Silver Just Had Its Best Month In 40 Years: Here Are July's Best And Worst Performing Assets Tyler Durden Mon, 08/03/2020 - 13:22

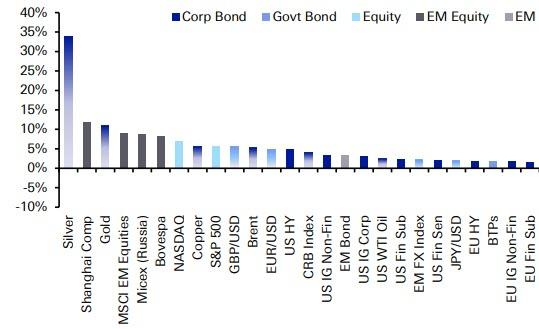

When looking at the torrid market performance in July, Deutsche Bank's Jim Reid notes that silver (+35%) had its best month since December 1979 while the dollar the worst for a decade. US equities had a good month in spite of rising virus caseloads due to a strong earnings season relative to expectations, especially in tech towards the end of the month. YTD Silver, Gold and the NASDAQ have been the three best performers while at the bottom of the leaderboard Brent, WTI and European Banks are all down at least 30%.

Below we present some of the key highlights from Deutsche Bank's July 2020 performance review

While July proved to be another decent month for risk assets, it was the performance of two other assets in particular which caught the eye. The first was Silver, which had its strongest month since December 1979. The second was the weakness in the USD, which ended with the USD spot index dropping by the most in a single month since September 2010.

Indeed the impact of the latter was fully felt when looking at returns in USD terms, with 36 of the 38 assets in DB's sample finishing with a positive total return. In local currency terms, that number dropped to a still-impressive 30 assets. As markets move into August, typically a more subdued month for volumes but perceived to be a weaker month for risk, the focus remains on the reopening of economies on the one hand and signs of rising cases in certain countries on the other.

First, let's look at silver, which rallied +34.0% during July, pushing it straight to the top of Deutsche Bank's YTD leaderboard with a +36.6% advance. Gold also had a strong month, in part helped by the tailwind of the weaker USD, rising +10.9% for its biggest monthly gain since February 2016. In fact it was a good month for

commodities all round, with Copper (+5.7%), Brent (+5.2%) and WTI (+2.5%) also up, while the broader commodity index gained +4.1%.

As mentioned, the other big mover was the USD with GBP, EUR and the JPY strengthening +5.5%, +4.8% and +2.0%, respectively, versus the greenback. EM FX also gained +2.1%. In USD terms, that move saw equity markets in Europe post gains of anywhere from 1% to 5% (with the exception of European Banks, which returned -0.8%) with the STOXX 600 up +3.9%; however, in local currency terms returns were flat to -4%.

As for US equity markets, it was another strong month for the tech sector with the NASDAQ returning +6.9% while the S&P 500 finished with a total return of +5.6%. It was more of a mixed story in Asia with the Shanghai Comp returning +12.0% in local currency terms while in contrast the Hang Seng returned just +1.5% and the Nikkei -2.6%.

Finally, as for bond markets, another month of declining yields and in some cases record-low yields meant returns were anywhere from +0.4% for Gilts to +1.7% for BTPs. Again, the weaker USD propelled USD returns last month, up to +6.7% for BTPs and +5.5% for Bunds. For completeness Treasuries returned +1.2%. Last but not least, it was a similar story for credit, where in local currency terms USD outperformed EUR by 1-2 percentage points, with USD HY outperforming IG.

A quick recap of where things stand YTD. In local currency terms 18 of the 38 assets in our sample have a positive total return while in USD terms that number rises to 20. Silver, Gold and the NASDAQ have been the three best performers while at the bottom of the leaderboard Brent, WTI and European Banks are all down at least 34%.

http://dlvr.it/RcwVFc

No comments:

Post a Comment