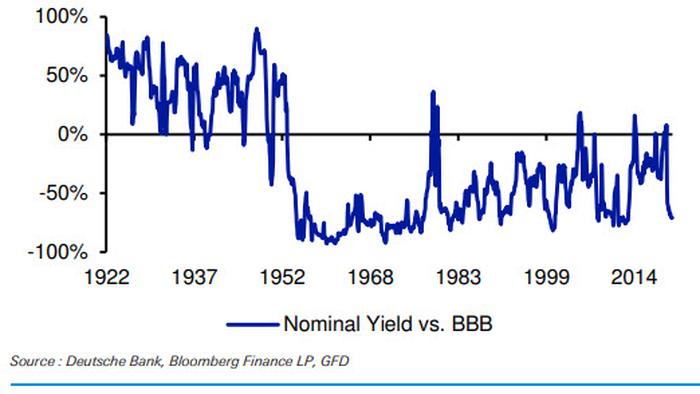

Reid observes that for nominal yields, the correlation between yields and spreads for most of the last 70 years has been negative. This makes some sense as "if yields are rising it normally is indicative of a stronger economy which in turn should be good for corporates and visa-versa."

However, this long-term inverse correlation was weakening before the pandemic. With the Fed having broken bond markets, the DB strategist tactfully notes that "QE and negative rates had perhaps created an offset to the traditional relationship as QE lowered yields even in a positive economic outlook." As such, he adds, "any reversal of QE or risk to it might lead to higher yields and spreads." Clearly, the market agrees with this.

Of course, the pandemic has taken the inverse relationship back to the extremes though as spreads have massively tightened since March in a period where nominal yields have steadily moved higher, especially since July. So normal long-term service has been resumed "but with spreads close to cyclical tights there’s a limit to how much this could continue if yields rose further." It now appears that 1.50% of 1.75% - depending on whom you ask - is the tipping point.

Interestingly, the correlation with real yields has become more positive over the last decade and stayed this way during the pandemic. In the massive tightening since last March, 10 year US real yields fell -150bps while nominal yields rose. Since mid-February though, real yields have risen 30-40bps and credit spreads have drifted wider, supporting the more positive modern day correlation.

As Reid summarizes, "with such a heavily indebted financial system, real yields probably matter more than nominal ones. If nominal yields rise but inflation rises more (i.e. lower real yields), this would no doubt cause some volatility but it should help those with high debts (e.g. corporates) assuming the economy wasn't suffering."

However, the worst case would be "if real yields rise notably from here, then all risk assets will likely suffer given the debt load the financial system has. So the correlation between real yields and credit will likely be strong going forward."

That's why last week's move was important but for now real yields are still very low, "just not quite as low as they were. This is what to watch." Tyler Durden Wed, 03/03/2021 - 19:00

http://dlvr.it/Rtw6d7

No comments:

Post a Comment